The start of 2020 was unprecedented, with the uncertainty around enough to stir trepidation across the nation. But as they say, where there’s a will, there’s a way. As the Indian startup ecosystem battled the pandemic, what shone through was its desire to survive. Resilience and empathy were undoubtedly the two tenets of 2020.

From achieving greater maturity and better business models, Indian startups also streamlined revenues and innovations. Even as they deal with challenges, Indian startups are playing the role of a catalyst in reviving the country’s economy.

India’s growth story and its potential remain a strong bet, with a thriving innovation-led entrepreneurial ecosystem poised to contribute significantly to the move to an ‘Aatmanirbhar Bharat’, or self-reliant India. This was also reflected in the world of startups that still saw investments flowing in amid a cautious business environment.

In the Union Budget 2021 presented by Finance Minister Nirmala Sitharaman on February 1, the government’s thrust on boosting small and medium-scale startups, as well as encouraging the investor ecosystem, was clear. Initiatives such as revising the definition of small-scale startups, allocating more than Rs 15,700 crore for the uplift of MSMEs, as well as the introduction of an investor charter indicate the role this sector can play in achieving India’s mission to achieve $5 trillion in GDP by 2025.

The 2020 Annual Funding Report by YOURSTORY RESEARCH aims to highlight the growth of the Indian startup ecosystem through three phases: evolution (2015-2017), innovation (2018-2019), and democratisation (2020). The report offers an in-depth view of the state of funding activity and key trends in the Indian startup ecosystem in January-December 2020, comparison 2015-2020, and outlook 2021.

Moving towards 2021, there is a stronger focus on underlying business economics, both from founders and investors; and a thrust on monetisation, which earlier got pushed to the latter years of a startup’s life. Companies that have purpose-built into their bottom line are most likely to remain viable.

