As the armed conflict between Russia and Ukraine escalates and the threat of a third World War looms large, the volatile geopolitical scenario seems to have triggered another crypto crash.

Almost all leading coins, including Ethereum (Ether), Ripple (XRP), Cardano (ADA), Solana (SOL) and Polygon (Matic), had recently taken a big hit, wiping more than $500 Bn off the crypto market. While the market is back on track, add to that the latest allegation that Russia may try to evade global sanctions by using cryptocurrencies or say ‘virtual digital assets’ (that’s how they are identified in India).

Nevertheless, crypto startups continue to enjoy investor confidence and raise funding despite the market crash and new controversies cropping up. For instance, six-month-old 5ire, a blockchain startup, recently secured a $100 Mn capital commitment from the Global Emerging Markets (GEM) Global Yield as it prepares for an IPO. Leading global venture capital firm Sequoia Capital has also announced a new liquid token fund worth $500-600 Mn targeting liquid tokens and digital assets.

“Our goal is to participate more actively in protocols, better support token-only projects and learn more by doing things ourselves. We remain committed to working collaboratively with the crypto community, including ongoing support for open-source research,” the VC firm said in a statement.

However, it is a rare occurrence when top investors, including SoftBank (Vision Fund 2), Tiger Global Management, Galaxy Digital, Sequoia Capital India, Republic Capital and others come together to invest $450 Mn in a bootstrapped crypto startup.

But the company in question is none other than Polygon, with an impressive track record.

Despite the emergence of ‘ethereum-killer’ blockchains like Solana, Polkadot, Fantom and the like, Polygon has been able to build some of the biggest Web3 projects. These include developing DeFi (decentralised finance) protocols for the lending platform Aave, luxury brand Dolce & Gabbana and NFT (non-fungible token) marketplaces OpenSea and Mark Cuban’s Lazy.com.

