“Our success is in finding the next 30 Olympic champions in startups.”

Girish Mathrubootham, co-founder of Freshworks, uses the ongoing Olympic Games as a metaphor to highlight the ambitions of his newly launched venture capital fund called Together Fund. The fund will mostly invest in homegrown startups in the software-as-a-service (SaaS) space as well as a few that provide new-age software services in consumer-facing sectors such as edtech and fintech.

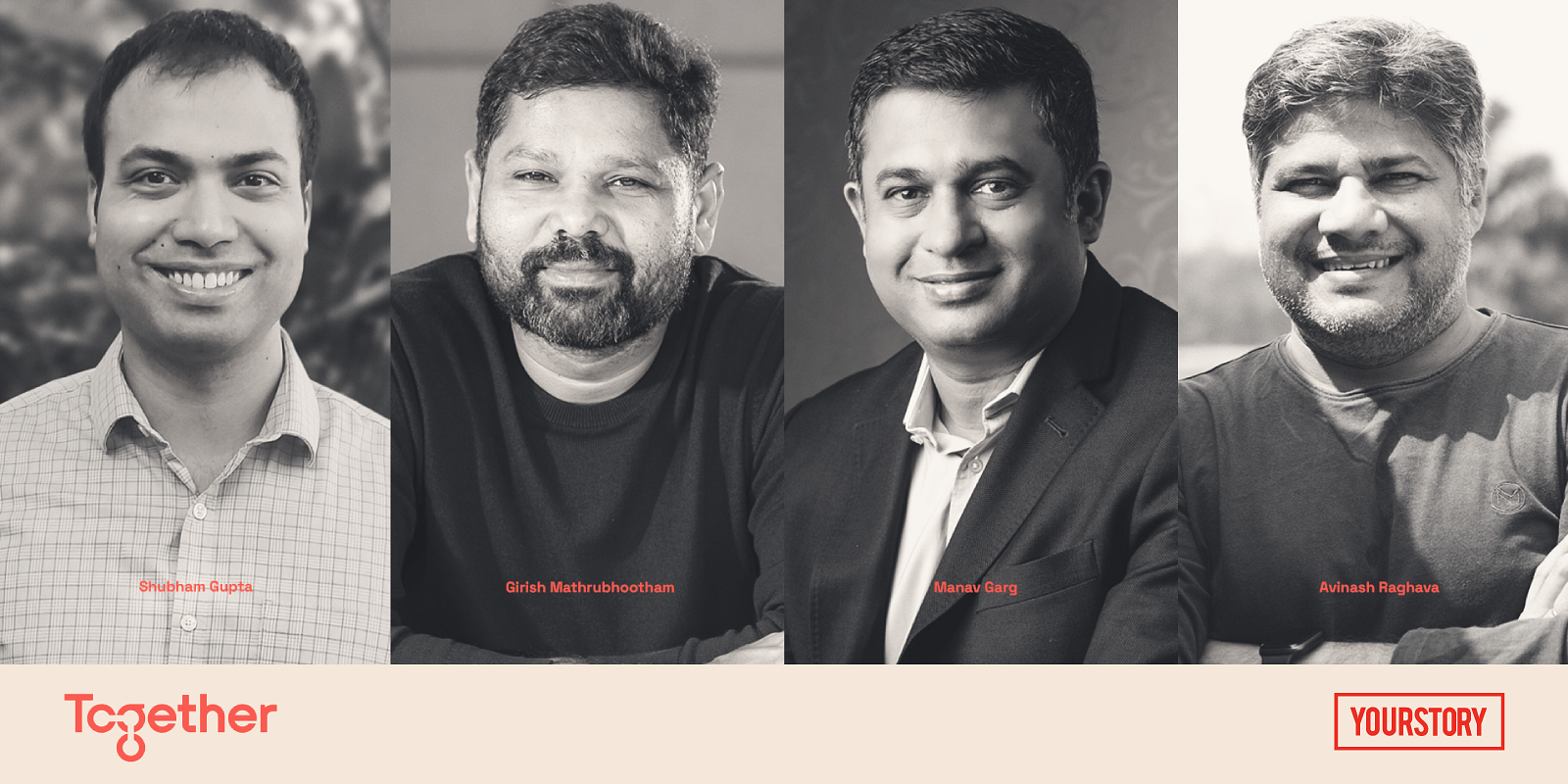

The choice of sectors isn’t a surprise considering Girish’s partners in the fund are Manav Garg, founder of Eka Software, and Shubham Gupta, who was leading SaaS deals at venture capital firm Matrix Partners India until last year, and Avinash Raghava, Founding Volunteer at SaaSBOOMi and Co-Founder of iSPIRT.

And yet, the Together Fund will not be like any other VC fund, emphasised the partners in a conversation with Shradha Sharma, Founder and CEO of YS.

That is also evident in the fund’s slogan: ‘For Founders, By Founders, and With Founders’.

The main currency of investment, they explain, will be time and mentorship for budding founders, and not merely money in startups, and the partners in the fund will span the entire startup ecosystem.

“You can call it as India’s first operator-led VC,” says Girish.

