From a workforce of 500-600 employees in February, Bengaluru-based Bikayi has more than halved its employee count in the past couple of months, with many employees being laid off after an allegedly opaque internal audit

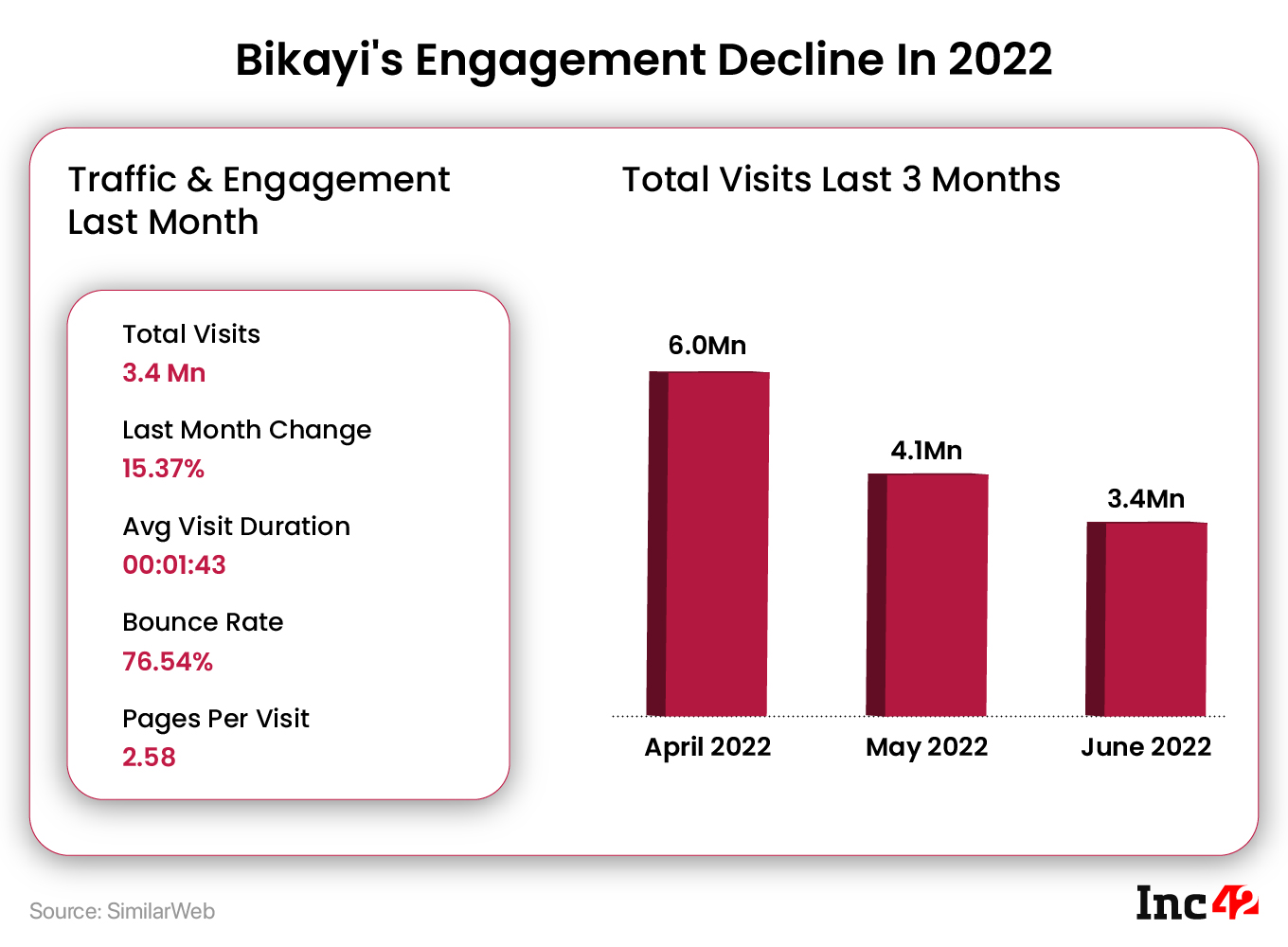

According to multiple sources, Bikayi’s revenue declined from roughly INR 1.9 Cr in April 2022 to just under INR 10 Lakh in July 2022 due to a number of challenges related to sellers as well as product pricing

Amid serious holes in its business model, Bikayi is pivoting to target enterprises and claims to have raised funds towards this, but there are far too many challenges for the Sequoia and YC-backed startup

“In January, the office chatter was that we would become a unicorn. The company is raising funds we were told. But four months later, I didn’t have a job at Bikayi.”

