From bookkeeping to compliance regulations to payment reconciliation, small businesses often struggle to keep up with the complexities of running a successful enterprise.

“The pain point was to help businesses in India grow, digitalise, and modernize. Treflo’s genesis was to be the default platform for all their digital needs when it came to SMBs in India,” says Rahul Meena, Founder and CEO, Treflo.

Founded in 2020 in Bengaluru, Treflo started as a B2B (business-to-business) marketplace startup for the trade of electronics and FMCG categories. Here, it saw immediate success, with an annual revenue generation of $2 million.

In January 2021, Treflo set forth in a new direction by focussing on ways to help small and midsize businesses (SMBs) grow and digitise their businesses.

Treflo is a freemium app, with the majority of its expansive service suite and core functionalities being free to use.

The platform offers a cloud-based mobile business management platform for SMBs, providing easy workflows to automate and simplify tedious business tasks.

Treflo’s product suite includes a free GST billing app, an e-way bill generator, and B2B commerce solutions.

“The resourceful platform can potentially help save uncountable hours by automating tedious compliance tasks like the generation of e-way bills and GST filing processes for the 80 percent of sole proprietors among the 64 million MSMEs (micro, small and medium enterprises). The platform’s tech prowess serves family-run enterprises or small business teams in effectively growing their business and automating all trivial tasks,” Rahul says.

The USP

According to Rahul, Treflo’s USP is stimulated by its main goal of enabling the power of financial analysis and business management to MSMEs in a format and language that they can understand.

The artificial intelligence and machine learning (AI/ML) based solution can provide growth insights to SMEs and warn them of possible dangers, allowing them to plan for the future and expand quickly.

The 10,000-strong Treflo community partners have been instrumental in keeping the startup focused on the most important problems faced by small businesses, the founders say.

“We are passionate about democratising SMB tech space, creating interactive technology platforms rather than passive tools as seen in our other competitors,” Rahul tells YourStory.

Treflo competes with the likes of MyBillbook, Vyapaar and ClearOne by ClearTax.

“Despite having considerably greater marketing budgets and technical teams, they have been unable to persuade value-conscious SMBs searching for simpler, quicker, and less expensive options,” says Rahul.

