The 30-share Sensex and the Nifty50 soared 516.97 points and 153.15 points each in opening trade on Wednesday ahead of the Union Budget 2023-24 presentation that will begin at 11.00 AM.

At 10.15 AM, the 30-share Sensex was trading 453.33 points or 0.76% higher at 60,003.23, with an advance decline ratio of 24:6. On the other hand, the Nifty50 was trading 127.8 points or 0.72% higher at 17,789.95, with an advance decline ratio of 39:11.

At 2.84%, ICICI Bank was the highest gainer on the Sensex, while the Nifty50 saw ICICI Bank gaining 2.76% over previous close.

Adani Enterprises, which has been in the midst of a storm with other group entities owing to the concerns over US-based short seller Hindenburg Research’s report, was trading 1.93% lower on the NSE despite reporting the close of the historic follow-on public offering (FPO) worth Rs 20,000 crore on Tuesday.

On December 21, 2022, when Adani Enterprises touched a 52-week high on the NSE, its market capitalisation stood close to Rs 4.45 lakh crore. And 30 trading days later, in absolute terms, the market capitalisation stands eroded by Rs 1.14 lakh crore at Rs 3.31 lakh crore. The market capitalisation erosion since the Hindenburg Research report was published on January 24, is Rs 61,466 crore from Rs 3.92 lakh crore.

Investor concerns in Adani group are evident from the fact that retail investors, for whom roughly half of the FPO issue was reserved, bid for just 11% of the 2.29 crore shares reserved for them while employees of Adani Enterprises applied for just 52% of the 1.6 lakh shares earmarked. for them.

At a broader level, the gap between the day’s high and low of 559.19 points (-0.93%) and 79.6 points (-0.45%) on the Sensex and Nifty50 are partial reflection of the fact that the markets have been resilient through April–December 2022.

The Economic Survey 2022-23 rightly flagged that while the global stock markets declined because of geopolitical uncertainty during April-December 2022, the Indian stock market saw a resilient performance, with the blue-chip index Nifty50 registering a return of 3.7% during the period.

As regards the US, S&P 500 Average Index declined by 15.3%, while Nasdaq Composite – heavily weighted (49%) towards technology sector companies, declined sharply by 26.4%. At the end of December 2022, Sensex closed 3.9% higher from its closing level on March 31, 2022. Even among major emerging market economies, India outperformed its peers in April-December 2022, the Economic Survey highlighted.

Though higher than other large economies, India’s GDP is pegged to grow in the range of 6.0-6.8% during FY 2023-24 which is comforting at a time when geopolitical risks are persistent and so are the worries around inflation.

The Economic Survey 2022-23 pointed out that the Reserve Bank of India (RBI) has projected headline inflation at 6.8% in FY23, which is outside the regulator’s target range. “At the same time, it is not high enough to deter private consumption and also not so low as to weaken the inducement to invest,” the Survey added.

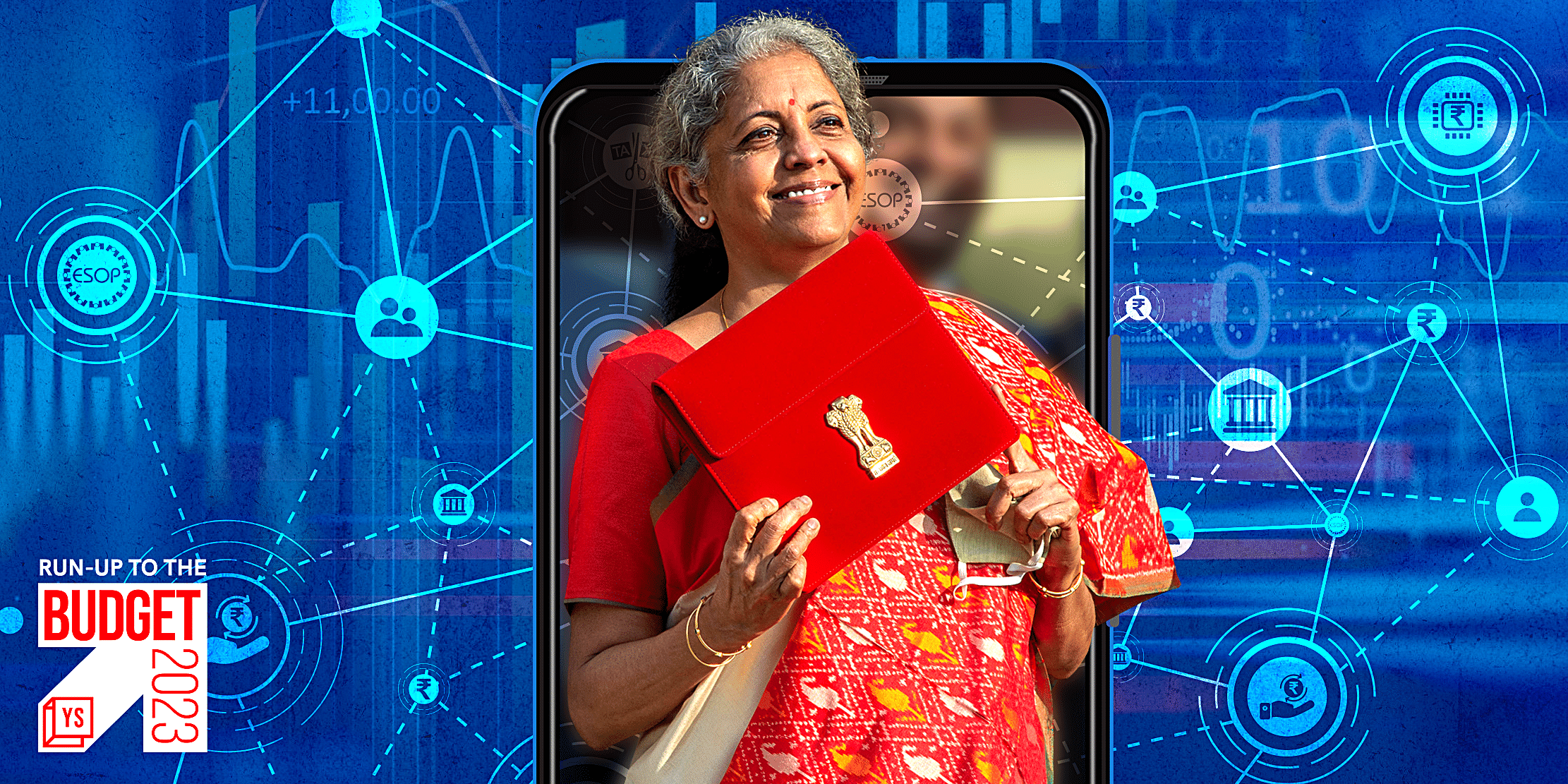

Clearly, a lot hinges on what Finance Minister Nirmala Sitharaman has to offer to the markets in the current government’s last full budget before the country goes to poll in 2024.

![Read more about the article [Funding alert] Digital mortgage platform, LoanKuber raises $1.25M as part of its ongoing Pre-Series A round](https://blog.digitalsevaa.com/wp-content/uploads/2021/08/61-1629441484186-300x150.png)

![Read more about the article [Funding alert] Policybazaar raises $75M led by Falcon Edge Capital ahead of IPO](https://blog.digitalsevaa.com/wp-content/uploads/2021/03/Yashish-Dahiya-1-1-300x150.png)