For the past 26 months, the Inc42 team has brought you 30 sector-agnostic startups every month, which have a unique value proposition and changed the tech ecosystem as we know it

The 27th edition of the ‘30 Startups To Watch’ List showcases companies that are solving tricky problems with innovative solutions across fintech, enterprise tech, agritech and blockchain sectors

The April 2022 Edition comes right after The Makers’ Summit 2.0 hosted by Inc42 and showcased products which may disrupt their respective sectors

It had been a wild, wild party last year, and the momentum continues in 2022. We are just four months into the new year (well, technically five), and the startup ecosystem has already reached a new peak. As many as 14 startups have joined the coveted billion-dollar club since January, lifting India’s unicorn tally to a fabulous 100!

Of course, some call it a new kind of froth and warn the ecosystem of valuation dips, massive layoffs and a long funding winter ahead. But as the saying goes, the secret of getting ahead is getting started.

Today, India is a thriving hub of small and medium digital businesses and home to more than 61K startups, of which 14K+ were recognised in FY22 alone. The stage is now set for the next wave as the country’s early stage startups try and revolutionise the internet space beyond the tried and tested products.

Like the true stalwart it has always been, Inc42 continues to champion the startups’ cause and has organised flagship events to bring together visionary companies and their founders who did not hesitate to reveal their product strategies that would drive the next level of growth.

After running the ‘30 Startups to Watch’ list for 26 months and showcasing more than 700 potential disruptors, Inc42 brings you the 27th edition shortly after concluding The Makers’ Summit 2.0.

As we sat down to shortlist the startups this time, we were keen to highlight scalable products that made an impact on consumer preferences (B2C) and/or propelled new business models (B2B).

In this era of new-age companies, many startups feel compelled to put their energy and efforts into niche segments like deeptech, automation and gamification. When the ecosystem proliferates, more and more disruptors will make it to the forefront, changing the world order and leading the enthusiasts to the promised land of 1,000 unicorns, as predicted by the government.

30 Startups To Watch: April 2022

With our focus on companies which are automating enterprise operations and easing the processes for consumers, Inc42 deep-dived into multiple sectors and handpicked quite a few unique business models.

For instance, we have listed seven startups each from the fintech and the enterprise tech segments. We have also found two exciting blockchain companies, one that marries the nostalgia of the Pokémon with complex blockchain jargon and the other tokenising real-life assets on-chain. Then there are three agritech startups working to boost India’s declining agri economy.

From changing the edtech scenario to communicating on social media, from disrupting traditional industry segments with conversational AI to bringing new asset classes to the investment core — some of the startups listed here are literally transforming the internet technology and its many uses.

As the need for tech grows – even simple use cases like loan advisory now require new-age convenience – these startups are attracting a vast user base as they build products to solve fundamental pain points hurting many sectors.

Check out the 27th edition of Inc42 Plus’ 30 Startups To Watch list.

Editor’s Note: The list below is not meant to be a ranking of any kind. We have listed the startups in alphabetical order.

Aerchain

Share On:

Why Aerchain Makes It To The List

Source-to-pay (S2P) is a critical procurement operation for any company. But it requires multiple steps and user interfaces, from locating a supplier to negotiations, contract signing and final payment for the goods delivered. Legacy S2P systems are primarily workflow-based, need human interventions and often tend to be opaque and error-prone. Set up in 2019 in Bengaluru, SaaS startup Aerchain wanted to address the S2P conundrum with four new-age solutions, enabling companies to automate the S2P cycle.

These solutions include strategic sourcing (to streamline all sourcing needs with RFx and maximise cost savings); tail spend automation (to predict requirements and source goods from the right supplier at the right price); AP automation (invoice/accounts payable processing), and P2P automation (for approval of end-to-end payments).

The procurement tech startup offers subscription-based solutions and claims revenue of $500K in FY22. It aims to hit an ARR of $1 Mn by acquiring 50 clients in FY23. Aerchain plans to expand more into the North American and Indian markets by 2025 and hit an ARR of $25 Mn.

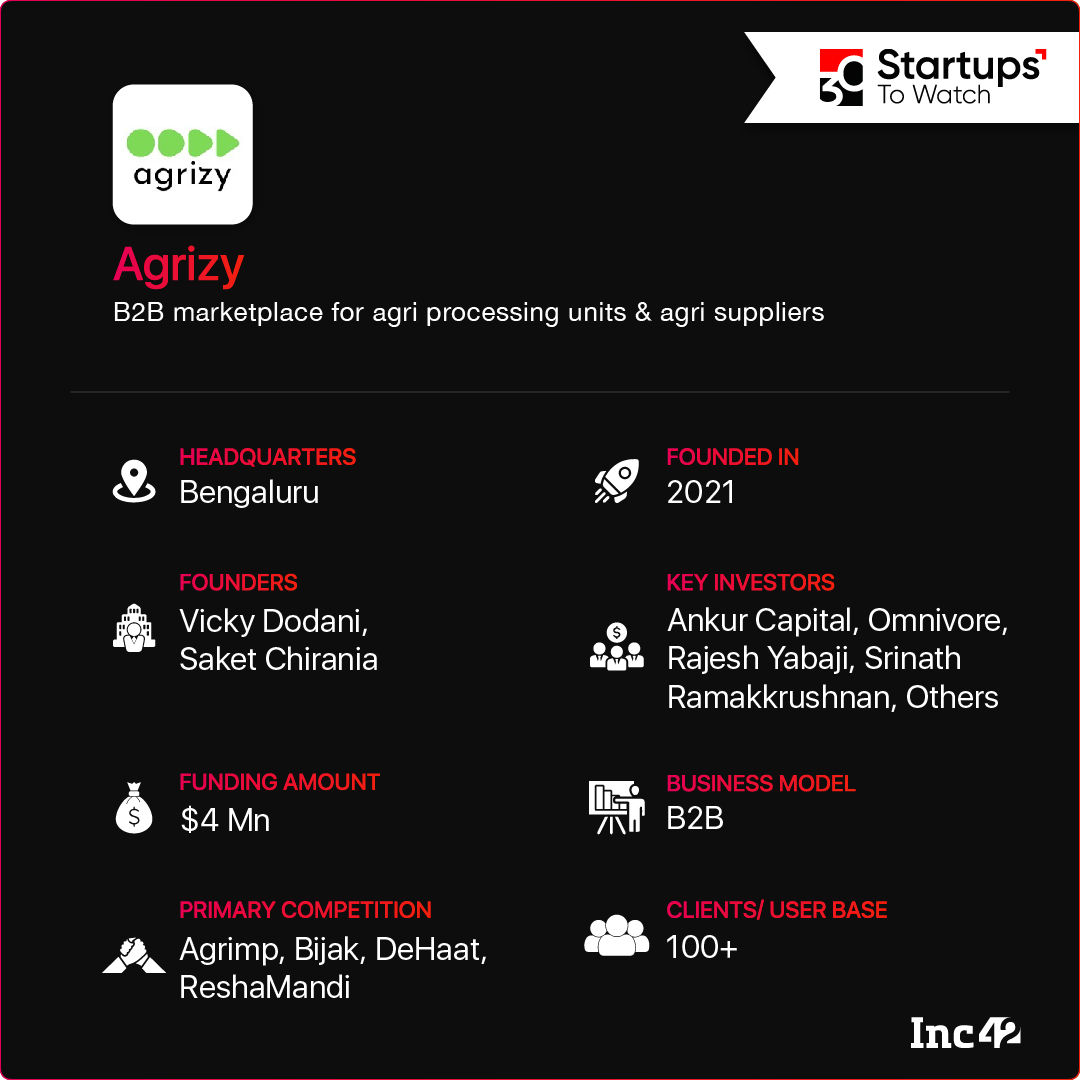

Agrizy

Share On:

Why Agrizy Made It To The List

India’s addressable agritech market is estimated to hit $24.1 Bn by 2025. But even now, the sector is plagued by pricing inefficiencies and a broken supply chain due to the lack of credit flow, resulting in low productivity and steadily falling revenues. To drive transactions at scale and sustainable pricing, Bengaluru-headquartered Agrizy was set up in 2021 as an agricultural e-marketplace to help wholesalers procure non-perishable farm products and cash crops like cereal, pulses, oilseed and jute directly from producers.

The platform provides networking, logistics and warehousing services besides automating payment cycles (for sellers) to facilitate trade. It further helps buyers and sellers with working capital, gets a commission on every transaction and earns interest on the capital.

The agritech firm started its operations in West Bengal, Assam, Tripura and other eastern states and currently services northern and central India. It claims to have onboarded 100+ B2B clients, aims to operate a pan-India marketplace this year and plans to grow at a 25% MoM rate.

