Neha Juneja, a 37-year-old serial entrepreneur and engineer, started her entrepreneurial journey in 2008 with a consumer-facing venture in the capital markets – AisaPaisa. Embarking on this business venture, Neha realised there was a major gap in the market for innovative investment products.

“Most retail investors and savers who are yet to invest are looking for predictable, stable returns which are also high – everybody loves high returns,” says Neha in an interaction with YourStory.

Later, in 2010, she co-founded Greenway Appliances and Green Ecodevelopment Pvt Ltd, a clean cookstoves enterprise with operations across rural India and sub-Saharan Africa, where she developed multiple credit partnerships focused on women as borrowers.

For a decade, Neha worked on the ground with microfinance operators and rural self-help groups who were distribution channels for Greenway, as well as international asset managers who offset carbon emissions through Greenway stoves projects.

“While on the field, I had a surprising discovery. Loans extended to semi-urban and rural women borrowers or debt seekers in the country were strong and growing with high yields and lowest NPAs (risk). And yet, it was cumbersome for them to seek loans from traditional institutions who were nevertheless lending to them,” adds Neha.

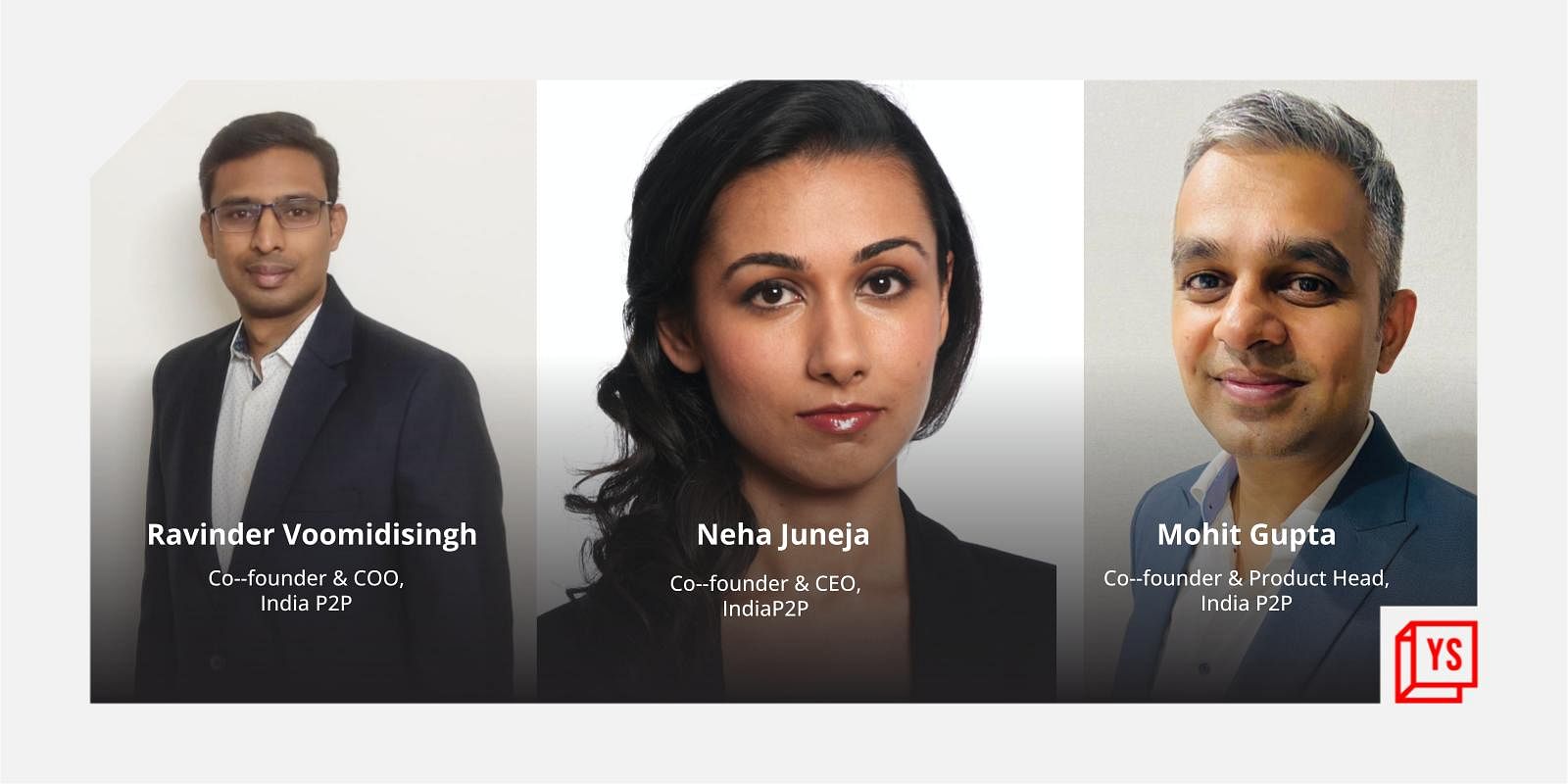

India P2P Co-founders –(L-R) Mohit Gupta( Product Head ), Neha Juneja( CEO ), Ravinder Voomidisingh, (COO)

In July 2021, Neha, along with Ravinder Voomidisingh and Mohit Gupta launched – a peer-to-peer lending platform for high-yield, fixed-income investment products, which also aims to be India’s vanguard for debt. Simultaneously, the company also wants to ensure borrowers get loans faster and in an easier manner.

