The new funding will enable Infra.Market to enhance its technological offerings, enter newer markets and advance their initiatives such as private label brands, direct-to-retail channel and exports

Infra.Market is a B2B online procurement marketplace for real estate and construction material

In FY20, the company had saw a 5.5X jump in its revenue

Marketplace for construction material, Infra.market has raised INR 100 Cr in venture debt funding from Alteria Capital.

Recently, the company also entered the unicorn club, after raising $100 Mn in Series C funding round led by Tiger Global.

The new funding will enable Infra.Market to enhance its technological offerings, seed newer markets and advance its initiatives such as private label brands, direct-to-retail channel and exports, the company said.

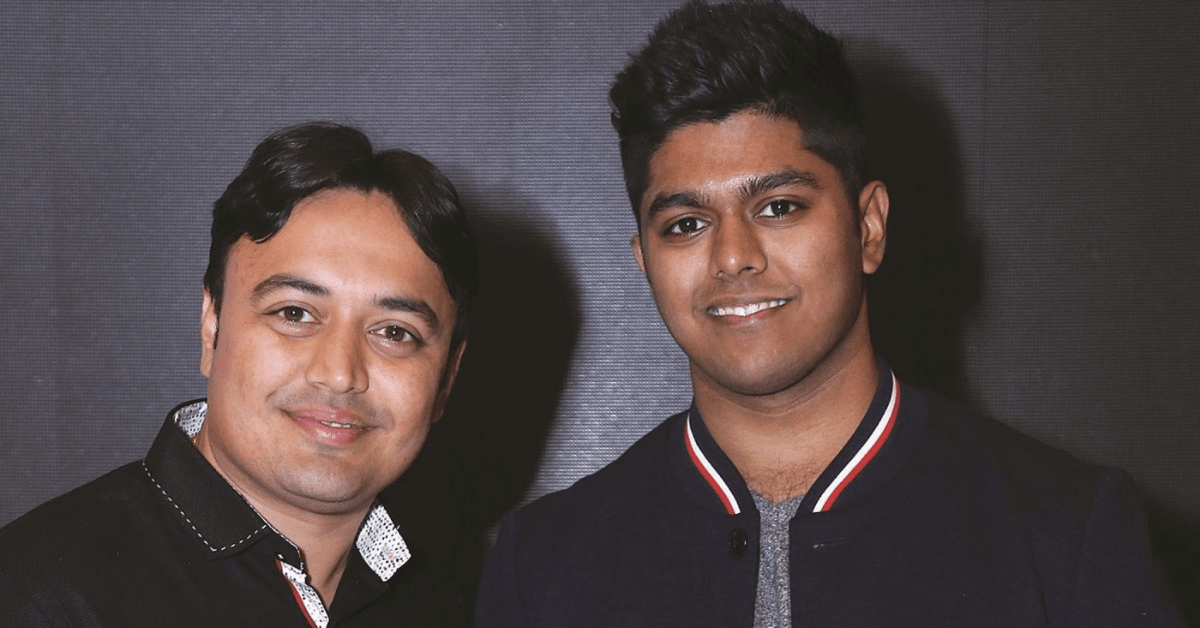

Founded in 2016 by Aaditya Sharda and Souvik Sengupta, Infra.Market is a B2B online procurement marketplace for real estate and construction material that leverages technology to offer a smoother procurement experience for its customers. The startup ties up with contract manufacturers and gets them to utilise idle capacity and manufacture products for its own brand.

“The company has performed exceedingly well and has beaten all expectations. The capital will be used for working capital requirements to grow the business as well as other uses,” said Punit Shah, partner, Alteria Capital.

Commenting on the deal, Souvik Sengupta, founder, Infra.Market added “We are excited to have Alteria on board. We have been pleased with the speed and thoroughness they have shown in understanding our business over time. We look forward to this partnership and leveraging their network as we scale our business in the coming years,”

The company has been profitable since its inception in 2016. In FY20, the company had noted a 5.5x jump in its revenue to INR 350 Cr. Its expenses grew at the same rate to reach INR 339 Cr, leading to a profit of INR 8.59 Cr. The B2B marketplace had reported a revenue of INR 63 Cr with expenses worth INR 60.75 Cr, leading to a profit of INR 1.74 Cr.

The company had also launched another subsidiary Hella Infra Market Retail in October 2019, which too turned profitable in FY20. The new subsidiary focuses on the direct-to-retail segment by directly selling its construction material to retails. With this, the company’s consolidated revenue reached INR 352 Cr with an expenditure of INR 330 Cr.

When speaking on their investment in the B2B company, Punit Shah commented “B2B commerce as a segment is still largely untapped and there is a lot of potential. So we felt that there is a strong need for a platform where founders can come together and share their learnings,”

The company is targeting the $140 Bn construction materials market with a strong focus on the infrastructure sector. “Infra.Market is expected to significantly benefit from the 34% increase in allocation for infrastructure projects in the 2021 Union Budget of India,” the company said in its release.

Despite its immense potential, currently the majority of the construction materials market is largely unorganised.