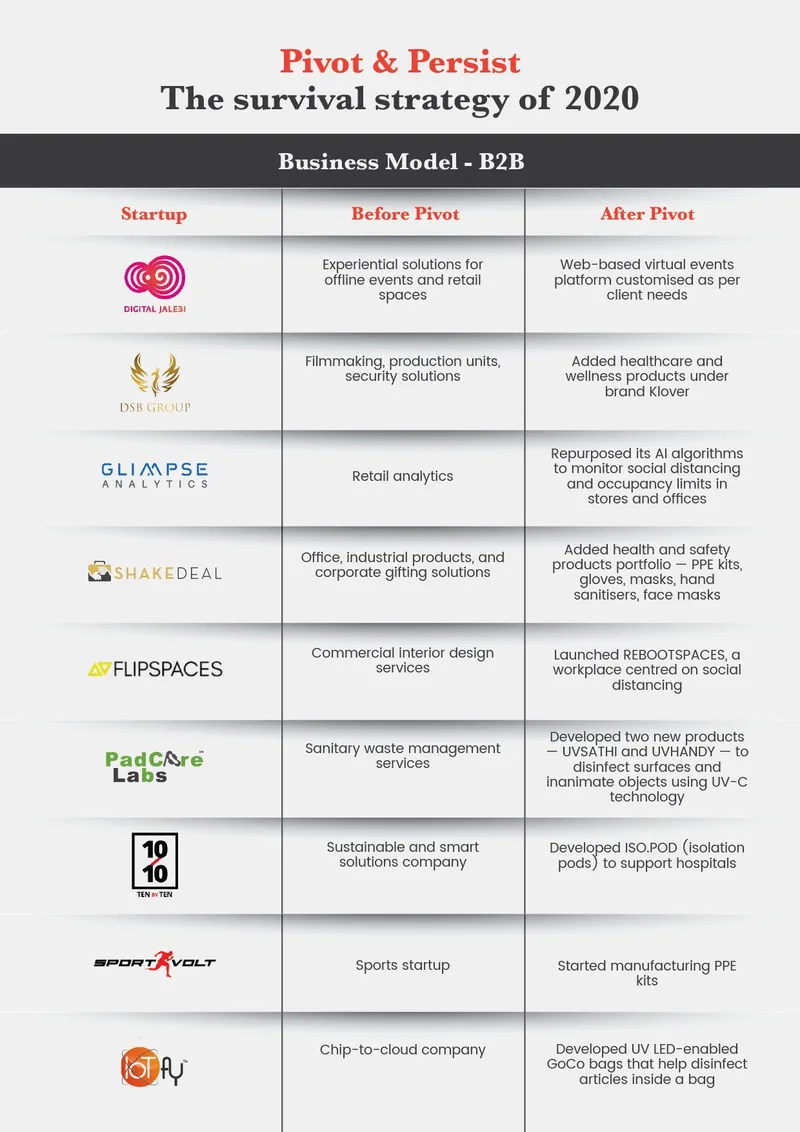

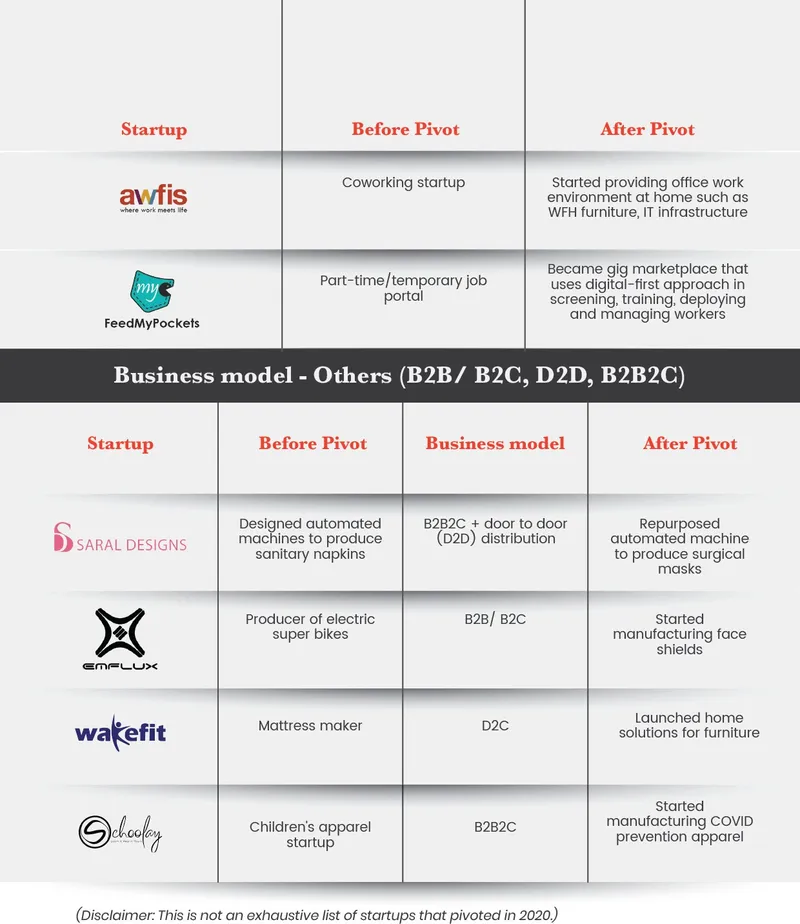

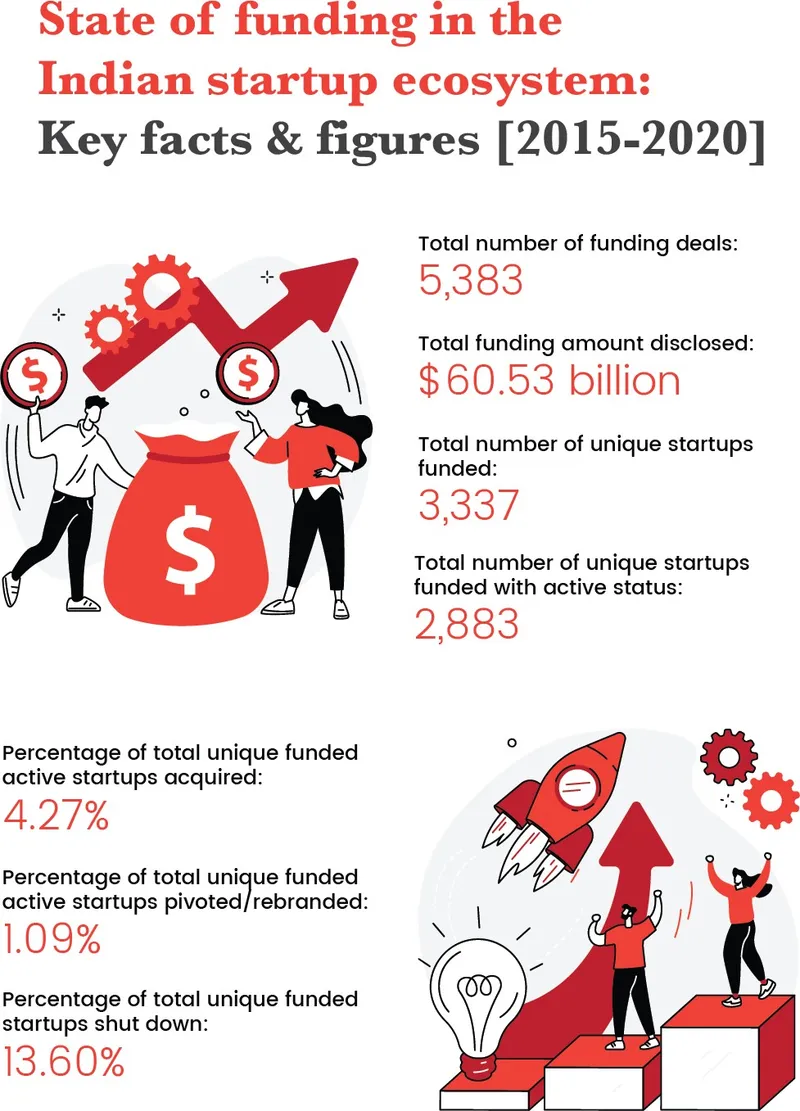

Pivot rather than shutdown was the sentiment for 2020

The years 2015 and 2016 are seen as the era of market correction in the history of the Indian startup ecosystem. These years together saw more than 360 startups shutting down. However, in 2020, we saw more startups adopting the pivot and rebranding route than shutdown. Exact data is not available for the number of pivots and rebrands. The analysis is made on the basis of public disclosures by startups on different media platforms.

Unique startup count for funding stays stable

It is observed that the count for unique startups receiving funding in 2019 (743) and 2020 (746) remained similar. Also, except 2016, when the unique startup count for funding grew by 17.5 percent, the subsequent years have shown a steady fall and rise in the number of unique startups that were funded.

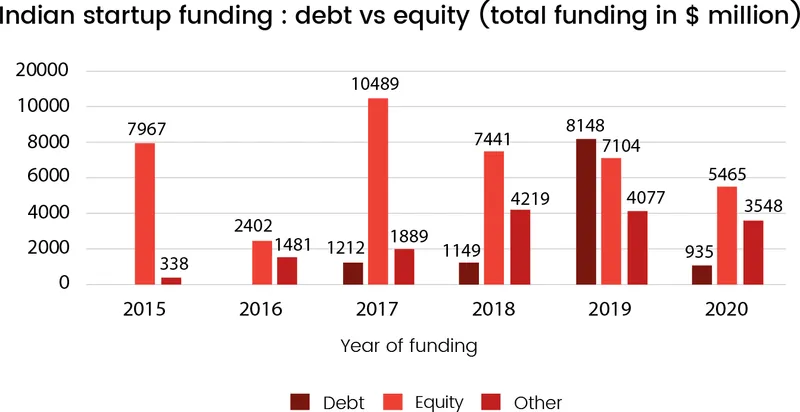

Fall in funding but overall positive sentiment

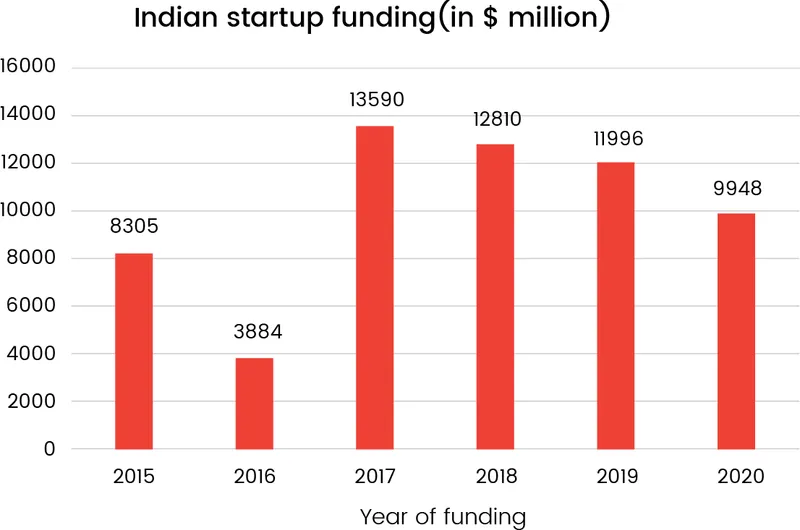

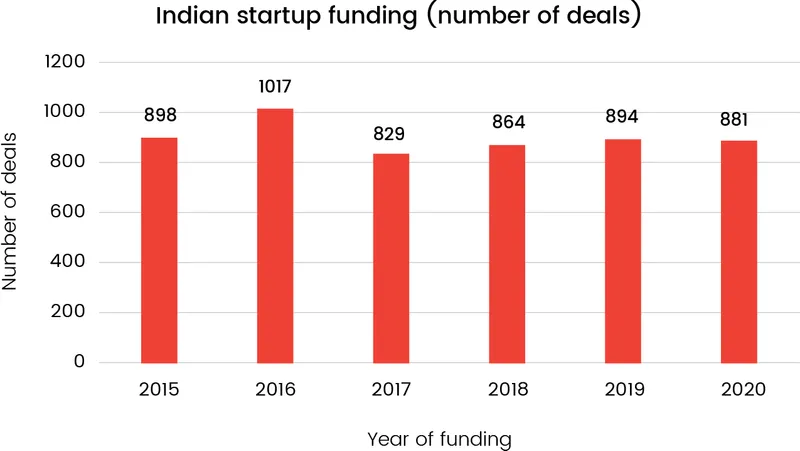

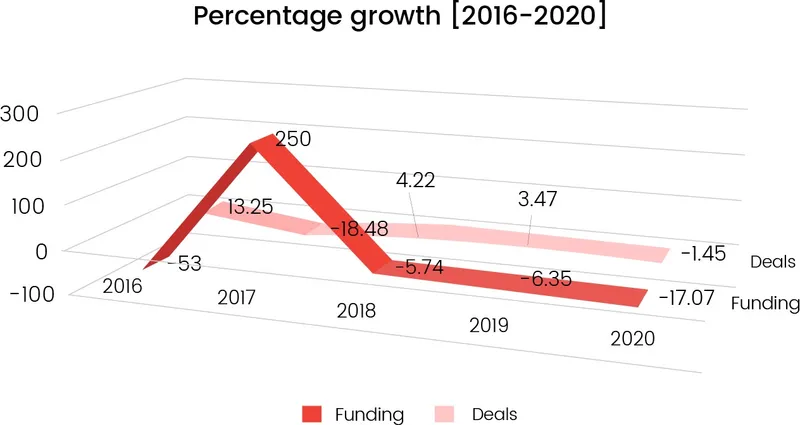

In 2017, the Indian startup ecosystem received the maximum funding of $13.5 billion across 829 deals. Since then, there has been a continuous funding decline of 5.7 percent (2018), 6.37 percent (2019) and 17.07 percent (2020). Even from the deals perspective, 2018 (+4.22 percent), 2019 (+3.47 percent), 2020 (-1.45 percent) did not offer any extraordinary trend, thus indicating an overall positive momentum across the ecosystem.

