WRX token was Nischal Shetty’s brainchild, and is circulated over Binance blockchain

Currently, WRX has a market capitalisation of $92 Mn with over 10K account holders

WRX token delisting, trade volume decline likely if the uncertainty over WazirX ownership prevails

The legend has it that Nischal Shetty floated the idea of a native crypto token WRX in 2018 at the time of founding crypto exchange WazirX.

However, the Reserve Bank of India’s (RBI’s) virtual ban on cryptocurrencies in 2018, which was later overturned by the Supreme Court in 2020, led to a delay in the launch of WRX.

WRX, a native utility token of WazirX, was finally launched in February 2020. The idea was to serve as a backbone to the entire WazirX ecosystem. So far, it has more than delivered on its promise, WazirX’s website claims.

WazirX tried to get users to use WRX tokens by saying it could be exchanged with other cryptocurrency coins in near future and also by offering lower trading fees on the crypto exchange.

Almost a year after WazirX’s inception, its so-called acquisition by Binance was announced in November 2019. Three months later, the native cryptocurrency token WRX was launched on Binance blockchain at a value of $0.018 per token.

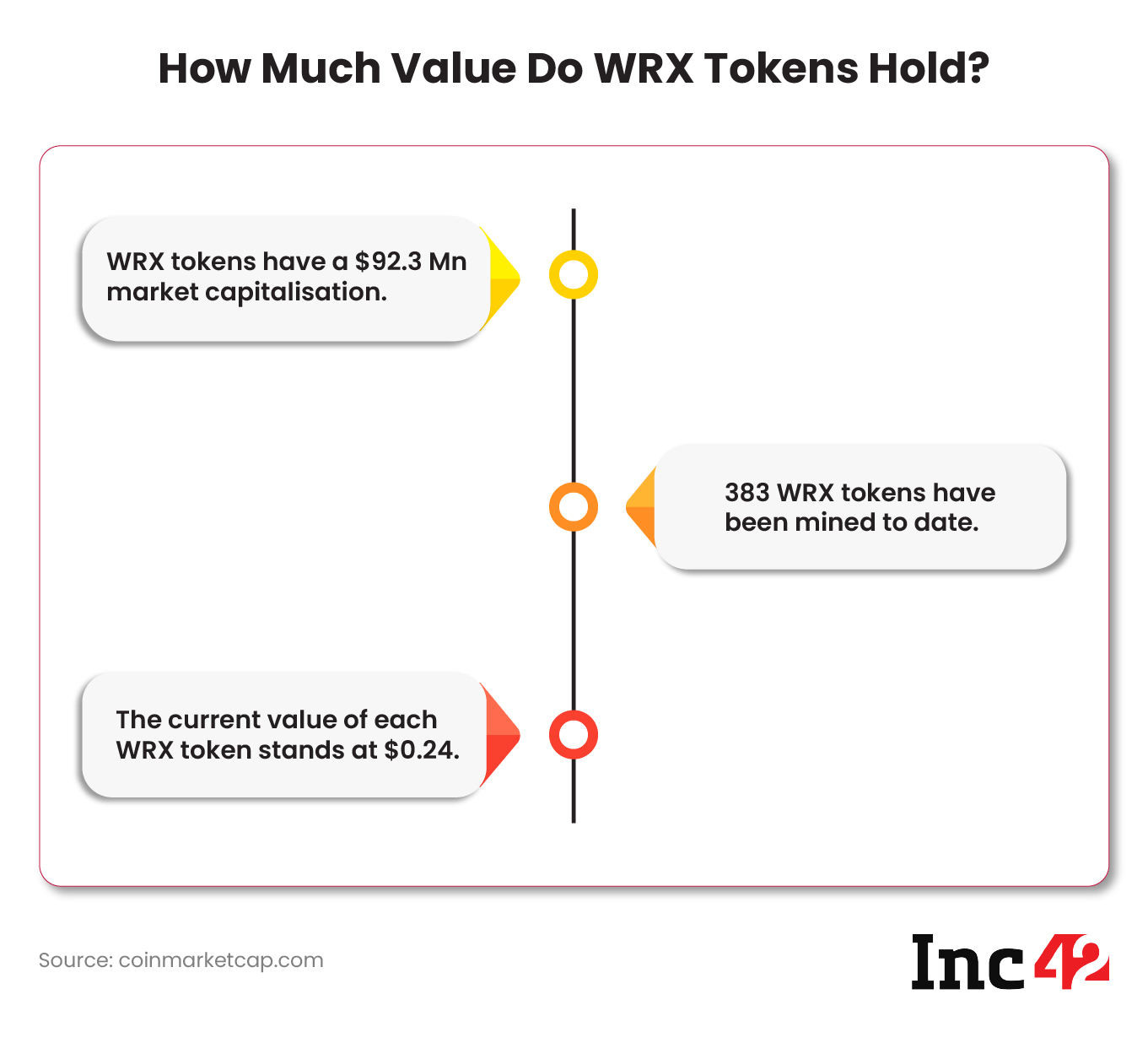

In the next two years (2020-2022), the WRX token’s valuation jumped by more than 1000%, crossing an all-time high value of $5 in 2021 and currently trading at $0.23 per token, as per data collated from coinmarketcap.com.

WRX tokens now command a valuation of above $92 Mn with over 10,000 account holders, official data from Binance suggests.