Anastrat

Share On:

Why Anastrat Made It To The List

Despite the outbreak of the pandemic in early 2020 and the subsequent economic slowdown, the Indian stock market added more than 2 Cr retail investors in 2020-2021. There is no shortage of DIY online investment tools either, but very few platforms help investors measure their performances, identify mistakes and improvise for the best outcomes. But a suitable solution came into sight when Bengaluru-based Anastrat was launched in 2021. The AI-powered post-trade analytics platform uses a proprietary system to evaluate and enhance the capability and performance of a professional investor while providing learning and upskilling resources to stock market newcomers.

The startup has developed the Anastrat scoring system to determine an investor’s trading excellence in sync with the market movement. The score is based on every trade computed and considers more than 100 parameters, including daily output, Sharpe ratio (ROI against risk), a weighted average of daily, weekly and monthly trades, consistency, duration, calculated response, risk management, aggression, panic selling and more. The subscription-based SaaS platform also features a daily trading journal that tags prime strategies and indicators for future references.

Anastrat allows the integration of major trading platforms such as Zerodha, FYERS, SAMCO, IIFL and Dhan on its dashboard for operational ease. It also claims that more than 1 Lakh traders operating on the NSE and the MCX use the platform. This year, the company plans to offer post-trade analytics for crypto traders and new investors in the blockchain space to push its revenue and market reach.

AntWalk

Share On:

Why AntWalk Made It To The List

In a world thriving on sustainable business strategy and cutting-edge tech, the need for corporate L&D (learning and development) is constantly on the rise. Until recently, these learning models were primarily MOOC-style or workshop-oriented and featured routine study materials, resulting in low engagement and high drop-out rates. Given the siloed process and the lack of learner motivation, former McKinsey consultants Joybroto Ganguly, Basav Nagur and Sriramkumar Sundararaman launched AntWalk in 2020, adopting a ‘by the professional, for the professional’ approach.

Bengaluru-based AntWalk offers paid and free content across 15-plus domains from more than 3K global professionals. The format here is experiential micro-videos, and the approach is refreshing, helping new hires to get acclimatised to the corporate environment and role objectives.

The startup offers self-paced content across business functions like sales, general management and product & design and the latest technology functions like data engineering and cybersecurity. It also provides one-to-one coaching and live group sessions. By connecting industry experts with industry newbies, the platform has thrown open enterprise L&D solutions for better outcomes and leadership development.

AntWork’s enterprise clients pay for these courses, and their employees have full access to the AntWalk LMS (learning management system), personalised curricula and class quizzes. They have to submit assignments and projects, and their progress/growth is monitored during and after lessons.

The startup claims to have delivered 1K+ hours of live interactions across 20+ startups and enterprises and plans to increase the number of companies to 200+ by 2022.

BurnCal

Share On:

Why BurnCal Made It To The List

After the acquisition of Drone Nation by EnerComp in 2020, cofounder Chetan Reddy set out on a personal fitness journey. He lost 40 kg, a massive physical transformation, and realised that fitness remained a tangible factor even in a digital-first world. The fitness industry largely depends on brick-and-mortar gyms, and personal coaching has an average 80% retention rate compared to self-service fitness apps and virtual training with a retention rate of 20% or so. In brief, there was a lack of synergy between personalised training by experts in the physical world and the booming virtual workout space. So, Reddy decided to become a certified fitness coach and started BurnCal.

The Hyderabad-based remote-first fitness facility started as a B2C platform, connecting enthusiasts to fitness coaches and nutrition specialists. It later evolved into a B2B2C web-based SaaS tool called BurnCoach, enabling fitness and wellness professionals to create programmes, track progress, communicate and collect payments from their members. Fitness professionals pay a subscription fee of INR 2,300 ($30) per month for this service.

The BurnCal app works at the B2C level and ensures that people keen to pursue workout routines are advised by professional coaches. Each B2C user pays a monthly fee of INR 2,950 for guided one-to-one workout sessions, personalised nutrition charts and progress tracking by connecting their fitness bands to the app, among other services. The startup has helped more than 1,500 users and recently partnered with a US-based marketplace with 137K coaches to roll out the product at scale.

BurnCal is working on the launch of its BurnCoach app and aims to clock $1 Mn in revenue by FY23. In the long term, it plans to create a Shopify-style platform where coaches can be content creators and launch their products.

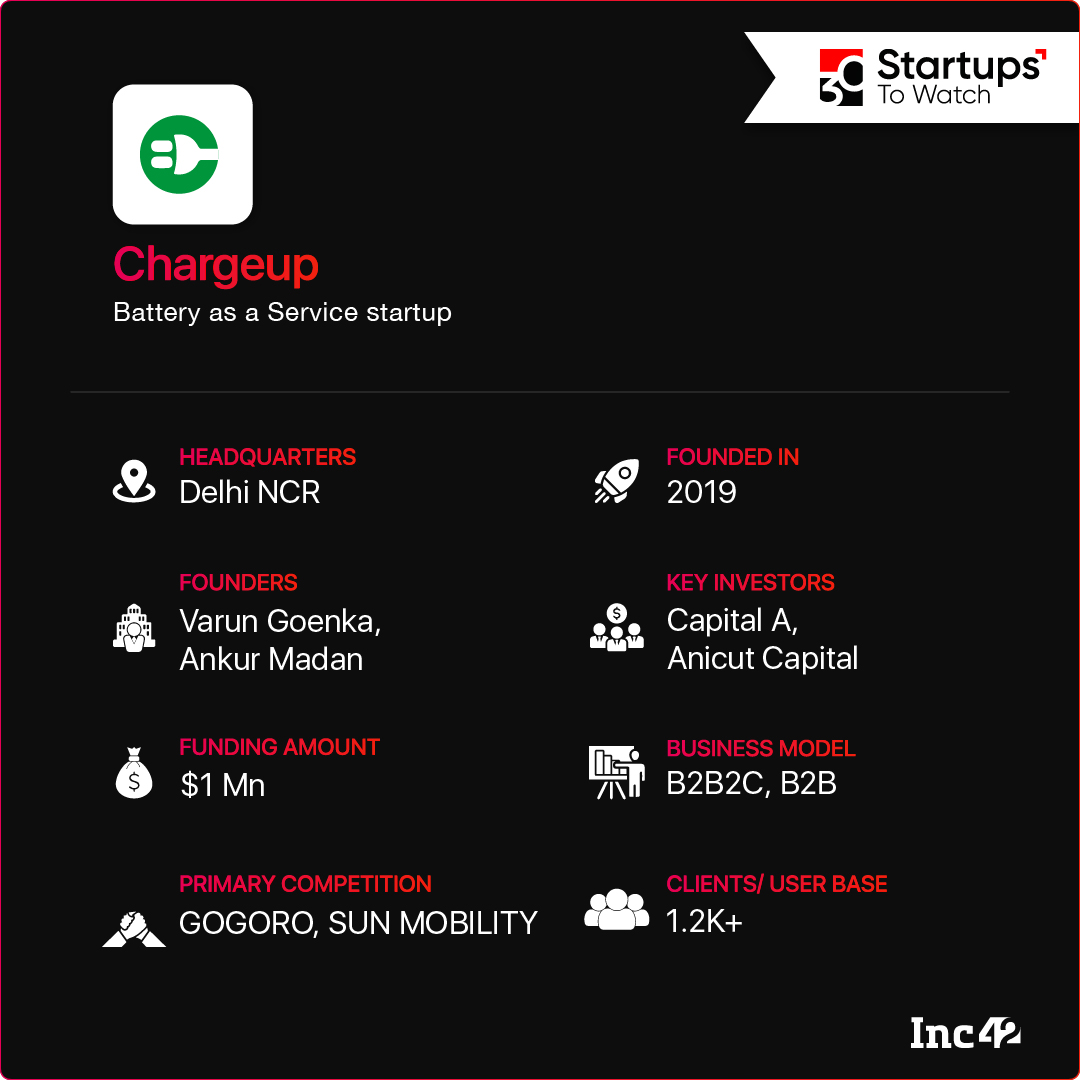

Chargeup

Share On:

Why Chargeup Made It To The List

Despite the recent unfortunate incidents, the demand for electric vehicles has not plateaued in India. However, companies and industry experts need to deep dive into critical issues such as battery safety, range anxiety and capping battery costs without compromising the quality of components and materials. Among many Indian startups in the EV space, the three-year-old Chargeup offers battery-as-a-service (BaaS) and claims battery swapping to be a safe and quick solution.

The B2B2C EV startup enables battery swapping at 150+ swap stations across Delhi-NCR. The batteries on offer are interoperable, which means these can be used for both two-wheelers and three-wheelers. The New Delhi-based startup has an asset-light operational model. It procures the batteries on lease from manufacturers and provides them as a service through dealer locations. It further uses a predictive model based on real-time data collected from battery usage and provides journey analytics to EV drivers to ensure smooth operations. The New Delhi-based startup operates on a subscription model, where drivers pay for the number of swaps per week/month. EV drivers also pay the battery cost to dealers, and the latter pays the franchise cost to Chargeup.

