“The IPOs signal a coming of age and a maturity for the Indian startup ecosystem. In the last couple of years, we have seen large acquisitions like Flipkart, seven unicorns in one week, big M&As like BYJU’S and WhiteHat Jr or Pharmeasy and Medlife, but so far IPOs have been very rare. This will represent a new phase for startups,” – Siddarth Pai, founding partner, 3one4 Capital.

Dear Reader,

It’s called the ultimate exit for any startup. An initial public offering or IPO is seen as validation for the idea and the toil behind any business. A vindication of the entrepreneur’s vision and arguably the biggest stepping stone in a startup’s journey.

And this year, more than half a dozen Indian startups are looking to take the IPO route. In many ways, this is a watershed year in the Indian startup ecosystem’s history. With these IPOs coming amid the pandemic, there are plenty of potential implications for the startups as well as the investors.

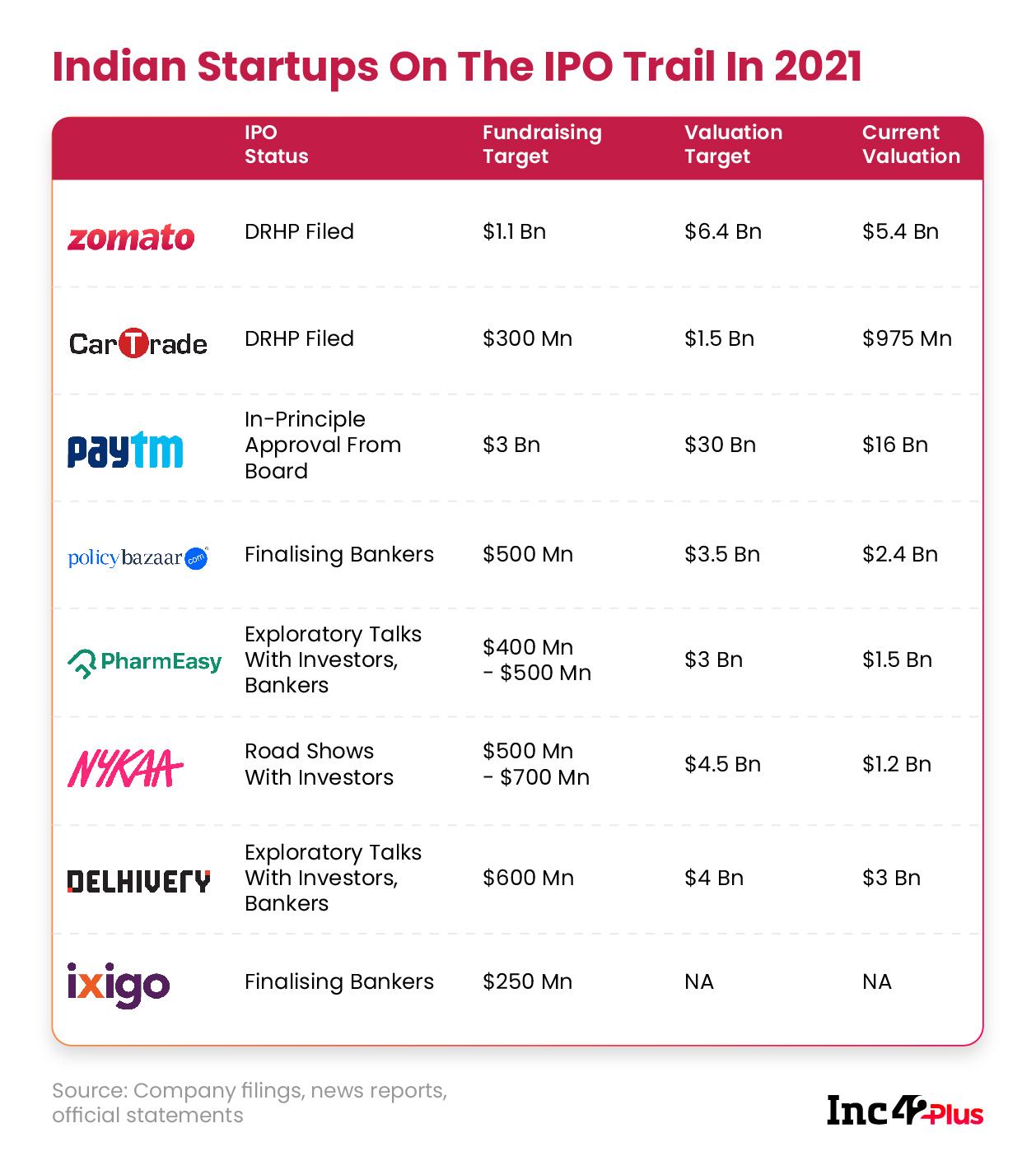

In recent months, Indian startups such as Zomato, Paytm, CarTrade and others have declared their IPO ambitions. Food aggregator unicorn Zomato and automobile classified company CarTrade have already filed the draft red herring prospectus (DRHP) for their IPOs. While Paytm is planning India’s largest public market debut with its $3 Bn IPO (at $30 Bn valuation) after it received an in-principle approval from its board. Beyond this, epharmacy startup PharmEasy, omnichannel beauty retailer Nykaa and fintech startup PolicyBazaar will also be filing their IPO papers this year.

