The pandemic has changed a lot of things around us, including the way businesses function. For Delhi-based The New Shop, a convenience store brand, the changing consumer needs helped the startup ride the tide and get surplus funding from investors.

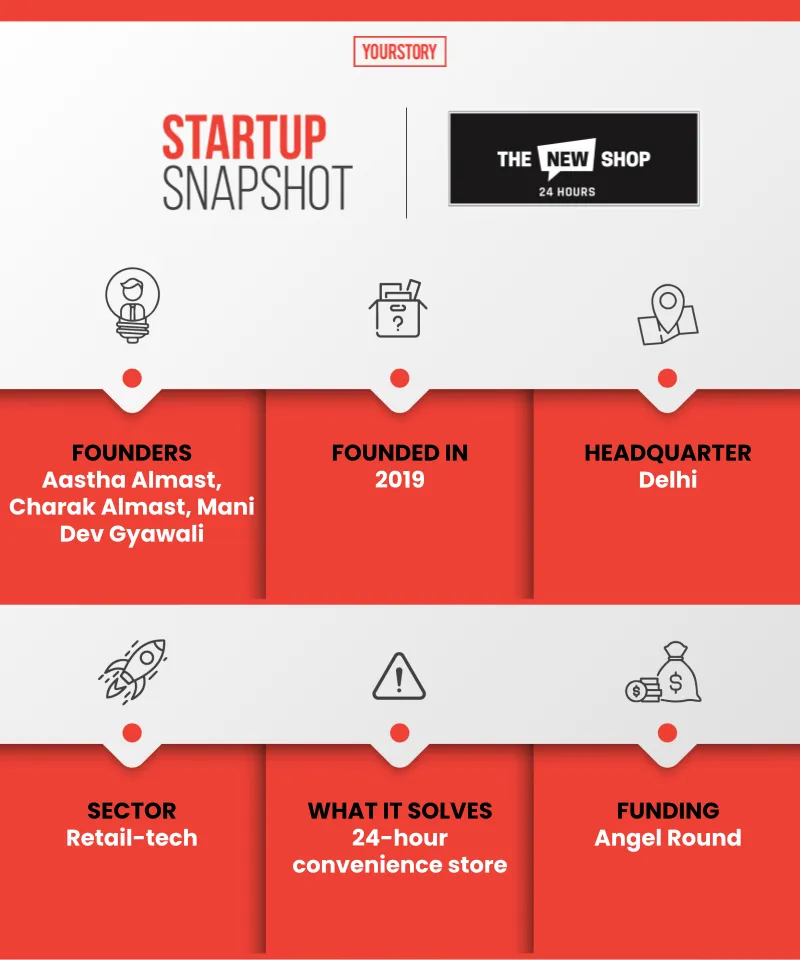

Started in March 2019 by brother and sister Aastha Almast and Charak Almast, and their mutual friend Mani Dev Gyawali, The New Shop is a chain of 24-hour open convenience retail stores.

Found at neighbourhoods, railway stations, bus stations, metros, petrol pumps, and tourist spots across the country, the New Shop sells everyday essential items such as grocery, snacks, ready-to-eat food, beverages, dairy, confectionery items, personal care & hygiene products, etc. It essentially is a retail technology company, building an asset light on the lines of global chain 7-Eleven like convenience stores for India.

Run and owned by Accelerate Productx Ventures Pvt ltd, The New Shop aims to become a convenience store brand that is within everyone’s walking distance.

“India is the youngest country and the third-largest consumer market in the world. The new on-the-go and modern India needs standardised and hygienic retail services across the country at affordable prices at transit points and round the clock,” says 35-year-old co-founder Aastha Almast.

The story

After a brief success, the New Shop’s operations were halted for some time, and now it is riding on the growth curve again. All the co-founders are serial entrepreneurs, and The New Shop is their third venture together. Their last startup was an online reputation management platform focused on retailers, which was bought by one of its clients in 2017.

Post that, the trio worked together on product sourcing for its previous retail and direct selling clients. “We sourced ‘Made in India’ products for top FMCG retailers and direct selling companies such as Patel Brothers, Walmart, Costco, Sam’s Club, Qnet, Vestige, Amway, Haldiram, Bikanerwala, etc. We clocked a GMV of $50 million in 2.5 years,” says 28-year-old Charak.

This experience taught them about how supply chain, operations, product pricing, and packaging work at some of the biggest retailers in the world, and that the retail sector needs technology and business model innovation. This is when the idea for The New Shop was conceived.

The trio decided to get started with the idea of convenience retail stores, and raised angel funding of $220,000 in March 2019 at idea stage to test the concept.