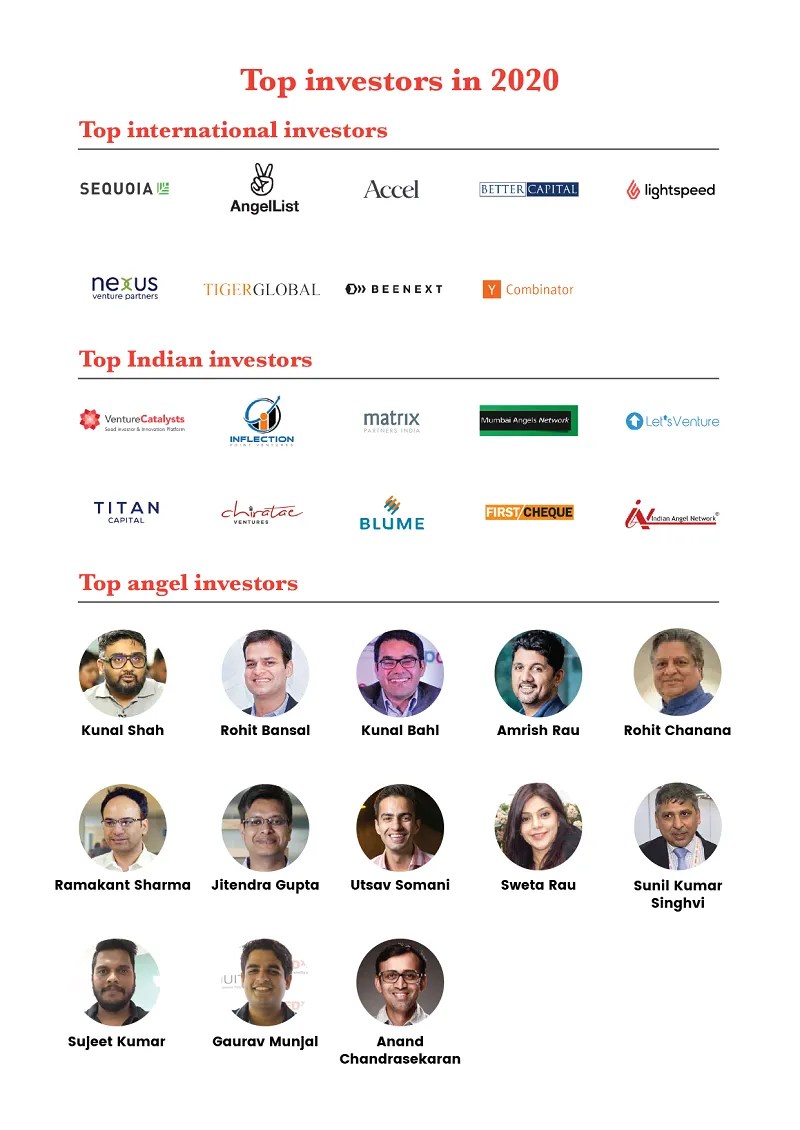

Investors focus on exploring new territories

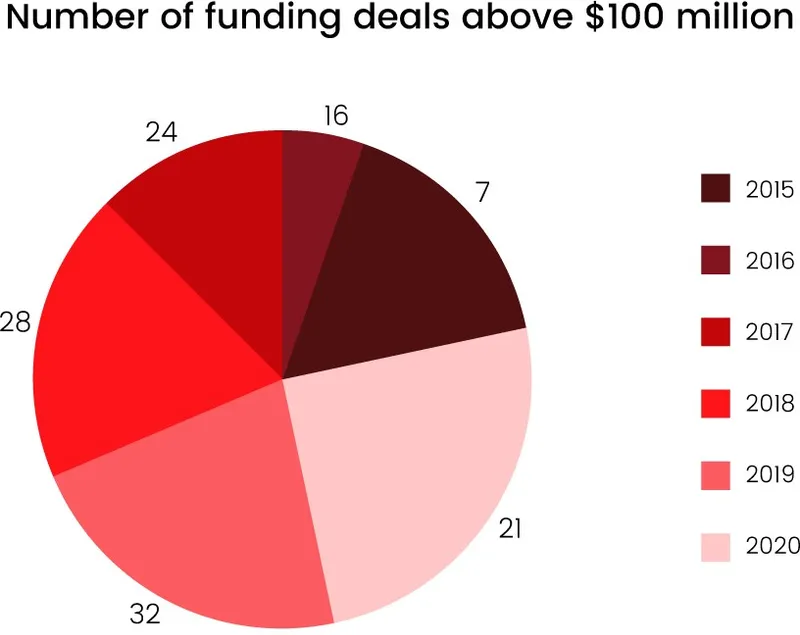

It is observed that over the years, the number of deals with more than $100 million funding amount has reduced in the ecosystem. This only indicates how cautious the investor ecosystem has become, aiming for a diversified pool of investments as well as increased willingness to test the waters in uncharted territories. In 2020, investors maintained a diversified approach while testing waters in unchartered territories and even kept the sentiment high with seed-stage and follow-on funding rounds.

Expansion of sectoral landscape

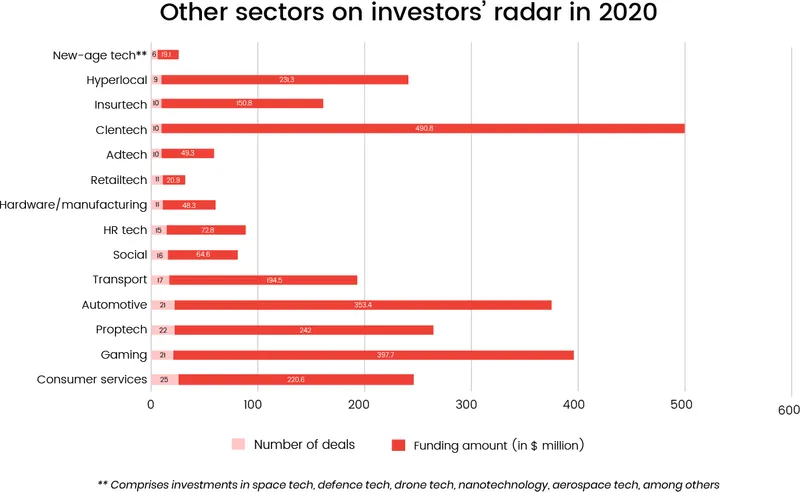

The rise in technology adoption led to investor hopes riding high on sectors integrating new-age technologies such as deep tech, adtech, insurtech, media and entertainment tech, space tech, defence tech, and drone tech. Investors were also observed to show interest in a few offbeat areas such as celebrity commerce, gig services, sports tech, and security solutions providers.

Inclination towards Tier-II/III startups

During the period 2015-2020, investments in Tier-I and Tier-III startups increased at an average of 5 percent. After 2018, and even during the pandemic, a steady growth of near 6 percent in investments has been observed in Tier-II and Tier-III startups.

Inclination towards IPO route of exit

More internet and technology companies went public in 2020. There was a time when companies took 20 years to file for an IPO; that has now narrowed to just three-five years. Also, a number of tech IPOs are lined up for 2021. This is a significant shift from the earlier M&A route adopted by Indian tech companies.

The upswing in telemedicine

Last year brought about the biggest health crisis known to humanity. The pace and scale of the COVID-19 outbreak led to a breakdown of traditional healthcare systems and brought about unstinted growth in telemedicine or online delivery of health services. Patients switched to video and audio doctor consultations, and began using fitness and wellness applications to track their health and pre-screen themselves. Online pharmacies also gained ground as the lockdown compelled people to stay indoors. This segment, in fact, saw some consolidation with the entry of large players like Reliance.

Penetration of tech and AI in healthcare

A sharper focus on the overall healthcare ecosystem helped expose its glaring inadequacies. In India, the heavily skewed patient-caregiver ratio is giving rise to the use of AI, ML, and other automation technologies in healthcare so as to reduce the need for human intervention. COVID-19 also led to a growth in ‘digital therapeutics’ or the use of smart healthcare devices, including mobile-based glucometers, oximeters, heart-rate trackers, and so on. The digitisation of personal medical records also got expedited.

Rise and rise of online learning

With offline education facing a crisis of continuity following the pandemic- induced lockdowns, edtech startups and e-learning platforms stepped in to help schools, coaching centres, private tutors, and higher educational institutions go online. They launched free live classes and ramped up their offerings to absorb the massive overnight demand for online learning post the lockdown.

