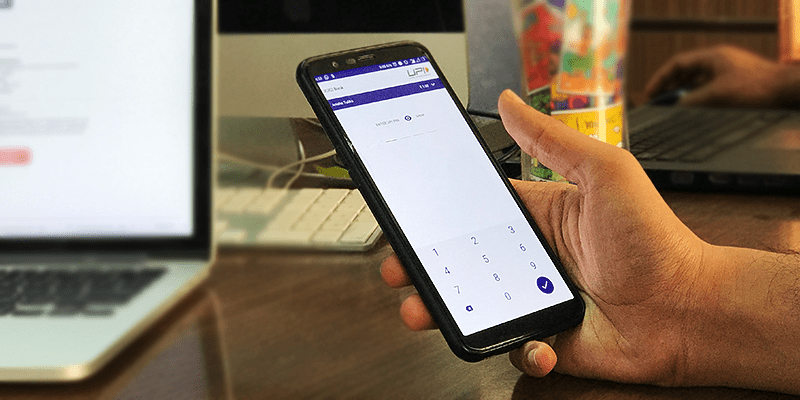

The Unified Payments Interface (UPI) transactions witnessed a marginal decline in transaction value for February, causing a temporary blip after being on a continuous rise since July 2016.

According to the data shared by the National Payments Corporation of India (NPCI), the transaction value on the UPI platform for February dipped by 1.5 percent as compared to January 2021. The total transaction value for February stood at Rs 4,25,062 crore as compared to Rs 4,31,181 crore in the previous month.

Similarly, the transaction volume was almost steady this month, with a small decline of 0.5 percent as compared to January. For February, the total transaction volume stood at 2.29 billion.

UPI — one of the sought-after way for digital India to conduct financial transactions — crossed an important benchmark of Rs 4 lakh crore in monthly value transactions in December last year. Since then, it has been consistently above the mark.

In fact, the transactions volume on the UPI platform crossed the two-billion mark in October last year.

However, NPCI is yet to publish data on the performance of various third-party apps operating on the UPI platform, including PhonePe, Google Pay, Paytm Payments Bank, Amazon Pay, and WhatsApp Pay, to name a few.

UPI transactions have been continuously on the rise since July 2016. The only time the digital platform suffered a dip was in April 2020, when India underwent a nationwide lockdown amidst the COVID-19 pandemic.

However, the lockdown turned out to be a booster shot for UPI as transactions on the platform has been steadily rising for months.

For 2020, UPI transactions recorded 105 percent growth as its value of transactions touched Rs 4,16,176.21 crore in December as compared to a similar period the previous year.