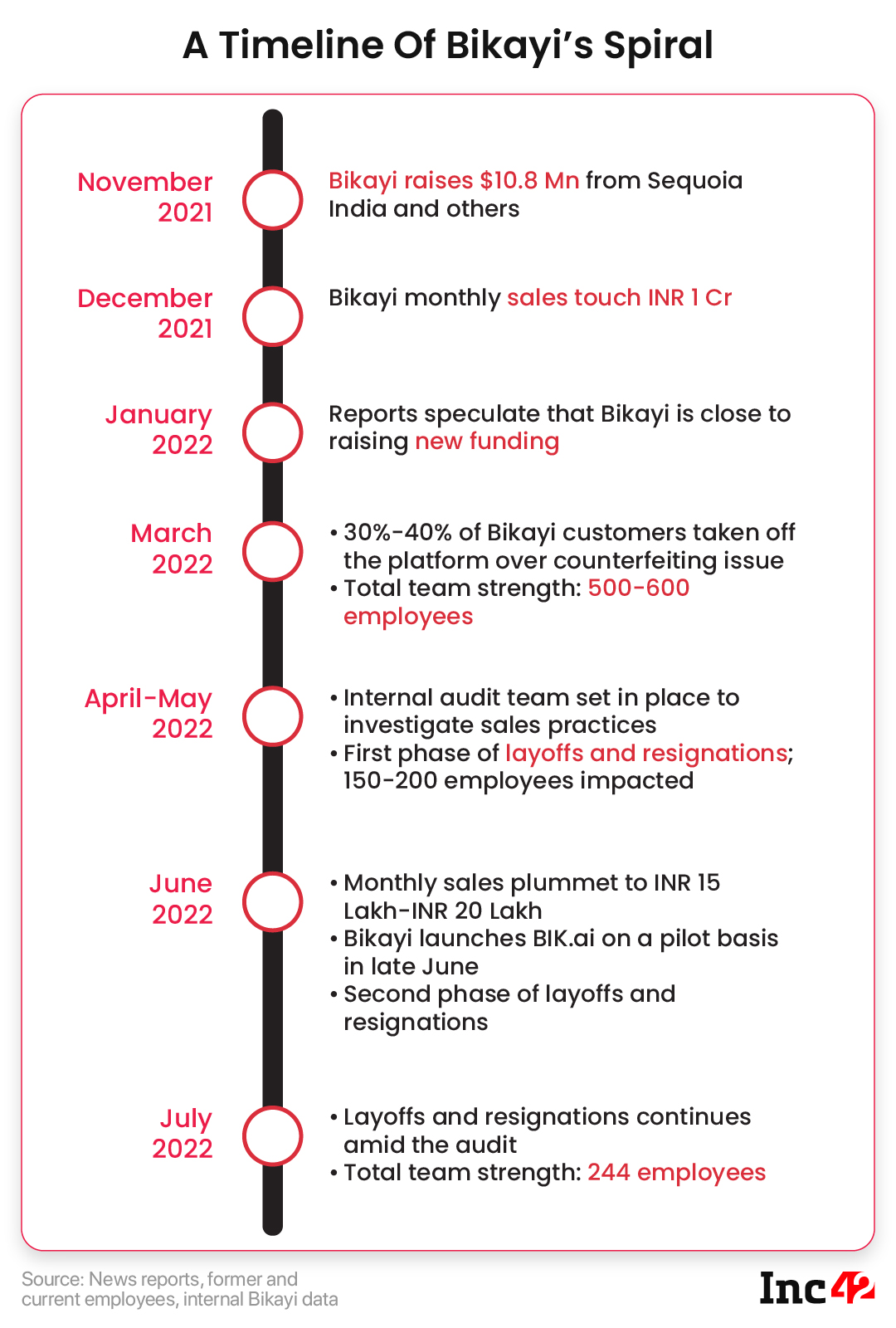

In the four months since March 2022, Sequoia and Y Combinator-backed retail tech startup Bikayi’s fortunes have taken a wild swing. Having tapped the digital transformation and retail tech boom in 2020 and 2021, Bikayi was set to raise a new round of funding at a unicorn valuation, but all that has come to naught.