Currently, Chargeup is only operating in Delhi-NCR, but it will expand to 10 cities by 2022. The startup will cater to 1 Lakh+ EVs by 2025, create an open data platform for connected solutions to optimise vehicle efficiency and provide EV financing.

Farm Prosperity

Share On:

Why Farm Prosperity Made It To The List

Agriculture in India is rarely considered a lucrative livelihood option. According to 2011 census data, around 2,000 farmers leave farming every day. And over the years, the dependency of rural households on agriculture had steadily declined to 50%, as per the 2018-19 Periodic Labour Force Survey. However, Rajesh Patidar, Sourabh Rai and Ritesh Patidar, cofounders of Noida-based Farm Prosperity Solutions, think more farmers will stick to agriculture if their farms yield better incomes. As the trio belongs to farming families, they feel strongly about India’s agrarian challenges.

Farm Prosperity was launched in 2020 to focus on cotton and chilli, two major cash crops of India. The startup has built a network of farmers and connected them to an ecommerce platform to ensure good quality agri-inputs such as seeds, pesticides, fertilisers, micronutrients, animal feed and more. It also provides advisory and agri-output services, including crop management, procurement, price realisation and food provenance, helping farmers raise their net incomes and generate rural employment. It operates in Madhya Pradesh and Andhra Pradesh but will soon expand to Telangana, Maharashtra, Gujarat and Karnataka.

FPS claims to have onboarded 150K farmers from four districts and 500 villages and earns through commissions on agri-inputs. It aims to clock more than INR 15 Cr in revenue in 2022 and reach 500K+ farmers across the country, with the continued focus on cotton and chilli produce. Its target is to reach 5 Mn farmers by 2025, hit a turnover of INR 300 Cr and leverage blockchain technology for remote sensing, crop advisory, crop quality assessment and food traceability.

FlipIt Money

Share On:

Why FlipItMoney Made It To The List

Lately, investing in stock and crypto markets has emerged as one of the most lucrative options. But many small and retail investors stay away from these assets due to their lack of market knowledge and the extreme volatility on the ground. To address this knowledge gap, former LocoNav executives Dipankar Biswas and Bharat Bhushan and serial entrepreneur Diptanil Das launched FlipItMoney (previously FlipItNews) in 2020.

The Gurugram-based startup is a financial literacy-first company offering a bunch of gamified services. These include FlipIt Circle (financial aficionados teaching others and learning from their peers); FlipIt News (bite-sized news about stock and crypto markets); FlipIt Advice (broking firms suggest whether to buy, sell or hold a stock); FlipIt Games (learning through predictive investments and gamified quizzes); FlipIt Research (provides 1-10 years of data on stocks) and FlipIt Invest (to track existing portfolios from smallcase, Zerodha and the like and invest in stocks and crypto).

More than 125K users have already installed the FlipItMoney app, and the company plans to grow the number to 1 Mn by 2022.

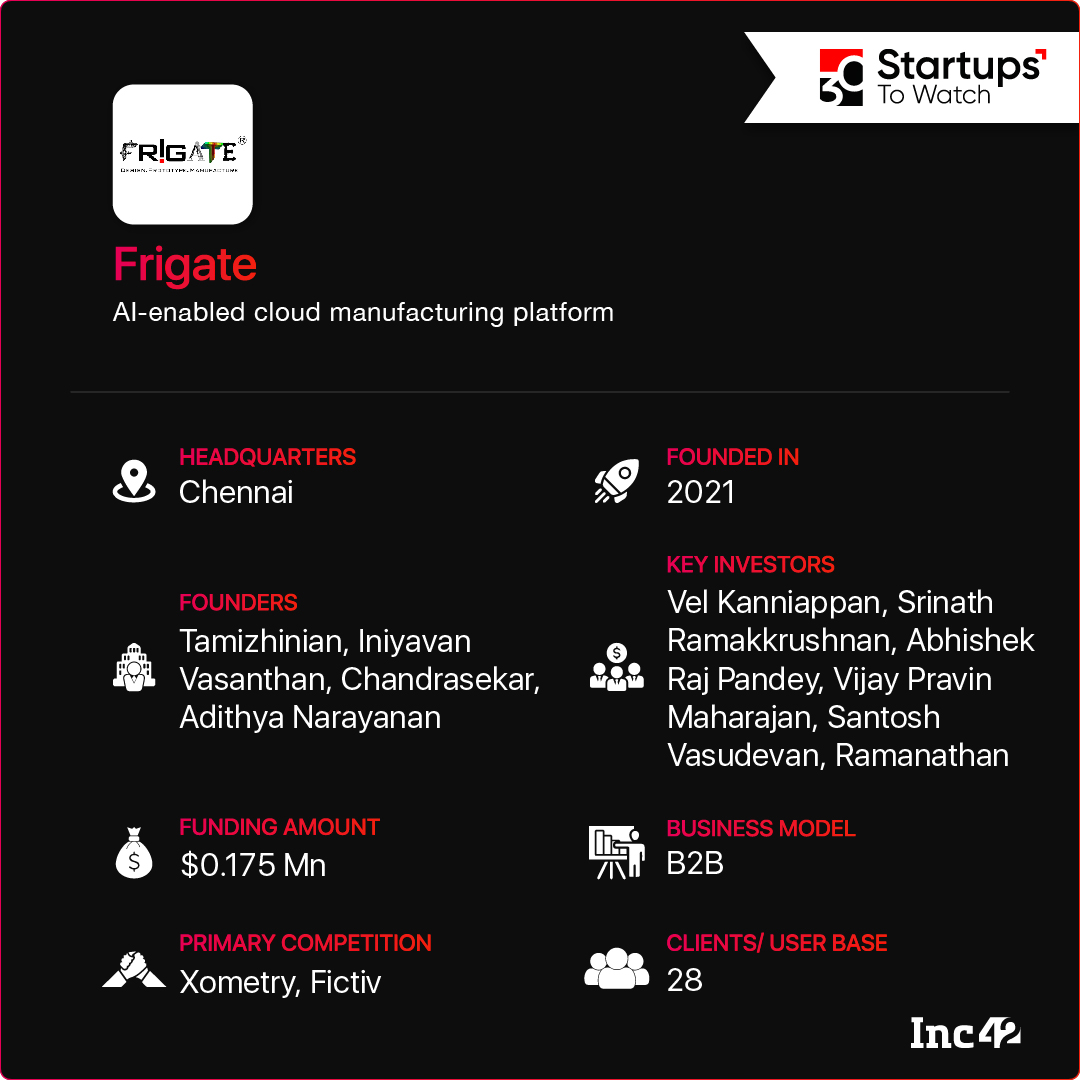

Frigate

Share On:

Why Frigate Made It To The List

Cloud manufacturing (CMfg) is a new concept in India’s advanced manufacturing space, but the segment is slated to hit the $1 Tn mark by 2025. It is all about leveraging manufacturing resources and capabilities offered by companies connected in the cloud so that their ‘distributed’ expertise can bring forth best-quality products and optimise their revenues. Chennai-based Frigate was launched in 2021 with the same objective to marry manufacturing prowess with cloud connectivity to create a robust, digitalised value chain.

Frigate started as a prototyping firm, making medical equipment and automotive parts until a year ago. But it pivoted to CMfg in late 2021 after one of its customers asked the company to manufacture the device it was prototyping. Now, the startup works as a cloud manufacturing platform for sectors like EV, defence and aerospace. Powered by the industrial internet of things (IIOT), it identifies the topology of every design and uses fabrication, 3D printing, CNC machining and other services to ‘build’ products.

The B2B platform caters to OEMs, SMEs and startups and claims to have onboarded 28 clients. It plans to take the number to 50 by this year and aims to become a $100 Mn company by 2025.