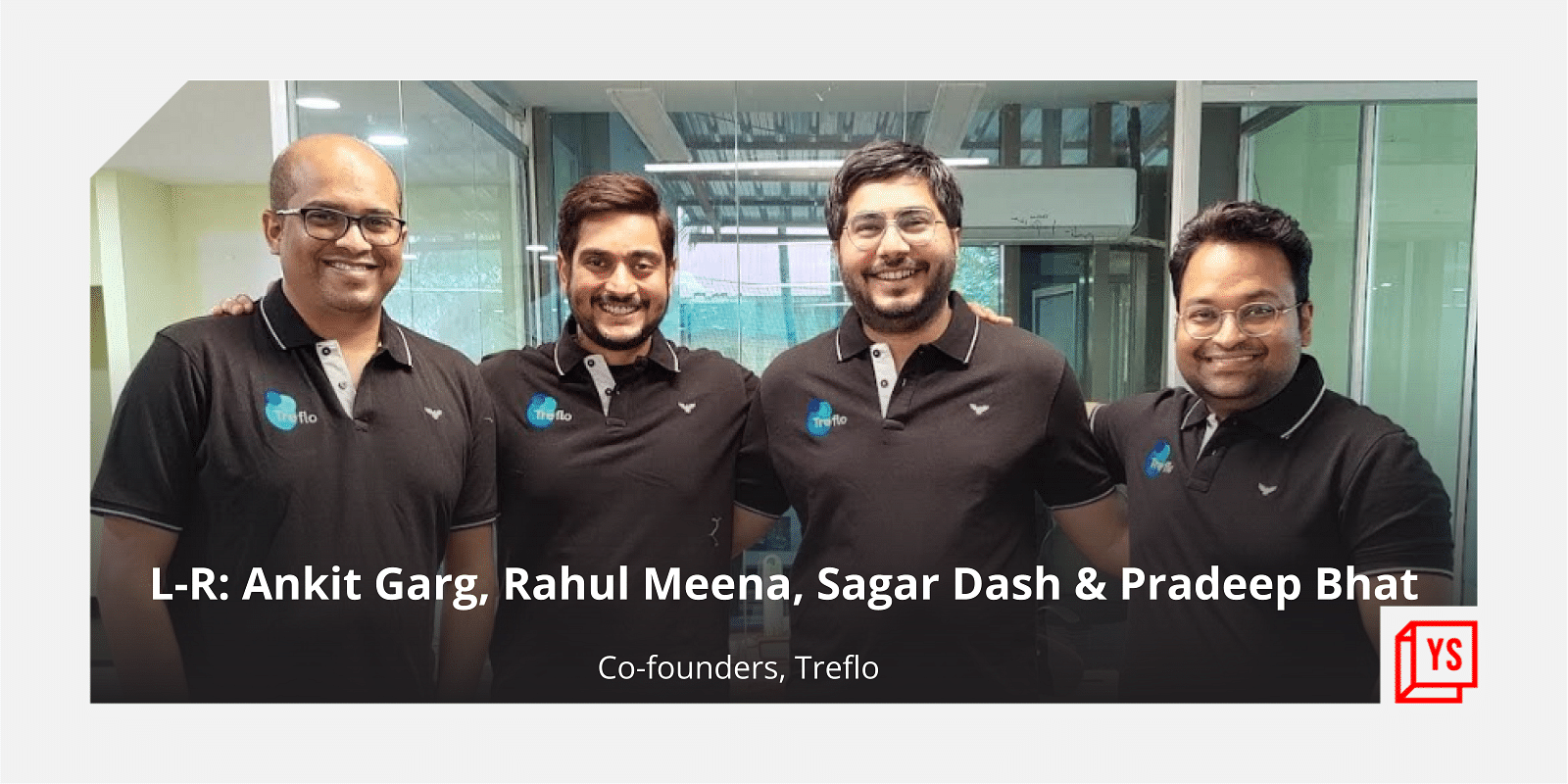

The team

Treflo is led by Rahul, the CEO and Founder, along with Pradeep Bhat, Sagar Dash and Ankit Garg as the Co-founders. They form the core team of Treflo who look over the day-to-day operations of the company.

With the accrued experience of 10-15 years in the building and scaling of tech products, the anchor team of Treflo says it has worked with some of the biggest players in the market, like Amazon, Gozefo, Samsung, and Udaan, among others.

Sagar and Rahul worked for Niffler Labs, which was acquired by Tapzo (a Sequoia-backed company). Ankit and Rahul are batchmates from IIIT Gwalior and have collaborated on many projects since their college days.

Ankit left Amazon to join Treflo in December 2020. Rahul and Pradeep started Officepulse together back in 2017, an enterprise SaaS startup automating the tail spend purchase categories for Indian enterprises where they worked with names like WeWork, Tata Global Beverages, Swiggy, Ola, and many other companies.

Treflo currently has a team of 30 employees.

Funding and monetisation

Treflo is a bootstrapped startup that began its journey with approximately $150,000 investment as loans from friends and family.

“However, we are now in the middle of fundraising, with 60 percent of the money coming from angel investors. The firm derives money from B2B trade through our marketplace. Recently, we have stopped growing the marketplace and are focusing on the SaaS product, but we still make over $2 million in revenue from the FMCG and electronics trades,” Rahul says.

As with other businesses, Treflo has had to face challenges posed by the COVID-19 pandemic.

“It has been challenging keeping the teams together during the lockdowns and keeping them aligned to the goals of the company as their personal lives were affected tremendously. Over the past 2 years, we have had to rigorously adapt almost every quarter, they say that the startup journey is a bumpy roller-coaster ride. Add the effects of pandemic and its influence, the roller-coaster might as well be battered and rusted, it’s a surprise it’s even functioning,” adds Rahul.

The way ahead

India is home to 64 million MSMEs, with 13 million of them being registered under the GST abidance. According to a report by the Ministry of MSME, Indian MSMEs contribute approximately 31 percent to India’s GDP, which is expected to rise to 40 percent by 2025.

While the MSME software landscape is still evolving, a report by Grand View Research suggests that the global business software and services market size was valued at $429.59 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 11.7 percent from 2022 to 2030.

“Out of this global market, India’s contribution is 16 percent,” says Rahul.

“With such a massive market, there is a lot of rivalry. With our execution capabilities, we are optimistic that we will take a substantial portion of the market share. Our team has a vast amount of expertise in building and growing technology from the ground up,” Rahul adds.

Treflo has a pan-India presence with a majority of customers from Maharashtra, Karnataka, Gujarat, and Uttar Pradesh. It currently has a user base of over 10,000 businesses. Some of its clients include Greenwood Energy, Max Agency, Daya Charan and Company, Vardhaman Trading Company, Raindew Commerce, Orbit Sales, and Varni Raj Industries, amongst many others.

“Our financial manoeuvrability revolves around the SaaS-based subscription revenue model. We are currently expanding at a rate of 250 percent MoM and are working hard to keep the growth trajectory. Our goal is to capture a sizable market and gain one million clients by the end of 2022. We envision acquiring $10 million in payments through our digital payments solution for SMBs,” states Rahul.

![Read more about the article [Weekly funding roundup May 29-June 2] VC funding rises sharply](https://blog.digitalsevaa.com/wp-content/uploads/2022/11/funding-roundup-LEAD-1667575602969-300x150.png)