The pandemic gave a major boost to direct-to-consumer brands as well as online sellers as the lockdowns forced people to adopt online shopping. Small and medium enterprises, that had traditionally relied on offline retail, were forced to jump onto the digital bandwagon since physical stores remained shut.

While some of these mid-sized sellers sell profitably, the challenge lies in scaling the business. Many of these third-party sellers either end up getting acquired by a multinational, raise capital from financial institutions, or figure out an unconventional game plan to scale.

Now there is a fourth way, where a startup can acquire them, keep the team and the founders on board, give them the agreed-upon stakes, and help them scale the business. This is ’s proposition.

Understanding the need of sellers

For four months before launching in January 2021, the co-founders of the Bengaluru-based startup deep-dived into this space and talked to multiple sellers.

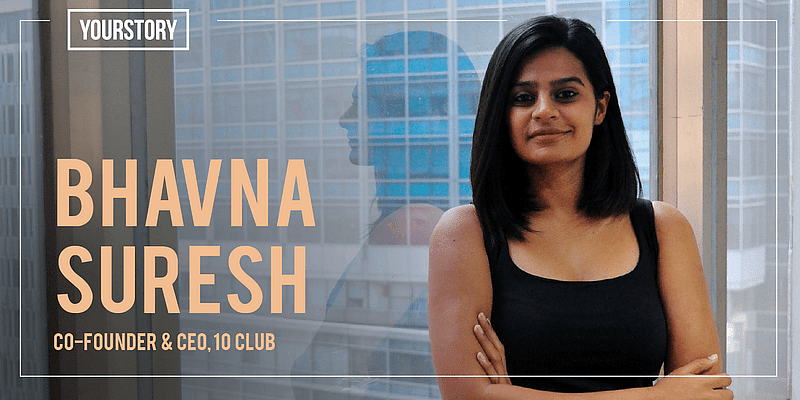

“We took until January 2021 to research and spoke with over 300 sellers, understanding the need of the market and the categories we could operate in,” Bhavna Suresh, Co-founder and CEO, 10Club told YS.

Bhavna is a serial entrepreneur who ran clothes rental firm Style Bank until 2016, and later, got an exit from Lamudi, a Philippines-based real estate platform. While speaking to sellers, she and her co-founders — Deepak Nair, a Bengaluru-based marketing professional, and Joel Ayala, a San Francisco-based investor — found that there was a variety among sellers.

10 Club’s founding team: Bhavna Suresh (left), Deepak Nair (centre), and Joel Ayala (right)

“There are many different kinds of sellers and they cannot be clubbed into a group. While some come from entrepreneur families, who have a traditional approach towards business, others are first-time tech-savvy sellers. You would also come across people who are very good at on-ground activities but not so much when it comes to being a CEO,” Bhavna explains.

To understand each company and their team better, 10Club spends four weeks doing the due diligence, followed by an integration process of six to eight.

“This is the most testing time for the founders as well as our team because we are asking the most difficult questions and poking holes in their business models. If something breaks here, then we might not take the deal forward as the future might not be good for us,” she adds.

The team deals with founders as well as the seller’s partners and vendors, and understanding whether people-led issues related to founders can snowball in the long run. 10Club also focuses on the strengths and weaknesses of a founder and their team during the due diligence.

Since launching 10Club, Bhavna and her team have onboarded 10 digital businesses across categories including home, pet, baby, and sports. The firm is also in conversation with appliances, electronics and stationery sellers.

While three firms have been completely integrated after making the necessary checks, the remaining seven are in the process of being integrated.

Post integration, the 30-member 10Club team works with the acquisition team.

“There is no hard and fast rule at this point. If the founder wants to run marketing or pricing, or if they want to work on ground they can do that with extensive support from us,” says Bhavna.

“We become full-time partners and acquire 100 percent of the business. The founder and us become one team. We don’t assist them but we run it together,” she adds.

Acquiring profitable businesses, 10Club is also focused on maintaining margins while growing the topline.

Business model and the market

While 10Club is majorly sector agnostic, it has consciously decided to stay away from sellers operating in the fashion industry. “In fashion retails, there are huge inventories, designs, and also seasonality. These are a few things we want to stay away from in a category,” says Bhavna.

All of these businesses are profitable and at least four years old.

“We want to hire profitable businesses because we are building 10 Club on those blocks,” she adds.

10Club’s model is inspired by US-based startup Thrasio, which acquires sellers on Amazon and provides them with resources to scale their brand. Founded in 2018, the startup’s valuation has soared to $4 billion, and has led to the birth of many competitors in the US. The model is being replicated in Europe as well.

In India, Ananth Narayanan, Myntra’s former CEO, with Snapdeal’s Kunal Bahl and First Cry’s Supam Maheshwari are leading the charge in this segment. While Ananth founded Mensa Brands, Supam’s GlobalBees raised a big Series A funding of $150 million.

Leading investors including Chiratae Ventures, Lightspeed India Partners, and Fireside Ventures remain extremely bullish about Thrasio-like startups.

While Joel wrote 10 Club’s first cheque, the startup also raised $40 million in their seed round led by Fireside Ventures and an unnamed Singapore-based investor.

Online ecommerce platforms have seen a huge influx of sellers and retailers. In December 2020, at least 70,000 sellers were selling through Amazon’s international selling platform. Many digital sellers have also been selling on other ecommerce platforms such as Flipkart, Ebay, and Etsy, as well as through social media platforms including Facebook, Instagram, and WhatsApp.

Credit: YS Design

In 2020, ecommerce saw a major drop in investor funding due to COVID-19-led uncertainties. The sector saw 57 deals in 2020 compared to 74 deals in 2019, according to YS Research.

But there seems to be no limits to the funding boom in the startup ecosystem with ecommerce startups getting huge cheques since the start of 2021. The biggest one was given to Walmart-owned Flipkart. The online marketplace raised $3.6 billion from Singapore-based GIC, Canada Pension Plan Investment Board and Softbank, among others.

YS’s flagship startup-tech and leadership conference will return virtually for its 13th edition on October 25-30, 2021. Sign up for updates on TechSparks or to express your interest in partnerships and speaker opportunities here.

For more on TechSparks 2021, click here.

Applications are now open for Tech30 2021, a list of 30 most promising tech startups from India. Apply or nominate an early-stage startup to become a Tech30 2021 startup here.