The live coding boom

The Indian government’s National Education Policy 2020 mandated schools to initiate coding classes for students from Class VI onwards to help build analytical skills from a young age. The rollout of the new reforms in August and the event of BYJU’S acquiring WhiteHat Jr spawned an all-new wave of live coding startups. Coding became one of the buzzwords of the year and this segment of edtech is expected to be among the most sought-after by VCs in 2021.

SaaS and the remote-work routine

In 2020, SaaS platforms assumed critical importance in the ‘new normal’ of remote work. An increasing chunk of SaaS workers globally are now keen on continuing with remote work or ‘work-from-anywhere’ and staying close to their hometowns. As a result, the adoption of enterprise software is only going to grow in the future. The year also saw the increased penetration of vertical SaaS companies across sectors such as healthcare, B2B retail, ecommerce, and videoconferencing. SaaS startups that build plug-and-play API solutions for global customers also grew rapidly.

Grocery ecommerce gaining ground

Until 2020, the biggest verticals of India’s ecommerce sector were electronics and apparel. But the pandemic-induced urgency shifted the focus to essential categories like food and grocery. While incumbents in the segment ramped up their presence in the aftermath of the lockdown, the year also saw the entry of new, deep-pocketed grocery commerce platforms. The festive quarter was the cherry on the cake, with other categories also showing swift recovery and surpassing 2019 in terms of gross merchandise volumes.

Growth of B2B farmer marketplaces and e-mandis

With the pandemic causing disruptions across the agri-supply chain, leading to shutdown of physical markets, restricting travel from farm to mandis, and halting other on-ground operations, farmers were left with unsold produce and staring at huge losses. B2B agritech startups, which operate e-mandis and aggregator marketplaces to enable direct transactions between farmers, traders, and buyers, stepped in to fix this. Additionally, the procurement needs of food retailers and agribusinesses led to a sharp rise in demand for B2B farmer-focused agritech platforms.

Increased adoption of farm-to-consumer (F2C) brands

The pandemic-induced health uncertainty led to a rise in the demand for safe, hygienic, and farm-fresh food. From fresh fruits and vegetables to meat and dairy, online direct-to-consumer (D2C) platforms gained a significant edge over traditional food and grocery retail. The shift in business models and distribution channels and contactless doorstep deliveries of products also adhered to stringent social distancing norms. F2C startups recorded a 10X reduction in their customer acquisition costs and 3X growth in volumes during COVID-19, as per investor estimates.

Sensational growth of online brokerages

With more hours at their disposal and increasing uncertainty about long- term wealth prospects, millennial first-time retail investors (also known as Robinhood traders) flocked to online brokerages by the hordes. Besides existing discount trading apps, a bunch of generalist fintech players launched stock trading options on their platforms to leverage the trend. A SEBI report noted that 4.9 million new demat accounts were opened in 2020 — highest in at least a decade — with more participation from small towns.

UPI continued to be fintech’s crown jewel

Until 2020, small-ticket cash transactions that drive most of the cash in circulation, were the main deterrents to UPI’s growth in India. But with 2020, the urgent need for cashless/contactless payments turned out to be a watershed moment for UPI-led platforms. UPI transactions reached new highs every month, even surpassing card transactions at one point, with the adoption of digital payments cutting across demographic segments. As per NPCI, 2.23 billion UPI transactions worth Rs 4.16 lakh crore were recorded in December 2020, registering a 70 percent growth over 2019.

Online gaming’s meteoric rise

With all avenues of outdoor entertainment and recreation coming to a grinding halt, online gaming became the go-to option for an anxious population. Gaming startups witnessed good uptick in new users and hit record app engagements during the lockdown. Gaming gained not only because it became a safe ‘stay-at-home’ option across age groups, but also because it enabled human interaction and bonding in times of social distancing. From being a historically under-financed sector, gaming startups became the darling of local and global investors in 2020.

In the wake of COVID-19, India’s current population, demographics, and economic situation might have put the country in a disadvantageous position compared to other Southeast Asian countries. However, due to the resilience and agility of Indian entrepreneurs, the investor ecosystem has not shied away from them in these tough times.

For instance, edtech led to a completely irreversible mindset shift for the Indian consumer, who had earlier never considered online education more than a value addition to the traditional institutional education system. In the last one year, not only has online learning become a mainstream sector, but also at the operational level, the digitisation has improved.

Next is ecommerce, where investors are now willing to test waters in different niches like reselling, social commerce, celebrity commerce, live video shopping, ecommerce SaaS, and more. Technology is reshaping Indian retail at an altogether different level, with local kiranas getting modernised layer by layer.

These are just a few examples from many other transformations that different sectors are undergoing. This democratisation has kept the overall investor sentiment positive, in theory willing to pour in enough funds to keep the mast of India’s startup ecosystem steady in these tough times.

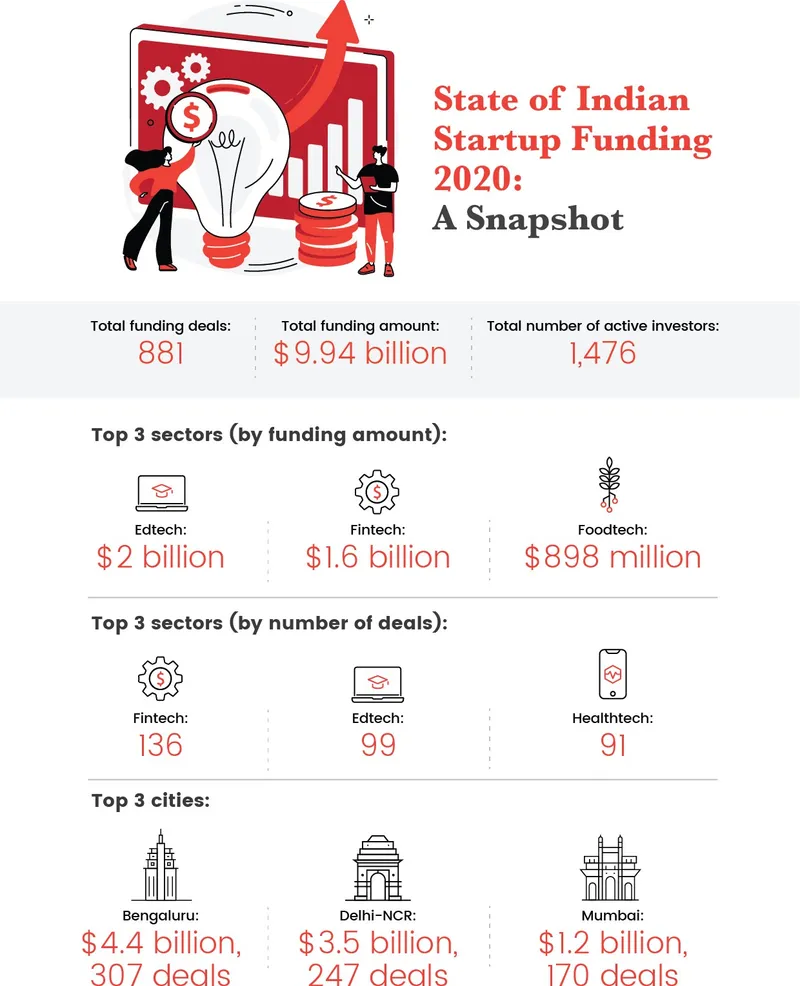

According to YOURSTORY RESEARCH, the ecosystem raked in a total of $9.9 billion funding across 881 deals. In comparison to the previous year, the funding amount reduced by almost 17 percent, while the number of deals received a setback of around two percent.

