Small and medium businesses comprise a significant part of the Indian economy, contributing 31 percent to the nation’s GDP, and employing over 124 million people.

Despite the numbers, there are several invisible barriers that are keeping small businesses from scaling quicker. One of the largest factors contributing to this inability to scale is the dearth of growth capital, and also access to their own financial data, which can help them take informed decisions.

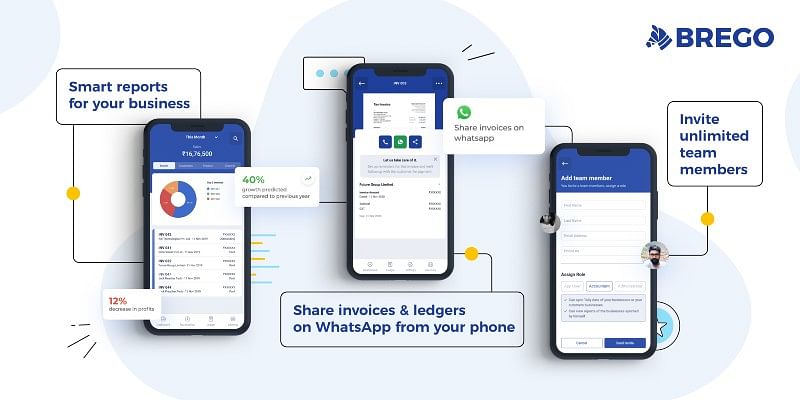

Enter Brego – a SaaS solution founded by Mihir Lunia and Rehan Netarwala, childhood friends turned business partners. Brego was built with an aim to help small and mid-sized businesses scale up by giving them easy access to their numbers – sales, receivables, profit & loss, cash-flow and more. It enables small business owners keep a keen eye on their numbers without having to rely on their accountants for financial data.

In a telephonic interaction with YS, Rehan, Co-founder at Brego says,

“The biggest problem for small and medium business owners is, they don’t have access and information on all their financial data. With Brego, the idea is to give them full visibility over all their data on their smartphone, so they can see their sales, expenses, receivables, their bank balance, and they can make decisions instantly based on the financial data.”

Second time entrepreneurs

Before starting Brego in 2019, both Mihir and Rehan were also founders of Savage & Palmer, an outsourced accounting services company that helped MSMEs and startups manage their bookkeeping and tax filing.

Founded in 2017 and bootstrapped to over $1 million in ARR, this venture gave them a deep understanding of the pain points faced by the Indian MSME when it came to finance and banking. While Savage & Palmer solved some of the MSME’s pain points through its professional services, the founders also identified pain points that could be solved via technology solutions and thus started Brego.

“Savage & Palmer was a professional services company which required a lot of manpower. We wanted to automate a lot of the work that we were doing, therefore we thought of Brego,” says Rehan. The first company is still operational, albeit with an independent CEO.

How Brego works

Brego integrates with a business owner’s Tally accounting software, and gives him/her all the necessary key reports and metrics that can be reviewed both on mobile app and web browser.

Explaining how the app functions, Rehan says that an accountant or CA must install a small setup file in his/her computer where the Tally is set up. Post this, the business owner or company founder can sign into his account and view all the key metrics from Brego’s mobile app or web browser.

“All the data comes from Tally, but since it’s a complicated accounting software, Brego helps business owners access all the reports in real time,” he adds. In terms of privacy, Rehan says all data is secured by the best end-to-end encryption practices, undergoes regular penetration testing, and is hosted on AWS.

With real time reports in easy access, business owners can share these reports with their team members, customers and vendors directly through WhatsApp or through email and facilitate faster business transactions.

They can also share ledgers (transaction history) instantly with any stakeholders, thus avoiding confusion between parties.

The team

An alumnus of the Indian School of Business, Mihir Lunia has over nine years of experience working in the financial services sector. At Brego, Mihir heads Business Development.

Rehan has over eight years of experience as a management consultant in the ecommerce sector, and he leads Product Development at Brego.

Juned Sayyed is the Engineering Head at Brego and has over 12 years of experience building mobile and web solutions. The company currently has a team size of seven across tech, marketing, sales and product.

Business model and traction

Brego’s android app was launched in June 2021, and it currently has a few hundred downloads. The app provides a 7-day free trial, with an annual subscription of Rs. 2,999, per company for unlimited users per plan.

As the fintech space is heating up, the startup has been approached by several early-stage investors and it plans to close its seed round very soon, says Rehan.

The way forward

Having understood the MSME sector’s unmet needs, Brego is looking to add a flurry of new features in the months ahead, as it envisions itself to be a network of creditworthy businesses where MSMEs can –

● Raise an invoice today and get paid tomorrow without waiting 30 / 60 / 90 days.

● Buy now and pay later – it plans to introduce Brego credit through which businesses can get an extended credit period on all their expenses and free up cash flow.

● Get access to high quality professional services to help the MSMEs with the heavy lifting of day-to-day operations

Other startups in the MSME fintech space include BizAnalyst, CredFlow and Hylobiz. While the overall MSME market comprises over 60 million businesses, Brego is targeting its product only towards the top 10-15 percent of the market that make up the organised sector.