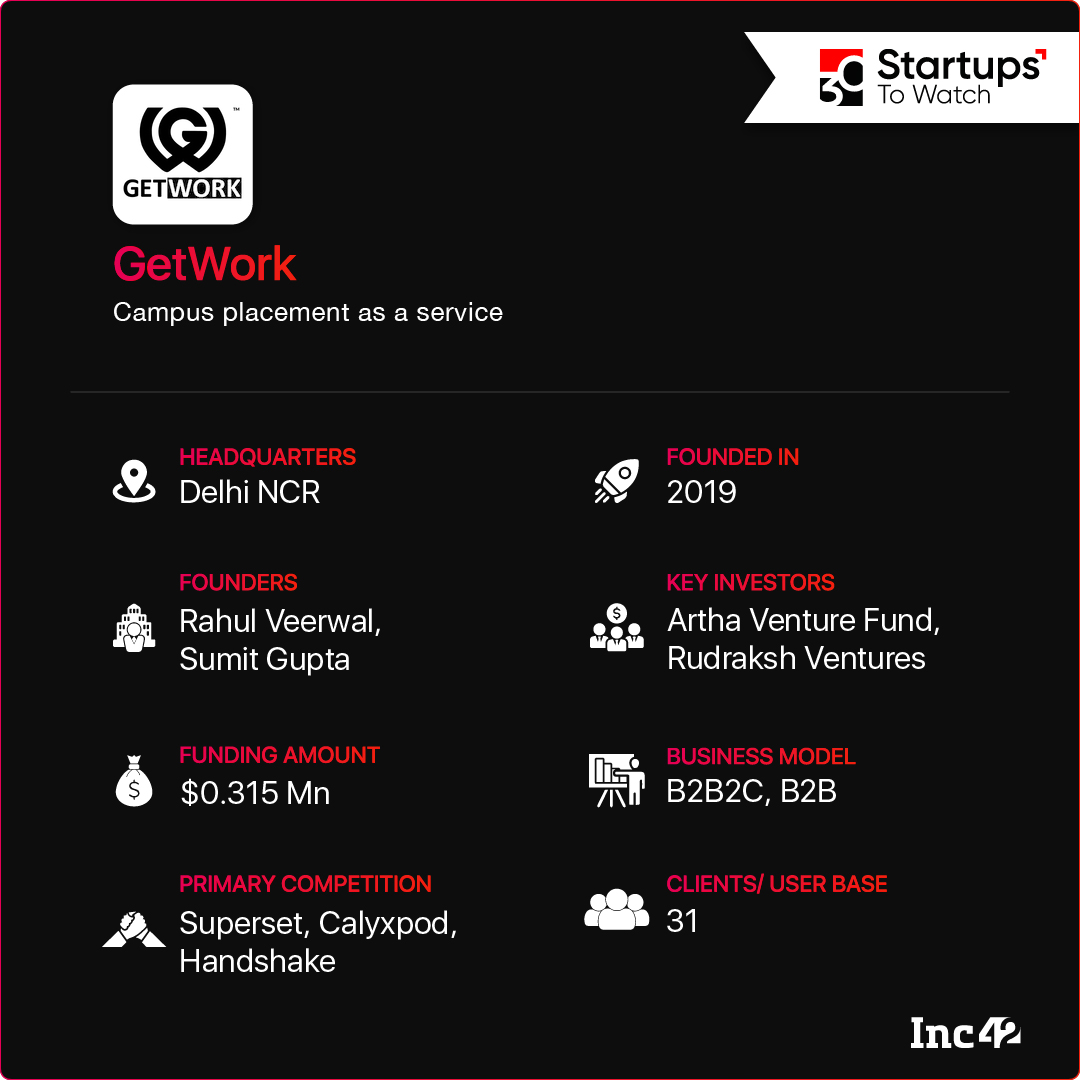

GetWork

Share On:

Why GetWork Made It To The List

When it comes to campus placements, the average pay difference between Tier 1 institutions and the rest tends to distress Indian students as 90% of them graduate from Tier 2-3 colleges. But the wide pay gap is just one part of the problem. It may also lead to disparity in representation and impact job satisfaction in the long run.

To address these pain points, MNNIT (Prayagraj) alumni Rahul Veerwal and Sumit Gupta came out with a holistic solution that would usher in more parity and launched GetWork in 2019. The Gurugram-based startup provides a two-way marketplace for both students and universities. While students can hugely benefit from the training/upskilling marketplace, the institutions on board can easily access companies and startups looking for talented freshers.

GetWork hosts a LinkedIn-like platform called OneApp for students keen on upskilling on the go and getting on-campus and off-campus opportunities. The startup charges students for the courses and mentorship sessions. However, it provides free auxiliary services such as resume and portfolio creation, a GetWork drive to store and manage official documents and a campus-connected chat to keep students updated about peers and job openings.

Additionally, the pay-per-student platform is managed by college placement committees that build corporate relationships, track job applications and shortlisted candidates and create targeted feeds for job discovery.

Employers/corporate houses use a credit/wallet recharge system to post jobs on the startup’s web platform (sales, data science, engineering and HR are some of the major categories), connect with students and conduct on-campus recruitment drives.

GetWork plans to onboard more than 1K paid colleges and place 100K+ students in 10K+ companies by the end of this year. In the long term, it aims to focus on democratising campus placement experience across Tier 2 cities and beyond and mint talented freshers by providing upskilling opportunities.

HuddleUp

Share On:

Why HuddleUp Made It To The List

Traditional employee engagement and performance tracking methods have gone for a toss in the wake of the pandemic that has triggered a dynamic and hybrid work culture worldwide. The legacy systems in use must be replaced by continuous intelligence (CI), smart tools and processes integrating real-time analytics with operations to study outcomes and recommend actions. The rise of augmented analytics to promote employee support amplifies job satisfaction, reduces burnout and brings down. Bengaluru-based HuddleUp has been built on this principle to help companies and employees.

Launched in 2021, the startup has developed an AI-powered plug-and-play system that creates a continuous communication and feedback loop between managers and their teams. This is done through real-time people analytics, one-on-one discussions, suggested learning, review features, kudos for excellence and more. The HuddleUp plugin sparks spontaneous watercooler chats within teams and generates a reward-based leaderboard on the successful completion of tasks. More interestingly, an AI-powered culture bot undertakes health surveys with empathetic conversations to understand how every team member is feeling mentally and emotionally.

HuddleUp can be used on multiple teamwork/collaboration platforms such as Slack, Teams, Office 365 and Google Workspace. It offers a personalised dashboard for every manager to check in with their teams, take steps to boost employee morale and undergo bite-sized management lessons, if necessary. All these can help reduce attrition by 70%, the startup says.

The SaaS platform bills organisations on a per-employee per-month basis and claims to have clocked 18x revenue growth in the past eight months. It plans to grow its team and onboard more businesses by this year.

IntelleWings

Share On:

Why IntelleWings Made It To The List

It is estimated that 2-5% of the global GDP comes from money laundering, and corruption is not likely to let up soon. However, former Infosys executive Pramod Sharma believes that tech is the way to lower the corruption level and make the world safer and better regulated. Founded by Sharma in 2019, IntelleWings is a regtech startup, making anti-money laundering (AML) and combating financing of terrorism (CFT) compliances easier with its suite of SaaS products called EYE.

Panchkula-based IntelleWing provides a host of services, including sanctions check, transaction monitoring, case management, integrated media check for PEP (politically exposed persons) and auto-generation of all regulatory reports. The Haryana startup has an Indian private sector bank and 10 DNFBPs (Designated Non-Financial Business and Professions) from the Middle East among its customers. It will also expand to the US, Africa and South Asia.

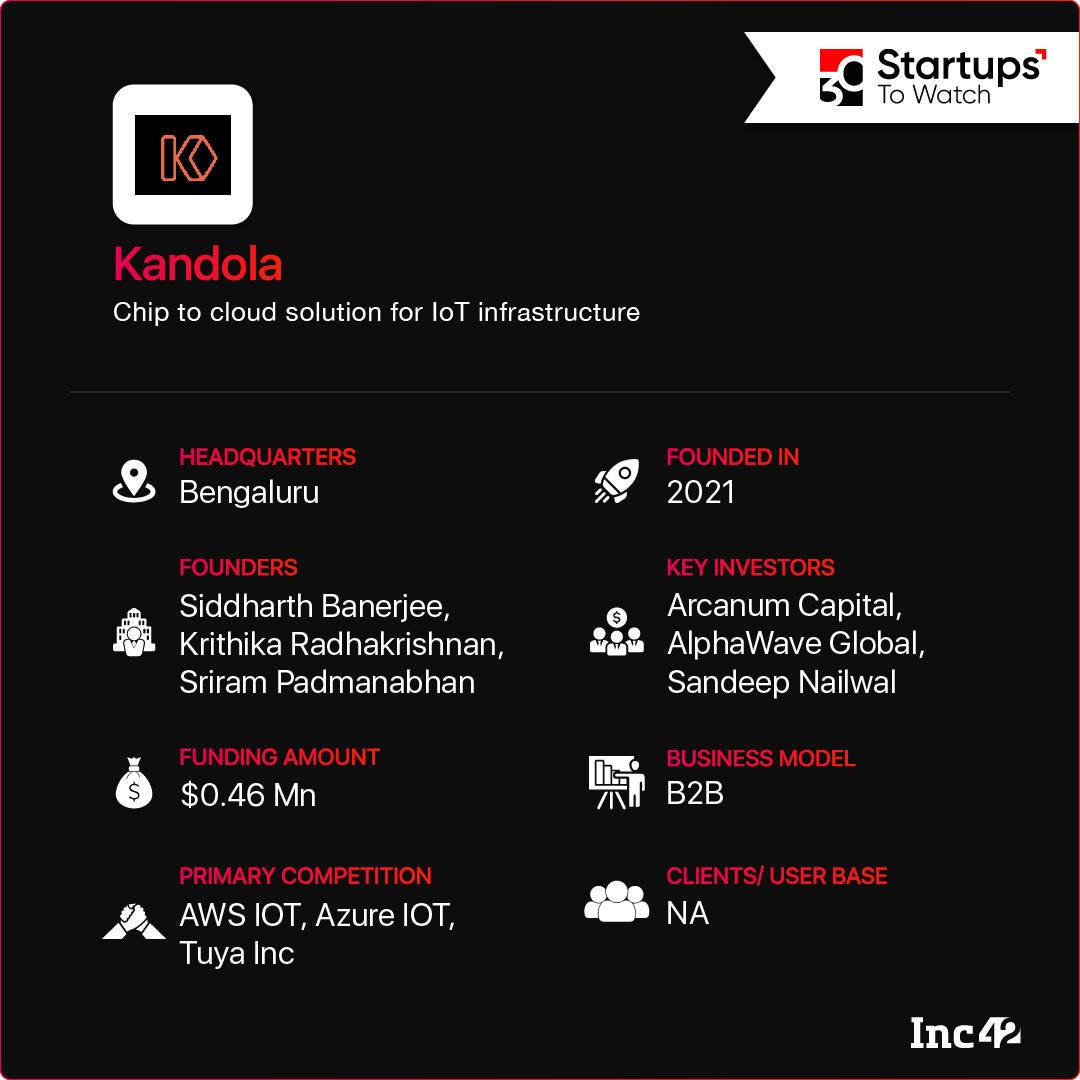

Kandola Network

Share On:

Why Kandola Network Made It To The List

The connected device market has reached $525 Bn globally, but all is not hunky-dory yet, given the system lag, data breach risks and skyrocketing prices. As for developers, finding a full-stack IoT platform that is secure, scalable and accessible-to-all is nothing short of a dream. So, Kandola Network from Bengaluru was set up in 2022, focussing on building Layer 1 and Web3-based decentralised, chip-to-cloud solutions for IoT applications, complete with device security, data privacy and other compliance standards required for this field.

The privacy-first, platform-as-a-service (PaaS) startup operates worldwide, except in countries that explicitly disallow Web3 projects. It is now solving two critical problems that hinder the Web3 infrastructure today – speed and transaction cost – to help Web3 scale beyond NFTs and DeFi and master other areas like real-time messaging, data storage and digital identity verification. The Kandola platform will provide firmware on the hardware, enable device identity management using decentralised identifiers (DIDs), ensure two-way optimistic verifications and use zero-knowledge protocol for data exchange between businesses.

The startup is still in beta but plans to go for a formal launch by March next year, allowing developers and companies to build their products on Kandola. It will also provide use-cases beyond IoT and explore areas like Web3 chat applications, decentralised social finance apps, the metaverse at large and Web3 gaming.

It further intends to operate as an IoT solutions marketplace and aims to incentivise developers with digital tokens on the Kandola protocol. Apart from the fees paid by the developers using the platform, the startup will charge a fixed amount for running the firmware and a commission for device and solution discovery on the Kandola Open Marketplace.

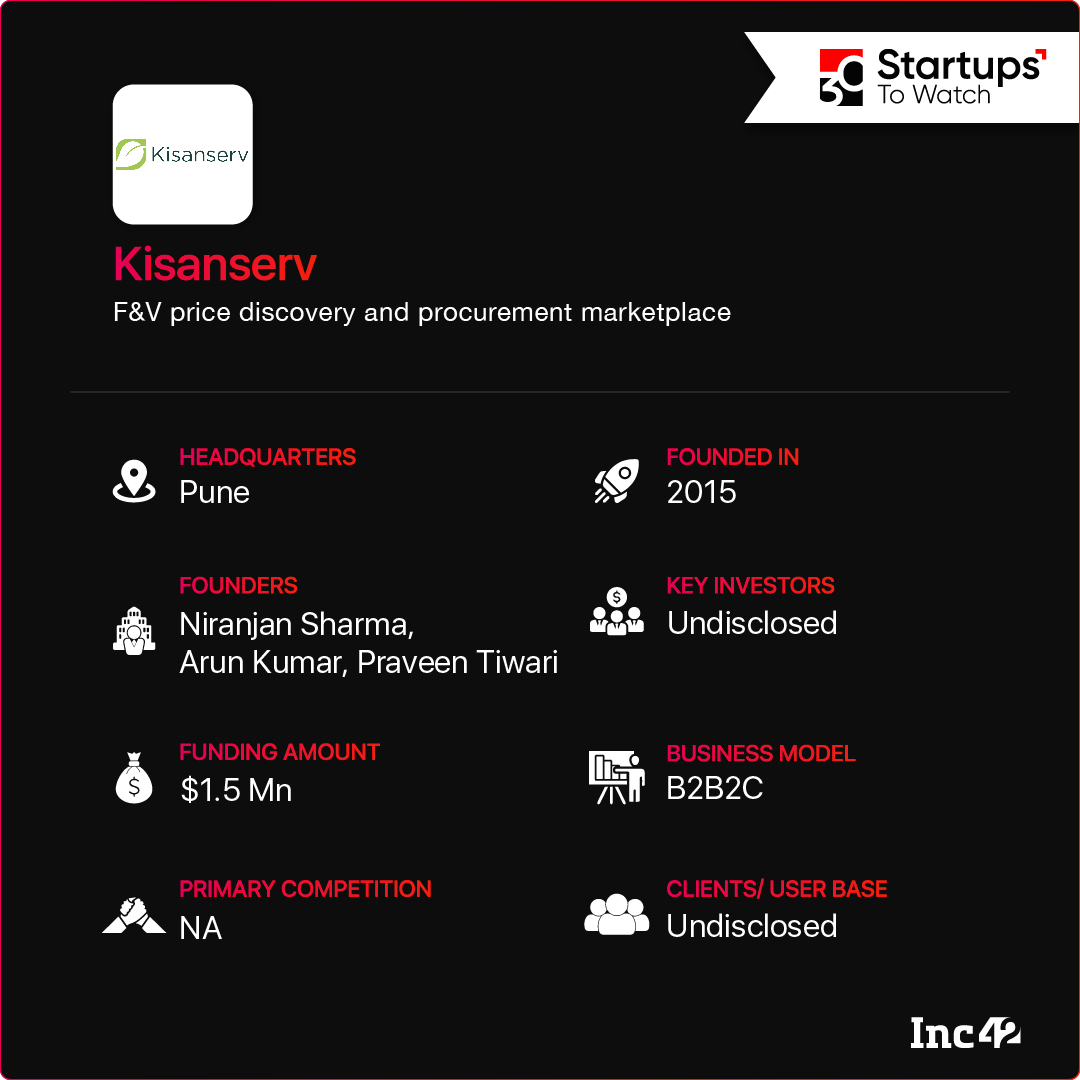

Kisanserv

Share On:

Why Kisanserv Made It To The List

Price discovery for fruit and vegetable (F&V) procurement has always been challenging in India due to random price negotiations happening across unorganised markets. It also puts agribusinesses at risk when it comes to scalability and profit. To address this pain point, Niranjan Sharma, Arun Kumar and Praveen Tiwari set up Kisanserv. This tech-enabled platform does away with pricing adjustments and only lists market-regulated prices of fruits and vegetables to avoid margin leakage. Set up in 2020, the Pune-based startup also eliminates intermediaries from the transaction process, does quality checks and bulk buying and ensures end-to-end delivery for F&V farmers, suppliers and corporate buyers.

Kisanserv houses five verticals: Bidb, the price discovery and procurement platform; Kisanserv D2C for end consumers who want to buy products directly; Kisanserv Saajhedari that partners with local retail stores for F&V procurement; Kisanserv Alliance for the Horeca segment that does bulk buying across locations and Kisanserv Trade for export and import of farm produce. The startup plans to launch Kisanserv Eats, a foodtech platform for ready-to-eat dishes, and Kisanserv Express, a hyperlocal delivery service that brings F&V to consumers in less than 30 minutes.

The company has adopted an arbitrage model, simultaneously buying and selling in different markets to take advantage of the price difference. It operates in Maharashtra and Gujarat and expects to clock INR 100 Cr in revenue by FY23. Kisanserv plans to enter 15 more cities in the west, central and southern India, targeting INR 1,900 Cr in revenue by FY26.

