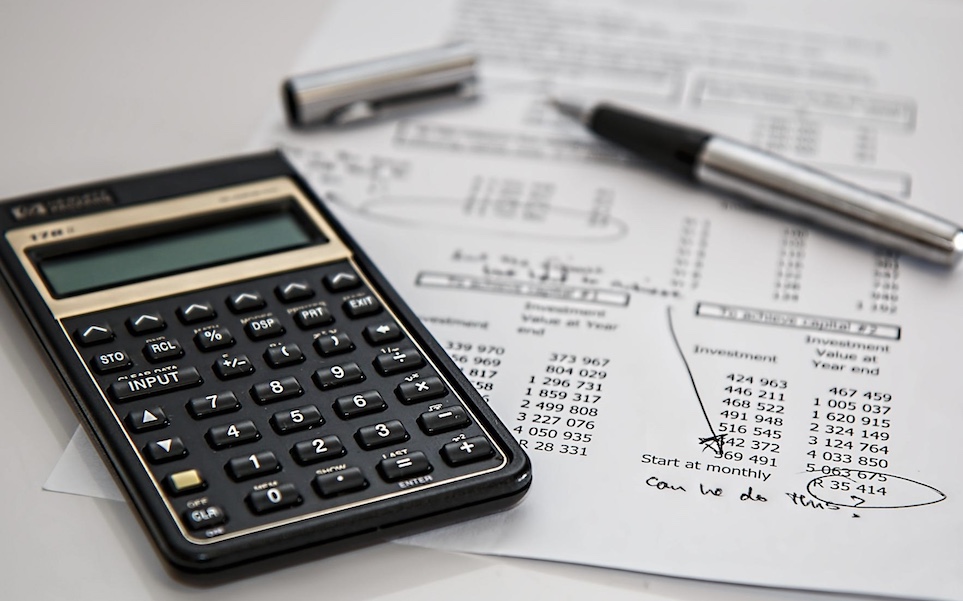

The term “expense management” is frequently linked with travel-related costs, but in order for the company to benefit fully, all expenses that an employee might be entitled to compensation for, from home office supplies to software subscriptions should be included. For a small firm, managing expenses is a difficult task. If done manually, it may need a sizable time and financial commitment.

Employee Mistakes in Small Business Expense Management

Lack of Visibility into Business Expenses By Employees

Numerous consequences result from this lack of visibility, including an inaccurate understanding of the profitability factors, and time wasted looking for information. Also the inability to recognize macrotrends and not being able to adapt strategies to changing market conditions. Even though this is by no means an exhaustive list, it should be enough to cause company managers to rethink their standard method of financial reporting.

Lack of Detailed Expense Records

In many businesses, records management is a routine that is frequently neglected. While a thorough, well-considered records management strategy can increase an organization’s effectiveness and efficiency, poor records management can result in disorganized workplaces, agitated workers, and information loss. Poor records may be devastating to a business, slowing productivity, wasting valuable time, and increasing staff stress levels. Companies that are exhibiting the signs of inadequate records management are assisted in finding remedies by Record Nations.

Poor Policy On Travel and Expenses

If your company doesn’t have a solid policy in place for travel and expenses, it can quickly become a hotbed for overspending and waste. This can put a strain on your company’s budget, and may even lead to legal problems if receipts are not properly accounted for. A good policy will help keep employees in check and ensure that expenses are kept to a minimum.

Expense Management Solutions for Employees in Startups

Use of Expense Management Software

Employees can save time by filing expense reports more quickly, especially with expense management software. The main advantage for startups is the ability to identify exceptions and keep better track of expense claims for a clearer picture of employee-initiated spending.

Ensuring You Validate Expenses

When running a business, expense management is not the first thing that comes to mind. Still, it is a crucial component of the company that all startup founders and business owners must not overlook. Since you are a startup founder or small business owner with limited resources, you will want to cut costs wherever possible, even if it means doing things manually

Have a Finance Team

A finance team is a department within your firm that manages all tasks associated with the financial health of your business. A finance team often oversees a wide range of duties, including accounting, recordkeeping, office work, and cash flow. The acquisition and management of your company’s capital funds are also the responsibility of the finance staff. The financial staff, which is sometimes ignored, has the knowledge to instruct you on how to efficiently manage your expenses.

Endnote

Small businesses need a wide range of multi-agencies who are responsible for its effectiveness. In order to make a successful business, expenditures, money flow must be managed to reduce losses and risks that emerge along the path of the business line.