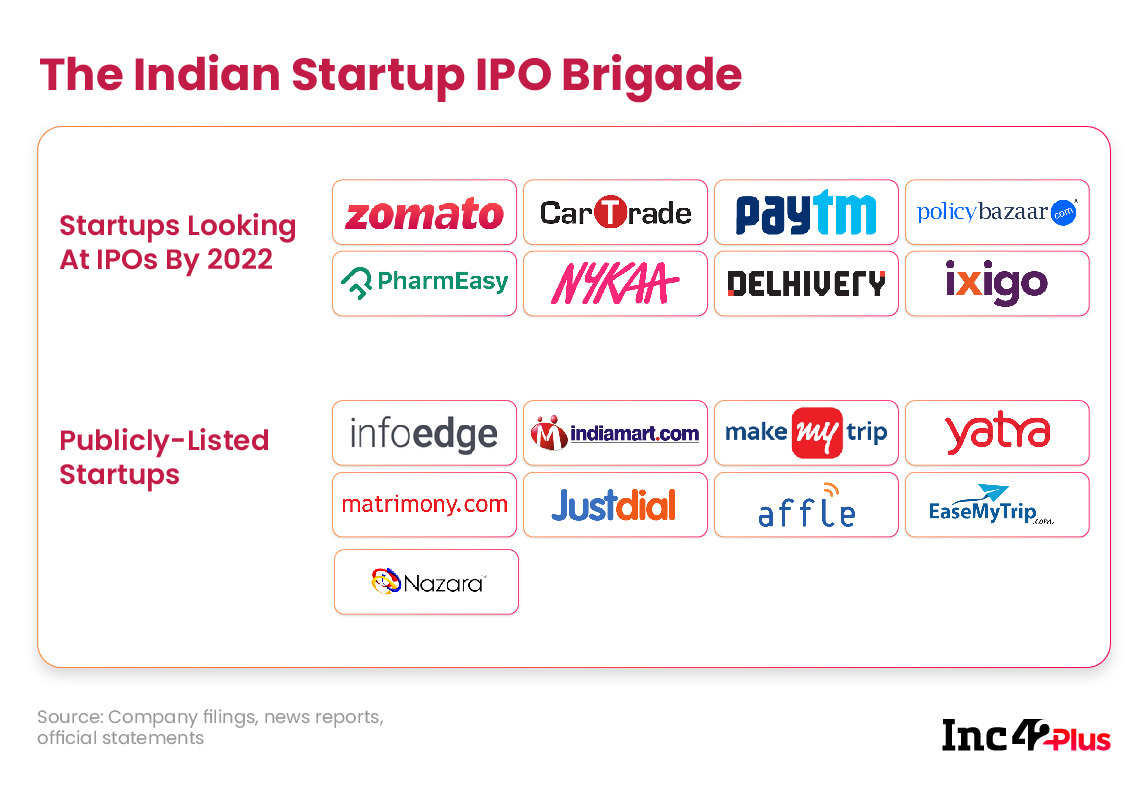

The IPO rush follows the successful public listing of gaming company Nazara Technologies and online travel platform EaseMyTrip, which have given confidence to the Indian retail and institutional investors. Despite the risks or challenges, market analysts and sector experts are bullish on the IPO potential of tech startups and new-age companies.

While just a few months ago, there was a fear that many of these startups might go for foreign listings and deprive Indian investors of the opportunity to be part of their wealth creation, there has been a changing of the tide. Now the mood in the market is largely positive around tech stocks such as Zomato, Paytm, CarTrade and others which are looking to list in India, even if the pandemic has made speculating a bit more speculative.

Some credit also goes to Securities and Exchange Board of India (SEBI) which relaxed listing norms in 2020 and in 2021, and made it easier for companies to move from the startup-centric Innovators Growth Platform to the main trading board.

In many ways, the IPO trend in 2021 highlights the second coming for the tech industry after the heydays of Infosys, Tata Consultancy Services, Wipro et al, which solidified India’s role as an enterprise and IT services giant. The rise of product companies as well as consumer tech services is an evolution and the IPOs can be seen as the graduation ceremony for this class of startups.

It also serves as an inspiration for other growth stage startups, said investors and analysts. Till now, no startup unicorn has gone for a listing, and with the likes of Zomato, Paytm, Delhivery, Nykaa and other unicorns gunning for an IPO, there’s an optimism in the air, which has replaced the typically defeatist attitude that dominates these discussions of exits and IPOs. According to Girish Vanvari, founder of advisory firm Transaction Square, there isn’t a better time for Indian companies to go public. There is great liquidity in the market as witnessed by the fundraising through IPOs in FY2021, he added. Indian companies raised over INR 31,000 Cr through IPOs in the year through the domestic equity market. This was the highest fundraising through IPOs in the last three years.