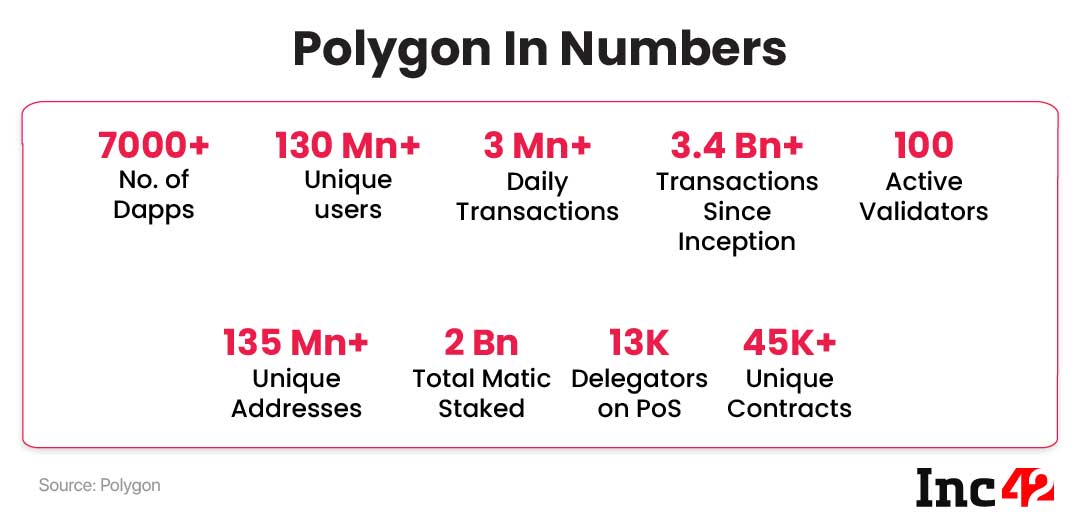

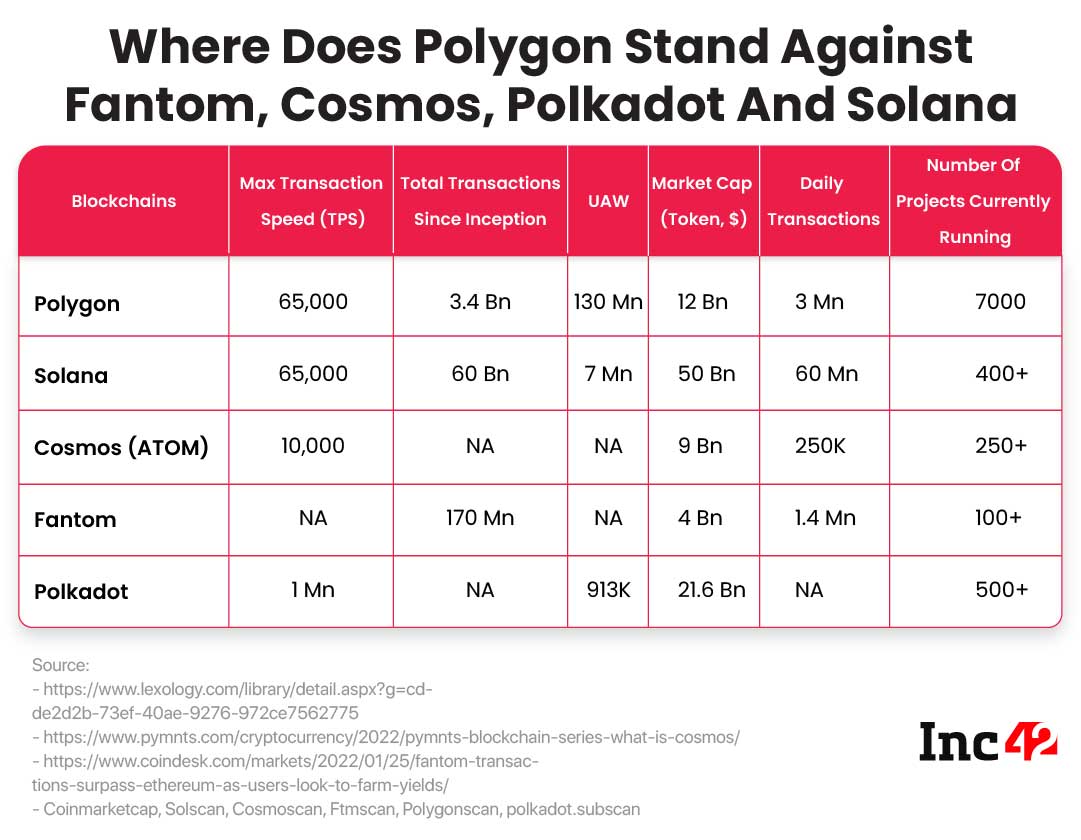

A Polygon official told Inc42 that the company uses a slew of scaling solutions that help it power up to 65K transactions per second (TPS) and is roughly 500 times more throughput than Ethereum’s at around one-thousandth of the gas fee. The cost of mining and transacting NFTs and other digital assets on Polygon is negligible in terms of time, energy cost and transaction fee. Understandably, the carbon footprint created by the Polygon ecosystem is only a fraction of Ethereum.

Interestingly, the scalability issue and the resulting lag in TPS have often hindered the ambitious plans of the blockchain ecosystems. Of late, this has become quite critical due to the current DeFi boom and rise in use cases, leading to network congestion, long spells of transaction and high gas fees. That is why rollup solutions have emerged to carry out transactions outside the main blockchain and then send the transaction data back to layer-1. This offloading tactic significantly reduces the computing and storage resources needed to validate all blocks. Polygon is particularly bullish on zero-knowledge (ZK) rollup, a layer-2 development that can ensure high throughput transactions without compromising layer-1 security standards.

But before we delve further into Polygon’s innovative technology and USPs, let us start with the basics.

The Backstory

Set up in 2017 by Sandeep Nailwal, Jaynti D Kanani and Anurag Arjun, Bengaluru- and Singapore-based Polygon has arguably emerged as one of the most happening ecosystems in the crypto-verse, boasting a vast pool of fanboys and critics on social media.

Three years later, the company added Serbia-based software engineer Mihailo Bjelic as another cofounder and rebranded from Matic Network to Polygon to strengthen its global presence. Since then, it has invested in a few blockchain companies and acquired a couple of startups.

In a first-ever and full-fledged merger of two blockchain networks, Polygon acquired ZK cryptography-based scaling project Hermez for 250 Mn. It also paid $400 Mn to snap up Mir, yet another project focussing on ZK rollup solutions.

