Image credits: koya979/Shutterstock

2021 was a remarkable year for the European venture capital (VC) ecosystem. Venture capital investment in Europe crossed the €100B mark for the first time in 2021, reports Pitchbook in the recently published “2021 European Venture Report” along with EMEA VC analyst Nalin Patel.

Here are six key takeaways from the report:

Get to know the amazing finalists here

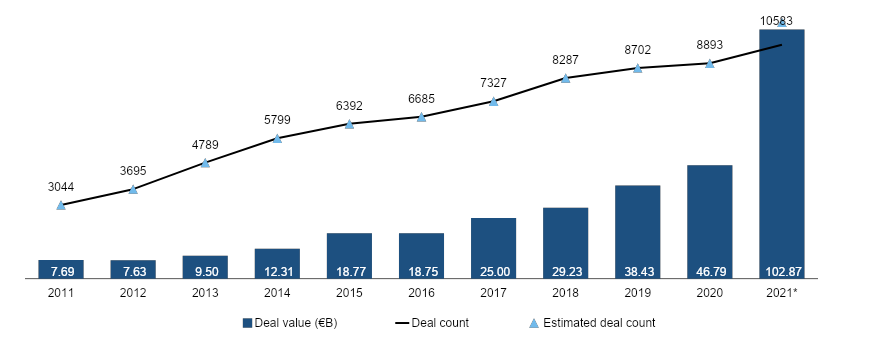

VC investment in Europe reached €102.9B

According to the report, Venture capital investment in Europe reached €102.9B as investors and startups closed substantial rounds throughout a bumper 12-month period.

The number of completed VC deals reached a record 10,583, indicating that rounds are growing in frequency and magnitude across the European VC landscape.

In 2021, late-stage capital accounted for a record 70 per cent of overall VC deal value — equivalent to €72B.

“COVID-19 has hastened growth rates and capital invested into the majority of late-stage VC-backed companies in Europe in 2021,” says the report.

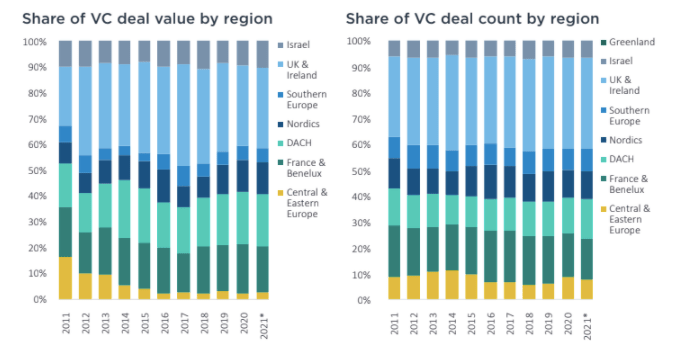

VC deals by region and sector

As per the report, startups in the UK, which is Europe’s most developed VC market, raised the most in 2021 out of all European countries. Many of the biggest deals came from the fintech sector, says the report.

In the DACH region, VC invested around €16.5B in German startups. Outside of Germany, Austria also saw large fundraisers from digital investment platforms like Bitpanda and GoStudent.

France saw around €9.9B investment, boosted by the government to bolster its startup ecosystem.

Amsterdam continued to solidify its status as a VC powerhouse with massive rounds, including payments provider Mollie, e-bike brand VanMoof, and cloud communication company MessageBird.

In the Nordics, Sweden-based battery developer Northvolt completed 2021’s biggest round at €2.3B. Others, including Klarna, MessageBird, Celonis, Gorillas, and challenger bank N26, also secured considerable backing, notes the report.

In Central and Eastern Europe, Lithuania saw the biggest increase in capital invested this year, albeit from a low starting point — with an increase of 990% to €351.2 million, adds the report.

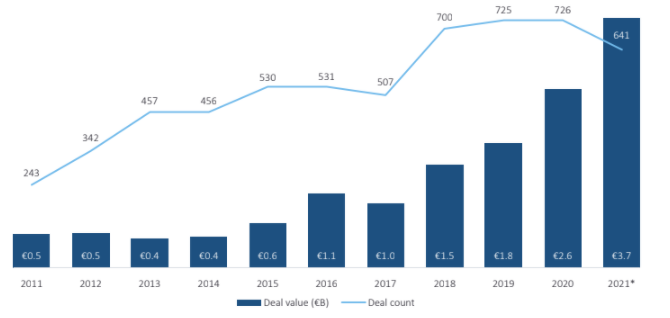

VC in Southern Europe

According to the report, the bulk of VC dealmaking in Southern Europe comes from Italy, Spain and Portugal. Deal value in the region reached a record €3.7B through Q3 2021, a 40.3 per cent uptick from 2020.