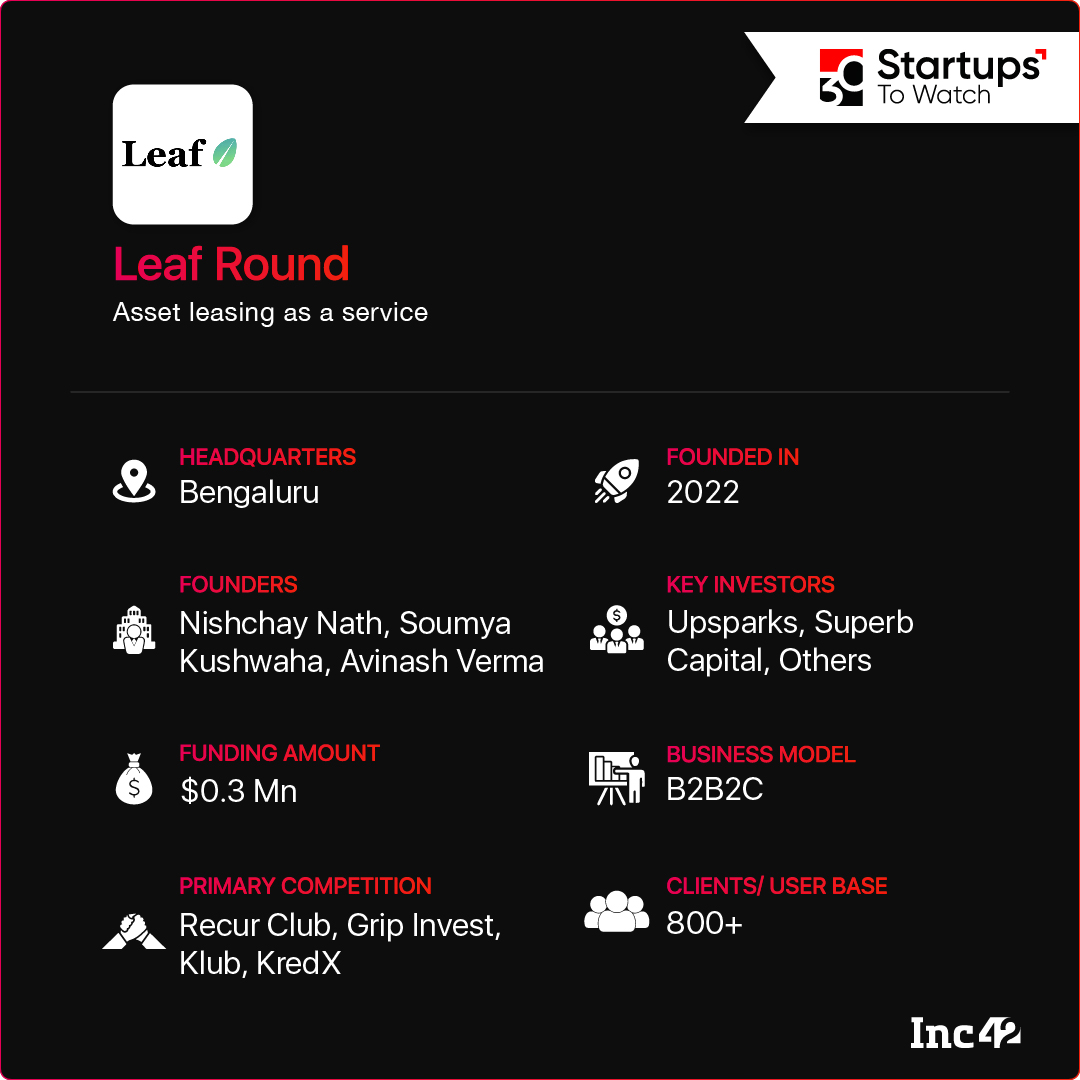

Leaf Round

Share On:

Why Leaf Round Made It To The List

If you mention rent or leasing, one is bound to think of earnings from real estate at the first go. But is it possible to build new wealth products that can be monetised similarly? This is easier said than done as most people tend to pursue a fixed path when it comes to asset monetisation or return on investments. However, IIM-Ahmedabad alumni Nishchay Nath and Soumya Kushwaha and former UiPath executive Avinash Verma decided to do it and rock the assets market.

Set up in February this year, the Bengaluru-based startup enables people to buy, own and rent out various assets such as furniture, IT equipment and vehicles to earn high returns as monthly rentals for up to 24 months. It has a marketplace model in place that helps retail investors find CAPEX-needy companies keen to sell their assets, purchase the same and sign a contract with those who want to pay monthly rents to use those assets. Leaf Round also ensures that the assets on rent will reach users in impeccable condition and on time. It uses a custom OS for documentation and payment collections, charging a fee for every transaction on the platform.

Currently, potential investors can reserve spots to invest via Leaf Round, but the startup is gearing up for a public launch in the first half of 2022. It has already done a beta launch between February and April to see the number of users grow 60% MoM.

Maatri

Share On:

Why Maatri Made It To The List

Childcare is no easy task, especially for new parents, as it can be challenging to keep track of medicines and vaccination schedules and cater to a newborn’s health and wellness needs. Founded in 2019, Maatri accompanies parents in their thrilling but critical journey stage by stage, from infancy through to adolescence.

With multiple products in place, including child development trackers, paediatrician teleconsultation services and vital signs tracking for toddlers, the Gurugram-based startup helps parents monitor how their children are growing up. There is a digital card to cover all vaccinations and an option to capture and store evergreen memories like an infant’s first birthday or the first teeth erupting.

Recently, the subscription-based child health startup further added a digital record-keeping and teleconsultation feature for the entire family, including the pets, on its Android and iOS apps, allowing parents to keep the whole family’s medical history in one place.

Mentza

Share On:

Why Mentza Made It To The List

The art of storytelling has evolved over the years, with social media and OTT platforms ushering in a variety of entertainment and interaction formats. Earlier, the text had given in to the video, but that, too, is undergoing a metamorphosis. This time around, podcasts and voice-first social conversations are rapidly taking over, and people are all ears for bite-sized content available on the go.

But there are few all-in-one homegrown audio platforms that allow users to listen, create and share stories à la Spotify. Bridging this gap is Mumbai-based Mentza, a live audio platform where the community can create, engage, transfer, share and exchange stories in 20-minute conversations.

Set up in 2020 and launched in August 2021, the community-oriented platform pushes micro conversations rather than narratives. In fact, this startup follows three distinct narrative styles.

First, users can create group chat-style Circles on Mentza’s Android/iOS apps. Here, like-minded people can talk about any topic, and they will get 40-second long AI-made teasers and highlights of these conversations displayed under the relevant category type. The Circles are collated into 12 learning communities such as personal finance, parenting, campus connect and recruitment, travel and food. Incidentally, these Circles are monitored by a select few (invite-only people) called the community architects.

The second format allows users to create, host and manage private channels where a 20-minute conversation is turned into a podcast episode. However, Mentza keeps a tab on the podcast quality.

The audio platform also provides a Studio feature that allows creators to turn 20-minutes conversations into shareable podcasts published on major platforms like Spotify, AudioPortfolio or Audvisor.

Mentza is still working on the revenue model, but it plans to adopt a subscription module for private communities. The startup will also monetise the Mentza Studio and allow brand partnerships to operate across Circles to earn ad revenues.

So far, the startup claims to have 120K+ members and 200K+ minutes of content. It also features more than 300 weekly series (member-run content), and the number is set to hit 1K+ per week in 2022.

Newrl

Share On:

Why Newrl Made It To The List

Mention blockchain and many people will immediately jump to more widespread use cases like NFTs and cryptocurrencies. But few would like to explore critical use cases like DeFi or decentralised finance, a fast-emerging fintech practice that can loosen the hold of legacy players and securely democratise all things finance.

According to the latest data, the amount of money currently locked in DeFi stands at $96 Bn, up from $10.3 Bn in 2020. Given this scenario, it is not surprising that DeFi startups like Newrl are coming up with lucrative financial solutions for segments like lending, borrowing, broker-dealer and custodianship, intending to create an ‘ownership economy’ as opposed to Web2’s customer-vendor economy.

Set up in 2019, Newrl is a Mumbai-based blockchain-as-a-service platform that helps companies create a protocol layer of template-driven transactions, smart contracts and DAOs. It also provides a decentralised exchange for asset trading and tokenises real-world assets and contracts. Lately, it has launched a service to tokenise startup equity.

Newrl is currently building an application layer for D2C brands, warehouse management companies, fractional property investment platforms and alternative asset managers to tokenise asset types such as properties, brand value, warehouse receipts and carbon credits. This will build trustworthiness and create the proof of ownership.

The Newrl network charges a fixed transaction fee that can be paid with stablecoins or Newrl tokens. The startup currently boasts an AUM of $100 Mn and plans to onboard 100 Mn users from India and the US by 2022, taking its assets under management to $1 Bn.

One World Nation

Share On:

Why One World Nation Made It To The List

Even in this digital-first age, most crypto conversations around native concepts such as DeFi, off-chain, APY and even crypto-mining sound like complex industry jargon to new users. So, Bengaluru-based One World Nation (OWN) was set up in 2022 to help people understand these terms through the gamification of blockchain technology and crypto products.

Inspired by the Pokémon anime, OWN has created a virtual planet called Crypton, where every cryptocurrency is called a Cryptonite (for example, Bitcoin Cryptonite). Enthusiasts can build a portfolio of Cryptonites, collect NFTs, play fantasy, leadership and prediction games linked to crypto markets using the Cryptonites and earn rewards while learning about the industry.

