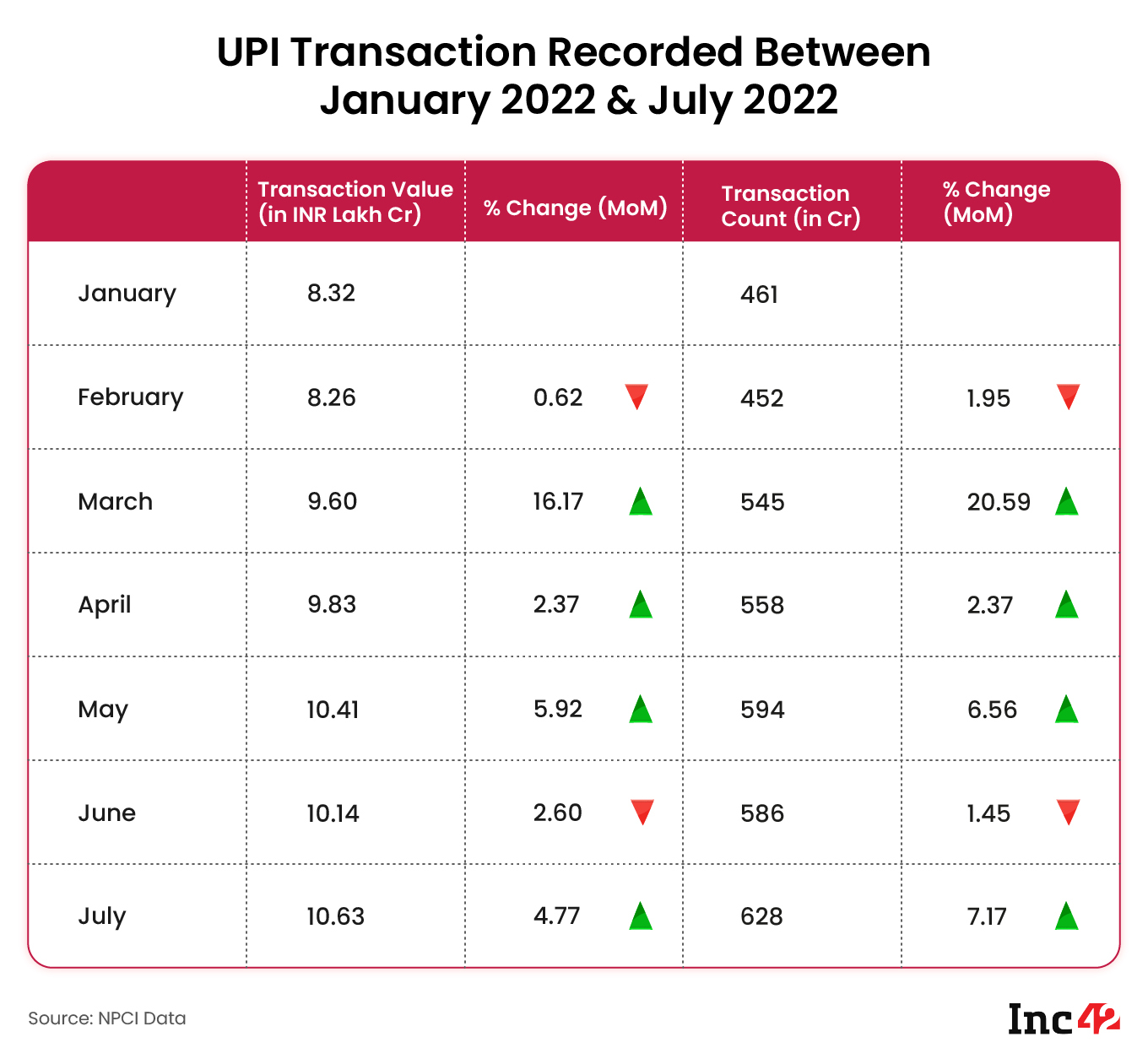

UPI transactions rose 7.7% MoM to 628 Cr in July 2022 from 586 Cr in June 2022

Transaction volume rose 4.8% to INR 10.63 Lakh Cr from INR 10.14 Lakh Cr in the previous month

In the seven months of 2022, UPI transaction volume has already crossed 92% of 2021’s volume

The transactions on the Unified Payments Interface (UPI) crossed the 6 Bn mark in July 2022, with the National Payments Corporation of India (NPCI) processing 628 Cr transactions worth INR 10.63 Lakh Cr during the month.

Both transaction count and volume saw a rise in numbers following a dull June, recording 4.8% and 7.7% month-on-month (MoM) growth, respectively. The previous month (June 2022) saw a minor decline in UPI transaction numbers as compared to May 2022.

The value of UPI transactions in 2021 stood at over INR 73 Lakh Cr (approximately $970 Bn), a year-on-year rise of over 110% from transactions worth INR 33.87 Lakh Cr in 2020. However, the transaction volume in the first seven months of 2022 has already crossed 92% of the UPI transactions volume in 2021.

The total transaction volume in 2022 stands at INR 67.21 Lakh Cr ($850 Bn) so far.

In July 2022, the NPCI also confirmed plans to begin operational linking of RuPay credit cards with the UPI by September 2022.

The beginning of linking UPI with credit cards will likely impact the average ticket size of UPI transactions, which currently stands at around INR 2,050 per transaction (in 2022). The Reserve Bank of India (RBI), on the other hand, recorded INR 87,682 Cr worth of credit card transactions in July 2022. Thus, the average credit card transaction value is around INR 4,740 in the country.

Thus, at the present rate, the linking of UPI to credit cards has the potential to take the average ticket size of payments via UPI upwards of INR 3,300.

UPI is currently the most popular digital payment system in India with linkage to 330 banks led by State Bank of India (SBI) (162.5 Cr transactions), followed by HDFC Bank (52.9 Cr transactions) and Bank Of Baroda (38.3 Cr transactions).

The NPCI was incorporated in 2008 as an umbrella organisation for operating retail payments and settlement systems in India. It started UPI in 2016 and also operates other payment features such as RuPay card, Immediate Payment Service (IMPS), Bharat Interface for Money (BHIM), BHIM Aadhaar, Fastag and Bharat BillPay. Most recent of its offerings include the UPI123Pay, a real-time wallet-style payment system for feature phones. NPCI has also inked a Memorandum of Understanding (MoU) with France’s Lyra Network for acceptance of UPI and RuPay Cards in the country.

Thus, NPCI is now going international to take the homegrown payments system to countries like Nepal, the UAE, Japan, and China, besides France.