However, as the dispute over WazirX’s ownership refuses to settle down, a big question arises on the money which has been invested in the platform’s native token – WRX.

On its website, WazirX maintains that the discounts offered to those who buy WRX tokens are extended at differential rates for over four years.

“WRX token is an integral part of the WazirX exchange. As WazirX grows in popularity in India, an investment in the WRX token can hold potential, as you may guess. By purchasing the WRX tokens, you will have access to the core features of the WazirX exchange platform and even get an opportunity to reap higher profits when trading tokens,” shows the information available on WazirX website about the tokens.

There is also the inclusion of quarterly token burning. This process is made to ensure that its price doesn’t slip, it adds.

The users are also promised that they would get healthy returns, a good investment vehicle, unlock more tokens, and can buy NFTS through WRX tokens.

Industry insiders told Inc42 that soon after the announcement of acquisition of WazirX by Binance in 2019, Shetty and his team got seed funding from Binance to mine WRX tokens on the line of Binance tokens (BNB).

The mining of a cryptocurrency token involves using a decentralised network of computers to generate cryptocurrencies.

Being the product developer that Shetty is known to be, WRX was clearly his brainchild. Shetty is these days busy developing L-2 ethereum blockchain project, Shardeum.

WazirX, Binance Made Millions From WRX Token Sale

By now, everyone knows about the ugly fight that broke out between Binance CEO Changpeng Zhao and WazirX CEO Shetty over the last weekend on the ownership of the Indian crypto exchange. This has brought the spotlight on operational control as well as equity stake in WazirX.

Amidst the Enforcement Directorate’s (ED’s) crackdown on WazirX, Binance is clearly trying to distance itself from the exchange, saying it never acquired the exchange and has no control over its operations. Shetty, meanwhile, has maintained that Binance has control over WazirX’s assets, technology and profit.

Shetty told Inc42 that Binance also has the ownership and operational control of WRX tokens. We have reached out to Binance on the matter, and the story will be updated as and when it responds.

Inc42 traced the link on various exchanges for ownership of WRX tokens. The link redirects to Binance (BNB) chain address, which conveys that there are 334.98 WRX tokens in supply with a total value of $78.8.

It further mentions that 0.4 Mn transactions involving WRX have been done so far, whereas there are 10,801 addresses that hold these tokens currently.

In fact, Binance held the initial exchange offering (IEO) of WRX on February 3-4, 2020. An IEO is the crypto equivalent of an initial public offering (IPO) and involves public and private sale of a particular token.

As per a public announcement made by Binance and WazirX in 2020, $200 Mn was raised through the sale of 10 Mn WRX tokens by means of a lottery system at the rate of $0.018 per WRX token. The token value rallied 700% post the IEO to touch a high of $0.144.

The crypto bull market led to further increase in the price of WRX tokens. It touched a value of $5 in 2021, giving good returns to investors.

As per estimates from coinmarketcap.com, WRX tokens currently have a market value of $92.3 Mn and are trading at $0.24.

Can Binance Delist WRX?

However, the current ownership battle about WazirX can hit not only the crypto exchange but also WRX tokens. Binance has the authority and even the reasons to delist WRX token.

According to various media reports, Binance CEO earlier stated that the exchange would delist low-volume crypto tokens. The largest global crypto exchange had said that there is a probability of delisting those coins where the daily trading volume is 10 BTC or less.

The recent turn of events around WazirX doesn’t augur well for WRX’s valuation as well as trading volume.

“The negative news, tussle over ownership, etc., may drag down the valuation of WRX, however I don’t see any immediate dumping of this coin since the holders had bought it at much higher value than the existing rate. So massive sell-offs are unlikely. It is already a bear market and hence we haven’t witnessed dumping as such. However, if there are more regulatory pressures around WazirX in India and uncertainty over its future, selloffs could happen,” Aditya Singh, cofounder of Cryptoo India, told Inc42.

The major impact, according to Singh, could be around usability/ features and other offerings that a coin like WRX offers.

Another crypto startup founder said, “Some of the major benefits users were offered with the purchase of WRX token were discount fees and access to key features on WazirX platform. With WazirX impacted, it is going to be very difficult to hold the users attracted to WRX coins in the absence of new features. In virtual tokens, usability and the features of an asset leads to its demand and even longevity,” a crypto startup founder commented.

A probable valuation decline and daily trading volume drop could thereby necessitate Binance to delist WRX. But it isn’t that simple for two reasons:

- Binance could be holding the majority of WRX tokens

- There is public money involved in WRX tokens and the company wouldn’t want to look bad to the Indian government/ regulators.

Certain crypto experts and founders, however, believe that delisting WRX could mean a wealth erosion for Binance too. Since the global exchange, in all likelihood, holds the majority of these tokens, its delisting may not happen immediately.

Although Binance may give some time limit to WRX holders for withdrawals or transfer to other cryptocurrencies, this also wouldn’t go down well with the crypto community given the bull run the market is in. Besides, this can also end up upsetting the Indian government more with public money involved – something Binance wouldn’t want to happen.

“But given the unprecedented turn of events where even a major acquisition was denied sometime back, we cannot even rule out delisting,” a popular crypto influencer said on condition of anonymity.

For now, all eyes are on WazirX and Binance and their ability (or inability) to put the public spat behind to salvage WazirX and WRX tokens. Besides, they would also have to fend off the ED’s investigation, which, as per sources, will intensify in future given the serious money laundering allegations.