OWN earns its revenue from transaction fees for NFT ownership and commissions charged on the games featured on its web platform. The startup will soon launch it on mobile to provide easy access to its user community as it aims to reach a DAU of 2 Mn by 2025. It will further build partnerships with NFT launchpads and introduce $OWNED tokens in April-June 2022.

PaisaGrowth

Share On:

Why PaisaGrowth Made It To The List

Although end-users have access to several financial services platforms nowadays, only a few on-demand financial infra platforms exist for intermediaries operating in the informal lending segment.

Founded in 2020, PaisaGrowth is a SaaS-based fin infra-on-demand platform that provides digital solutions to loan advisors, loan agents and direct selling agents (DSAs) to help them set up and grow independent businesses.

The Gurugram-based startup provides an Android app that integrates all well-known digital lenders like Lendingkart, Indifi and LoanTap and recommends the best-fit companies for borrowers based on higher chances of loan approval via its matchmaking platform. It also provides a dashboard for agents to create leads and send those to lenders. Plus, there are screening and decision automation software programmes for smooth operations.

The platform charges a transaction fee from lenders and pays a commission to agents upon successful transactions every month.

Paycorp.io

Share On:

Why Paycorp.io Made It To The List

The B2C payments segment has undergone rapid digitalisation, thanks to the ubiquitous UPI and other P2P options. But the same cannot be said about the B2B space, as e-mandates, subscription systems, or recurring payments have not thrived due to sluggish technology upgrades. That’s why Paycorp.io was launched in 2020 to set up an ecosystem for B2B payments collection and processing recurring payments in the B2B2B and B2B2C segments.

The Bengaluru startup offers a cloud-native tech stack to small businesses for payment processing. SMEs can choose a bank, convert or transfer their ACH mandates to Paycorp’s digital dashboard, and track, create and receive payments to their bank accounts. For digital lenders and large corporations, the startup provides an API-based payment processing platform where legacy payment data from Excel sheets can be uploaded onto the dashboard, helping them manage all inbound and outbound recurring payments. It extends its API integration for banks, allowing the latter’s corporate customers to reap the benefits of Paycorp features.

The startup charges a fixed transaction fee and claims to have earned revenue of INR 4.5 Cr in FY22. It partnered with eight banks in Q1 2022 and subsequently acquired more than 25 customers across India, the UAE and the Sultanate of Oman. It plans to partner with 25 banks this year and enter the market across Dubai and Abu Dhabi.

PaySprint

Share On:

Why PaySprint Made It To The List

Building a cutting-edge fintech solution is always a challenge, keeping in mind critical issues like ease of use, data security and a host of other things. With the Indian fintech market estimated to hit $1.3 Tn by 2025, developing robust solutions is the need of the hour as the demand for overarching and inclusive fintech solutions is rising.

Founded in 2020, New Delhi-based PaySprint provides APIs that help develop a number of payment solutions such as payment gateways, insurance backends, neobanks and lending, investment and trading platforms for different sectors. The startup works with legacy banks (the State Bank of India, Axis Bank) and fintech behemoths like Razorpay, Fino and Paytm, among others, to help build an end-to-end fintech ecosystem.

It also provides APIs for PAN card creation and verification, Digilocker solutions, KYC and bank account verification, education and travel solutions and more.

Rupyo

Share On:

Why Rupyo Made It To The List

Earned wage access (EWA) is an advance payment solution that helps people get a part of their earned salary before payday. This concept of ‘on-demand’ payment is finally catching up in India, especially in the wake of the pandemic, when ready cash is in great demand to meet emergency expenditures. Leading the charge in this space are startups like New Delhi-based Rupyo, as more and more employees welcome the idea of payment flexibility.

Set up in 2020 by serial entrepreneur Shivin Khanna and CA and financial auditor Pragun Jindal, Rupyo can ensure employees’ financial well-being by providing access to accrued wages before the month’s end. The rest of the salary is paid at the end of the pay period. Most importantly, unlike salary-based lending or payday loans, EWA does not involve any borrowing on the part of the employee and costs very little.

Rupyo’s EWA platform charges a 2.5% transaction fee from employees, but the service is free for companies. It further provides Rupyo Plus, an additional service featuring credit products for employees, including personal loans, emergency medical loans and more. The startup is also working on a freemium SaaS tool for attendance and leave, payroll and employee benefits management. It claims to have catered to 20K+ employees by March 2022, with MoM growth of 116%.

Rupyo aims to serve 500K+ employees by FY23, disbursing earned wages of INR 12 Cr. It is further building an internal credit rating metric to offer need-based loans to employees to expand its lending portfolio.

SocialBoat

Share On:

Why SocialBoat Made It To The List

The outbreak of the Covid-19 pandemic in 2020 brought most physical businesses to a grinding halt, but the online industry continued to boom. Given the series of lockdowns and travel bans, Swapnil Vats and Rahul Jain, cofounders of the travel tech startup Holidaying, had time on their hands. The duo and many of their friends spent the time on fitness apps and virtual fitness classes, trying to grow their immunity. But what bothered them most was the delayed gratification (one doesn’t get the perfect body shape in a day) and hence, the sustainability of the online fitness industry. SocialBoat was born out of a play-to-earn concept where users are rewarded for burning calories.

Launched in 2021, Gurugram-based SocialBoat is a real-life fitness game that combines the competitiveness of sports and the fun of video games. In the end, players collect points if they finish their daily tasks like running for a kilometre, doing 20 push-ups or accomplishing something similar.

The team-based, influencer-led gaming module further allows fitness influencers and fitness centres to create games, build teams and make workouts fun for fitness enthusiasts. These influencers authenticate the fitness journey of each team member when they upload their daily achievements (screenshots of fitness band data) or connect their fitness bands to their profiles, post which the winners get monetary rewards.

For instance, the Decathlon Atria Mall in South Bombay created a task on their mobile web for a marathon and saw more than 30 participants. Cycling clubs such as the Faridabad Cycling Club and Pacing Panthers also compete with each other for motivation.

As of now, SocialBoat is free for all. But the startup is working to build a subscription-based revenue module where users can access special features, including group and guided workouts from trained instructors and a digital fitness metaverse with avatars emulating people’s fitness status. The platform hosts 145 teams with 2K+ users and plans to reach more than 50K by 2022. It will also launch a digital FitVerse and reach a global audience of 100 Mn in another three years.

Solv

Share On:

Why Solv Made It To The List

Globally, India is the second-largest MSME hub after China, but the sector accounts for just 30% of the country’s GDP. So, Standard Chartered-backed Solv started surveying the critical challenges faced by the MSME sector in India. According to the study, a lack of networking beyond Tier 3 markets, the absence of timely and adequate credit at critical junctures and the slow pace of technology adoption hindered MSME growth. Subsequently, the Bengaluru-based startup set up a full-stack B2B marketplace in 2020 to drive trade and revamp the cash and credit flow needed for rapid scaling.

Solv is an e-marketplace for suppliers and buyers transacting at competitive prices, and the platform charges a commission on every transaction. As most MSMEs in India are still unorganised and lack access to formal credit, the Solv platform provides a full bouquet of financial solutions for business expansion, supply chain financing and merchant BNPL to support small businesses. The startup has also developed a Solv scoring system, an alternative credit rating that analyses the MSMEs’ digital footprints to assess their ability and willingness to pay.

The startup currently operates in six categories – the FMCG, the FMCD and the HoReCa segments, as well as home furnishings, apparel, footwear and accessories. The startup claimed a $500 Mn AUM in FY22. As of now, it has 200K+ MSMEs on its platform and plans to add another 100K+ by the end of 2022.

Struct Finance

Share On:

Why Struct Finance Made It To The List

The significant growth of crypto derivatives and the DeFi ecosystem have triggered the need for structured products or market-linked investments. But existing derivative instruments are laden with static parameters, predominantly set by protocol developers, leaving the investors very few choices.

Set up in 2021, Chennai- and Singapore-based Struct Finance is addressing this pain point and building a suitable DeFi protocol by expanding the spectrum of on-chain structured products. It will offer a way to customise interest rates on instruments and leverage the options available in the ecosystem to construct a superior financial product called Factory. The platform, thus, intends to increase the number of investment choices available, enabling varying protection levels, abstracting risks and taking complex pricing away from its users while providing highly competitive yields on various digital assets.

The startup will launch on Avalanche by Q3 2022 but intends to scale across other EVM-compatible chains shortly.

Toplyne

Share On:

Why Toplyne Made It To The List

Products are the core component of any company, triggering revenue growth, building brand recognition and lifting it to the next level. Therefore, a business thriving on product-led growth always ensures frictionless sign-ups and a smooth product experience, optimising its earnings. Such product-led expansion also marks the success of the best SaaS companies, and Toplyne was set up in 2021 to make that happen seamlessly.

