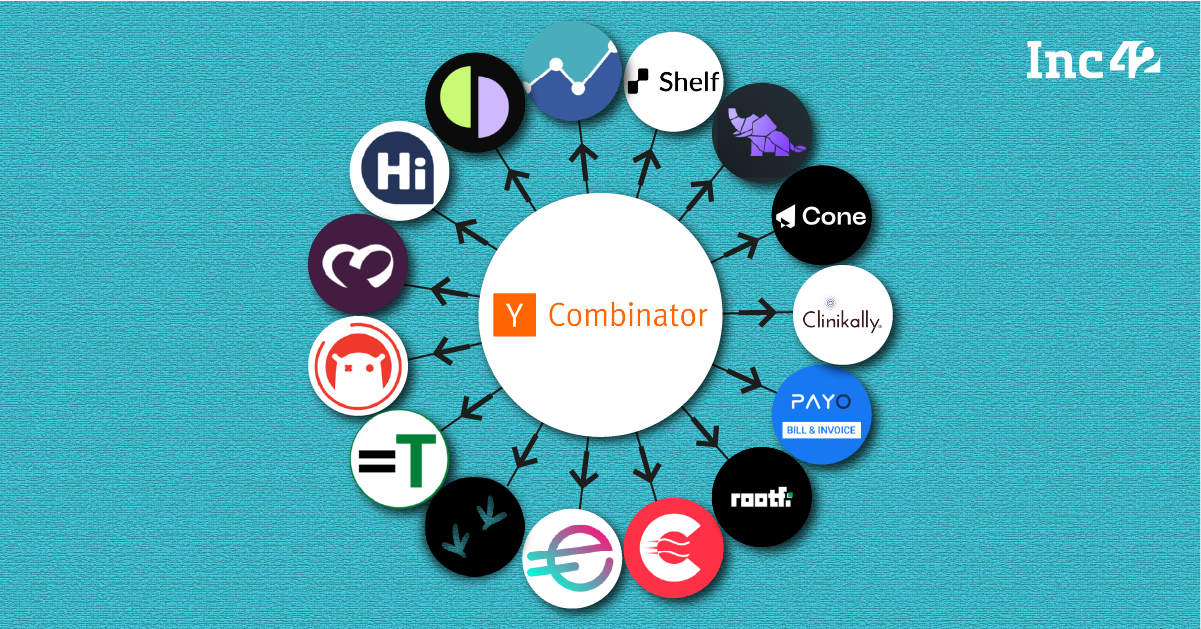

Y Combinator has selected 15 Indian startups for its Summer 2022 cohort, out of the total 250 it selected across the world

The US-based startup accelerator reduced its cohort size by 40% from the Winter 2022 cohort

While India has experienced a funding slowdown, investment in early-stage startups went up by 165% year-on-year in H1 2022

The US-based early-stage startup accelerator Y Combinator announced the list of startups that made it to the summer edition of its biannual cohorts for 2022. The list includes around 250 startups from around the world, 15 of which are of Indian origin.

This year’s Summer cohort comes against the backdrop of reduced startup funding across the world, with fears of a funding winter abound. Multiple new-age tech startup stocks have also underperformed massively.

India’s startup ecosystem has also felt the heat (or rather, the cold) of the global macroeconomic conditions being as hard as they are currently.

July 2022 was the worst month of the last 17 months in terms of startup funding in India, as Indian startups could only raise $1.16 Bn, according to Inc42 data. Last month, startup funding was down 90% from the corresponding month last year.

However, early-stage funding in India is on the rise. In the first half of 2022, $1 Bn was raised in seed funding across 419 deals, 165% higher than the $377 Mn raised in the corresponding period in 2021, according to Inc42 data.

In May, the US-based accelerator issued a 10-point survival strategy for its portfolio startups to prepare for a 24-month-long funding winter. “The safe move is to plan for the worst,” Y Combinator had said back in May.

YC added, “If the current situation is as bad as the last two economic downturns, the best way to prepare is to cut costs and extend your runway within the next 30 days. Your goal should be to get to Default Alive.”

It is little surprise that Y Combinator has reduced the size of its Summer cohort this year by around 40%. Summer 2021 had seen 414 startups picked for the cohort, which includes Y Combinator investing $500K in the startup, along with three months of YC’s accelerator program.

In a statement given to TC, Y Combinator said that while the Summer 2022 cohort is significantly smaller than its most recent cohorts, it is still bigger than most of the cohorts over the last five years.

Consequently, the number of Indian startups that got into the cohort halved over six months. In the Winter 2022 cohort, YC had selected 30 Indian startups, double the amount that it had selected in the Summer 2022 cohort.

We have compiled a list of the 15 startups that feature in Y Combinator’s latest cohort from the Y Combinator Startup Directory and our primary research.

