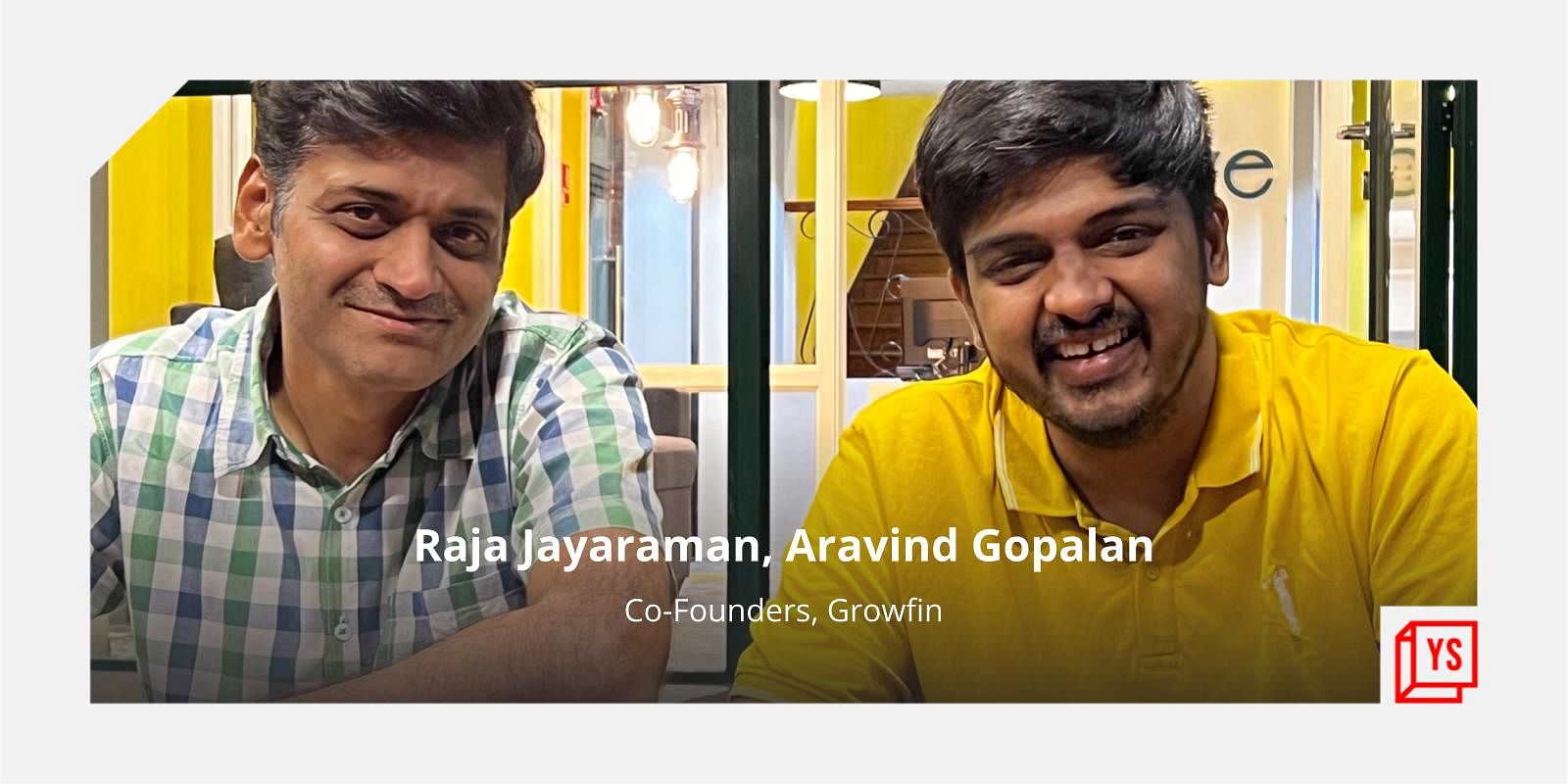

In 2012, SaaS giant acquired Aravind Gopalan’s startup Frilp, a social recommendation tool to find trusted businesses through friend recommendations.

While integrating into the company, he and his colleague Raja Jayaraman realised that B2B enterprises were using B2C payment methods.

“Each stakeholder had their own system to track invoices, check Accounts Receivables (AR) balances of customers, and what needed to be collected. There was no one place where stakeholders across the company could see which customers owed how much, and what invoices were due. That single visibility was lacking,” Arvind says.

