“We strongly believe that every person, irrespective of their financial status and understanding, has the right to improve their lifestyles by investing and achieving their goals,” says Anshul Sharan, Co-founder, and CEO, Elever, a personalised investing app committed to helping the masses invest like professionals, banking on their deep personalisation and rule-based algorithms.

Founded by Anshul Sharan, Ram Subramaniam, and Santosh R, Elever was born out of personal experiences when the founders felt a dire need of finding an investment advisory that was affordable and unbiased. Their combined individual expertise in financial products, with technology and marketing, led them to launch Elever in 2020.

What Elever offers

The Bengaluru-based wealth tech startup envisioned creating an investment platform without advising investments through mutual funds. Instead, the idea was to create a fully personalised and customised investment platform, based on the customer’s risk profile, financial ability, future goals, and requirements.

“We hit the trifecta with Elever. We were our venture’s first customers. Combine this with the rise of millennials, traditional investments losing sheen, and a mindset focusing on market investments; we knew the idea would resonate with a large audience. Besides, with less than 7 percent of India participating in the financial markets, there was a demand in the investment advisory space,” adds Anshul.

Aiming to elevate people’s wealth and lifestyles, Elever slowly forayed into the voyage of emerging as India’s one-of-a-kind, fully personalised, goal-based investing app. Expanding on this, Ram Subramaniam, Co-founder, and CTO add that Elever’s advisory is not blindly return-centric, instead, the focus is to use the returns to help people achieve their lifestyle goals.

“We first comprehend your risk appetite and financial reality, then help you identify, and prioritise your goals and required investments. Then we design a zero human bias, rule-based portfolio with a mix of asset classes, and finally, track and manage them until the goal is achieved,” he explains.

Without depending on mutual funds or human-driven stock picking, Elever as an app can understand a person’s current financial reality, map it to their future dreams, and turn them into an actionable target to be finally achieved by a customised portfolio.

However, it was a bumpy ride for Elever in the beginning, especially with the low levels of financial literacy, even among highly educated professionals. “ After all, how do you make a case of a product being better than others if people lack the basic understanding of what constitutes a good product in the first place?” asks Anshul.

“Once we made people understand the product’s real value, none of our customers have left, to date. This is also why along with our business bottom lines, a key focus for us is also in raising the bar in financial literacy of the masses in the long run,” he adds.

Elevating newer goals

Elever’s 100 percent retention rate of paying customers speaks volumes regarding the product experience by its users. To this, Anshul feels that this is a great validation of the product, and can be better thought of as a reward for the complete transparency and incredible affordability of the offering.

“The need gap that we experienced first-hand is indeed one that is shared by many. Moreover, this vindicates our decision to build the product the hard way, i.e. against some entrenched user behaviour and educate people in investing habits that are genuinely better for them,” he adds.

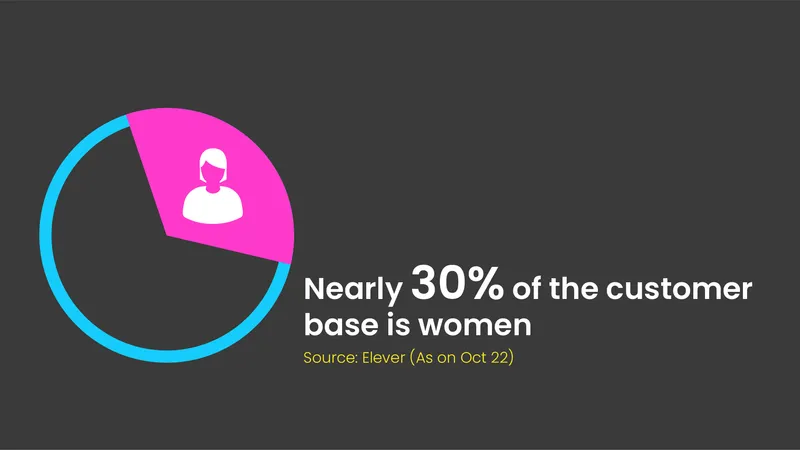

Besides, Elever’s 30 percent customer base includes women investors when compared to the norm of over 90 percent being male. Anshul anticipates a rapidly expanding segment, as more women enter the workforce and start becoming financially independent, and the need to manage and grow their money in the right way becomes inevitable.

The most important factor that needs to be highlighted is that men and women genuinely lead different lives. From adolescence to marriage, and childbirth, the requirements of women differ from men in some critical ways. “As Elever’s core benefit to customers lies in its personalisation, it becomes a great product to design investments precisely for these needs,” says Anshul.

Revenue structure

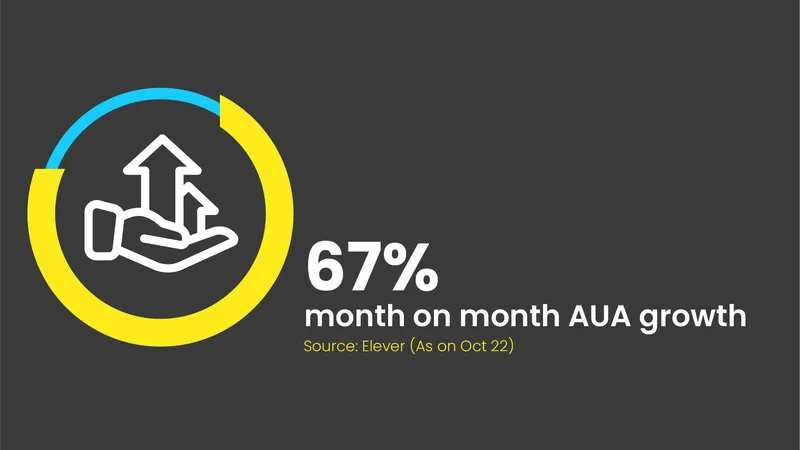

In the current revenue structure, Elever is growing its AUA (Assets Under Advisory) between 65-70 percent m-o-m, indicating the growing acceptance of the product in the market.

Looking back, since the launch of the Elever App six months back, it had witnessed excellent growth in downloads, customers, and AUA. The first month of operations in May 2022 only had 400 downloads, 275 signed-up customers, and an AUA of Rs 20 lakh). The current report speaks of 5,000+ downloads, 2,500+ sign-ups, and an AUA of Rs 3 crore.

“We have not seen a single drop-out, thereby maintaining 100 percent retention. We have achieved this without investing much in marketing, it has largely been driven via referral, word-of-mouth, and direct reach-outs. More so, we have almost 22 percent of customers who have started more than one goal, showing trust in our advisory. For us, this means that once people understand how we are delivering value and the cost of such end-to-end advisory, we have converts for good,” says Santosh R, Co-founder, and CMO, Elever.

Elever has already raised pre-seed money of $750,000 last year through a group of angel investors that have helped in product development and launch. Now, the next goal is to scale up the growth by raising $2 million.

The future ahead

Five years down the line, Elever aims to become a trusted household name for building and managing wealth, and serve at least more than a million customers with AUA of $5 billion in India and globally. From a product perspective, Elever will be known for its plethora of investment advisory services, including goal-based investing, factor investing, comprehensive portfolio management, taxation advisory, etc.

“Technology will be at the core of our offerings to ensure personalisation, zero human bias, and higher reliability. The services will cover domestic and international assets, including stocks, bonds, ETFs, real estate, etc. Our vision is to help people invest like professionals to build wealth and ultimately achieve their overall financial objectives,” concludes Anshul.