The 15 Indian Startups At Y Combinator’s Summer 2022 Cohort

Abridge

Founded In: 2022

Headquarters: Mumbai

Sector: Enterprisetech

Abridge is an end-to-end software for freight logistics companies. Based in Mumbai and Mountain View, California, the startup allows freight logistics companies to digitise their processes by accepting a booking, automating compliance documents and communicating with supply chain partners on its platform.

AlgoTest

Founded In: 2021

Headquarters: Delhi NCR

Sector: Investment Tech

AlgoTest is an investment tech startup that allows retail traders to do backtesting for their trading strategies for free. In retail investment, backtesting allows users to access historical data to gauge profitability and risk before investing any actual capital.

Users can also execute their trading strategies in the real market with AlgoTest by buying credits to do the same.

Cone

Founded In: 2022

Headquarters: Hyderabad

Sector: Enterprisetech

Cone is a B2B SaaS platform that provides financial services to corporates. Cone provides services such as bookkeeping, tax filing and CFO services, and AP/AR, along with real-time insights on the accounts and cross-border accounting.

Craze

Founded In: 2022

Headquarters: Mumbai

Sector: Gaming

Craze is a gaming platform where people can discuss real-world events and trade them like stocks. Users can buy ‘shares’ of a poll and if the answer is correct at the close of the poll, the user wins INR 100. The ‘traders’ can withdraw their winnings and also put in money in Craze’s app to participate in more ‘trades’.

Clinikally

Founded In: 2021

Headquarters: Delhi NCR

Sector: Healthtech

Clinikally is a dermatology-focused healthtech startup, which features telemedicine and an e-pharmacy for the treatment of conditions such as eczema, acne, hyperpigmentation, ageing and hair loss.

EthosX

Founded In: 2022

Headquarters: Bengaluru

Sector: Fintech

EthosX is a decentralised finance (DeFi) platform that creates end-to-end financial derivatives on the blockchain. The startup has started with cryptocurrencies as the basis of its financial derivatives and allows users to buy derivatives from the platform without the need for an exchange or counterparty.

Hiresure.ai

Founded In: 2020

Headquarters: Bengaluru

Sector: HR Tech

Hiresure.ai is an HR tech platform that allows companies to communicate better with job candidates. The platform offers a more visual and engaging format of offer letters, company information and other details about the company than the normal communications and offer letters.

Landeed

Founded In: 2022

Headquarters: Hyderabad

Sector: Proptech

Landeed is a proptech startup that digitises land records and issues Encumbrance certificates to landowners to make sure that there are no land disputes. The app is only available to property owners based in Telangana, Tamil Nadu, Maharashtra and Uttar Pradesh currently.

Maya Labs

Founded In: 2020

Headquarters: Bengaluru

Sector: Enterprisetech

Maya Labs is a no-code platform that allows users to build programs and processes with the help of natural language. A user can build a program to fetch data, visualise the data or perform actions such as trigger an API or modify an entry. Users can mix and match different blocks of code to create a program specific to their use case.

PayO

Founded In: 2020

Headquarters: Bengaluru

Sector: Fintech

PayO is a B2B fintech platform that allows businesses to simplify their billing processes, stock management, payment collections and supplier payments.

Raven

Founded In: 2020

Headquarters: Bengaluru

Sector: Enterprisetech

Raven is a SaaS platform that allows businesses to manage customer notifications in one place. With the help of APIs, Raven’s platform brings all the notifications from channels including WhatsApp, Slack, SMS, Emails, and Telegram into one dashboard.

RootFi

Founded In: 2022

Headquarters: Bengaluru

Sector: Fintech

RootFi is a fintech SaaS platform that builds APIs for banks, lenders, and fintech companies to help streamline their lending operations. The company also offers lending-as-a-service, that is, companies can embed RootFi’s solution into their products. The startup also offers APIs, loan servicing and underwriting for the same.

Shelf

Founded In: 2022

Headquarters: Bengaluru

Sector: Fintech

Shelf is a finance app that allows groups of users to manage their money using only one platform. The app offers group wallets, tracking expenses as a group and a debit card for the group.

Tersho

Founded In: 2022

Headquarters: Jaipur

Sector: Enterprisetech

Tersho is a formula generator tool for Microsoft Excel and Google Sheets. Available as both a platform and an add-on, Tersho allows users to get a formula per the user’s requirement. Tersho doubles up as an explainer for more complex formulas.

Videobug

Founded In: 2022

Headquarters: Bengaluru

Sector: Enterprisetech

Videobug is a devtools platform that logs code execution so that developers can replay it and watch it execute line by line. The developers can use Videobug to detect bugs in their code and debug faster and with more efficiency.

Editor’s Note: This list has been collated from Y Combinator Directory & Inc42 Sources. For any changes or additions, please write to us at [email protected]