Education may be priceless, but it does come at a cost. Especially in a developing country like India, where millions of students are unable to afford higher education.

Sample this: India’s gross enrollment ratio (GER) in colleges is only 25-27 percent, as per industry estimates. This means only one-fourth of those who finish school go on to get a college degree.

It gets worse at the post-grad level. On the contrary, GERs of developed countries like the US, the UK, and China are at 50-70 percent. The biggest reason for this is the lack of finance at the students’ end and/or limited access to external credit.

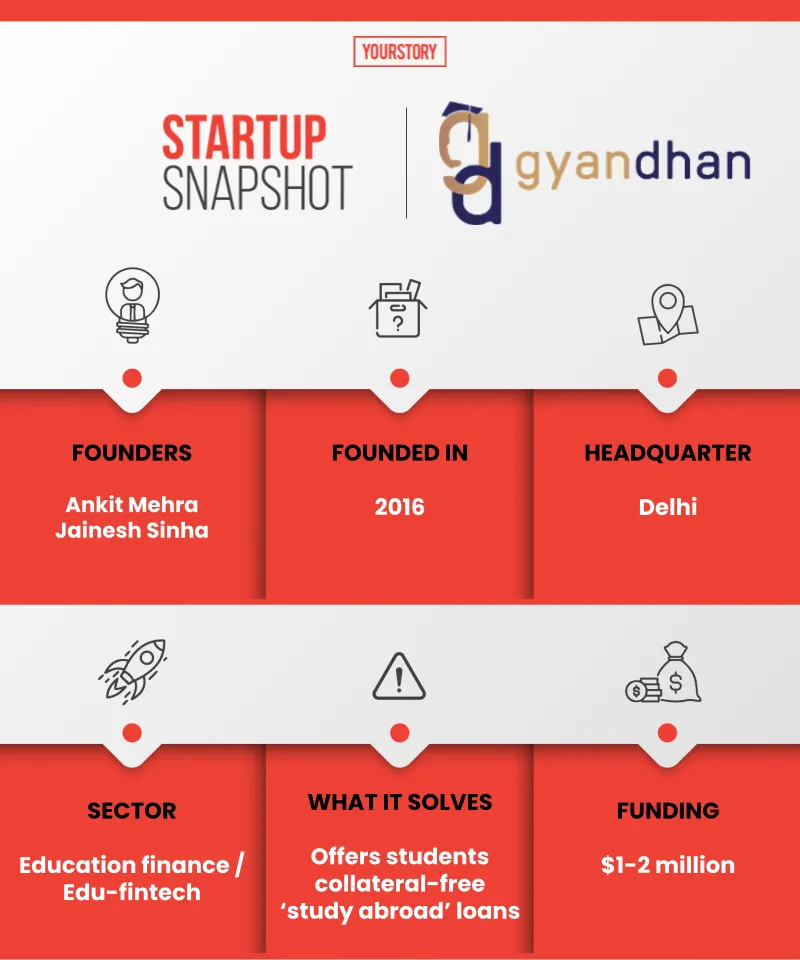

GyanDhan works towards solving this very pain point.

GyanDhan Founders Ankit Mehra (left) and Jainesh Sinha

The Delhi-based startup, which launched operations in 2016, was born after its founder Ankit Mehra witnessed the education financing problem from close quarters during his MBA degree at Spain’s IESE Business School.

“I was lucky enough to get a loan myself, but the bank IESE had tied up with was going back on its commitments to fund non-Europeans. And I saw a lot of students from India struggling to get a loan,” he tells YS.

Not just that, even those who managed to get the loan could cover only about one-fifth of the entire cost of the course.

“Public and private banks lend just Rs 20 lakh when you need about a crore to cover the entire course. Some NBFCs give bigger loans with collaterals, but even that isn’t enough,” Ankit reveals.

In 2015, Ankit returned to India, and along with fellow IIT alumnus, Jainesh Sinha, founded GyanDhan. The latter is now the Co-founder and COO of the company.

What GyanDhan solves and how

GyanDhan is essentially an education financing marketplace that curates a variety of lenders — from banks and NBFCs to even individuals — to fund the students of their choice, either through loans or scholarships.

To assess students’ loan eligibility, the startup has built a proprietary risk scoring model known as the GyanDhan Score. It analyses the financial and academic data of students and predicts their future employability to assign them a credit score.