Undoubtedly, Covid changed the way tech companies have been seen in the Indian context. Till 2020, tech companies and startups were looked at as solutions that only reach a fraction of their addressable base. But all that changed in the past year with the digital transformation wave across consumers and businesses. On the consumer front, a large number of new internet users came online and transacted on food delivery or ecommerce platforms.

“You are already seeing the kind of interest that investors have for stocks of Apple, Google, Amazon and Tesla in India. These are being traded from India now and I think it’s the right time for Indian tech companies,” Vanvari told us.

In other words, it’s the age of tech companies and startups. If companies have a solid business model and experienced promoters/founders, there are no roadblocks to an IPO any longer. Of course, the proof as always is in the eating of the pudding, so it’s not a smooth course ahead, and there are challenges for these startups.

Startups Dig Deep For Profitability

The big question is of profitability, as many of the startups that are going for an IPO this year or early next year, did not report profits in their latest full fiscal year financials. While these are some of the highest valued companies in India, their massive market share has come at the expense of losses. Will they realise their vision for profitability any time soon? Those profits may have to come soon to justify a rich stock market valuation. Will the pandemic’s ‘upside’ for these businesses hold up in the long run?

Dinesh Arora, a partner at PwC leading the deals track, believes that startups are changing their attitude towards the things that make public companies. This means turning EBITDA positive, setting up corporate governance structures and hiring the right personnel, which should help change their image of being VC-funded cashburn operations.

This notion is backed by what Delhivery CFO Amit Agarwal told Inc42 in March this year. “We have been working as a public company for three years now, presenting quarterly and annual budgets to the board and shareholders. The targets are in line with the KRA (key result area) of each senior executive and down below. We have an audit committee and a regulatory compliance committee that oversees financial control, compliances, executive compensation and business continuity,” Agarwal had said.

