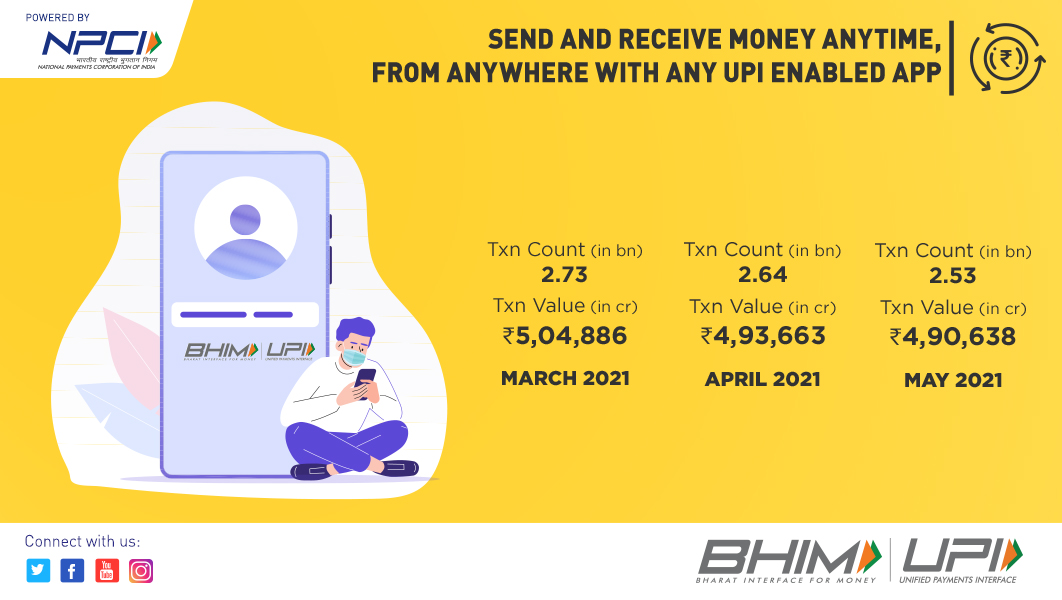

In May, NPCI reported 2.53 Bn UPI transactions, down 4% month on month compared to 2.64 Bn transactions in April

Although UPI transactions recorded a jump in March, the staggered lockdowns introduced across states starting 14th April impacted consumer behaviour again

The slowdown this time has been more gradual compared to the 20% dip in transactions reported in April 2020

The intensified covid-19 wave continues to affect UPI (unified payments interface) transactions in the country negatively. May data shared by National Payments Corporation of India (NPCI) shows that transactions dipped marginally for the second month in a row.

During May, NPCI reported 2.53 Bn UPI transactions, down 4% month on month compared to 2.64 Bn transactions in April. Value of transactions also registered a marginal decline to INR 4.90 Lakh Cr (down 0.6% month on month) compared to INR 4.93 Lakh Cr in April. In March 2021, UPI had reported its best ever figures with 2.73 Bn transactions amounting to INR 5.04 Lakh Cr.

Although UPI transactions recorded a jump in March, the staggered lockdowns introduced across states starting 14th April impacted consumer behaviour.

Launched in 2016, UPI transactions volume saw the first massive dip in April 2020, after falling below the 1 Bn mark to 990 Mn, while the value of transactions dropped to INR 1.51 Lakh Cr. This fall was in the wake of the Covid-induced lockdown and restrictions that shut down all major services including traveling, dining out, ecommerce and offline transactions.

However, the slowdown this time has been more gradual compared to the 20% dip in transactions reported in April 2020. This has been largely due to the staggered nature of lockdowns across the country this time.

According to fintech analysts, the impact across kirana and small essential local retailers is likely to be lesser during the second wave simply because their movement has not been impacted this time if they can manage deliveries. With digital transactions gaining steam over the past year, essential product and service retailers are on a safer footing this time. This segment is also a larger beneficiary of UPI compared to SMEs.

UPI transactions started recovering soon after May 2020, and crossed the 2 Bn transaction mark in October 2020, but the story has been all about decreasing growth numbers since then.

Business sentiment in India has taken a beating in May, with 70% of businesses citing a weak demand situation as a key factor for business, according to a survey released on Monday ( May 31) by industry body FICCI. The overall business confidence index as measured by FICCI nosedived to 51.5 in May from a decadal high of 74.2 measured in February.