From around 500-600 employees in February this year, Bengaluru-based Bikayi has cut its workforce by more than 50% and now has 244 employees, as of July 27, 2022.

According to multiple sources, revenue has dried up in recent months and sellers were deplatformed in early 2022, after which it had to resort to audits and internal investigations, resulting in several terminations and resignations (more on this later).

Amid this churn, Bikayi’s core business of enabling small retailers and offline sellers to set up ecommerce stores has taken a massive hit due to pressures from retail brands looking to tackle counterfeit products, according to multiple sources within the company.

Besides this several existing Bikayi merchants have complained publicly in the past few months about the lack of resolutions for critical technical bugs, lack of marketing performance reports, and inaction on refund requests.

As one seller told us, “If my customers cannot even add products to cart, what good is WhatsApp and Facebook marketing?”

As we will see, many of these operational failures, layoffs, and customer issues have come as a result of the push to grow. But it’s also a lesson that India’s SMB and small sellers still cannot offer great lifetime value as customers of tech products. As Bikayi’s revenue growth stagnated, the company went back to the drawing board and is now betting on a new product where the landscape has some major competition.

The Bikayi Revenue Puzzle

Founded in 2019 by Sonakshi Nathani and Ashutosh Singla, Bikayi primarily enables small retailers and SMBs to launch a managed ecommerce store with support for payments, shipping and digital marketing.

Backed by the likes of Y Combinator and Sequoia, Bikayi managed to grab a sizable number of customers (as per its own claims) in the first couple of years as the digital transformation wave set in. The company has raised over $12.8 Mn in its lifetime.

It earns income through subscriptions on an annual basis, commissions from its partners for payments and deliveries, digital marketing services and related add-ons from the SMB customer base.

On the point of revenue, CEO Nathani claimed that by April 2022, the company had an annual revenue rate of $3.5 Mn (roughly INR 26 Cr based on then foreign exchange rates). However, the company has not reported its financials for FY20, FY21 or FY22 so there is no way to verify these claims.

From internal data shared by sources, the company indeed had INR 1.9 Cr in sales in April 2022 to arrive at that ARR. However, the revenue has plummeted seriously since then such that a $3.5 Mn ARR seems too optimistic.

Inc42 has seen screenshots of Bikayi’s internal sales reporting spreadsheets which clearly point to a huge decline in sales since April 2022. From meeting and exceeding the sales targets in March, the situation turned grim.

The magnitude of Bikayi’s revenue collapse is clear from the fact that till July 27, 2022, the company’s sales force had only achieved 3.1% (INR 9.5 Lakh) of the month’s target of INR 3 Cr.

From a peak of INR 1.9 Cr in April, the sales income fell to INR 42.4 Lakh in May, going up slightly to INR 54 Lakh in June before falling 82% lower in July. The company only touched INR 1 Cr in monthly revenue in December 2021.

Despite these grim numbers, Bikayi CEO Nathani claimed that the company is “on track to hit profitability soon” but did not specify any timeline for this.

Missing Tech Stack & Pricing Conundrum

Profitability is a factor of unit economics and scale, but Bikayi’s prospects were looking bleak due to the low price of its product in the initial days. It decided to increase the annual subscription price — from INR 5K in January 2021 to INR 15,000-INR 18,000 in mid-2021, to INR 30K in March 2022.

Selling a subscription plan at INR 5,000 meant that Bikayi could only end up with positive unit economics if those customers purchased the digital marketing credits as add-ons.

The tiering of the product was necessary given the revenue margin constraints in Bikayi’s business model, but also due to the addition of more features and third-party partners. But the pricier plans were proving to be a hard sell.