In the post-pandemic market startups are more keenly aware of the need to focus on becoming unit-economic positive, while also running a tight ship when it comes to corporate governance. Many have scaled back or retreated from unprofitable lines of business or verticals in the past year amid the pandemic and have trimmed costs aggressively in the past couple of years.

Zomato, for instance, turned unit economics positive largely because of the pandemic-induced market conditions. It had to support fewer large restaurants, which typically offered lower payouts, while at the same time delivery-only cloud kitchens came to the fore. Then there was the temporary addition of groceries to meet the demand for essentials. But the biggest boost came from consumers moving away from their discount-happy habits and actually becoming ready to pay full price.

Landmark transitions such as this have definitely helped startups in their preparation to hit the public market where investors value companies very differently and perhaps with a stricter eye than venture capitalists and hedge funds. They can’t raise money from the public markets only based on projections of future revenue or profits. They need to show that the customer is moving towards what they are selling, which is happening now, as illustrated by the Nazara IPO.

Secondly, with just 10% of the issue reserved for retail investors, the risk is lower for startups as institutional investors are certainly more familiar with the long-term value of tech companies. As per SEBI norms, prior to listing companies need detailed disclosures on business plans, risks, profits, and where money will be spent. But because of the lack of profits, these companies will not be able to have a retail portion larger than 10% in their public offering issues. In a normal IPO, where the company has at least INR 15 Cr net profit for three out of the last five years, retail investors can subscribe to up to 35% of the IPO.

Many believe that retail investors may not be able to parse through the valuations and might lack the long-term outlook needed for tech stocks. Having a large institutional portion will work out in the favour of the companies going public, add experts, as these institutional investors are seeing tech stocks soaring, given the success of IndiaMART, IRCTC, EaseMyTrip, Nazara Technologies and Affle in the past 12-18 months.

“Without going into any specific case, I don’t think there will be a challenge because there is a huge appetite for companies, which have digital models. If you look at the listed companies such as IRCTC or InfoEdge or Matrimony. They are all trading at very good multiples,” PwC’s Arora added.

India’s Innovation Train Faces The Biggest Litmus Test

One thing does set the new brigade of Indian startups going for an IPO. Most of India’s already-listed tech companies — with exception of perhaps EaseMyTrip and Nazara — come from the old school of tech companies, perhaps just one step removed from the IT services culture. On the other hand, the current brigade of startups going for an IPO, represent the next wave of innovation. This innovation has so far been celebrated in private circles and on Twitter threads, but for true-blue businessmen, the real test is the public market, where bluster or the charisma of a founder rarely make a dent.

Santosh N, managing partner for D&P India Advisory, is excited to see how Indian startups will prove themselves in the market. He dismissed the fears about the lack of profitability citing the example of Amazon, which did not turn a profit even after listing for a couple of years. Investors who realise the value of digital platforms will invest in them for the long run and the future is digital. Even when the economy is fully reopened, digital solutions will continue to gain momentum and traction.

The fact is everyone loves to question a tech stock. Perceptive investors who can read the value of innovation in such a disruption-friendly environment will reap the rewards.

Take the example of Apple, arguably the world’s most famous stock, which went for an IPO, 41 years ago in 1980. For decades, the Apple stock grew in small increments till the age of computers peaked and Apple cashed in on the smartphone age. Investors who sold Apple stock before the 2010s must be kicking themselves — a whopping 80% of Apple’s market valuation has been created since 2013, with the company having a scarcely-believable market cap of $2.1 Tn.

Of course, that doesn’t mean that the next Apple will come from Zomato or Paytm or CarTrade, but it does show that the tech industry can change suddenly and rapidly. A lot hinges on the timing of the IPO too. These companies have proven that they are willing to ride the tide over the years, and there is a palpable excitement among market watchers for the new breed of Indian public companies given the right timing and market conditions for digital companies.

