With Cohesive, a software development environment that enables product teams to test and deploy code, Unacademy is foraying into an all new space

Cohesive By Unacademy is being led by Vaibhav Sinha, who is listed as the project’s CTO on LinkedIn, while Pratiksha Dake is the head of products

Is Cohesive another that the Unacademy Group is looking to ensure profitability at a group level after years of running on heavy losses?

Even as it faces tough questions around burning cash, expanding into new verticals and laying off thousands of employees and teachers, Unacademy is launching a new product and it’s one that seems completely out of the left field. With Cohesive, a software development environment that enables product teams to test and deploy code, Unacademy is foraying into a space that not only has huge competition, but also straying away from edtech further.

Cohesive By Unacademy is being led by Vaibhav Sinha, who is listed as the project’s CTO on LinkedIn, while Pratiksha Dake, who had founded fintech unicorn INDMoney with Ashish Kashyap in 2018, is the head of products. Sinha has been with Unacademy since 2018.

While we could not reach Sinha or Dake for a comment, an Unacademy spokesperson told Inc42, “We have an in-house R&D division at Unacademy and as part of this division, we keep experimenting with technology solutions which solve a need. Cohesive is one of the experiments by the in-house R&D team of Unacademy.”

As per our sources in Unacademy, Cohesive currently has a team of 10-12 employees, and is looking to hire a principal engineer.

What Is Cohesive By Unacademy?

The company has not made an official announcement of the product, but there’s a waitlist that development teams can join. The accompanying blog post for Cohesive claims it is looking to solve industry-wide problems such as complex setups, slow deployment and lack of integrations or dependencies.

The company claims Cohesive easily syncs up with Github repositories and automates deployment of new software commits. It will offer collaboration tools for teams to work together on products and a deployment environment for testing, staging, or production, before software can be shipped. Product teams can create unlimited environments — ephemeral or permanent, and with support for public collaboration.

Cohesive also claims that it syncs with “all services required for the successful deployment of your projects like SQS, S3, MySQL, PostgreSQL, MariaDB, Redis, SNS etc.” However, the exhaustive list of services is not yet available. The platform will offer a fully-managed Cohesive Cloud infrastructure-as-a-service solution and also allows customers to import their own cloud infra for greater control.

According to a Research And Markets report, the global market for application development software could be a $733.5 Bn opportunity by 2028, growing sixfold from the market size in 2020. This is uncharted territory for Unacademy. It is entering a space that has the presence of the likes of Jira, Microsoft Visual Studio, Eclipse IDE, Jupyter Notebook, Flowfinity and others, which offer alternatives of Cohesive or some other development environment or devOps software.

Cohesive — A Play For Profitability Amid Edtech Downturn?

