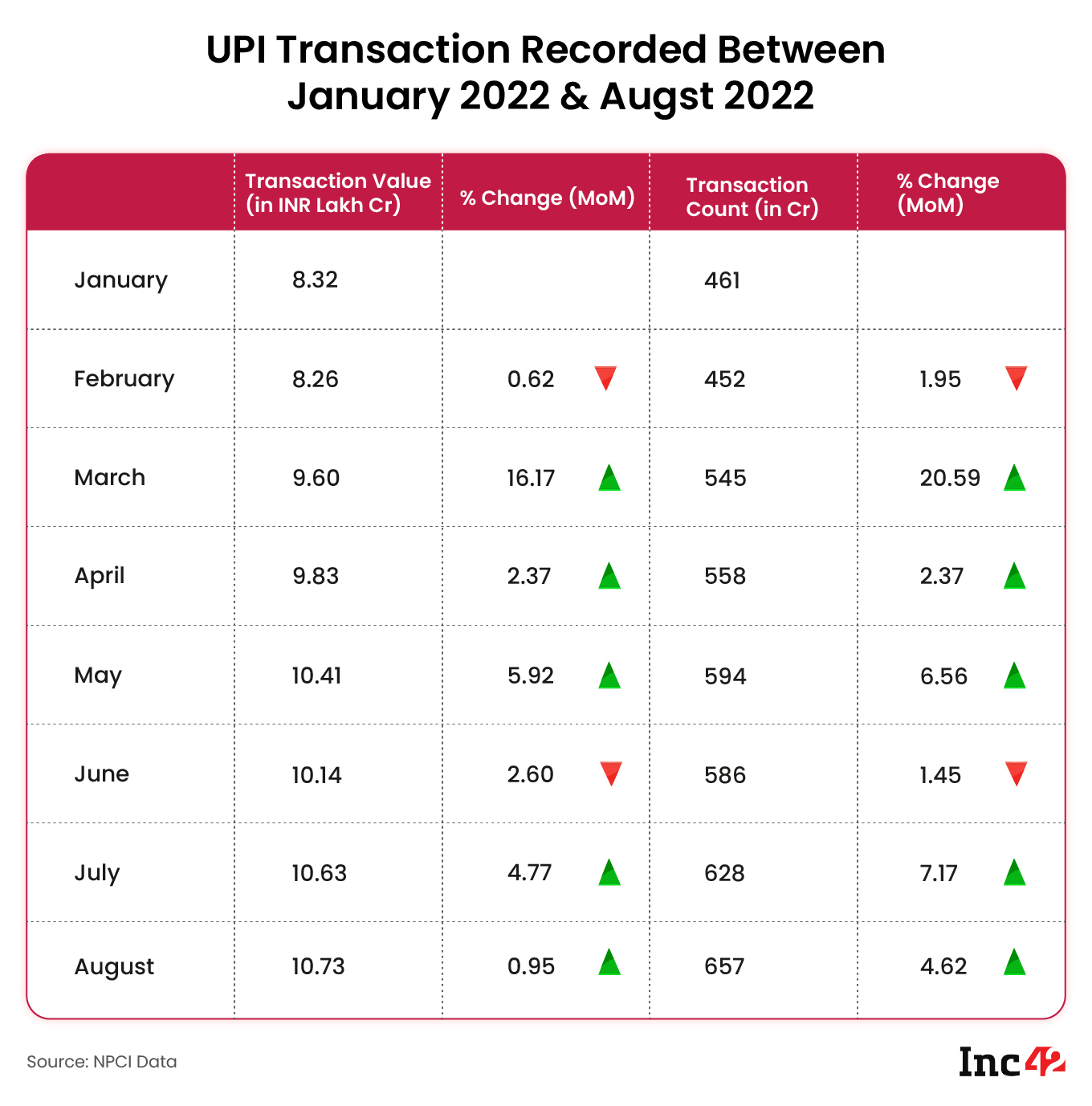

In August 2022, the transaction volume increased by a mere <1% whereas the transaction count grew 4.62% month-on-month growth

In July 2022, UPI recorded INR 10.62 Lakh Cr worth of 628 Cr transactions

Besides the month-on-month growth, UPI is likely to get a growth spurt as NPCI is likely to operationalise credit card linking starting September 2022

UPI recorded 657 Cr transactions in August 2022, nearly 5% month-on-month (MoM) growth from July 2022 when it registered 628 Cr transactions. The transaction volume also increased (even though it was less than 1%) from INR 10.62 Lakh Cr to INR 10.72 Lakh Cr ($135.10 Bn).

So far, the total transaction volume in 2022 stands at INR 77.94 Lakh Cr ($981.72 Bn) and has already crossed the 2021 volume. The value of UPI transactions in 2021 stood at over INR 73 Lakh Cr (approximately $970 Bn), a year-on-year rise of over 110% from transactions worth INR 33.87 Lakh Cr in 2020.

In July 2022, the NPCI had stated its plans of starting the operational linking of RuPay credit cards with the UPI by September 2022. Even though the numbers stand at their ever-highest every month, the percentage growth has only been in the single digits.

UPI Coming On Credit Cards

With UPI coming on credit cards, the average ticket size of UPI transactions will be largely positively impacted. Currently, the average ticket size of UPI stands at INR 1979.90 (in 2022), whereas the Reserve Bank of India (RBI) recorded INR 87,682 Cr worth of credit card transactions in July 2022 and the country’s average credit card transaction value is around INR 4,740.

Linking credit cards and UPI is expected to boost credit card utilisation as well as further the digitisation of small payments within the country. Yet, a lot of questions about its implementation still need answers.

Inc42 had previously consolidated the views of industry experts on the Merchant Discount Rate (MDR) impact on credit cards vis-a-vis UPI who have stated that these MDR charges will play a big role in deciding the outcome of this integration.

MDR is a fee that merchants are usually charged by the payment infrastructure provider. Currently, the credit card industry has a business model based on a 2%-3% MDR and interest model while UPI on debit cards has zero MDR.

Experts suggest that the success of this integration will also increase the acceptance of credit cards in the country and consequently disbursal of loans at low cost.