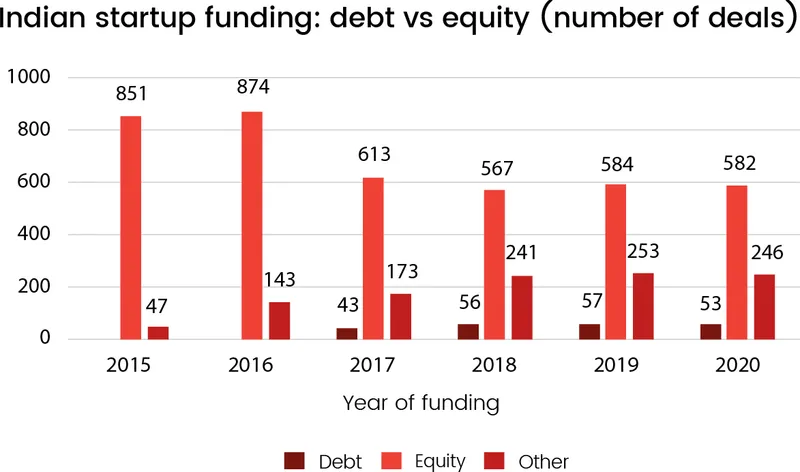

This indicates that although investors adopted a cautious approach, they continue to diversify their portfolio and support the existing portfolio companies with small ticket-size funding and follow-on rounds.

(Other includes crowdfunding, bridge round, grants, post IPO equity, etc.)

- The Indian startup ecosystem came full circle in 2020, with the funding raised and number of deals reaching a similar state as in 2015, a year considered the tipping point for initiating the growth of startups in India.

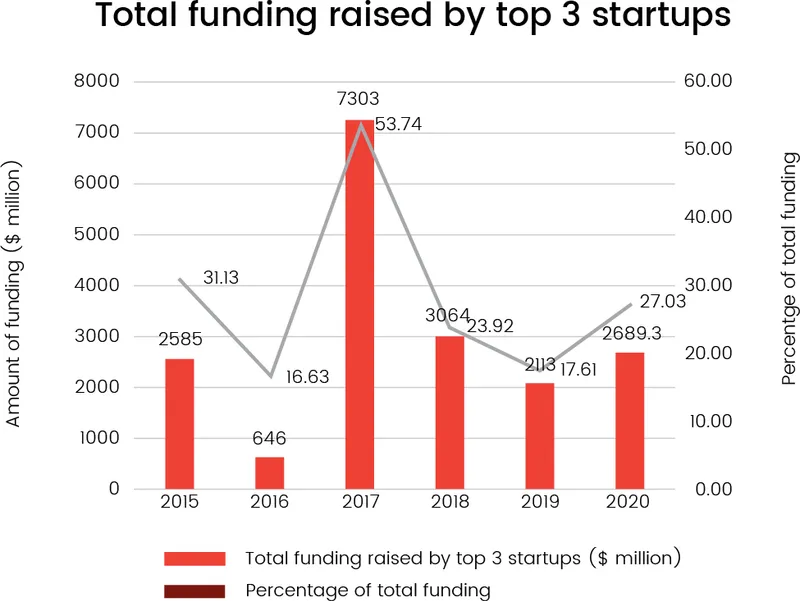

- If we compare the data across the period 2015- 2020, it was only in 2017 that the total funding raised by the top three startups exceeded 50 percent. For the other years, the total funding raised by the top three startups has been 23.26 percent of the total funding on an average.

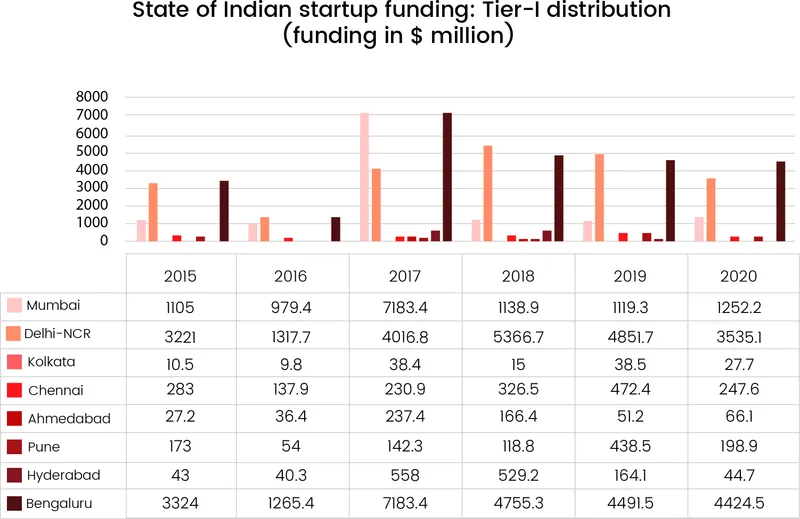

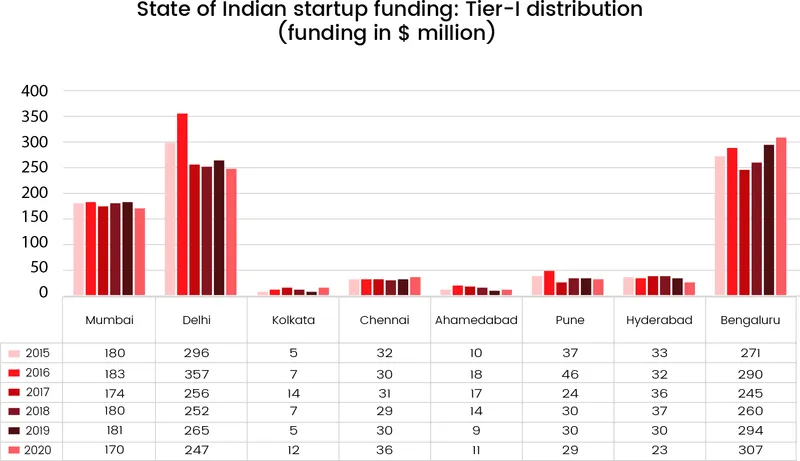

- After the top three Tier-I startup hubs — Bengaluru, Delhi-NCR, and Mumbai — Kolkata, Ahmedabad, and Chennai are now on the investor radar. In 2021, these three cities are expected to gain much higher investor attention for startups spanning SaaS, deep tech, space tech, retail/consumer brands, fintech, and enterprise tech.

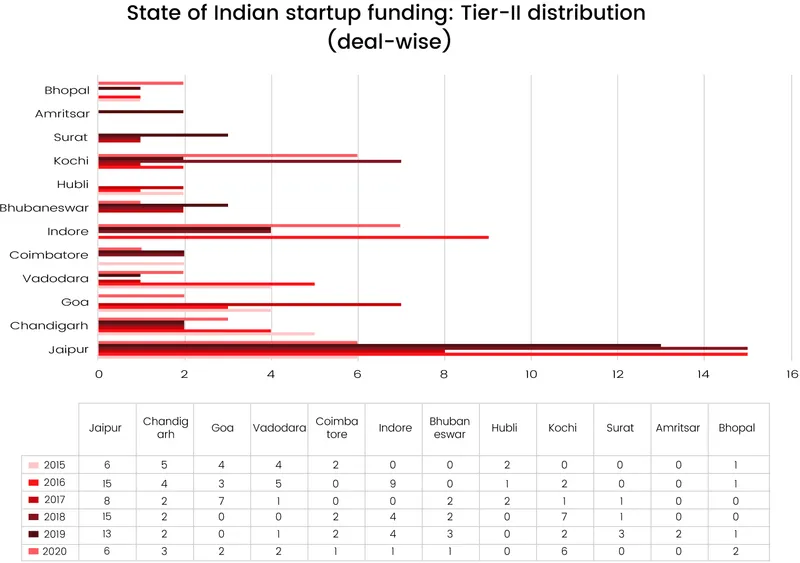

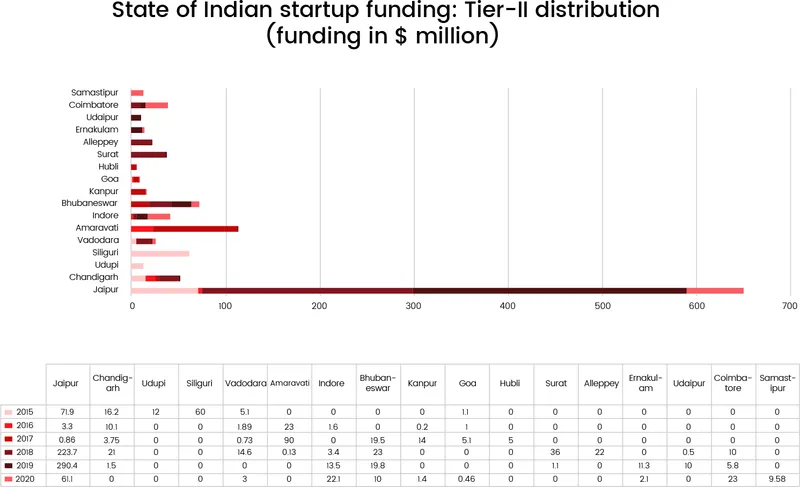

- In the Tier-II landscape, while in 2020, Indore even surpassed Jaipur in terms of number of funding deals, Jaipur still gets the highest ticket size among all Tier-II cities in India. Other promising destinations in the near future are Goa, Chandigarh, Kochi, Bhopal, and Vadodara.