How does it work?

Mumbai-based IndiaP2P leverages new-age technology and machine learning to create financial products that mitigate risk without compromising on returns.

The company has launched two products – the IndiaP2P Growth Plan and the IndiaP2P Income Plan.

The founders claim IndiaP2P investment products are the first of its kind in India.

“Retail investors desire investments that deliver high, regular, stable returns and IndiaP2P does exactly that – delivering up to 18 percent per annum in predictable month-on-month earnings,” says Neha.

She adds, “There is no other competing product that matches the reward-risk profile of IndiaP2P. We are able to deliver this reward-risk profile by making fractionalised, high-yield debt assets available to retail investors in a portfolio form wherein our algorithm estimates the correction between each fraction, and creates the most risk-reduce i.e., diverse portfolio even for very small investment ticket sizes of Rs 5000/-.”

IndiaP2P also wants to change the way credit is being channelled to women borrowers. It is also the only platform where over 95 percent of the borrowers are women (or women-led SMEs), according to Neha.

“IndiaP2P borrowers are predominantly (> 95percent) women business owners who have prior credit histories. They have taken at least one loan before and repaid it successfully. Indian women have better CIBIL/credit scores than men making them safer borrowers and yet women are underserved by many traditional financial institutions. With a focus on women borrowers, not only does IndiaP2P aggregate safer, better borrowers but also corrects a critical gender credit gap.”

Team IndiaP2P

She adds that despite being better borrowers, women face 2.5 times the rejection rate compared to men when taking a loan, and this is attributed to biases. “Women are made to seek NOCs/written permission from family members even while being fully financially independent themselves, “exclaims Neha.

“We have examples of borrowers who run restaurants and have taken loans from us to expand seating capacity etc. to cater to post Covid demand surge, some who are increasing production capacity at their units and more,” she adds.

Certified by the Reserve Bank of India (RBI) as an NBFC-P2P, the startup does stringent KYC, physical verification, and credit check for each loan/borrower. Investors can invest as low as Rs 5,000 and see the highest-grade diversification of their investment with monthly returns.

The tech stack

The startup has developed its own technology stack and product modules within it, ranging from a borrower app, a cloud suite for agents, an underwriting module, and most importantly, its proprietary portfolio engine which uses advanced machine learning and real-world inputs to create the lowest risk products.

“Using the same tech stack, we will be manufacturing and launching other products as well, catering to different investment tenures and more,” claim the co-founders.

The founding team

Neha and Mohit Gupta went to the same engineering school and worked on systemising the buy-now-pay-later (BNPL) programmes at Neha’s previous startup Greenway. Mohit is now Product Head at IndiaP2P.

The duo met Ravinder Voomidisingh when he invested in Neha’s previous startup.

Ravinder, who is the COO at IndiaP2P, is an experienced investment professional with over 14 years of experience in financial inclusion, impact investing, ops/credit risk management, and managing high-value relationships.

The startup has a team of 16 members today, with a field agent network across India for borrower diligence and sourcing.

“The idea and opportunity of creating an investment product with a never before value proposition for retail investors are what brought us together,” says Neha.

Industry veterans Roopank Chaudhary, Ankit Mathur, Nagarajan Muthukrishnan, Shiji Pavithran and Rachit Mathur play advisory roles. Roopank Chaudhury, Nagarajan Muthukrishnan and Rachit Mathur are financial services industry veterans having worked across organisation building, lending to high-yield borrowers, and technology. Shiji Pavithran and Ankit Mathur come with deep experience in building BNPL programmes and user communities.

“As a platform we are seeking the highest quality expertise to safeguard the interests of retail investors and make a product that is the best in every sense,”says Neha.

Market opportunity and business model

According to a CRISIL report, the market for high yield debt in India is approximately $140 billion with the largest chunk being microfinance women borrowers.

“IndiaP2P is creating investment products for this segment. Our current segment is approx $50 billion in size,” claims Neha.

The firm’s business model is manufacturing investment products and then selling them to retail investors. The manufacturing bit entails sourcing high quality, high yield debt, underwriting, processing approved debt assets through our portfolio engine and creating the final investment product.

YS Design team

“IndiaP2P is already the fastest growing manufacturer of investment products with over 25 percent of the AUM coming via existing investor top-ups in a very short period. Through our field agent network, we currently reach out to 120,000 women borrowers across multiple states in the country. We are actively expanding this base to reach 1 million borrowers over the next six months,” she adds.

The startup charges Rs 300 on average as a processing fee from the borrower.

Funding and way ahead

In February this year, the startup raised an undisclosed pre-seed round from Antler India.

Speaking about its future, Neha says, “We aim to expand India’s investor base while also fulfilling the country’s credit demand. We are reimagining India’s financial future and want to soon become the de-facto investment product for all Indians. Our most immediate milestone is to get to Rs 2000 crore AUM.”

Others in the same sector include Faircent, finzy, and Lendbox.