Infographic: YS Design

Co-founder and CEO Ankit explains, “Educational loans should look at the future employability of a candidate, and see whether graduating salaries are commensurate with the cost of education. Loan eligibility cannot be based only on how much property their family owns. It must be on par with their own ability, the course they’re pursuing, the average salaries and job opportunities in that sector, and so on. We spent our first year building tech just to solve this.”

Once the GyanDhan Score model was in place, the startup went about fixing the supply side, which is the loan providers. GyanDhan partnered with Axis Bank to activate its ‘study abroad loans’ category, and disbursed the first loan in May 2016.

Since then, it has roped in a mix of PSUs (SBI and Bank of Baroda), private banks (ICICI Bank), education-focused NBFCs (Auxilio, InCred, Avanse Financial, Credila), and international lenders (MPower Finance, Prodigy) on its loan marketplace.

“We keep the number of loan partners low so we can focus on the depth of offering,” says the founder.

GyanDhan has disbursed education loans worth Rs 800 crore to 2,500 students

Growth and business model

GyanDhan has disbursed Rs 800 crore in study abroad loans to over 2,500 students in India. This is a small percentage of the six lakh-odd applicants on its platform.

The average ticket size is Rs 30 lakh, with loan repayment cycles ranging from three to 15 years after the student graduates. The US, Canada, and Australia have emerged as the top three ‘study abroad’ markets on GyanDhan in the last four years.

Interestingly, the UK is seeing strong demand since September 2020, following revisions in its work-visa structure.

Overall, GyanDhan has witnessed strong recovery in volumes in the last five to six months, with international borders opening and a “huge pent-up demand” playing out on the education finance landscape right now.

GyanDhan has partnered with banks, NBFCs, and international lenders to service students

Ankit shares, “From a business generation standpoint, we’d come to a complete standstill after the lockdown. So, we had to realign ourselves with universities that were opting for the hybrid model of learning. We also had to work a few things around with lenders who were willing to give loans for online ‘study abroad’’.”

But September onward, there’s been a 2.5X surge in demand year on year. “We expect a huge rebound in ‘study abroad’ this fall season as we come out of COVID-19 and the Trump Presidency [in the US]. We’re looking to disburse Rs 650 crore in loans this year,” Ankit states.

Without disclosing specifics, GyanDhan is projecting a 3X jump in ARR in FY22. The platform takes a cut of the loan amount that banks lend to students on top of the referral fees lenders pay GyanDhan.

The startup has also received RBI’s nod to start its own NBFC and lend directly to candidates, which will be a new revenue stream.

Funding and future roadmap

Following a $125,000 funding round led by US-based impact investor Gray Matters Capital in 2019, GyanDhan expanded its portfolio to include skill-building loans too.

It plans to disburse 45,000 skill-building loans by the end of 2021, using its proprietary student employability assessment framework.

Prior to this, the startup had raised funds from Sundaram Finance (in 2017), and angel investors, including Satyen Kothari (Founder of Cube Wealth), Pravin Gandhi (General Partner of Seedfund), and the Indian chapters of Stanford Angels and Harvard Angels (in 2016). GyanDhan is now in talks to raise a $5 million round.

Ankit says, “We’re actively hiring for our technology and data science teams and are hoping to close the funding round in the August-September period.”

India sees 2.5 lakh ‘study abroad’ students annually, with 40-50% looking for loans

The 41-member startup operates in an edu-fintech market valued at $10 billion, along with a bunch of other players like Leap Finance, Eduvanz, Credenc, Finwego, GrayQuest, and Propelld among others. How does it differentiate in this busy space?

“GyanDhan differentiates on the risk factor and is willing to extend the loan cap for both secured and unsecured loans,” Ankit says.

“We also offer a differentiated customer experience with a mobile-responsive website. We’ll launch our app as we get into lending in the domestic market,” he adds.

Opportunities abound, with 2.5 lakh Indian students looking to study abroad every year. Almost 40-50 percent of them look for “some kind of financing product”.

Add to that, the ecosystem surge in edtech and edu-fintech — Indian Private Equity & Venture Capital Association (IVCA) has identified ‘fintech in education’ as one of the top value-creating segments to watch out for — and GyanDhan is poised well.

Ankit sums up GyanDhan’s mission by saying, “We want to break the myth that education loan is a toxic asset class by bringing down the high NPA ratios.”