udaanCapital has announced that, through its lender partners, it has enabled credit of over Rs 2200 crore to more than one lakh small electronics, lifestyle and general merchandise retailers across India, on the udaan platform in FY22.

Through its lender partners, udaanCapital enables small- and medium-sized shops to make purchases for their stores from a wide array of suppliers by providing credit facilities.

According to the company, its proprietary risk algorithms leverage alternative datasets, enhance lender partner’s underwriting decisions, transaction patterns and trade invoices to pre-select borrowers, and improve approval rates for borrowers by 35%. As a result, 97% of the disbursed amount is collected before the due date from discretionary category retailers.

Chaitanya Adapa, Head, udaanCapital, said, “The market gap in working capital availability for trade is still very huge. This milestone gives us a lot of conviction that we are on the right path in helping reduce this gap. We will work with our lender partners and continue investing in core infrastructure areas like collections and risk advisory to keep chipping away at this problem.”

Discretionary goods categories tend to have longer sales cycles and goods stay on store shelves for long before they are sold. Therefore, retailers need to stock more inventory, which in turn makes working capital access central to operate and scale such stores.

Over one lakh stores across India, dealing in discretionary products, access credit through udaanCapital. In FY22, more than 50% retailers of discretionary products on the udaan platform were powered by credit enabled by udaanCapital. The base of users availing themselves of this facility grew by 25% in FY 22.

To power this service, udaanCapital partners with various banking and NBFC partners and provides them a full stack of services, including proprietary risk assessment, collections and end-points for tech integration, thus enabling lender partners to safely deploy their capital into end-use controlled MSME credit lines with minimal upfront investment.

udaanCapital leverages the udaan group’s logistics and sales network and has built collection capabilities to service the segment.

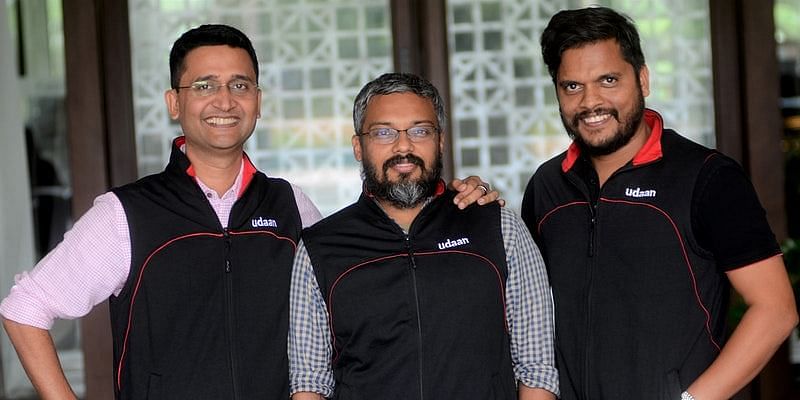

The company was founded in 2016 with a vision to transform the trade ecosystem and empower small businesses by leveraging technology. It has operations across categories such as lifestyle, electronics, home and kitchen, staples, fruits and vegetables, FMCG, pharma, toys, and general merchandise. It has over 3 million retailers and 30,000 sellers on its platform across the country.

The platform enables supply chain and logistics operations focused on B2B trade. According to the company, it is built on strong technology for daily delivery across 1200 plus cities and 12,000 plus pin codes, through udaanExpress. udaan enables financial products and services to small businesses, manufacturers, and retailers through udaanCapital to help them grow their business.

![Read more about the article [Funding alert] Blockchain developer tool provider Biconomy raises $9M led by Mechanism Capital and DACM](https://blog.digitalsevaa.com/wp-content/uploads/2021/07/Imagekjwm-1627533865648-300x150.jpg)