Bengaluru- and US-based Toplyne is a plug-and-play SaaS startup that enables freemium software companies to identify the non-paying customers who have the potential to turn into premium users. Now used by more than 15 enterprises such as designing giant Canva and testing platform BrowserStack, Toplyne’s Sales Assist product helps these companies stitch consumer information from product analytics, invoices and CRM behaviour across its platform. The startup then ranks the collected data by suitable indicators such as financial, behavioural and demographic touchpoints, creating a consumer engagement strategy.

Toplyne provides a usage-based freemium subscription model to earn revenues from enterprise customers when the latter could monetise their clients. It plans to launch a Self Serve product by H1 2022 and aims to become the go-to analytics provider for product-led companies.

Tridex Bazaar

Share On:

Why Tridex Bazaar Makes It To The List

Setting up a robust distribution network is a tough challenge for any new-age FMCG business. Worse still, few traditional distributors adopt cutting-edge supply chain technologies to deliver competitive advantages in a crowded market. Consequently, small CPG (consumer packaged goods) companies tend to lose their market share to big brands as they fail to foray into new or niche markets not yet dominated by industry behemoths.

Vipul Singh, Arsh Gauttam and Kartikey Bhatt, who had started their confectionary brand Baked With Love in early 2019, faced the same issue. But not the ones to crib and suffer, the trio set up Tridex Bazaar that same year as an online marketplace to connect all three major stakeholders of the FMCG business – brands, distributors and retailers.

On the Tridex platform, brands can discover and onboard new distributors and reach out to more retailers. Again, distributors can pick brands with high fulfilment margins and increase their inventory turnover. As a result, retailers also get access to a large number of SKUs with high margins. The New Delhi-based startup focusses on a fulfilment model and provides solutions for inventory and order management, invoicing, bookkeeping and more.

Tridex charges a 20% trade margin from distributors and gets 5-15% sales commissions from brands. It is now working to monetise its business intelligence platform to minimise the brands’ warehousing needs and create a just-in-time supply chain module. So far, the retail tech startup has brought in six brands and 2K+ retailers. It plans to reach 50K+ retailers and hit a turnover of INR 100 Cr by 2023. It further aims to hit $1 Bn in annualised GMV in another two years.

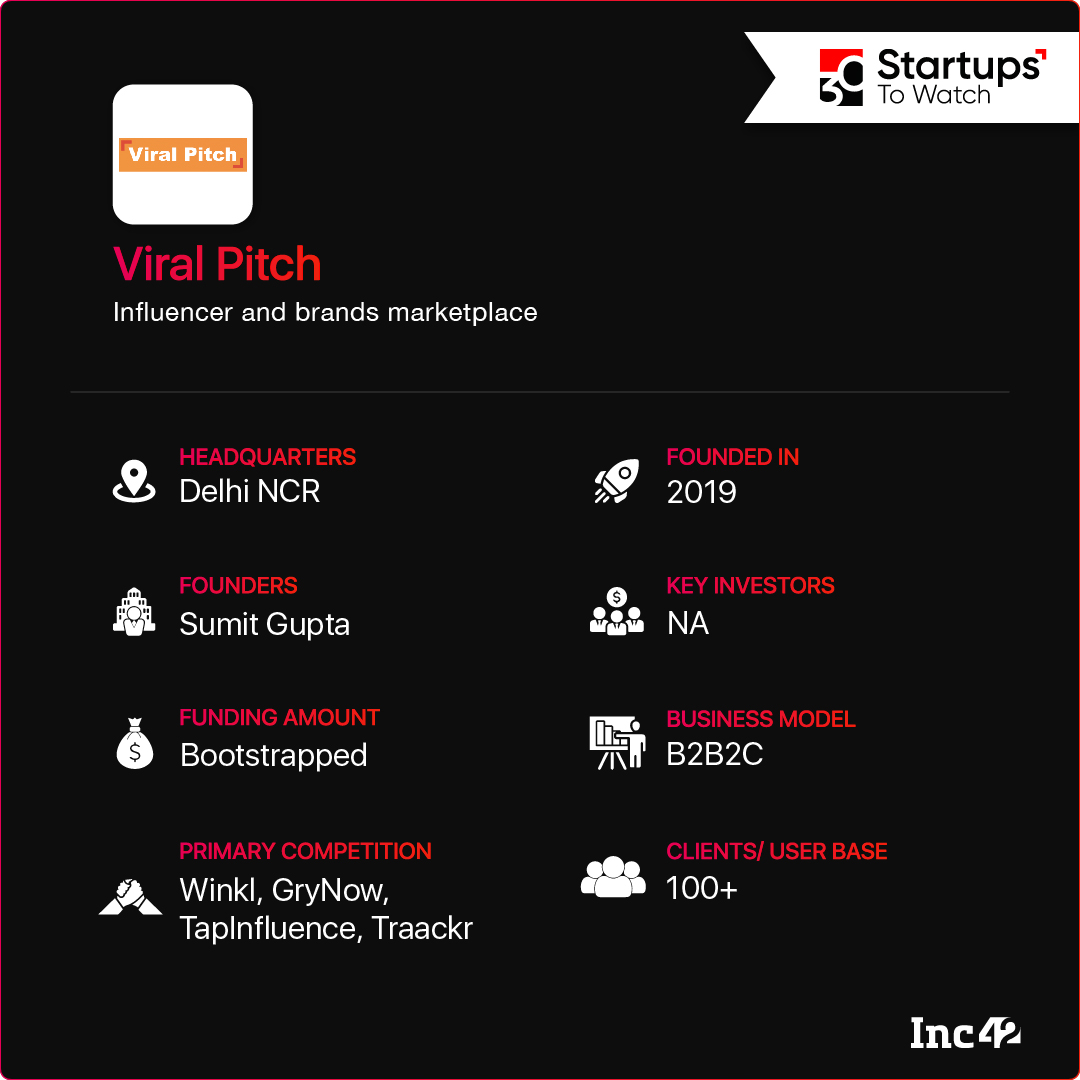

Viral Pitch

Share On:

Why Viral Pitch Made It To The List

One comes across many platforms that connect influencers with brands in these digital-first times. But serial entrepreneur Sumit Gupta wanted to create an entire ecosystem besides a creators’ marketplace. Viral Pitch was launched in 2020 as a platform that not only recommends synergies between brands and influencers but also creates and monitors data-driven ad campaigns across social media platforms.

The Gurugram-based startup features an influencer marketplace, allowing brands to choose from nano-influencers to mega-celebrities from more than 10 categories such as fashion, gaming, travel and more. They are most active on top social media platforms like Instagram, Snapchat, Facebook, YouTube, Twitter and LinkedIn, with access to 600+ cities.

To make influencer search easy, the platform has several search options in place, including types of content produced by influencers, topics and keywords, location with radius search, interests and fees. The brand-first influencer marketing agency also provides effective tools to create social media strategy within one’s ad budget, an AI-driven campaign mapping and monitoring option and a campaign performance collation via a brand campaign dashboard.

Viral Pitch recently acquired Bengaluru-based influencer marketing agency Talkative for an undisclosed amount to focus on building a campaign automation system. It plans to create a global marketplace for creators by 2025, akin to what Spotify has done for the music people.

Voiceoc

Share On:

Why Voiceoc Made It To The List

The pandemic has dramatically changed how we interact with digital businesses, especially via chatbots. But until now, the healthcare industry has not fully leveraged the benefits of conversational AI to deal with operational bottlenecks and enhance process co-ordination. But when everything went awry during a medical emergency (from booking appointments to receiving reports to getting medical support from hospitals), former classmates and colleagues Kush Aggarwal and Samarth Bhalwar decided to build a hybrid (text and voice) quick-communication solution on WhatsApp.

The New Delhi-based startup offers AI-powered voice and text assistance to help healthcare companies automate the entire patient journey. From service and centre discovery to checking discounts, from appointment booking to accessing medical documents and more, everything is available for patients in real time and on WhatsApp. They can also drop a text or give a voice command in the language of their choice via WhatsApp, and the Voiceoc-enabled WhatsApp chatbot will provide pre-recorded responses or connect users to company representatives.

Businesses can use the chatbot plugin on their websites or provide their WhatsApp numbers to users or promote the same as a call to action on their social media.

The plug-and-play health information system has been customised, and the ‘algo’ has been vigorously trained to overcome the data silos of a healthcare organisation to ensure a seamless experience for patients.

Voiceoc charges an annual subscription fee from its B2B clients based on the features and their usage. Some of its key customers include Clove Dental, Max Labs and Alfa Laboratory.

Currently, the startup caters to the healthcare industry alone, but it is working on communication solutions for other segments such as D2C, education, consumer services, real estate and the automobile industry. It will expand beyond its current presence in India, the Middle East and Indonesia and plans to foray into the African markets by 2022.

[Edited By Sanghamitra Mandal]

![Read more about the article [Weekly funding roundup] Indian startup ecosystem buzzing with IPO, M&A activity; venture investments decline](https://blog.digitalsevaa.com/wp-content/uploads/2021/07/Weeklyimage-1577460362436-300x150.png)