The Essence: Polygon Is The Upper Deck Of The Ethereum ‘Bus’

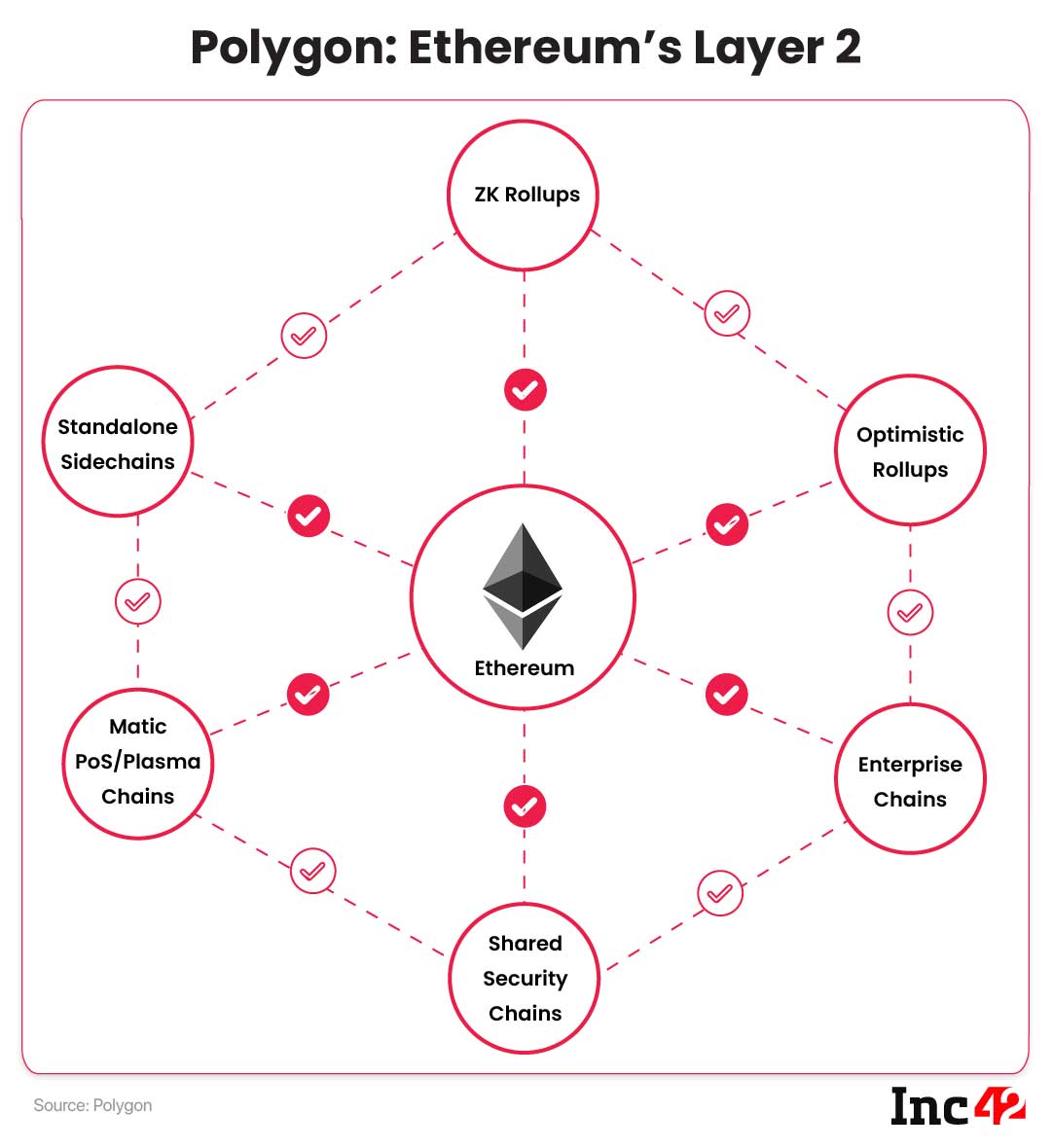

Polygon is a sidechain, which means it runs parallelly to the Ethereum Mainnet and operates independently. However, the layer-2 protocol works in sync with the Ethereum main chain to improve its speed and capabilities.

For the uninitiated, Polygon cofounder Sandeep Nailwal has explained a sidechain as the upper deck of a double-decker bus that enhances the capability of a single-decker vehicle.

Speaking at The Crypto Summit hosted by Inc42, Nailwal said, “Layer-2 is like the double-decker bus. If you want to increase the capacity of a bus, there are two ways to do it. You can somehow increase the capacity of layer-1. A lot of projects like Solana and others are trying to do that. The other way is to scale it vertically instead of horizontally. So you create a parallel layer, an upper deck of the bus (layer-2, in this case), and process a large number of transactions.”

