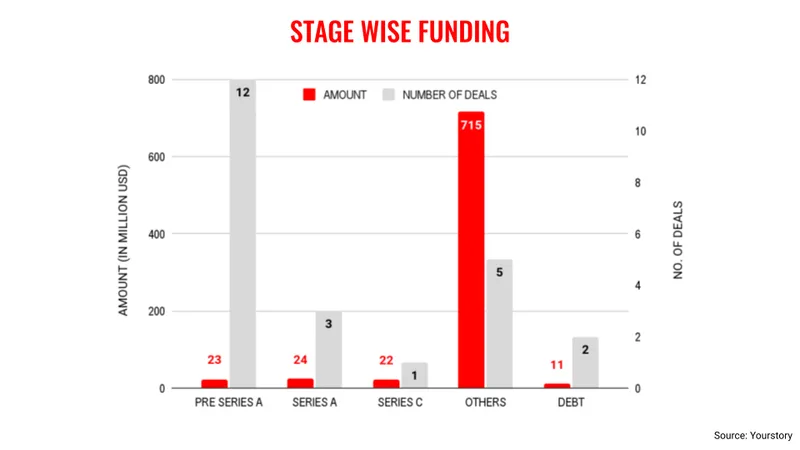

The third week of March saw a sharp rise in venture funding in the Indian startup ecosystem largely thanks to unicorns that drew in venture capital. This underlines the trend of strong companies continuing to fetch investor backing in the midst of a funding slowdown and an unfavourable macroeconomic environment.

The omnichannel eyewear retailer Lenskart and fintech company PhonePe raised $500 million and $200 million, respectively, from overseas investors. These transactions helped take the total venture funding for the week to $794 million as compared to $185 million in the previous week.

However, this sharp rise in venture funding needs to be tempered with the not-so-encouraging news coming from the global venture funding ecosystem. Y Combinator, the famed platform for early-stage startup investment, has said that it would dial down on late-stage funding of these young companies.

In a similar vein, a report from The Wall Street Journal noted that Tiger Global has marked down its last year’s venture investments by 33%. An important player in the VC industry, Tiger Global’s development does not bode well for the startup ecosystem.

These developments put a dampener on any hopes of a quick revival of venture funding inflow into startups in 2023 as there was an expectation that the second half of the year might see some uptick.

Key transactions

Fintech company PhonePe raised an additional $200 million in primary funding from Walmart at a pre-money valuation of $12 billion.

Direct-to-consumer (D2C) brand The Ayurveda Co raised $12.2 million in a Series A round led by Sixth Sense Ventures.

Bengaluru-headquartered HealthPlix Technologies raised $22 million in a Series C funding round led by Avataar Venture Partners and SIG Venture Capital.

Gynoveda, a femtech platform, raised $10 million from India Alternative Fund, RPG Ventures, Wipro Enterprises, Alteria Capital, and Fireside Ventures.

B2B marketplace Jumbotail raised Rs 75 crore ($9 million approx) from Alteria Capital and Innoven Capital in a venture debt funding round.

Solartech platform Aerem raised $5 million from Avaana Capital, Blume Ventures, and other financial institutions.

Gaming platform BuyStars raised $5 million from Lumikai, Chiratae, and Leo Capital.

![You are currently viewing [Weekly funding roundup March 13-17] VC investments into unicorns give boost](https://blog.digitalsevaa.com/wp-content/uploads/2022/12/Weekly-funding-roundup-1670592545805.png)

![Read more about the article [Funding alert] Vernacular short news app Way2News raises $16.75 M in Series A led by WestBridge Capital](https://blog.digitalsevaa.com/wp-content/uploads/2022/06/way2news1-1654767001335-300x150.png)