Market intelligence platform Tracxn Technologies has raised a little more than Rs 139 crore from anchor investors.

The company’s initial public offering (IPO) will be entirely an offer for sale (OFS) of 38,672,208 equity shares by promoters and investors. It will open for subscription on October 10.

The company has decided to allocate a total of 1.74 crore equity shares to anchor investors at Rs 80 apiece, aggregating the transaction size to Rs 139.22 crore, according to a circular uploaded on the Bombay Stock Exchange website.

India Acorn Fund, BNP Paribas Arbitrage, Whiteoak Capital, Kotak Mutual Fund (MF), ICICI Prudential MF, Nippon India MF, and Reliance General Insurance Company are among the anchor investors.

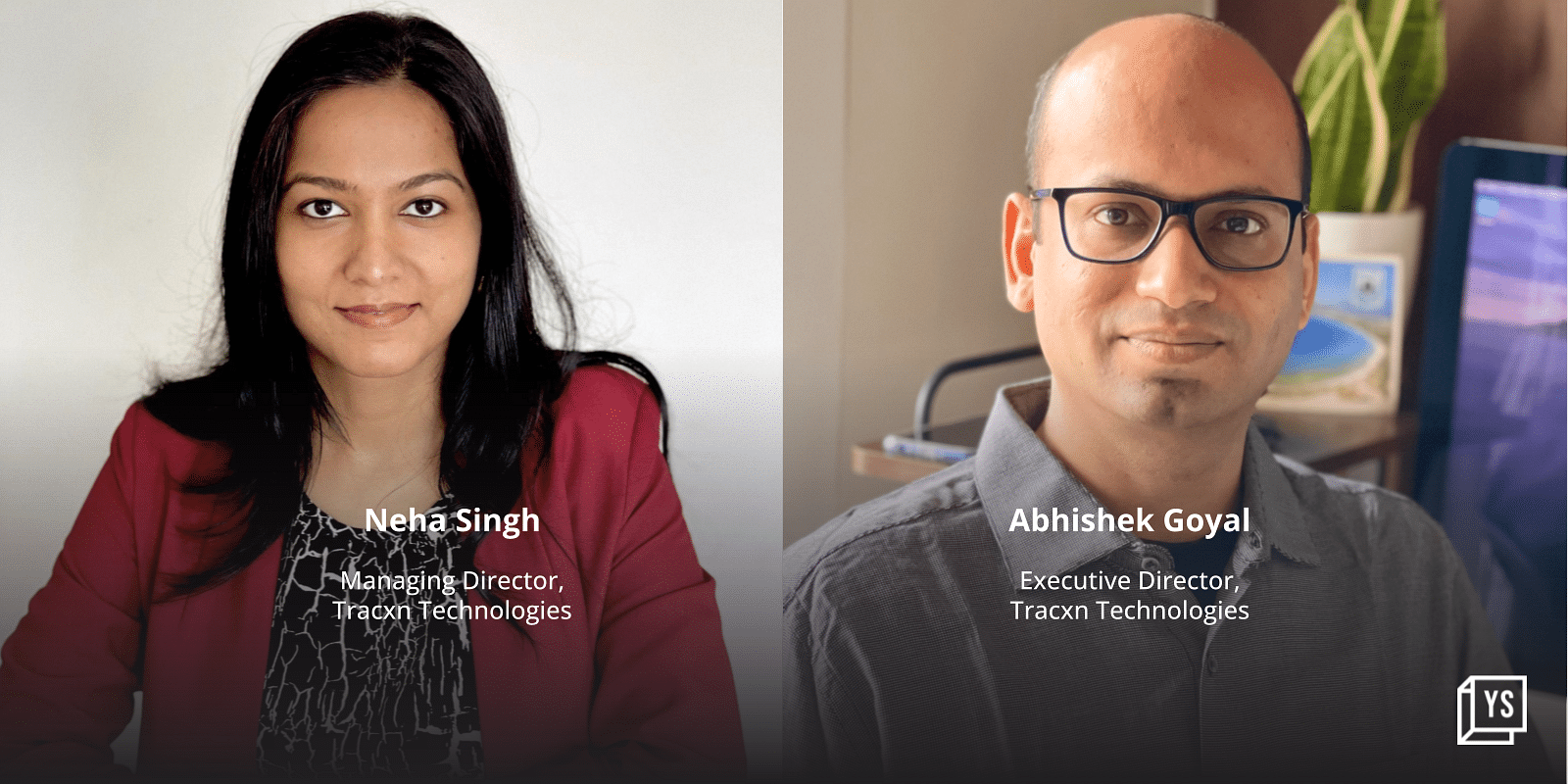

The OFS will see sale of up to 76.62 lakh shares each by promoters Neha Singh and Abhishek Goyal and up to 12.63 lakh shares each by Flipkart founders Binny Bansal and Sachin Bansal.

Up to 1.09 crore shares will be offloaded by Elevation Capital, 40.2 lakh shares by Accel India IV Mauritius, 21.81 lakh shares by SCI Investments V, and 2.07 lakh shares by Sahil Barua, among others.

The issue, with a price band of Rs 75-80 per share, will open for public subscription on October 10 and close on October 12. At the upper end of the price band, the IPO is expected to garner Rs 309 crore.

Tracxn was launched in 2015 by Neha Singh and Abhishek Goyal, who have had stints as venture capitalists at Sequoia and Accel Partners, respectively. The Bengaluru-headquartered market intelligence provider operates on a software-as-a-service (SaaS) model.

As of June this year, the company had 3,271 users across 1,139 customer accounts, in over 58 countries.