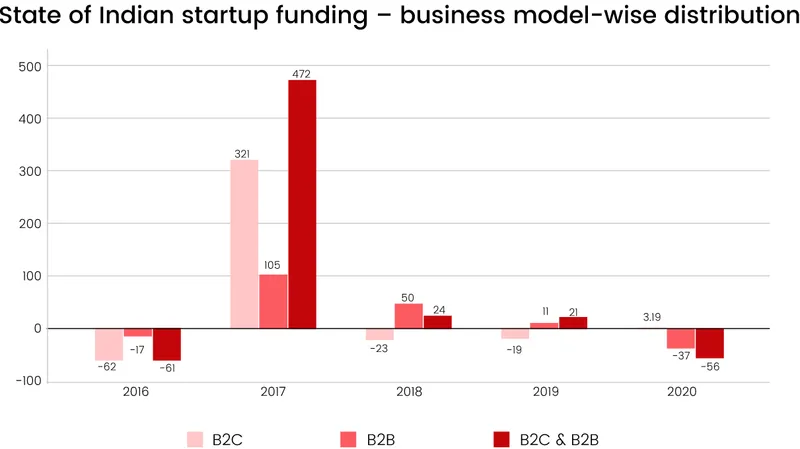

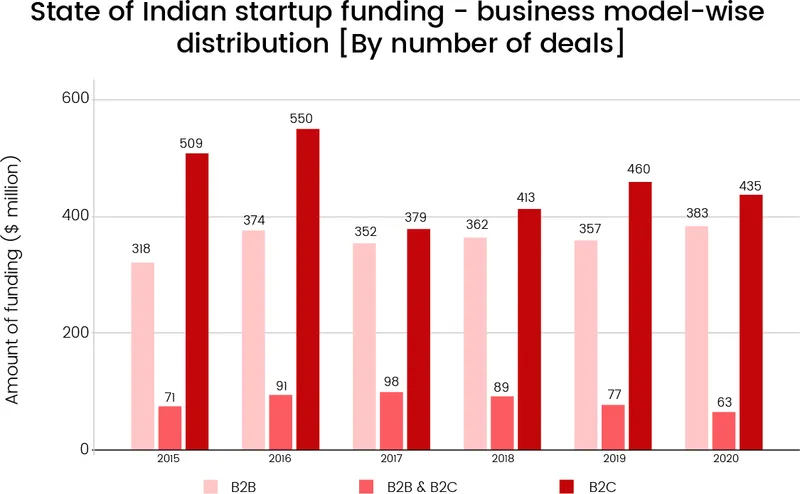

- The B2C business model has again built up trust among investors. Although the number of deals in 2020 fell by 5.4 percent, the amount of funding increased by 3.19 percent as compared to 2019.

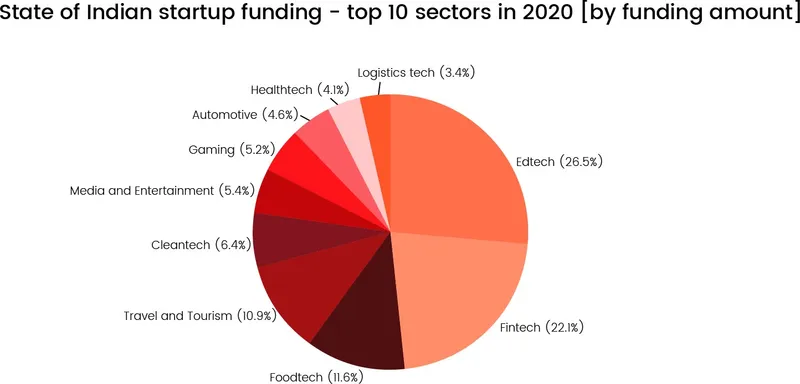

- With only 28 deals, foodtech took its position among the top three startup sectors with the highest funding, in comparison to fintech’s 136 deals and edtech’s 99 deals. This indicates that the sector was able to attract more late-stage and high ticket-size funding in 2020.

- In 2020, edtech startup BYJU’S secured the highest funding of $1.2 billion. This is the first time in the period 2015-2020 that any edtech startup has raised the highest funding, leaving behind other hot sectors such as logistics, ecommerce, and foodtech.

- B2B startups faced a 37 percent fall in funding amount as compared to 2019, while the number of deals increased by 7.28 percent. On a positive note, this may be taken as an indication of an increase in the level of maturity attained by B2B startups of the country. It is believed that these startups are finally being able to focus on strengthening their revenue streams and are not willing to burn investor money only for scale.

- Despite getting the third highest number of deals, the amount of funding raised by the healthtech sector was $316 million. This is less than several other sectors, which secured much higher funding with fewer deals, such as foodtech (28), travel and tourism (8), and cleantech (10).

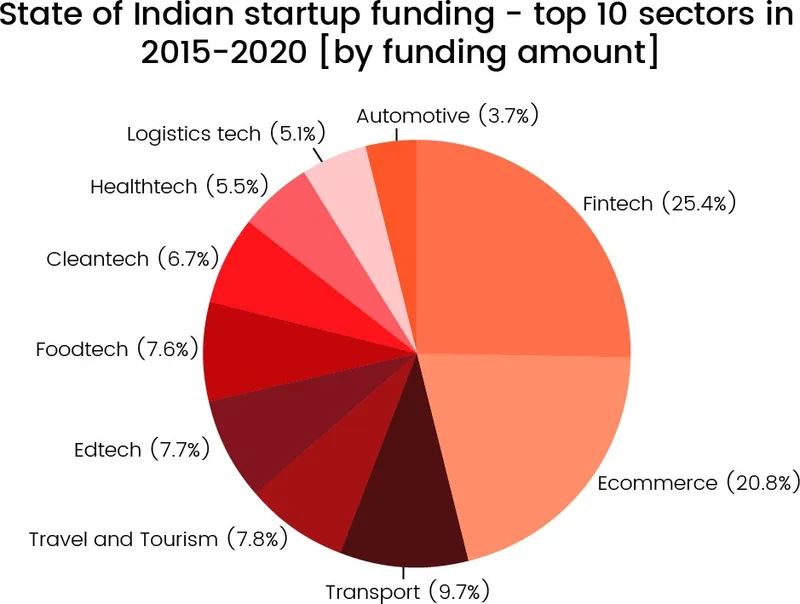

- For the first time in 2020, edtech made its way to the top three sectors in the period 2015-2020. As expected, a key role was played by the massive adoption of online education due to the lockdown, which boosted investors’ interest in the sector by several folds.

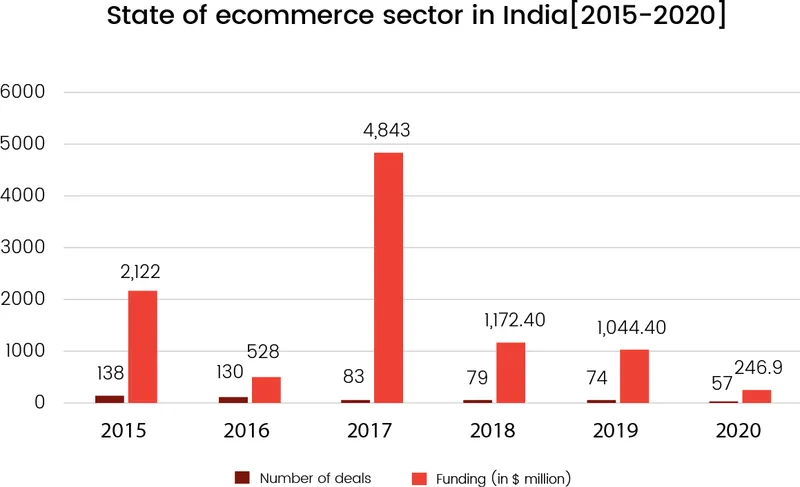

- After making it to the top three from 2015 to 2019, the funding secured by the ecommerce sector fell drastically in 2020 and it was not able to make it to even the top 10 sectors for the year.