Beyond this, there is still the risk that tech stocks that saw gains for a limited amount of time due to market conditions will come crashing. Food delivery startup Doordash’s IPO, coming in the middle of the pandemic, saw a big boom on opening, but has now steadily fallen as restaurants in the US reopen post the vaccination. The Doordash stock is trading at 40% higher than its IPO listing price, a far cry from the 80% higher price it saw on the opening day of trading in late December.

The next few months will tell how the market will shift and the success of the IPOs will hinge on the resilience of the startups’ business models.

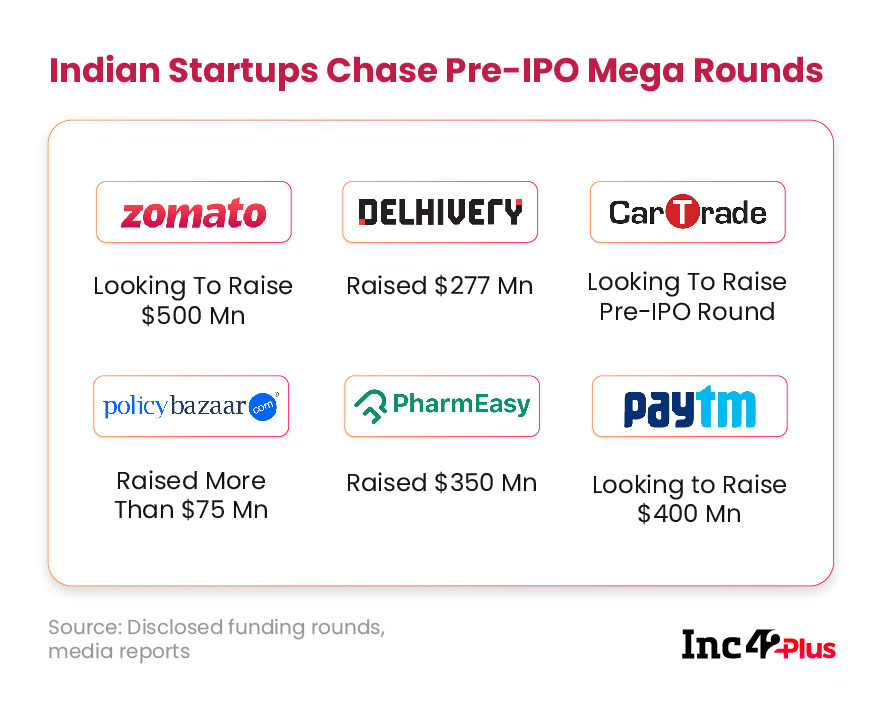

Pre-IPO Rounds In Vogue

Before the IPOs will come a slew of funding rounds to help companies bring comfort to retail investors that their valuation is valid, particularly, if the startup has closed its earlier rounds a year or two earlier. It’s also about attracting new investors to the cap table to prove the pre-IPO health of the company.

In fact, leading banks are launching pre-IPO funds to target investments in these companies. Kotak Investment Advisors Limited has brought forth a pre-IPO fund called the Kotak Pre IPO Opportunities fund, which will target high-quality companies that have a strong technological bent.

While IPOs remain the ultimate exit, another major exit strategy for startups is in the form of mergers & acquisitions (M&A), particularly with corporate giants looking to snap up startups to bolster their digital operations.

In recent weeks, the Tata Group has emerged as an M&A juggernaut, having acquired BigBasket, 1MG and California-based AccessBell. It’s also said to be preparing to acquire Curefit with its recent $75 Mn investment, and there’s speculation about a potential majority stake acquisition in Dunzo too.

A lot of these M&As and IPO plans have come at a time when the Indian market is rapidly changing and transitioning to a new reality after the lockdowns of last year and the first half of 2021. With mega corporations also eyeing digital companies and late-stage startups staring at exits, there are plenty of indications that the age of startups is reaching a stage of maturity.

Till Next Week,

Nikhil Subramaniam

![You are currently viewing [The Outline By Inc42 Plus] A Bull Run For Indian Startups In IPO Season](https://blog.digitalsevaa.com/wp-content/uploads/2021/06/1200x628.jpg)