The year 2021 has certainly been a momentous period for the Indian startup ecosystem after a very challenging 2020 but now there is renewed hope that this bull run will continue in 2022.

The key highlight of 2021 was certainly the billions of dollars which flowed into the Indian startups and this figure is expected to be north of $30 billion for the year.

The resultant impact of this fund inflow was the emergence of unicorns – startups valued at $1 billion and above – with the total number standing at 44.

Hopes are now riding high that the momentum seen in 2021 will continue into 2022 as there is a positive sentiment about the Indian startup ecosystem. Besides, the capital there are also very promising startups emerging almost on a daily basis.

The year 2022 has cemented the position of digitisation in the Indian economy and its reach is only expected to get bigger and wider where the benefits would start to accrue beyond the metro cities. This is the opportunity that startups seem to target.

The last week of December saw a total fund inflow of $323 million across 17 deals. The highlight during this period was the two more addition into the unicorn club in the form of GlobalBees and Mamaearth.

There was hardly a dull week in 2021 whether in terms of fund inflow, the emergence of unicorns, or M&A deals. The expectation is that this would continue even in 2022.

Deals of the week

Ecommerce roll-up company GlobalBees raised $111.5 million from Premji Invest, Steadview Capital, SoftBank and FirstCry at a valuation of $1.1 billion.

Neobank startup Jupiter raised $86.6 million from Tiger Global, Sequoia Capital, QED Investors, Matrix Partners and others.

Fintech startup FLP Technologies raised close to $76 million from QED Fund, Ocean View Investment, Sequoia India and others.

D2C brand Mamaearth raised around $37.5 million in its latest funding round led by Sequoia and others at a unicorn valuation.

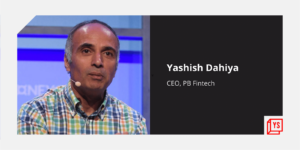

Insuretech startup SecureNow raised $6 million led by Apis Insurtech Fund I, managed by Apis Partners LLP.

Mensa Brands, the Thrasio-like startup acquired High Star, a digital first denim brand from India for an undisclosed amount.

![You are currently viewing [Weekly Funding Roundup Dec 25-31] Strong ending for 2021 raises expectations for 2022](https://blog.digitalsevaa.com/wp-content/uploads/2021/12/weekly-funding-roundup-1640354161359.png)