Amid intense competition leading to a worker crunch in the gig economy, Zomato and Swiggy have retreated from certain verticals

India’s gig economy is at a crossroads. The rapid rise of quick commerce, instant delivery, food delivery’s growth over the past year in India and the entry of new players such as Zepto in the grocery delivery space has changed the gig economy and the competitive landscape immensely.

Not only are the likes of Zomato and Swiggy facing the threat of poaching of their delivery personnel by Zepto and Dunzo and others, but the immense outrage against the lack of income stability and job security has also forced new internal policies. Given the competition, Zomato and Swiggy both have retreated from certain verticals in light of this crunch.

We will look at why this is a critical moment for India’s gig economy, but first a couple of key stories from this past week:

- ⏬ SoftBank’s Woes: SoftBank’s $1.4 Bn investment in Paytm has seen a 42% drop in value. But did the Japanese VC’s IPO pressure on Paytm lead to this?

- ⛈️ Raining Controversies: We are not even halfway through 2022 and we have already seen several scandals and controversies hit some of the biggest startups. Here’s a recap

The Race For Gig Workers

Even the best laid plans can come undone. This past week, Zomato has reevaluated plans to launch 10-minute food delivery and rollout in Bengaluru has been halted as per reports. And rival Swiggy is also going through a bit of a kerfuffle and has halted operations of Supr Daily in five cities and Swiggy Genie courier delivery service in certain cities as well.

Even as Swiggy acquired Dineout from Times Internet to take on Zomato’s dine-in business, the Bengaluru-based food delivery unicorn’s Genie service was pulled from three major cities, primarily due to difficulties in hiring delivery workforce. As competition in the delivery space intensifies and more players scale up to major cities, such cutbacks are likely to come for services that are not really helping pad the unit economics.

Gig Economy Booms In India

It’s hard to estimate just how many Indians make a living from the gig economy given the unorganised nature of some of the segments, but according to a Boston Consulting Group study, more than 8 Mn citizens will be part of the gig economy in India, which is expected to grow to 24 Mn by 2023-24 and 90 Mn before the end of 2030.

While food and quick commerce delivery workers comprise only a small portion of this pool, these are the gig workers that are the most visible in the public sphere. So far food delivery was the primary service, but quick commerce has become another huge pillar for the gig economy. According to a recent RedSeer report, India’s quick commerce market is expected to witness a 15X growth by 2025, reaching a market size of close to $5 Bn.

Competition For Riders

In a way, it is the very working conditions created by gig economy companies that are now coming back to bite them. For instance, the fact that job security and income stability are not hallmarks of the gig economy in India makes it easier for these part-time workers to jump between platforms that pay them more.

Zomato is also facing a shortage of delivery workers for its 10-minute food delivery service, which was already being criticised as creating undue pressure on the delivery workers. Besides this, Zomato, which has announced its intention to acquire Blinkit, which is also in the crowded space, finding it hard to keep up with Zepto, Swiggy’s Instamart, Tata-owned BigBasket and others who have jumped with both feet.

Zepto, in fact, has announced plans similar to Zomato Instant with Zepto Cafe and also has plans to enter medicine delivery in the near future after its recent fundraise. So now Zomato and Swiggy — the two primary delivery employers in India — are in retention mode.

Retention As A Moat In Gig Economy

Given the gig worker crunch, retaining the delivery fleet is the name of the game in mid-2022. Since the government’s social security code for app-based workers is yet to become official, companies have resorted to private policies for retention.

Some companies like Reliance-backed Dunzo have professed to have taken a serious look at how much value they are creating for gig workers and looking to change the narrative around India’s gig economy.

At his fireside chat at The Makers Summit 2022, Dunzo’s cofounder and CEO Kabeer Biswas said the company plans to scale up its delivery fleet to around 60K workers by next year from the current 15K. And he claimed this cannot happen unless startups start looking at gig workers as full-time employees from the point of view of culture, value and wealth creation.

Job Security Becomes Paramount

One can boil it down to looking beyond the on-paper status of a gig worker and considering them just as essential a talent as any other full-time employee. That’s something Swiggy is looking to introduce with the Step Ahead accelerator programme for its delivery executives. Swiggy said it would train delivery executives to transition into managerial roles within the company, helping them move into ‘full-time jobs with a fixed salary and other benefits’.

In a similar vein, Zomato CEO Deepinder Goyal donated ESOPs worth $90 Mn to the Zomato Future Foundation, which various benefits to the delivery partners including free education of up to two children and special programmes for girl children for livelihood and higher education support.

Even if these may be called belated moves, these initiatives are commendable. Of course, one may argue that this is the only option left for gig economy platforms.

In the absence of government-mandated job and income security policies, the competition in the delivery space means internal programmes and projects such as the accelerator or ESOPs will become indispensable for gig companies.