In 2021, this led the duo to start work on SaaS-based fintech platform Growfin, which connects customers, sales, finance and customer success teams on one platform. The platform was launched in 2022. Aravind explains that transactions between companies, no matter how large or small, are a complex process. Finance is not the only aspect involved; sales and customer success also must be considered.

After talking to a focus group of over 300+ finance professionals in 2021 to understand their pain points in collecting AR during, before, and after the pandemic, Aravind says existing systems or vendors were not solving this problem “the right way”.

“We learned that these skilled professionals were being hampered by existing archaic systems and were spending a lot of resources on managing receivables with poor efficiency. Their current ERP/payment systems or the legacy vendors were not helping solve their problems, as these platforms were simply tools to record and process invoice creation, deliver invoices, and provide payment options,” he says.

What Growfin does

Despite the growth in modern CRM systems for sales and innovation in fintech payment solutions, little has been done to manage the business of collecting B2B payments.

Bengaluru-based Growfin is squarely aimed at solving this problem by creating transparency in the payments journey with a one-stop solution.

“The system and process required for each is different, and that is where Growfin fits in. The platform combines these in a collaborative space where invoice payments can be handled between businesses and customers. It paves the way for greater transparency and removes inefficiencies in B2B payments,” Aravind says.

Growfin offers modern accounts receivable automation software that helps enterprises accelerate cash collections and makes cash flows more predictable by giving real-time visibility into receivables, making collections smarter and more collaborative, and automating manual processes. The founders wanted to begin by exploring the startup space and roped in contacts from their networks to “build a core team of like-minded people”.

“We come from SaaS backgrounds, so we understood the problem and saw it first-hand,” Aravind explains. “We were very clear about validating this problem before jumping into it and starting to sell it.”

Growfin has positioned itself as a fintech solution that looks at finance CRM, and this gives it a first-mover advantage in the market. The aim is to not only simplify B2B payments, but offer a convenience-driven approach to clients. The 360-degree integration of processes, from invoice to cash, makes it structured and efficient.

Presently a 20-member team, Growfin aims to expand in the near future.

Growth amid the pandemic

COVID-19 led to dramatic changes in the workplace and for businesses and enterprises, leading to a boom for fintech companies across the world.

Aravind says the pandemic affected Growfin’s business as well. “We had a focus group and we knew that the problem was very real. The pandemic had worsened the cash collection situation. Payments had become even more of a challenge.”

Payment methods previously involved keeping tabs on Excel sheets – a cumbersome and archaic process. ERP systems, meanwhile, seemed redundant in the midst of remote work, which fuelled the call for alternative solutions to modern problems.

Growfin, which says customer success is “inherent to the very functionality of our offerings”, stood out from competing services with its narrowed focus on B2B sales, finance, and customer relationship management. Moving quickly into the SaaS fintech space to tap the pandemic-driven opportunity, Growfin is upscaling to match the demand for its services. However, there are other key players in the payments segment catering to SMEs.

Aravind says Growfin did look at the competition to put their systems in place. “If you look at this landscape, there are broadly two sets of solutions, apart from ERPs and invoice billing solutions. There are payment solutions like Stripe and Razorpay, which provide a workflow solution targeting SMEs. If you’re using Razorpay, you will also be able to invoice customers and accept payments. The challenge with that, though, is the complexity which grows in a B2B environment. It holds better in B2C environments where there is no transaction.”

In contrast, Growfin’s offering works as an accounts receivable automation software. It helps businesses gain visibility in real time regarding receivables included in their processes. In simpler terms, it is a financial CRM that streamlines receivables across teams such as sales, finance, and more so that companies can track and collect payments.

The AI-powered system provides end-to-end visibility for the B2B segment by bringing in invoices, information, and cash flow in a collaborative space. Its client portfolio includes names such as Whatfix, Intercom, Darwinbox, and more.

In 2022, the fintech startup raised $1.4 million through seed funding. The startup counts 3one4 Capital as one of its investors

Speaking about future plans and goals, Aravind says, “One is expanding our customer base; we want to target the US and global customers in English-speaking countries. Two, we also want to expand our product base beyond finance. We want to offer an integrated payment solution, along with an integrated cash solution.”

![Read more about the article [Funding alert] B2B ecommerce startup TyrePlex raises undisclosed amount in seed round led by AdvantEdge Founders](https://blog.digitalsevaa.com/wp-content/uploads/2021/07/Imagexoyl-1625127165479-300x150.jpg)