Even at INR 18,000 per year, the subscription was a hard-sell in this customer segment, sources claimed — up to 90% of the customers opted for the EMI-based subscription. Further, it also stopped allowing part or EMI payments for subscription after April 2022.

What complicated the sales situation further was that many sellers decided to complain on app stores and Twitter about how marketing credits have been spent. This hurt Bikayi’s reputation massively, sales people in the company told us.

For instance, Mumbai-based beauty brand Facetonic’s proprietor Sanaa Saif claimed that she is yet to see the marketing analytics and performance report for the INR 12,000 spent towards marketing credits in April 2022.

Of the 25+ Bikayi stores that Inc42 contacted, we could only reach the proprietors of six individual stores, with plenty of dormant Bikayi stores still around.

Just one seller — SA Foods — reported positive sentiments about Bikayi. The Mumbai-based store was featured in Bikayi’s 2021 pre-funding pitch deck as a star customer. Its proprietor told Inc42 that he has signed a ‘lifetime’ deal with Bikayi, which lasts up to 2051.

Others claimed that Bikayi is not great for stores with a large customer base because of the tech issues and challenges in customer support.

The tech and customer support operations have many weak points, according to Nikhil Gala, proprietor of Mumbai-based Ganesh Dryfruits, who had signed up for the INR 5K annual plan in January 2021. “They did not even have a backup of the previous version that they could restore.”

Further, there was no ticketing system for customer support or resolving technical issues. Bikayi’s operations for customer support were largely handled over WhatsApp group chats, reviewed by Inc42.

Gala added that the startup’s technical and customer support teams had full control over the stores and this led to several issues being introduced without consent of the store owner.

Sales Fraud, Audits Lead To Cutbacks

Amid the current slowdown in funding, and pivots and restructuring to find profitability, over 11,300 startup employees have been impacted by the latest cutbacks.

In the case of Bikayi, this has happened in two ways — a part of the workforce was let go due to misconduct, while others were told to resign or were forced to resign due to the company’s decision to end remote working and move into an office in Bengaluru.

Bikayi’s current team strength is 244 with 54 employees in the sales department as of July 27, 2022. Inc42 has seen screenshots of an internal meeting calendar for the week of July 16-July 21 which shows at least 20 meetings pertaining to resignations by individual employees and a dozen other meetings related to relocations, which also routinely end in resignations, employees claimed.

The laid off employees allege an opaque internal audit into misconduct beginning May 2022 where even those who were only tangentially related to any misconduct were told to leave.

Others resigned voluntarily but only under threat of not being able to get their full-and-final settlement, employment letters and pending sales commissions. Among this group, several told us that these payments have yet to arrive.

Slack messages from Nathani confirm the appointment of an auditing team to vet sales since November-December 2021.

The audit was related to Bikayi salespersons forging signatures of sellers and kirana store owners to sign them up for subscription plans based on EMI payments. In many cases, Bikayi’s salespersons would contribute from their own pocket for the down payments needed to sign up these customers.

The EMI payments were enabled through electronic or paper NACH mandates for repayments. However, as Bikayi salespersons pushed to meet weekly targets, many customers were signed up without a thorough assessment of their ability to pay EMIs.

Slack messages from CEO Nathani, screenshots of which Inc42 has reviewed, corroborate claims from employees about forgeries by salespeople.

While Nathani admitted there were some discrepancies, she said these sales did not account for any significant portion of the company’s revenue, even though she declined to reveal the amount involved.

Bikayi’s Counterfeit Problem

Among retail tech players, the startup competes with Dukaan, Aarzoo, Kirana King, Shop Kirana, Peel-Works, Khatabook, Dotpe, OkCredit, MSwipe, Magicpin and other startups in the SMB space.

“The whole model is to bring bazaars and informal marketplaces from Indian towns online. And we all know how prevalent counterfeit products are in such markets. This is not only a Bikayi problem, but you will find such sellers on Shopify, Dukaan, Bikri, whatever platform you pick,” according to the founder of another Bengaluru-based retail tech platform which competes with Bikayi.