Top 3 startups

In 2020, edtech startup BYJU’S secured the highest funding of $1.2 billion, followed by OYO Rooms ($807 million) and Zomato ($660 million). This is the first time any edtech startup has raised the highest funding leaving behind other hot sectors such as logistics, ecommerce, and foodtech.

Drop observed in total funding raised by top 3 startups

Tier-I landscape

In the Tier-I geography, Bengaluru continued to top the charts in 2020, with $4.4 billion in funding across 307 deals. It was followed by Delhi-NCR ($3.5 billion across 247 deals) and Mumbai ($1.2 billion across 170 deals). The other Tier-1 cities, Kolkata, Chennai, Pune, and Hyderabad, however, saw a significant fall in funding amount as compared to previous years.

Surprisingly, Ahmedabad saw a rise in funding amount in 2020 despite the pandemic. Although the percentage of growth was quite less, this will surely make the city worth keeping an eye on in the near future.

In the period 2015-2020, Bengaluru has continued to top the charts in terms of the number of deals since 2018. The number of funding deals in Bengaluru increased by 4.4 percent as compared to 2019 and 18 percent as compared to 2018 despite the pandemic impact. Among the other Tier-I cities, Chennai, Pune, and Hyderabad are growing fast in comparison to previous years, while Kolkata still has a long way to go. However, in 2020, Kolkata, Chennai, and Ahmedabad did show signs of a promising future with an increase in the number of deals even as corresponding figures dipped in top cities.

Comparing the funding distribution for the top three cities by funding amount and number of deals, it is observed that investors are returning to old markets while adding some new territories to test waters.

For instance, if we look at data for top five Tier-II cities each year, then it is observed that after a slow start in 2015, the three cities, Coimbatore, Indore, and Bhubaneswar were again on investors’ radar in 2020. While in 2020, Indore even surpassed Jaipur in terms of the number of funding deals, Jaipur still gets the highest ticket size amid all Tier-II cities in India. Other promising Tier-II areas in the near future are Goa, Chandigarh, Kochi, Bhopal, and Vadodara.

The B2C business model has again built up its trust among investors. Although the number of deals in 2020 fell by 5.4 percent, the amount of funding increased by 3.19 percent as compared to 2019. This is more significant when compared to the previous years, wherein the funding amount in this segment suffered quite a setback, with 2017 being the year of exception: 2016 (-62 percent), 2017 (+321 percent), 2018 (-23 percent), 2019 (-19 percent)

B2B startups, however, faced a 37 percent fall in funding amount as compared to 2019, while the number of deals increased by 7.28 percent. On a positive note, this may be taken as an indication of an increase in the level of maturity attained by the B2B startups of the country. It is believed that these startups are finally able to focus on strengthening their revenue streams and are not willing to burn investor money only for scale.

Not included Flipkart (acquired)

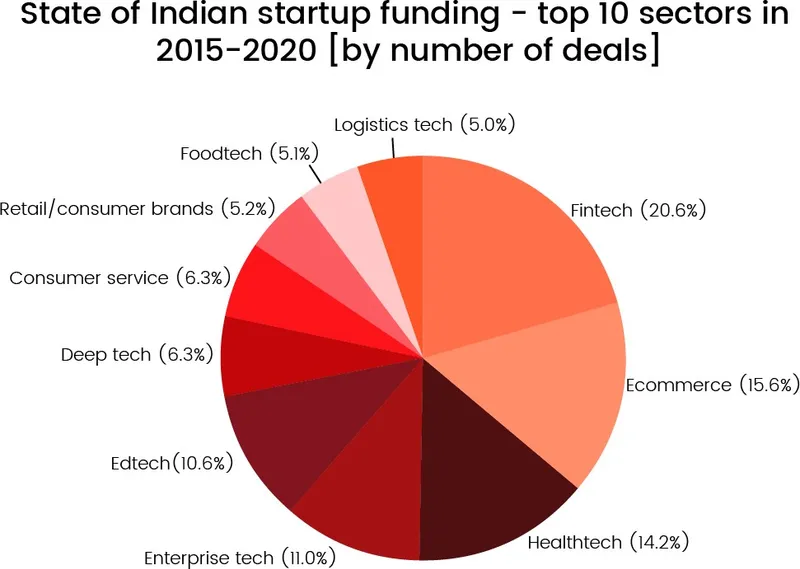

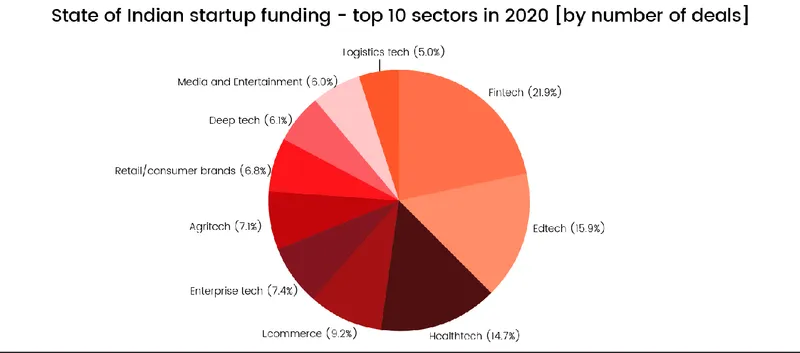

As observed with respect to distribution of funding deals, in 2020, fintech scored the top position with 136 deals, followed by edtech (99) and healthtech (91). However, with respect to funding amount, edtech took the flag with $2 billion funding, followed by fintech ($1.6 billion) and foodtech ($888 million).

Interestingly, with only 28 deals, foodtech took its position among top three startup sectors gaining maximum funding, in comparison to fintech’s 136 deals and edtech’s 99 deals. This indicates that the sector was able to attract more late-stage and high ticket-size funding in 2020.

Further, despite receiving the third highest number of deals, the amount of funding raised by the healthtech sector was $316 million. This is very less in comparison to many sectors, which secured much higher funding with fewer deals, such as foodtech (28), travel and tourism (8), and cleantech (10).

This is the first time edtech has made its way to the top three sectors in the period 2015-2020. As expected, a key role here is played by the massive adoption of online education due to lockdown, which boosted investors’ interest in the sector by several folds.

The sector even saw BYJU’S becoming the third most valued unicorn in 2020, reaching a valuation of $8 billion. The company raised $1.2 billion, which is 60 percent of the total $2 billion funding raised by edtech startups in 2020. The company’s acquisition of code learning startup WhiteHat Jr. and Aakash Educational Services has raised the bar much higher for peers in the segment such as Vedantu and Toppr.

Edtech startup ecosystem: Top players

After making it to the top three from 2015 to 2019, the funding secured by the ecommerce sector fell drastically in 2020, and it was not able to make it to even the top 10 sectors for the year. Although the number of deals remained high, overall, a continuous decline can be observed comparing the period between 2015 and 2020. This clearly indicates the fall in ticket size from the investors’ end. Despite being a mainstream sector gaining attention from global investors, the startups, particularly in the B2C segment, are still struggling with creating continuous revenue streams, which suggests the investors’ sceptical nature at the moment.

Apart from the traditional sectors such as ecommerce, fintech, tourism, transport, and logistics, there were several other sectors that gained investors’ attention in 2020. In the last few years, most investors were only testing the waters in many of these sectors. However, in 2020, these sectors emerged as future-looking for many.

