India’s education sector, despite ranking amongst the largest in the world with 250 million school-going students, is one of the most severely underfunded. Even though public schools can access government funding, money barely trickles down to the grassroots level. Private educational institutes, meanwhile, have very limited access to funds in the form of debt from banks and other financial structures.

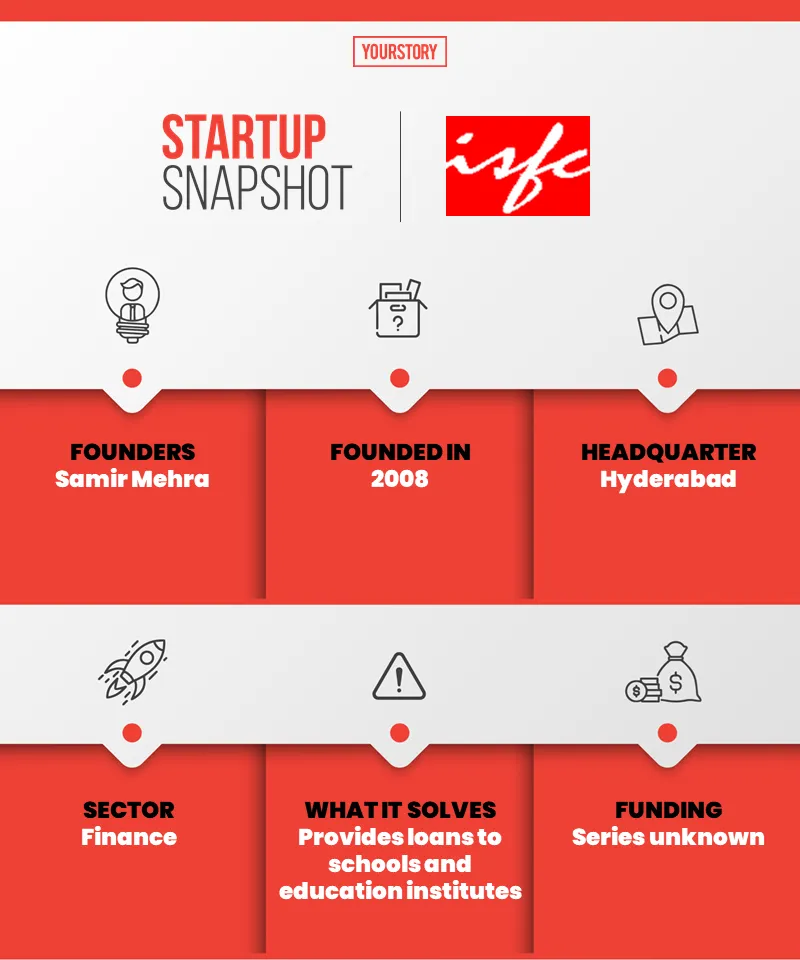

Fintech startups are solving this problem easily by developing systems that can help bridge this gap between banks, financial institutes, and the educational infrastructure system easily. Among them is the Indian School Finance Company (ISFC), founded in 2008 by Samir Mehra, which caters specifically to the Indian education system, including schools, teachers, and parents.

The Hyderabad-based startup helps schools and educational institutions access funds in the form of loans from the organised loan sector, via banks and RBI-registered NBFCs, at reasonable interest rates. They can use these to undertake various infrastructure-related activities such as repairing and renovating classrooms, building labs, buying equipment, and expanding the building, among others.

“ISFC addresses shortcomings in the educational funding landscape by providing customised loans to entities in geographies that were least focused on by formal and large financial institutions,” Sandeep Wirkhare, Managing Director and CEO, tells YourStory.

Sandeep Wirkhare, MD and CEO of ISFC

Earlier, educational institutes, especially affordable private schools, faced challenges to get funding from the formal financial sector. As a result, they either borrowed from the unorganised market at higher costs or shelved/delayed projects they needed to undertake. ISFC helps educational institutions undertake projects as planned without delays, the company adds.

To date, IFSC has helped fund more than 5,500 schools across the country already, impacting nearly 38 lakh students. The startup expects to double these numbers in the next three years, Sandeep says.

Catering to all parts of the education system

While educational infrastructure loans to schools form a large part of the startup’s portfolio, ISFC also helps school teachers and government employees who need funds for their personal requirement and parents looking to borrow money to pay school fees or access formal loans from financial institutions.

Educational infrastructure loans range between Rs 5 lakh to Rs 1.5 crore at an interest rate of up to 20 percent, while ticket sizes for personal loans start at Rs 50,000, up to Rs 5 lakh, at an interest rate of up to 22 percent.

Catering to various parts of the education system helps ISFC cement its relationship with the institute as well as create goodwill in the school community.

“Apart from institutional finance, ISFC provides loans to teachers and parents at 0 percent interest, and on EMI basis, for activities such as skill development, undertaking online professional courses, etc, thereby catering to the complete ecosystem around education,” Sandeep says.

The startup is present in more than 150 locations through its 22 branches across the country, with more expansion under way.

ISFC has raised a total of $36 million from various investors, as per Crunchbase. In August, last year, the startup raised $30 million in debt and equity from existing investors Gray Matter Capital Inc, an Atlanta, US-based impact fund, and other partner NBFCs, including InCred, U GRO Capital, and Profectus Capital.

It has been profitable for the last nine years of its operations, Sandeep says.

In the current year, ISFC expects to raise two rounds of equity capital “to cater to accelerated demand from last year’s gap”. The first round would be around $5 million to $7 million from family offices and high net worth individuals (HNIs). The next would be from institutional private equity and international impact funds.

During the pandemic-induced lockdown, the company focused on extending interest-free fixed instalment loans to educational institutes, and helped schools digitise. It hopes to disburse Rs 300 crore in loans in the current academic year, as schools reopen in a staggered manner.

Its competitors include companies such as Intec Capital, Shiksha Finance, Credelia, Avanse, Eduvanz, among others, as well as NBFCs and banks, which the company prefers to think of as partners.

In the past four years, education loans in India shrank by 25 percent, with only 2.5 lakh students able to secure loans in 2019, versus 3.34 lakh students in 2015, according to a CRIF Insights report. As per estimates by Unitus Ventures, the Indian education loan market is worth about $10 billion. Loans worth over $3 million were disbursed in 2019.