The Indian startup ecosystem has been awash with billions of dollars in funding this year, but many young companies are still struggling to raise capital on favourable terms despite a business model that has steady revenue streams.

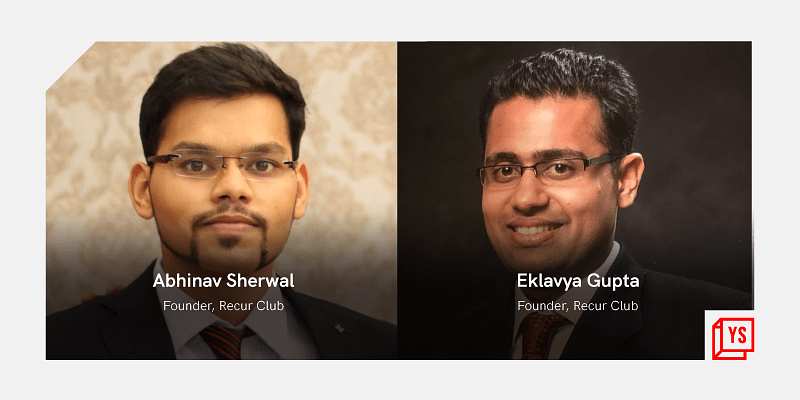

Given this environment, entrepreneurial duo Abhinav Sherwal and Eklavya Gupta, through their fintech startup Recur Club, want to rewrite the rules of how founders can raise capital to run their businesses.

Founded in June this year, Delhi-based is a subscription-based financing platform that enables companies with recurring revenues to raise cash in a much faster manner without diluting their equity.

The journey

Abhinav and Eklavya, who have been friends since their IIM Calcutta days, were intrigued by the challenges startup founders faced when they wanted to raise capital.

An IIT Delhi graduate and technologist, Abhinav, during his career as a product developer, saw many startups giving discounts on their products to retain customers, which affected their cash flow and hampered their growth plans. This was more pronounced for startups in the SaaS and B2B space.

“We wanted to solve the cash flow problems of startups despite them having a steady form of revenue in terms of subscription,” says Abhinav.

Challenges of fundraising

Typically, startup founders have about three options of fundraising and each comes with a challenge.

In equity category of funding, the founders normally would have to shed much of their ownership stake to raise the money, while other two routes like venture debt and revenue-based financing come with not so favourable terms.

Also, these can be very time consuming, which can distract startups from their core focus on the business.

“We wanted to create a platform where it can provide capital to startups without diluting equity or having those restrictive conditions of debt,” says Eklavya, who is a finance professional.

How it works?

Recur Club gets access to the revenue streams data and other such relevant information of a company to create a financial product where the underwriting is done through its AI and ML models. Following this, a tradeable product is given to financial institutions that provide the capital by purchasing this asset.

“Our AI, ML engine underwrites the profile of customers to give them rankings and pricing,” says Abhinav.

For example, if a particular startup gets Rs 100 as subscription revenue per month, which amounts to Rs 1,200 per year, it can raise almost 90 percent of this amount in one shot from a financial institution with the repayment done on a monthly basis or as and when they get the payment from the customer.

In such a transaction, the founder does not shed any equity to raise the required capital and the financial institution also gets the chance to participate in the growth story of such new companies, which is not the case normally.

“Our platform enables access to capital in a non-dilutive model, which is founder friendly and helps these startup grow in a sustainable way,” says Eklavya.

The founders believe they have created a new asset class and are providing financial investors access to fixed income. The startup also becomes an exchange for recurring revenue contracts where investors can see the rating and bid for it.

The tech platform of Recur Club facilitates the sourcing of such startups, enable financing and also acts as a collection agent. This entire exercise is done digitally.

Focus areas

Recur Club mostly focuses on startups in the SaaS and D2C space, which have a steady stream of revenue. The platform has already enabled over $40 million of tradeable product with close to 30 startups raising capital through them.

According to Abhinav, Recur Club claims to have enabled startups with a revenue of $100,00 going all the way up to $40 million to raise capital.

Around 70 percent of its customers are from the SaaS segment and the rest fall into the categories of D2C and managed workplaces. The investors who bid for these contracts are banks, NBFCs, and credit funds.

On the competition front, especially with the presence of other forms of raising capital like venture funding, venture debt or revenue-based financing, Abhinav says, “The main focus for us is speed and founders who raise money through us can get their cash within two days.”

The founders believe the startups that are active on their platform for a longer duration period have the chance of raising capital in much more favourable terms especially on the interest rates. This is because investors are more confident about the longevity and stability of these startups which is results in them offering a larger quantum of money at lower interest rates.

The market

The addressable market for Recur Club runs into billions of dollars given the need for capital from startups. It faces competition from all those who are funding these startups be it venture capital firms, venture debt companies, revenue-based financing entities though the founders believe they do not have any direct competition.

Recur Club has a team strength of around 20 people and has already raised $2 million in the pre-seed round of funding. It earns revenue through the commission charged for its services.

The fintech startup has also created a network community platform for startup founders by bringing in other players in the ecosystem, which will provide services like partnerships, sales, advisory, and even raise capital from VCs.

“Recur is on a mission to democratise fundraising,” says Abhinav.

![Read more about the article [Funding alert] Invoice factoring startup Reevoy raises seed round led by Stellaris Venture Partners](https://blog.digitalsevaa.com/wp-content/uploads/2021/06/Untitled-12-1623214756373-300x150.png)