Indian Startup IPOs & Tech Stocks Tracker

- Delhivery’s IPO Subscription: Amid market volatility, the logistics unicorn’s IPO saw 163% subscription, primarily driven by the QIB segment

- OYO Faces Opposition: Industry body FHRAI urged SEBI to axe OYO’s IPO citing mounting losses suffered by hospitality players and other issues at the company

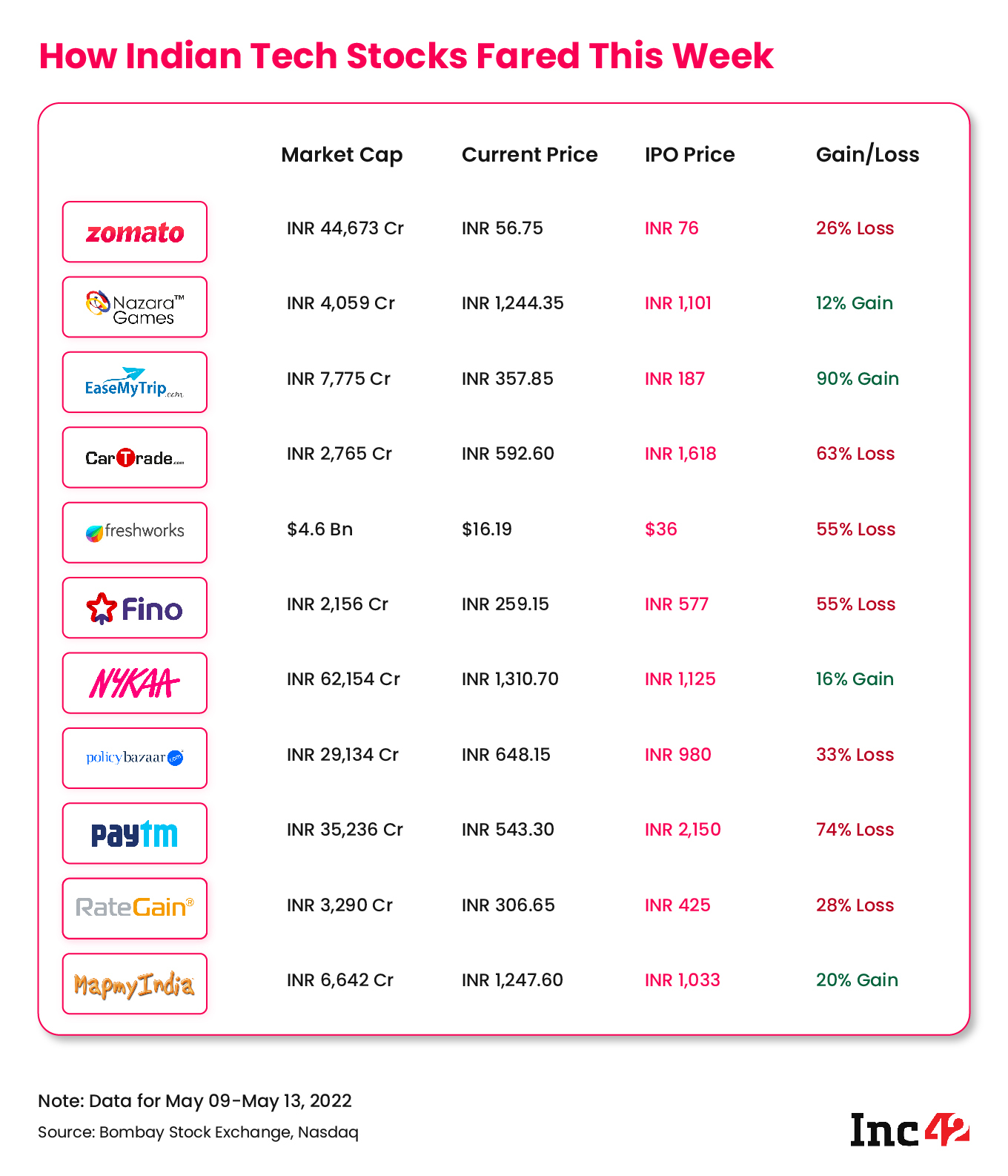

- IPO Parade Halted: With the exception of Policybazaar, all recently listed tech companies saw their stock prices fall further in comparison to their IPO price. The market volatility has halted most tech IPO plans in 2022, with Delhivery being an exception

Here’s how some Indian tech stocks have done since listing:

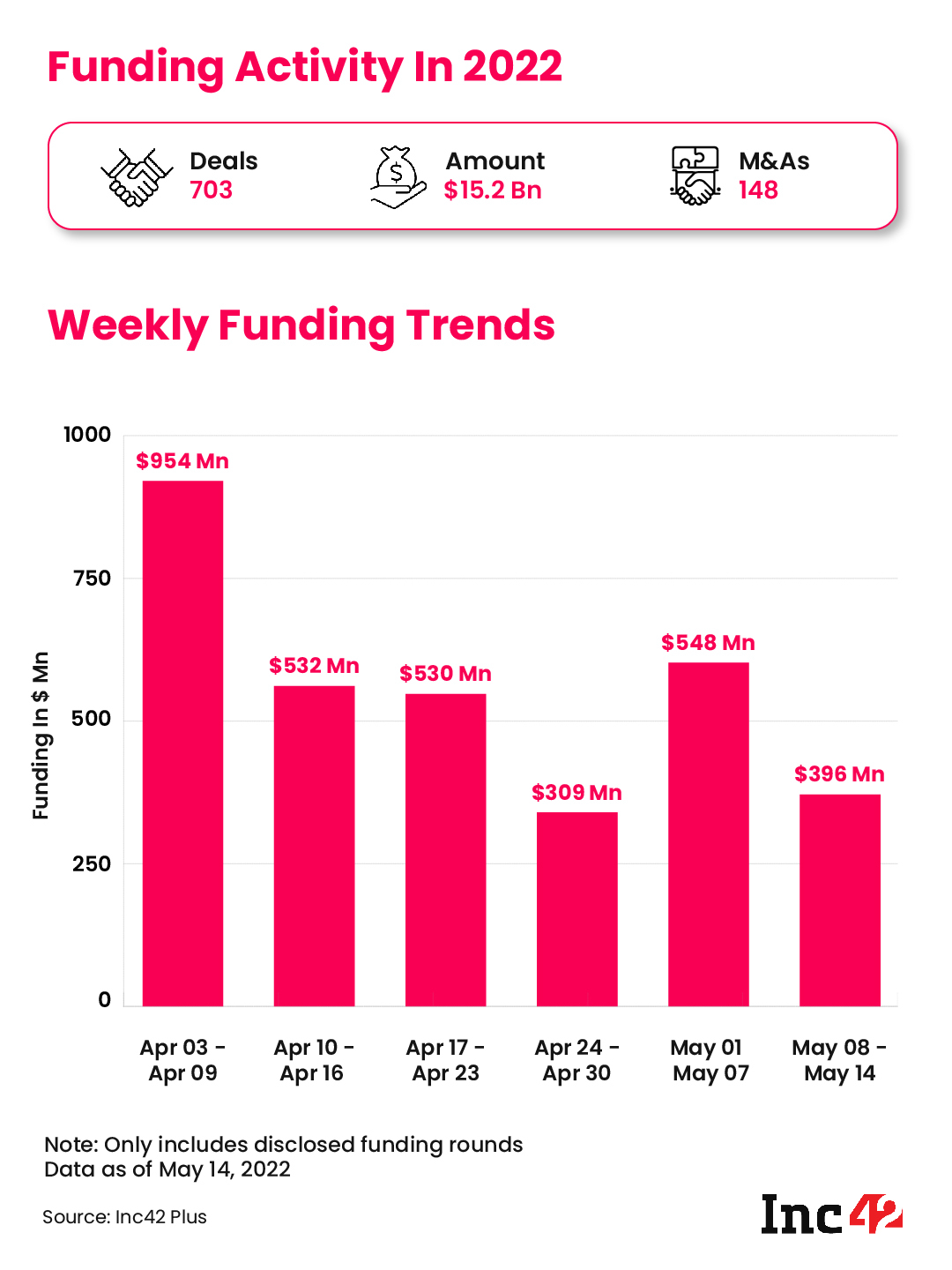

Startup Funding Tracker

The second week of May plummeted further after witnessing a slight uptick in funding in the first week. Between May 9 and May 14, the ecosystem managed to raise $396 Mn across 33 deals. This is a 27.7% drop from $548 Mn raised last week.

Luna Bust & Other Top Stories

- 🛰️ Starlink In India? Elon Musk-led SpaceX’s satellite internet service Starlink is now available in 32 countries, and will be coming to India soon

- 💣 Luna Bust: Following the crash of Luna, Indian exchanges delisted the token, which went from $100 at one point to nearly zero on Friday

- ⚖️ Amazon Vs Future: Amazon has approached the NCLT to dismiss the insolvency resolution plea filed by the Bank of India (BOI) against Future Retail

- 📱 Xiaomi’s Tax Troubles: Indian tax authority froze $478 Mn lying in local bank accounts of Xiaomi in February as part of a probe into alleged tax evasion, as per a court filing

- 👮 FIR Against Flipkart CEO: Kalyan Krishnamurthy has been named in an FIR in a contempt of court case, an allegation the company says is “non-maintainable”.

That’s all for this week. See you next Sunday with another weekly wrap-up