Besides the four partners, these ‘operators,’ explains Manav, will include not just founders but also functional specialists such as product and marketing experts, as well as the peer founder community. It will, of course, also include VC firms.

“We are taking the entire ecosystem together, be it the founders who want to invest through time and money, be it the VCs who want to participate and take our help in whatever they want to get. As it’s said, it takes a village to create a company,” says Manav.

Subham says more than 150 executives and operators from the U.S., Singapore, and South Asia, essentially India, have expressed interest in signing up.

For founders, with founders, by founders

The founders of several established companies are already investing in startups in their personal capacity, including Girish and Manav. Girish has backed over three dozen startups including Unacademy and Chargebee, while Manav has backed over a dozen startups as an angel investor. But they realised budding entrepreneurs need more than just money.

“We are giving them a lot of operational help, we were personally investing in startups, we were trying to help them, but really we felt that entrepreneurs need time and operational help, they need operator help. So, that is when the idea came. The evolution was to really put together a network of founders and entrepreneurs who can help the startups,” says Girish.

That harks back to the philosophy of ‘For Founders,’ says Manav, adding Together will help entrepreneurs from the perspective of a founder.

They “will live the journey,” he says, right from framing the founding agreement to deciding on whether to first hire a sales head or a product head, and from helping with a go-to-market strategy to deciding what is required, besides money, to build a scalable company.

“We believe that it is not about money, it is not about the fund size,” adds Girish. “It is about really giving entrepreneurs a chance. Funding gives them time, while the network of people, including founders and operators, actually gives them good advice from people who have been there, done that.”

It may not be only about the money, but funding is certainly a part of the game.

The Together Fund is targeting a corpus of $85 million and will write checks ranging between $250,000 and $3 million per investment.

The choice of sectors to invest in is not just because of the backgrounds of Girish, Manav, Shubham, and Avinash.

SaaS, consumer tech, and fintech startups accounted for 75 percent of VC investments in 2020, compared with 65 percent in 2019, and for 14 of the 22 $100 million-plus deals last year, according to a Bain & Co report in March. SaaS in particular saw clear signs of maturity, with average deal size jumping to $25 million in 2020 from $14 million in 2019, the report said.

The success of these sectors is because “Software consumption of businesses has been democratised,” says Girish. He says that most software firms traditionally build for enterprise customers because only they have that kind of spending power.

But what about the small- and mid-sized businesses? “They’re not going to spend a million dollars. They want something that is simple, something they can do on their own, something that fits their budget but is still a world-class product. So that is the opportunity for Indian SaaS, where we will be able to build and sell it to a long tail of global customers,” he says.

Manav adds that the Covid-19 pandemic, and ensuing months-long lockdowns, have led to sales processes being done virtually. That he says will lead to a behaviour shift in the big companies and give smaller developers a chance.

“Previously you could only do (sales to) SMBs virtually, but now enterprise sales motion also you can do maybe 80 percent online and 20 percent offline. That is also going to shift the balance towards a software developer sitting in Dehradun or wherever,” he says.

Given their experience, Girish and Manav are perhaps best placed to offer the sort of advice that founders need. Girish is preparing Freshworks for a public offering, while Manav’s Eka is now at $50 million annual recurring revenue (ARR). But it has taken them the best part of a decade to hit these milestones, stumbling and learning along the way.

Together aims to use its experience to help founders minimise mistakes to reach these milestones faster. The objective is to ensure the next Freshworks or next Eka “appears in the next six-seven years, instead of 10,” says Girish, and to “reach $20 million (ARR) in five years, instead of six years. Or even faster, even three years,” adds Manav.

But wouldn’t that pit Together against established VCs such as Lightspeed Venture Partners, Accel India, Nexus Venture Partners, and Sequoia Capital’s accelerator programme Surge, among others? Not really, say Girish and Manav. They are firm in their stand that Together Fund will not compete with other funds to make investments. Moreover, Girish points out they may not have to since many top-tier VCs are already in Together as LPs.

In fact, the founders say that they would be satisfied to provide their entrepreneurship experience even if the founder of a startup ends up choosing another VC for funding. “So if you want to bring in a VC to help you raise capital and you want help from us on building a SaaS company, we will be fine. If you want us alone, we will be fine,” emphasises Manav.

Girish adds that their internal mantra of the partners is ‘reputation over returns,’ which means that they aren’t going to do anything that will damage the reputation they have built over a decade.

Subham makes the most emphatic argument, “I think there is enough capital, firstly. So we are not fulfilling that. We are not a venture fund, we are Together.”

Powering 30 Olympic champions in startups

Their measure of success for Together is also rather unique.

“We will never probably define success as ‘we want 3X, 5X, 10X return on the 100’. Maybe that will happen. But that’s an effect,” says Girish.

That effect, adds Manav, will be achieved by creating value, which will benefit the whole ecosystem.

“So we want to create more scalable businesses who can create great value, not just unicorn status, but building a great long-term value. So that, you know, the return could be superior for investors, for entrepreneurs and for us in the process, and the whole ecosystem grows.”

Manav has the last word.

“So, in a nutshell, if you have 30 Olympic teams, we want to see 30 gold medals. But is it possible or not? Only time will tell, but we want to try.”

With inputs from Shreya Ganguly and Naina Sood