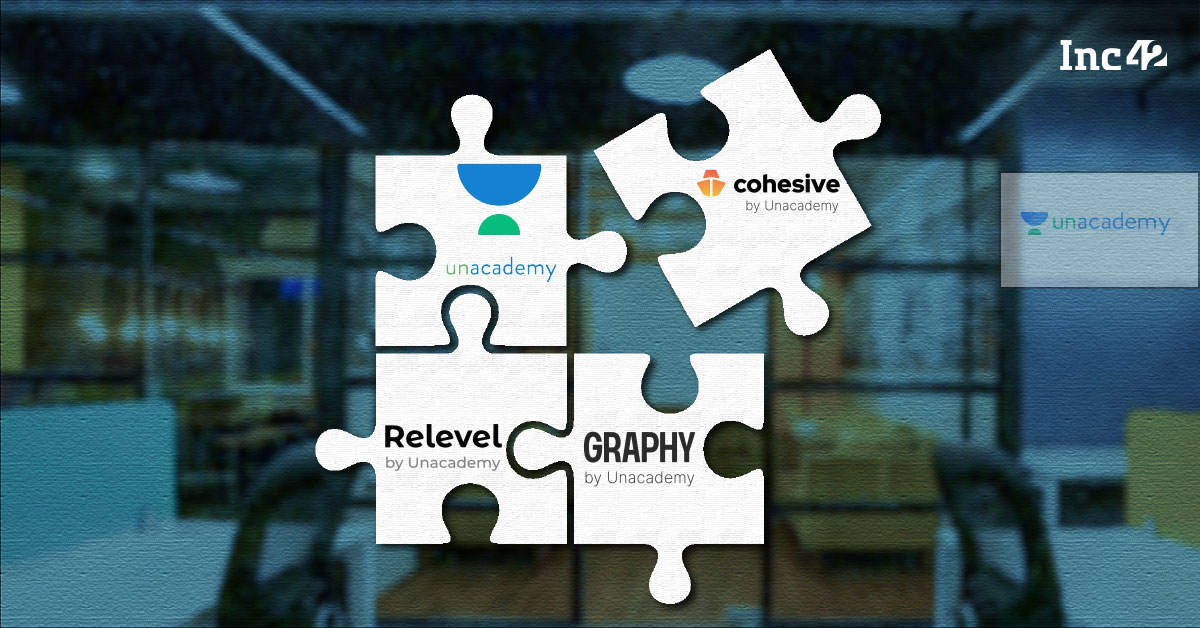

So far, the ‘edtech’ unicorn has an edtech product in Unacademy, a creator SaaS tool in Graphy and Relevel, a test assessment platform with placement opportunities. However, Cohesive is not only targetting a whole new customer base, but also requires a different kind of approach to sales and marketing than perhaps what one might be accustomed to when it comes to Unacademy.

Within the enterprise tech space, not only does Unacademy have to contend with smaller players but also some of the giants mentioned above. So what is the company’s plan? And how will it execute this at a time when the focus is also on streamlining the edtech core.

On the edtech front, Unacademy’s foray into offline test prep centres has been met with stiff competition from some of the legacy players including Allen Career Institute in Kota. There, Unacademy is looking to get the best teachers from offline players to set up its base. This approach is likely to be a capital-intensive play.

So one does wonder whether the foray into enterprise and devOps tech is something that Unacademy is looking at as a bulwark against its cost-heavy verticals. SaaS products typically require low capital expenditure and the economies of scale are far more favourable than for consumer products, which demand large user bases to become profitable.

Besides this, Cohesive is the first true B2B product from Unacademy targeting enterprises and startups — Graphy is targetted at the less sophisticated creator audience while Relevel is a B2B2C play.

Soon after news of the layoffs at Unacademy were reported, CEO Gaurav Munjal told employees that they must learn to work under constraints and focus on profitability at all costs. Is Cohesive one of the ways that the Unacademy Group is looking to bring in a measure of profitability at a group level — to balance the ship at large?

But this ‘experiment’ also comes at a time when the company is reducing burn in every way possible. Sources in the company told Inc42 that cost-cutting directives include reducing reliance on paid software such as Notion or Zoom.

At the same time, questions are also being raised about laying off employees from the core business and the core promise of all these years and focussing on an experiment. Even when investors have called for a sharper focus on the core proposition, Unacademy is “experimenting with technology solutions“ as the company puts it.

However, such experiments also need fuel to succeed, a different go-to-market approach than edtech and the right team — will Unacademy be hiring for B2B enterprisetech roles and compete with other SaaS players?

Before the cutbacks in 2022, Unacademy saw its losses widen by 494% with a total loss of INR 1,537.4 Cr in FY21 on a total income of INR 464 Cr. With total expenses coming up to INR 2,029 Cr in the year and bringing in INR 397.6 Cr in operating revenue, the company spent INR 5.1 to earn every rupee.

Unacademy’s Acquisition-Laden Ship

Since March 2021, the edtech giant has raised over $450 Mn in its Series H round at a valuation of $3.44 Bn. In its quest to have a presence in every education sub-segment, Unacademy has been on an acquisition spree over the past couple of years. It has acquired over ten startups including Rheo TV, PrepLadder, Mastree, CodeChef, SwifLearn, Kreatryx and TapChief.

TapChief was then spun off into Relevel, but in the case of PrepLadder and Mastree, the products were shut down, which led to a number of layoffs in early 2022.

Last year, the Unacademy Group made an infusion of $20 Mn in Relevel, while Graphy has also been given acquired Spayee for $25 Mn, while also launching an INR 100 Cr creator grant. Relevel claims to be clocking $2 Mn in monthly revenue as per cofounder and CEO Shashank Murali, but without a breakdown of the consolidated revenue of Unacademy for FY22, it would be hard to gauge the profitability of Graphy, Relevel or indeed the Unacademy learning platform.

While many of these products from Unacademy have received sizable backing from the group company, will the same be seen in the case of Cohesive, which the company claims is just an experiment.

Plenty Of Unknowns For Unacademy

On the other hand, with the right pricing and if it already has a few customers on board, Cohesive might start turning profits sooner without much of a cash infusion.

Of course, there’s plenty of unknowns at this time. Including whether Unacademy is an edtech company any more or is it simply creating new products for the problems that it has seen first hand through its journey so far? Secondly, Unacademy also has to sell its own expertise in creating such products beyond the product itself — it is trying to disrupt an established workflow for product teams and this is typically a major challenge for new players.

Some might even question the fact that while Unacademy has attracted funds and achieved its scale on the back of edtech, it’s simply using this to launch disparate products that do not fit in seamlessly under one bucket. And if Unacademy does not speak about its long-term vision, these questions will persist for a while.