“We wanted to test for the ideal size of the store and ideal locations for expansion. We identified three store sizes – small (10 sq. ft), medium (50 sq. ft), and large (100-150 sq. ft),” says 29-year-old Mani Dev Gyawali.

The company tested each of these store sizes at seven location categories such as educational institutions, offices and co-working spaces, hotels, gyms, residential complexes, hostels, and railway stations. They also experimented with the product mix to promote more Indian alternatives to gauge their acceptance in an environment where people need those products. And it worked well for them.

“By January 2020, we grew to more than 100 stores of all sizes and even bagged a partnership with Indian Railways for expansion,” says Aastha. This led them to expand to other transit points such as highways, petrol pumps, and bus stations as well.

The Covid curve

Aastha says that by March 2020, the company had enough data on the working model and unit economics on each location category and the potential for scalability, and the startup was clocking net gross margins of 18-20 percent.

But when the company was on the cusp of growth, the pandemic hit it hard, and all of its brick and mortar stores had to close doors to walk-in customers. “But what came as a saving grace was the fact that we were already building a technology for omni-channel retail, which was to be executed once we had a massive scale,” says Aastha.

The team accelerated its tech solution that is built on a centralised blockchain and enables end-to-end inventory management portal, which helped the team to operate in an omni-channel manner.

Amidst the COVID-19 pandemic, the company turned all its stores as dark stores for ecommerce fulfilment and survived as well as thrived.

“Taking our stores online with the help of in-built technology helped us multiply our store revenues by 10 times per store,” says Charak. At the same time, the company started operating for 24 hours to meet the needs and to deliver essentials during the lockdown period.

The New Shop at Delhi’s Anand Vihar Railway Station

“We expanded our store size to an average 800 sq. ft in residential areas and 400 sq. ft in transit points,” says Aastha. She adds that The New Shop has an omni-channel presence through Dunzo, Swiggy, Zomato, Paytm and its own online delivery platform. At present, The New Shop is running 10 stores with a team of 15 people.

“We are on our way to open seven-10 new stores each month by partnering with real estate companies, Indian Railways, petrol pump association, and many more,” says Aastha.

Growth, Make in India, and revenue

Aastha says that The New Shop stands for Indian brands and is supporting PM Narendra Modi’s clarion for Atmanirbhar Bharat and Vocal for Local.

“We are currently retailing over 2,000 SKUs across 75-80 brands, and 80 percent of its product mix is Made in India, and has only 20 percent MNC/foreign brands,” claims Aastha. She adds that the company is working closely with the Government of India to promote Indian brands.

The New Shop earns money from the sale of goods at its stores and works on a variable cost model where it works on higher margins with brands and all its operating costs come out of a percentage of that margin.

At present, all its 10 stores earn an average revenue between Rs 15 lakh per month to Rs 30 lakh per month and are profitable on unit economics level.

Funding and plans

The New Shop has raised funding to the tune of $920,000 in two rounds that include investors like Abhijeet Pai, Partner at 9unicorns Fund; Sreeram Reddy Vang, General Partner at Hustle; American Shark Kevin Harrington; Huddle Accelerator; Anthill ventures; AngelList India; Let’s Venture; and various HNIs.

Aastha says that during the last round of funding, which was closed in November 2020, the company was about to raise $500,000, but the round was oversubscribed and it went up to $700,000.

Now, The New Shop is seeking to raise another round of funding in the next six months to support its expansion plans. It is also looking to open 100 stores across five cities in the next 12 months, expand its team, and build technology.

Aastha says that the Coronavirus has negatively impacted the real estate market, which is a boon for a fast-growing retail company like The New Shop. “We want to grab as much real estate as we can while the tide is in our favour. Our scalability comes from very low capex and disruptive tech. With the next round of funding, we will develop our tech further to solve for all complexities in retail and build a land bank. We will build our team and will be extending our brand portfolio, with more curated and relevant products for our consumers,” she says.

Market and competition

According to a report by the World Economic Forum, retail is a $1.3 trillion market in India, with India being the third largest consumer market with an estimated size of consumer demand to reach $6 trillion by 2030. The New Shop’s focus segment is transit retail, which is estimated to be $22 billion by 2030, according to consultancy firm Knight Frank.

The company competes with the likes of 24Seven and 7-Eleven, but Aastha says that there are no chains that have a presence across India.

“The New Shop’s core focus is to take organised convenience retail offering to the masses and hence our location segments are transit points and residential colonies.”

Aastha adds that the retail sector is unorganised, and the company wants to bring consolidation and standardisation in convenience retail.