The Tech Edge: How Polygon Functions As Ethereum’s Sidechain

As explained by Nailwal, there are two ways Ethereum can increase its capabilities or throughput. One is on-chain upgradation, and the ecosystem is already scheduled to undergo a major upgrade later this year.

The other way is through layer-2 off-chain solutions, including optimistic rollups, ZK rollups and state channels that rely on the Ethereum blockchain security. On the other hand, there are solutions based on sidechains and plasma chains that also communicate with the Ethereum Mainnet, but they run their own consensus mechanisms to meet a variety of goals.

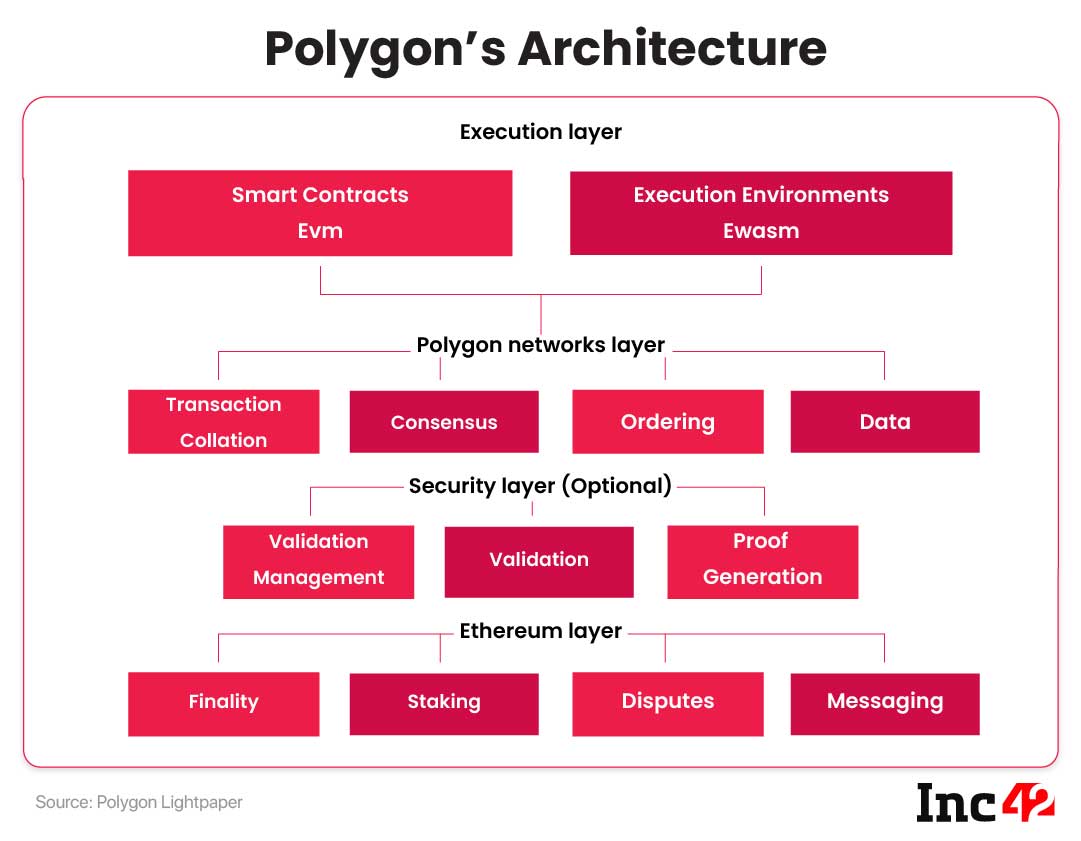

Polygon has developed an Ethereum sidechain called PoS and Polygon Plasma Chains to provide interoperable layer-2 scaling solutions for Ethereum-compatible blockchains. As shown in the image, the Polygon ecosystem is made of four layers – the Ethereum layer, the security layer, the Polygon networks layer and the execution layer. While the Ethereum and the security layers are optional, the other two are mandatory layers.

The Ethereum layer refers to the smart contracts implemented in the ecosystem. These may include transaction finality, staking, dispute resolving and communication between the two chains – the Ethereum Mainchain and Polygon sidechains.

The security layer runs side by side with the Ethereum system and acts as a service validator, providing an additional layer of security to the chains developed on the Polygon system.

The Polygon Lightpaper defines the Polygon networks layer as a constellation of sovereign blockchain networks. Each network serves its respective community and maintains a number of functions such as transaction collation, local consensus and block production.