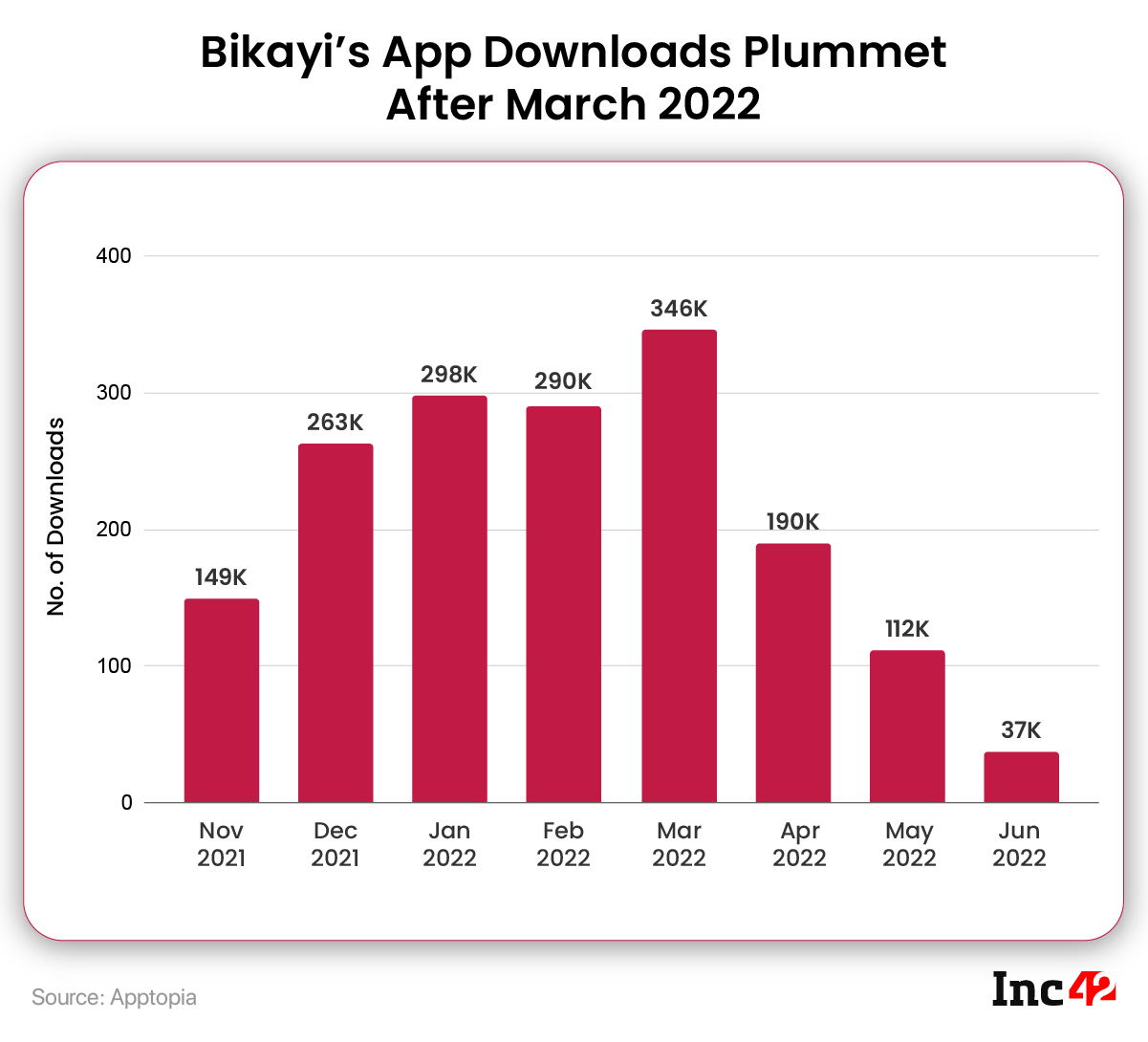

Bikayi’s revenue took a massive hit when it had to oust sellers that had actually driven its revenue growth, but who were selling first-copies or counterfeits. It cut ties with over 40% of its customer base in March and April this year. That means around 2.8 Mn merchants were taken off by Bikayi earlier this year, if the company’s claims of 7 Mn customers hold true.