However, there are few large late-stage VC-backed companies in Southern Europe compared to other European regions, adds the report.

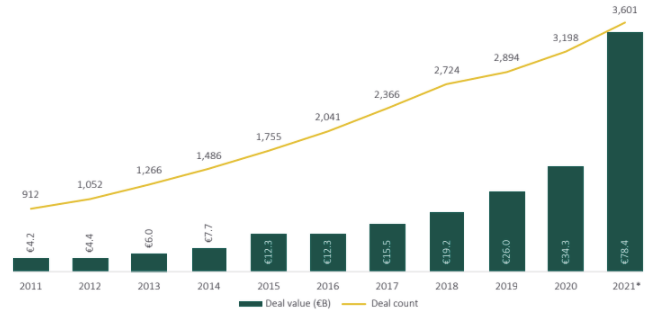

VC deal activity with non-traditional investor participation

Recently, non-traditional investors, including investment banks, PE firms, hedge funds, pension funds, sovereign wealth funds, and corporate VC (CVC) arms, have significantly increased their exposure to VC.

VC deal with non-traditional investor participation reached a record €78.4B.

The finding says that non-traditional investors have also been drawn to emerging startups for strategic partnerships and synergistic opportunities.

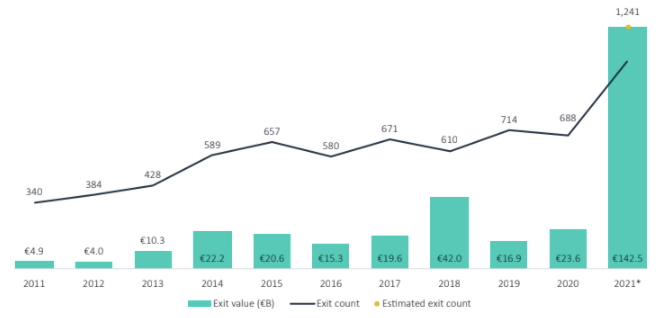

VC exit activity

In 2021, exit value spiked to a staggering €142.5B, more than triple the previous best set in 2018. According to the finding, a record number of companies exited in 2021, at 1,241, nearly double the quantity from 2020.

Some of the notable exits that helped generate record aggregate exit value in 2021 included the public listings of Sportradar, On, Wise, Deliveroo, and AUTO1 Group.

In 2021, a record 186 public listings of Europe-based companies took place, which generated an astounding €117.3B, nearly four times larger than the previous peak set in 2018.

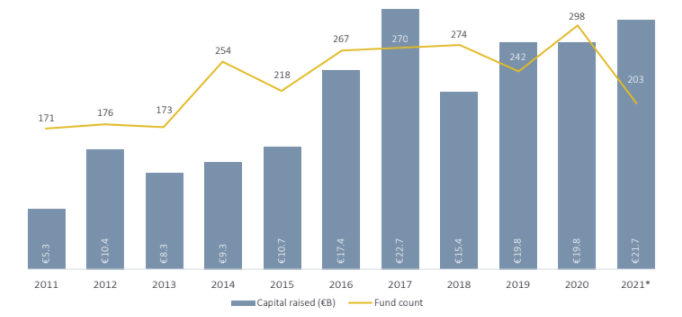

VC Fundraising activity

In 2021, 203 VC funds closed and raised €21.7B, representing a 31.9 per cent decline in fund count and a 10.1 per cent increase in capital raised from 2020 figures.

Capital raised reached the second-largest calendar year total, however, 2021 had the lowest VC fund count since 2013, adds the report.

Several established GPs (General Partnerships) closed a collection of outsized funds in 2021, including Index Ventures, which closed a €1.7B ($2B) growth-stage fund.

Further, notable fundraises include Cathay Innovation Fund II closing at €649.5M, Balderton Capital raising €519.6M for its latest fund, and Accel raising €539.1M for investments in Europe.

According to the report, the bulk of VC fundraising in 2021 took place in the UK & Ireland, DACH, and France & Benelux ecosystems. The three regions contributed €16.7B, equivalent to 76.6 per cent of the aggregate capital raised across Europe. The funds in the UK & Ireland led the way with €6.7B.

“Transitioning into 2022, we believe VC fundraising will increase in Europe. 2021 was a record year for exit value, and surplus liquidity has been delivered to LPs. As a result, we feel capital commitments will increase, and VC vehicles will expand in size, thus driving up overall fundraising totals,” says Nalin Patel.

How partnering up with Salesforce helped him succeed!