The execution layer, an implementation of Polygon’s Ethereum Virtual Machine (EVM), executes the transactions based on the consensus developed within the Polygon network layer.

Polygon says there are certain restrictions on plasma-based transactions. For instance, a seven-day withdrawal period is associated with all exits/withdrawals from Polygon to Ethereum on the Plasma bridge. On the other hand, the PoS bridge is more flexible and features faster withdrawals.

While startups like EPNS, Biconomy and Arcana Network are currently developing various decentralised products and services in Web3 space, Polygon intends to offer a comprehensive suite of solutions for developers and users to meet the requirements of Web3 and aims to become the AWS of the Web3 space, enabling users to interact with various decentralised products and services seamlessly.

How Polygon Stays Ahead Of Competition

“The excitement about Polygon and Ethereum is that together they are building the base layer for this new Internet,” – Galaxy Investment Partners CEO Mike Novogratz.

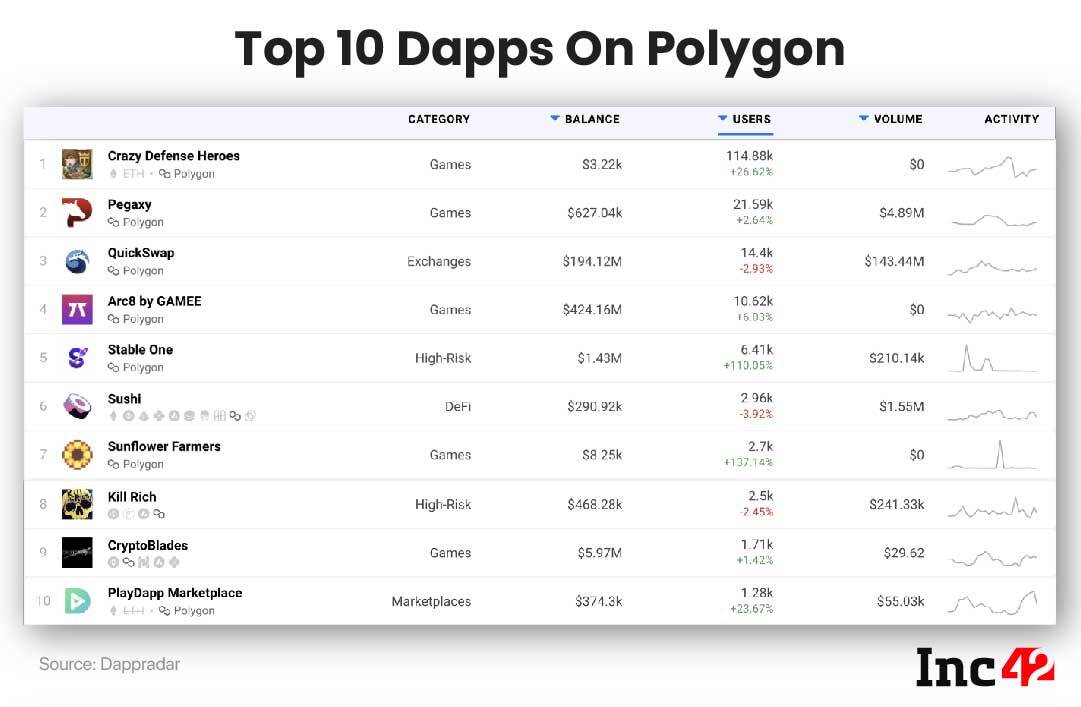

According to DappRadar’s January Report, Polygon was the most improved blockchain in terms of adoption. The number of UAW (unique active wallets) connected to it increased 76%, surpassing 209,000 UAW a day on average. The Polygon system is largely leveraged by the games industry, which is fast becoming the network’s dominant category.

Although Polygon solves the issues involving scalability, transaction speed and gas fees for Ethereum-compatible chains, a similar goal is also achieved by protocols like Fantom, Cosmos and Polkadot. In fact, these are even deemed better than Polygon for some use cases. But when it comes to collaboration, partnerships and hosting dApps, Polygon outshines most of its peers out there.

The number of projects currently running on the system amount to 7,000+, as per data from Alchemy, a developer platform helping companies build decentralised applications. (However, this number does not include dApps that use Infura or Moralis to develop on Polygon. This number is more than double the 3,000 present on the blockchain in October 2021 and a 233x increase from the 30 projects built on Polygon in 2020.