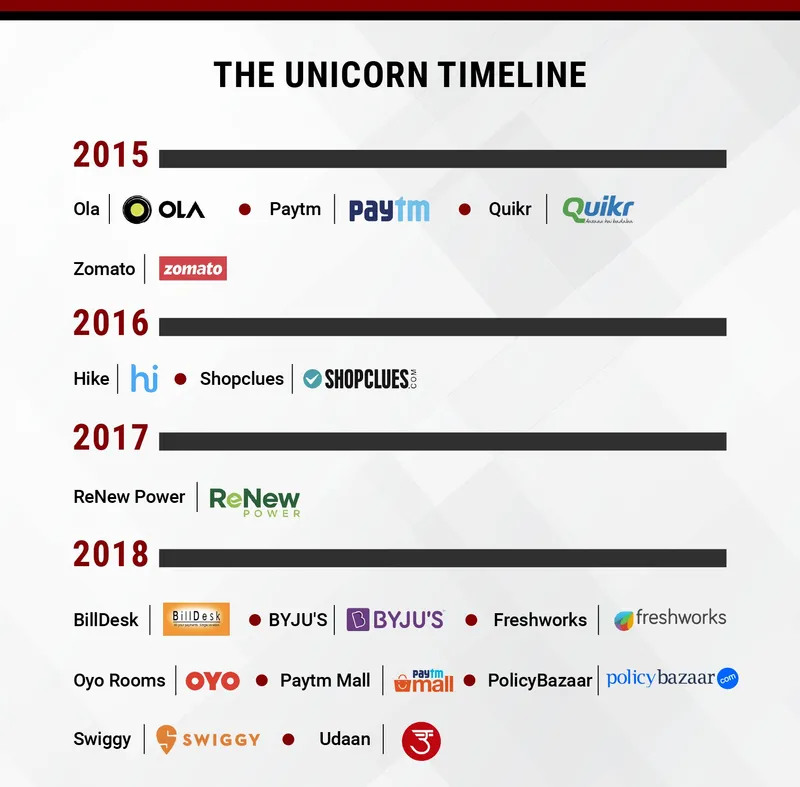

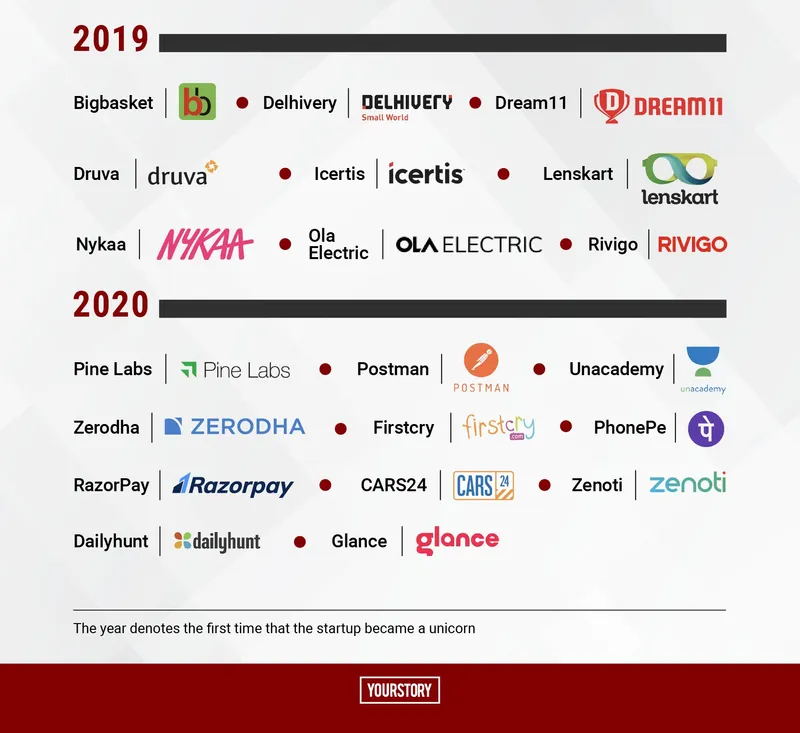

The year 2020 saw 11 new entries to the unicorn club without any billion-dollar ticket size investment unlike the trend observed when companies like Flipkart, Paytm entered the unicorn club.

For instance, compared to Bigbasket that raised a hefty $656 million to become a unicorn in 2019, startups that joined the club in 2020 did so by raising much lower amounts. They include Nykaa ($104 million), Postman ($208 million), and Razorpay ($212 million).

Overvalued companies, particularly unicorns and decacorns, incurring huge losses drew a lot of criticism for years. This led to a key development over the last decade: founders diluting their shareholding that put them at risk of losing control of their startups.

Amid the economic fallout of the COVID-19 pandemic, metrics such as unit economics, profitability, expansion, scaling, and sustainability became the benchmarks for potential investments.

The year 2020 observed more than 24 funding deals with ticket size equal to or more than $100 million even amid the pandemic. This indicates the maturity the Indian startup ecosystem has achieved.

However, overall, the number of such deals has been on the decline in the period 2015-2020.

India is expected to have 100 unicorns by 2025, despite the huge impact of COVID-19. Indian startups are gradually looking for investment models other than equity funding. This includes crowdfunding, revenue- based financing, venture debt, and bank loans. With bootstrapped startups Zerodha and Freshworks turning unicorns, the new generation of startups is expected to focus on building revenues from the inception stage itself and not depend on venture capital for survival.

More funding deals but smaller ticket size

Startups can expect to see higher funding this year, with investors’ risk appetite improving significantly since 2020. More early-stage companies are expected to attract investments in small to medium-sized deals than large ones because even though investors are ready to take risks, the overarching sentiment is that they’d rather put lesser money at risk in more companies, than more money in fewer companies.

More IPOs

Several startups are expected to go for a capital market listing via an initial public offering this year, including Zomato, Delhivery, Freshworks, PolicyBazaar, Nykaa, Flipkart, and Ola. With benchmark indexes hitting record highs in India of late, and a spate of oversubscriptions last year, startups are hopeful of a strong debut.

More unicorns despite strong M&A/IPO pipeline

Industry experts have predicted that India will have 100 unicorns by 2025. And given the rate at which new unicorns are being added, the Indian startup ecosystem seems to be well on track to achieve that. Some startups waiting in the wings to hit the coveted $1-billion mark are CRED, Vedantu, Practo, BlackBuck, Urban Company, among others. Additionally, even as the M&A and IPO pipeline accelerates, India is on track to count more than 50 companies in the unicorn club in 2021, according to a Nasscom-Zinnov report.

Deep tech, B2B, SaaS startups will grow

With remote work becoming part of the future of work, and businesses looking for better ways to increase their efficiency, startups that provide innovative software-as-a-service solutions are expected to see strong growth. According to our estimates, investments in deep tech startups will likely return to 2019 levels, if not exceed them. Deep tech has helped transform key pandemic-related industries such as healthcare and transportation. In 2021, expect to see more innovation and collaboration between deep tech companies and startups looking to leverage tech.

Focus on Aatmanirbhar Bharat will birth more regional startups

With the government taking its goal to empower and bring more regional startups to the forefront more seriously than ever in an attempt to boost the economy, ventures from beyond metros will gain more traction in 2021. Regional startups are likely to appeal to investors’ sensibilities because they tend to understand their demographic better and have a better understanding of issues they can help solve. Startups in metros and urban cities have also started building more inclusively, offering services in vernacular and Indic languages. The next wave of online users is

expected to come from smaller cities and towns — and companies are actively looking to capitalise on and cater to those users.

YS Research, the research arm of YS Media, is the definitive source for data-led insights and analysis of trends impacting the Indian entrepreneurial and tech ecosystem.

YS Research focuses on market research, market intelligence, startup discovery, and consulting in the startup ecosystem in India.

YS Media Private Limited is India’s leading digital platform for positive, inspirational stories of change makers and entrepreneurs across India.

©YS Media Private Ltd. Produced by YS Research

Lead Analyst(s): Meha Agarwal, Naga Nagaraju

Contributor(s): Sohini Mitter, Aparajita Saxena

Edited by: Lena Saha, Saheli Sen Gupta, Tenzin Pema

Design: Aditya Ranade, Karuna N

Production: YS Editorial and Design

Website: research.yourstory.com

Email: research@yourstory.com