If 2022 was the year of reckoning for startups in India, the venture capital and private equity industry’s approach has been cautious at best. The investment momentum over 2022 continued to remain positive, with Indian startups raising nearly $24 billion, down 33% from 2021 though twice than that of funds raised in 2020 and 2019, indicating faith of private market investors in Indian startups.

Ahead of the 2023 national budget, industry bodies and representatives have sought much-needed taxation reforms to benefit their portfolio companies and to make private market investing a more rewarding proposition.

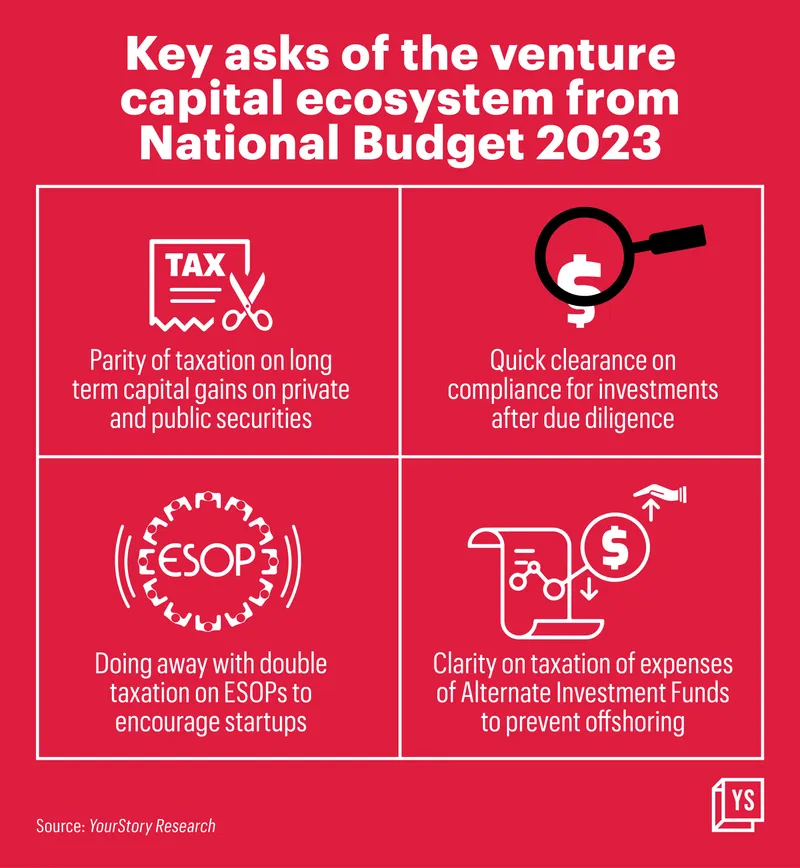

Budget asks from the VC ecosystem

Parity on taxation for listed and unlisted shares

The Indian Venture and Alternate Capital Association (IVCA), an industry body representing venture capital and private equity players in India, has asked for parity in tax treatment for various security classes in a presentation made to Finance Minister Nirmala Sitharaman ahead of the Budget.

Currently, the Long Term Capital Gain (LTCG) on investment in private shares is taxed at 20%, while the taxation on publicly listed shares is at 10%.

“Investors take a higher risk by investing in private companies. We are not asking for a preferential rate of return for investments in unlisted entities, but we would like it to be on par with the listed entities,” Padmaja Ruparel, Co-founder at and Founding Partner at Indian Angel Network Fund, told YourStory.

Ease of investment

While the India story has continued to be attractive for foreign investors, easier clearance for capital inflow in the startup sector stands to benefit both startups and investors.

“All clearances for investors to invest into Indian funds and startups should be brought down to a seven-day period, including compliances, etc.,” said Anirudh A Damani, Managing Partner at . “After heavy-lifting by the founder to clear due diligence, it often takes 60 days to 90 days for the investment to come through.”

Adding to the burden, Anirudh pointed out, was that clearances required for smaller funds continue to be on par with large funds.

“The requirement for a third-party valuation report at the time of entry and exit of investment in the private sector is cumbersome and dissuades people from opening fund houses in India,” he said. “As a micro-VC fund, our compliances are on par with the large funds and there is a need to foster an ecosystem of multiple funds.”

Taxing ESOPs

Employee Stock Ownership Plans, or ESOPs, are quite common in the startup world to attract talent and as a reward mechanism for employees.

As part of ESOPs, companies allow employees to buy shares at a rate below the prevailing Fair Market Value (FMV), or offer these as part of the compensation. Employees can choose to exercise their right to buy the shares after a vesting period.

While the amendment brought as part of Budget 2020 ensured that employees did not have to pay taxes in the year they decided to exercise the options, ESOPs continue to be taxed twice.

Employees are required to pay taxes through TDS (Tax Deduction at Source) at the time of exercising the options, as well as at the time of sale on the difference between the sale price and the FMV as capital gains tax.

“If we want to retain high-quality talent and prevent startups from flipping or moving out of the country, the taxation on ESOPs will have to be taken to the next level, despite the five-year moratorium,” said Padmaja of Indian Angel Network. “ESOPs have a long gestation and it is not going to work if you tax them five years later without monetisation. Employees are dipping into their cash flow without any gains.”

She added that especially for startups, where companies can take a turn for better or worse suddenly, the resolution of ESOP taxation can help.

Clarity on taxation of AIF

IVCA in its submission to the Finance Ministry has also asked for tax pass-through on expenses for Alternate Investment Funds (AIFs), and for this to be extended to hedge funds and listed market funds as well to encourage setting up funds within the country.

In July 2021, a tax tribunal ruled that indirect taxes were applicable on expenses incurred by venture capital, private equity and mutual fund firms, including those operating under a trust structure.

This applies to expenses incurred by a fund, including the ‘carry fees’, or the share in profits offered to fund managers in proportion to the performance of the fund. Other expenses taxed include legal fees and salaries.

“To grow the venture capital industry, we need clarity on treating gains for investors being treated differently from that of fund managers,” Padmaja said. “The reason it is important is to prevent the flight of quality investment talent and it becomes unremunerative for the fund managers.”

![Read more about the article [Techie Tuesday] Innovative and tech-driven concepts changing the food retail sector](https://blog.digitalsevaa.com/wp-content/uploads/2022/03/A5BCFA59-8137-4946-8F0C-1219C7779945-1646660551250-300x150.png)