Many companies have chosen to build solely on Polygon. Alchemy data shows 55% of the projects have been solely integrated with Polygon compared to 45%, which have been deployed on other blockchains too.

Andre Cronje, DeFi architect at Fantom Foundation, has an interesting take on the company’s success saga. “Polygon has the best marketing,” he tweeted.

But others have a different opinion.

“Polygon has been more flexible towards experimentation and adoption than any other layer-1 or layer-2 blockchain. The company started with plasma, but it didn’t bring the result. So, it quickly moved to other POS frameworks. Now it has acquired a slew of ZK rollups, currently seen as the gamechanger,” said a US-based VC who actively invests in blockchain startups.

At the Inc42 Summit, Nailwal explained the difference. “From Day 1, we have been very clear about our goal – we want to keep it developer-friendly. Our team is more developer-centric and more hardworking. That’s why it captured a lot of developer traction in the beginning, and later on, it was network effect.”

Last year, EY, one of the Big Four accounting firms, collaborated with Polygon for developing its own blockchain solutions. Commenting on the project, EY’s global blockchain leader, Paul Brody, said, “Working with Polygon provides EY teams with a powerful set of tools to scale transactions for clients and offers a faster roadmap to integration on the public Ethereum Mainnet. We discovered our shared priorities around an open system and networks, and the Ethereum ecosystem would make collaboration in this area much easier.”

Of Interoperability Issues And ZK Rollups

The Polygon project is one of the more recent attempts at blockchain interoperability and scaling, designed to address some of the limitations perceived across Polkadot and Cosmos projects. For one, it is compatible with the Ethereum Virtual Machine, which makes it convenient for those accustomed to building apps on Ethereum and programming in Solidity. Its rival Cosmos uses a WASM(Web assembly)- based virtual machine.

Through Polygon, developers can launch preset blockchain networks with attributes tailored to their needs. These can be further customised with a growing range of modules, which allow developers to create sovereign blockchains with more specific functionality.

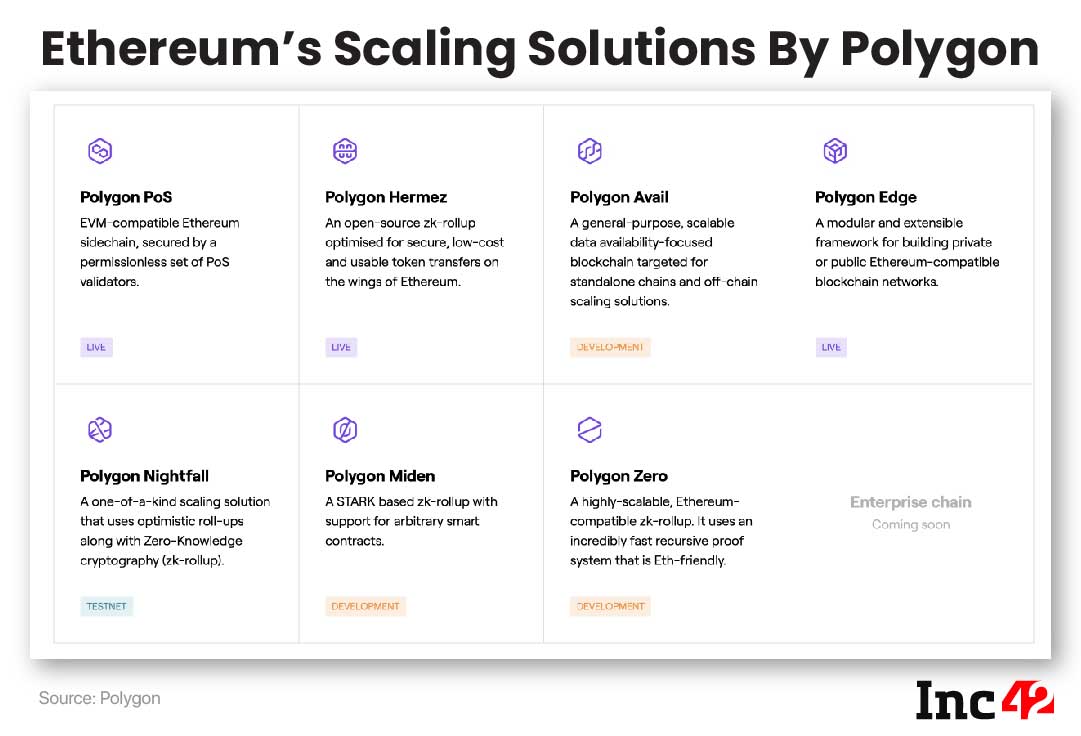

In 2021, Polygon actively worked on multiple layer-2 solutions, including ZK rollups and optimistic rollups. Three of its solutions – Polygon PoS, Polygon Edge and Polygon Hermez – are already live; Polygon Nightfall testnet has been launched and others are in the development phase.

