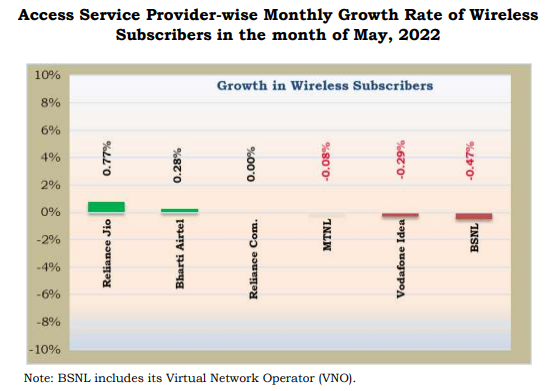

Bharti Airtel added 1.02 Mn customers to its wireless user base, while Vodafone Idea (Vi) lost 7.59 Lakh subscribers

State-owned Bharat Sanchar Nigam Limited (BSNL) lost 5.31 Lakh customers, while another government enterprise MTNL, which serves metro cities, lost 2,665 users

The total number of wireless users in the country grew 0.25% MoM to 1,145.50 Mn at the end of May, according to TRAI data

Telecom operator Reliance Jio saw an addition of more than 3.1 Mn wireless subscribers in May 2022, according to the monthly subscription data released by the Telecom Regulatory Authority of India (TRAI).

Bharti Airtel also added 1.02 Mn customers to its wireless user base, while Vodafone Idea (Vi) lost 7.59 Lakh subscribers.

State-owned Bharat Sanchar Nigam Limited (BSNL) lost 5.31 Lakh customers, while another government enterprise MTNL, which serves metro cities, lost 2,665 users.

Majority of the user additions for both Jio and Airtel came from rural areas. While rural additions accounted for 1.7 Mn or 56% of the total wireless additions for Jio, it stood at more than 99% for Airtel’s total wireless user additions.

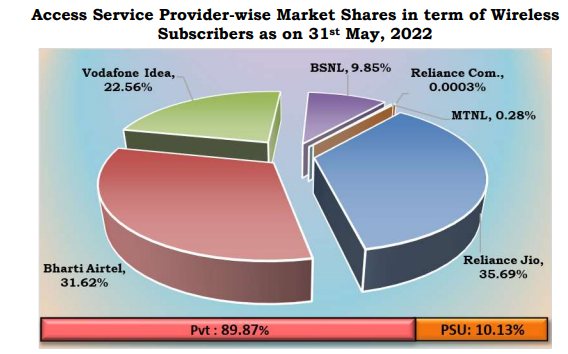

Jio again led the wireless market in May with a market share of 35.69%, up from 35.5% in April. It was followed closely by Bharti Airtel, which also saw its market share rise marginally to 31.62%.

Net wireless subscriber addition stood around 2.6 Mn. In total, the total number of wireless users in the country grew 0.25% month-on-month (MoM) to 1,145.50 Mn at the end of May.

The wireless tele-density in the country also grew to 83.2% in May from 83.05% at the end of April. While urban wireless tele-density fell to 129.83% in May from 129.87% in April, rural tele-density witnessed an increase of 0.21% to 58.15% in May.

On the other hand, wireline users increased 0.27% MoM to 25.23 Mn in May. The overall wireline tele-density in the country in the month of May remained constant at 1.83%.

State-owned BSNL and MTNL together held 39.17% of the wireline market, while Jio held 26.7% of the market share and Airtel accounted for 23.66% of the total market.

The broadband segment also grew in size as total user base increased 0.98% MoM to 794.68 Mn. Jio led the pack with 52.18% market share, followed closely by Bharti Airtel with 27.32% of the total market.

Telcos also logged 7.97 Mn requests for Mobile Number Portability (MNP). Maharashtra registered 6.2 Lakh MNP requests, while Karnataka logged 4.1 Lakh such applications.

The numbers will bring cheer to the two main contenders – Jio and Airtel. The telcos have been involved in a price war over the last few years to grab a bigger pie of the telecom market. The positive additions coupled with better average revenue per user (ARPU) will give them a boost.

Airtel’s ARPU rose to INR 178 in January-March quarter of 2022, driven largely by higher tariffs and one-time gains. In comparison, Reliance Jio’s ARPU stood at INR 167.6 in the fourth quarter (Q4) of financial year 2022 (FY22).

Meanwhile, the companies are all set to lock horns again in the upcoming 5G spectrum auctions. While the government expects to conduct the auction later this month, telecom companies are looking to snap up the best circles, even as the bidding is expected to fetch record prices for the government.

![Read more about the article [Funding alert] Bhavin Turakhia’s third venture Titan raises $30M at $300M valuation](https://blog.digitalsevaa.com/wp-content/uploads/2021/05/Bhavin-Turakhia1563805293326-300x150.png)