Nathani claimed that such deplatforming did not have any significant impact on the customer base, claiming “less than 0.01% [of the base] is impacted (by deplatforming) so far (till July).”

Despite terms and conditions against onboarding such sellers, the company went all-in to sign-up all kinds of sellers in 2021, including those who sold counterfeit products. The company also chose to actively promote such sellers through digital marketing, as per one employee.

But CEO Nathani denied that any employees were terminated due to misconduct, and insisted, “We have not laid off a single employee since inception.”

What we do know is that, as it looked to grow aggressively in 2021, Bikayi is said to have bulked up its sales team to 250 employees. It even brought on board former execs from startups such as WhiteHat Jr to handle sales operations between September 2021 and January 2022, when its employee count had grown to 500.

As per data sourced from the Employees’ Provident Fund Organisation (EPFO), Bikayi’s India entity Comida Technologies Pvt Ltd had a massive spike in total PF deposit for the month of February 2022. From 73 employees in January 2022, the number grew to 227 employees in February and then to 288 in March, before coming down to 234 in May 2022.

It must be noted that EPFO data is an analogue for the number of new hires and not the exact count of employees.

Similarly, LinkedIn data for hiring also indicates a downward trend after a spike in February 2022 with a trickle of hiring in May and June.

In contrast, Nathani claimed that the company is hiring more aggressively and that’s only possible because of the cash in the bank and revenue growth.

Bikayi’s Next Big Bet: BIK.ai

To solve the unit economics situation, Bikayi has been forced in many ways to extend its offering to enterprise and mid-market companies and not just small sellers. This is the BIK.ai platform targetted at enterprises launched in June 2022.

The pivot, Nathani told us, is a revenue play since larger enterprises and mid-cap companies have a higher propensity to pay. “Scaling up marketing services for SMBs was a huge challenge. The ops involvement is very high and we have to scale up the team and while that is not a problem, managing this large team is a huge problem,” she said.

The thesis is that enterprise and mid-market companies that have an existing customer base would need automated tools for engagement and retention. Bikayi has signed a partnership with Meta to enable WhatsApp marketing for this segment.

It’s not yet clear how BIK.ai is different from the array of competition in the enterprise marketing SaaS space, including the likes of WebEngage, MoEngage, CleverTap, Wigzo, Reliance-owned Haptik, Tiger Global-backed unicorn Gupshup besides US-based tech giants such as Salesforce, Microsoft, Google and others.

Competing against this cohort will not be easy, nor will it come without constantly iterating on the product. And here, the company’s technology stack and customer support will be key, which have not been Bikayi’s strong points so far, as highlighted by several sellers that Inc42 spoke to.

To get there, Nathani claims that Bikayi’s US-based parent entity Bikayi, Inc has received a fresh infusion of funding in May 2022 from existing investors. The CEO declined to share more details, while Sequoia Capital India also did not disclose whether it had invested in this round. The company’s other existing investors — Y Combinator, Mantis VC, Leonis Investissement, Pioneer Fund, Bossanova Investimentos, and angel investor Ankur Nagpal — did not respond to questions about this funding round.

What Bikayi’s Spiral Means For Dukaan Tech?

At the moment, it is not clear just how well positioned Bikayi is to target the enterprise space. It would be looking at larger retail companies and D2C brands to increase its penetration and move on from the SMB space.

Bikayi’s experience has definitely dented the image of retail tech being a sustainable model, and it has forced startups in this space to target larger brands and businesses. For instance, Dukaan is positioning itself as a Shopify alternative and is looking to bring mature brands to its platform.

Speaking of Shopify, the ecommerce enabler is also going through a churn and is laying off 10% or 1,000 employees from its workforce, owing to expectations of slow revenue growth.

In the end, revenue is the biggest hurdle for these startups looking to unlock ecommerce for smaller sellers and brands. As startups bring more high-value clients, larger brands and enterprises on board, the low-value and low-margin SMB proposition is likely to take a backseat.

So the question now is will retail tech startups with high cash-burn and opex-heavy models be left by the wayside? India’s retail and kirana tech brigade raised millions of VC dollars on the back of the promise of organising this long-unorganised and informal segment of the retail industry. Have they failed this promise?