Out of the eight solutions that Polygon aims to integrate, three solutions – Polygon Miden, Polygon Hermez and Polygon Zero – leverage the ZK rollup concept, while Polygon Nightfall uses a combination of optimistic rollup and ZK rollup architectures. Going by this dominant trend, it is now clear that the company is keen to push this tech concept for specific advantages. So, it is essential to understand its exact nature and how it differs from other layer-2 solutions.

Simply put, ZK rollups enable Ethereum scaling without sacrificing the blockchain’s robust security features. In this model, data computation takes place on the layer-2 blockchain, while the data itself is stored on the Ethereum Mainchain. This innovative split reduces the computational overload on the main Ethereum chain but still takes advantage of its high hashrate and security model. (Hashrate refers to a network’s computational power used to verify transactions and add blocks.) ZK rollups store address and balance data in a Merkle tree structure, and the root of the tree is then stored in a smart contract on-chain.

After acquiring Mir in December 2021, Polygon now boasts an unrivalled collection of ZK efforts. Its portfolio includes a zkEVM being developed by Polygon Hermez, a privacy-focussed Polygon Nightfall built in collaboration with EY, Polygon Miden’s general-purpose, STARK-based rollup and Polygon Zero that supports recursive ZK proof generation, leading to horizontal scaling and higher throughput.

“Polygon is committed to ZK cryptography as a scaling method. We have dedicated $1 Bn from our treasury to design and develop ZK solutions, hire ZK-knowledgeable developers and fund our ongoing research in this area,” a company spokesperson said.

Merkle Vs Verkle: The ZK Rollup Is Still Evolving

ZK rollup uses a mathematical architecture called the Merkle tree to validate all transactions. According to Ethereum founder Vitalik Buterin, a Merkle tree is a hash-based data structure, and its purpose is to encode a large number of data chunks in short and secure hashes. This process has to be continued until the total number of hashes becomes only one – the root hash.

Understandably, a Merkle tree is an essential part of blockchains and ZK rollups. But as observed by Buterin, Verkle trees are a powerful upgrade, generating even smaller proof sizes. Instead of providing all ‘sister nodes’ at each level, only a single proof is provided to validate all commitments from each leaf node to the root. This allows proof sizes to decrease by a factor of 6-8 compared to a Merkle tree and by 20-30 or more compared to the Patricia tree that Ethereum uses today.

Asked about the company’s plans to go for a Verkle tree data structure for its convenience, a Polygon official said that Verkle trees promise to reduce the data cost and have been posited by some as a viable scaling solution in the future. However, the development part is still in its infancy.

What The Big Funding Means For Polygon

As discussed earlier, Polygon recently raised $450 Mn from more than 37 global and local investors in one of the biggest crypto fundings so far. Apart from marquee investors like Tiger Global, SoftBank Vision Fund 2 and Sequoia Capital India, companies like Unacademy and Bitfinex also took part in the round in 2022. But more than the amount, the latest round confirmed large-scale institutional backing, providing the company with some much-needed heft.

In a statement post-funding, the company said that it would allocate $100 Mn to an ‘ecosystem fund’ for supporting new projects on its network. The rest would serve as buffer money to help Polygon’s 240-member team build the platform and grow.

Cofounder Sandeep Nailwal said in an interview that the latest funding happened from the Polygon Treasury. Therefore, Polygon Treasury tokens were allocated to some of the investors. In this case, (stake) dilution means the dilution of the treasury. But the company would like to maintain the Polygon Treasury for a longer period.

“It’s a three-year vesting period, and they get 33% of their tokens unlocked after every year,” he added.

Web3.0: Decentralised Or Not, That Is The Question

Web3.0, a blockchain-powered, decentralised internet era, is about to take over and pave the growth path for new-age tech companies like Polygon. The concept appeals to the global tech community, not favouring a centralised Web2.0 and its muscle-flexing Big Tech (popularly known as FAANG before Facebook became Meta). But not everyone is convinced that the new internet era will be as transparent, secure and free from the Big Five’s control (Alphabet, Apple, Amazon, Meta and Microsoft) as it is touted to be.

Twitter’s cofounder and former CEO Jack Dorsey is one of them.

A Bitcoin enthusiast, Dorsey currently heads digital payments services company Block and earlier tweeted about the true nature of the new internet era.

“You don’t own Web3.0. The VCs and their LPs do. It will never escape their incentives. It’s ultimately a centralised entity with a different label. Know what you’re getting into.”

Tesla founder and CEO Elon Musk also aligned himself against the concept, asking, “Has anyone seen Web3.0? I can’t find it.”

When quizzed about investors’ control and influence in this space, the Polygon official said he was not convinced. “Before the latest fundraising, Polygon was almost entirely bootstrapped, and we worked for the retail market. The institutional investors decided to jump in only after we got up and running and became a multi-billion-dollar company.”

That’s not to say we reject the influence of venture capitalists. Their connections to Wall Street and the broader financial arena will surely benefit Polygon. Institutional investors worldwide have started looking at crypto as a strong asset class. And whoever is backed by these investors typically obtains mindshare in the market. Institutional visibility also ensures exposure in specific markets and helps drive growth, the official added.

Isn’t the very ambition of setting up Polygon as the AWS of Web3.0 centralised/controlling in nature?

“The idea behind that ambition is not about control,” the official said. “Developers can use all our customisable features – sidechains, ZK rollups, Polygon POS and Polygon Edge (formerly Polygon SDK). They can use specific servers and databases if they want and fully utilise the scope of our technology. Polygon developers can also modify various parameters such as transaction fees, censorship levels, the scope of decentralisation and more.”

Web3 Gaming Set To Trigger Growth

“Web3.0 builds on the early Internet’s open-source ideals, enabling users to create the value, control the network and reap the rewards. Ethereum, scaled by Polygon, will be the bedrock of this next stage in the Web’s evolution,” said cofounder Sandeep Nailwal.

As NFTs and the metaverse emerge as the new face of Web3 gaming, there will be many changes compared to Web2.0. One of the biggest plus points: Now, gamers will be paid to play. Also, every move in Web3 gaming is printed in blockchain and hence, are irreversible.

In a bid to stay ahead of the curve, the company launched Polygon Studios in July 2021 to help big brands and developers launch Web3 games and NFTs on its platform.

Polygon clocked 7x growth in dApp development in the past few months but witnessed the maximum traffic in gaming. According to DappRadar, four out of its top five projects belong to that genre, including Crazy Defense Heroes, Pegaxy, Arc8 and Kill Rich.

The company hired YouTube’s head of gaming Ryan Wyatt in January this year to push this momentum further. As big brands have a strong presence on YouTube, Polygon wants Wyatt to forge good business relationships with them to pursue growth.

“Ryan has headed gaming at YouTube, where he has done multiple partnerships with gaming companies, studios and players to push gaming on YouTube. He has done multiple contracts and partnerships with big gaming studios, and we need those,” said Nailwal.

Will Ethereum 2.0 End Polygon’s Reign?

“The platform of choice to build on the blockchain today is Polygon,” Shailesh Lakhani, MD at Sequoia India.

But that is how things stand today.

One of the key reasons why layer-2 solutions exist today is Ethereum’s limited transaction capabilities. But by the end of this year, an upgraded Ethereum 2.0 will come into play, increasing the mainchain’s transaction capabilities to 100K per second. Will that affect Polygon’s business dominance?

Ethereum 2.0 will bring about a much-needed scaling and efficiency upgrade for the blockchain via sharding (splitting a large chain into smaller ones or shards) and the transition to PoS. But according to the Polygon official mentioned earlier, given the rise of DeFi and gaming finance (GameFi), Ethereum 2.0’s throughput may not be adequate to process all the transactions users will throw at it.

Ethereum’s goal to become a ‘world computer’ means it has to process much more than thousands of transactions per second. A case in point is the GameFi space, where developers are already integrating systems that rely on massive amounts of transactions, speed and fluidity for games running 24/7.

Polygon’s role in a world where Ethereum 2.0 exists will be essentially the same as it is now but even more amplified. “Through the use of our sidechains, ZK rollup technology and other horizontal scaling techniques, Ethereum 2.0 can be scaled even further to reach transactions above hundreds of thousands, or even millions, per second,” said the company official.

Eventually, how the potential of blockchain technology pans out will also determine the growth trajectory of Polygon and its ilk.