With many of the earliest fintech startups going the IPO way, it’s a validation of the strong business models that are enthusing smaller fintech companies

For an early-stage fintech startup, it is heartening to see that the naysayers have been proven wrong based on the upcoming IPOs of fintech unicorns like Paytm, PolicyBazaar and Mobikwik

The strength of the business model can be seen if we go deep into the size of the opportunity, the distribution advantage gained, stickiness with customers and ability to scale into new segments

Any business is built around trust, but for financial services and fintech startups, it is the most important aspect. A decade ago, when “Fintech” was emerging as a category there were a lot of questions and dismissals from naysayers, in fact, many skeptics voice the same concerns today:

- Only a small portion of India is bankable, what niche will you go after?

- Why will customers trust you?

- Online transaction adoption will be low for these segments.

- Loss-making companies won’t survive, how will you monetise?

- Building a brand is very difficult!

- Will multiple start-ups survive?

- Regulators will favour large incumbents.

For an early-stage fintech like mine, it is heartening to see that the naysayers have been proven wrong based on the upcoming IPOs of fintech unicorns like Paytm, PolicyBazaar and Mobikwik. While skeptics will say that these companies remain unprofitable, they would be missing the point.

The strength of the business model can be seen if we go deep into the size of the opportunity, the distribution advantage gained, stickiness with customers and ability to scale into new segments. DRHPs of these companies help us answer the questions regarding their business models.

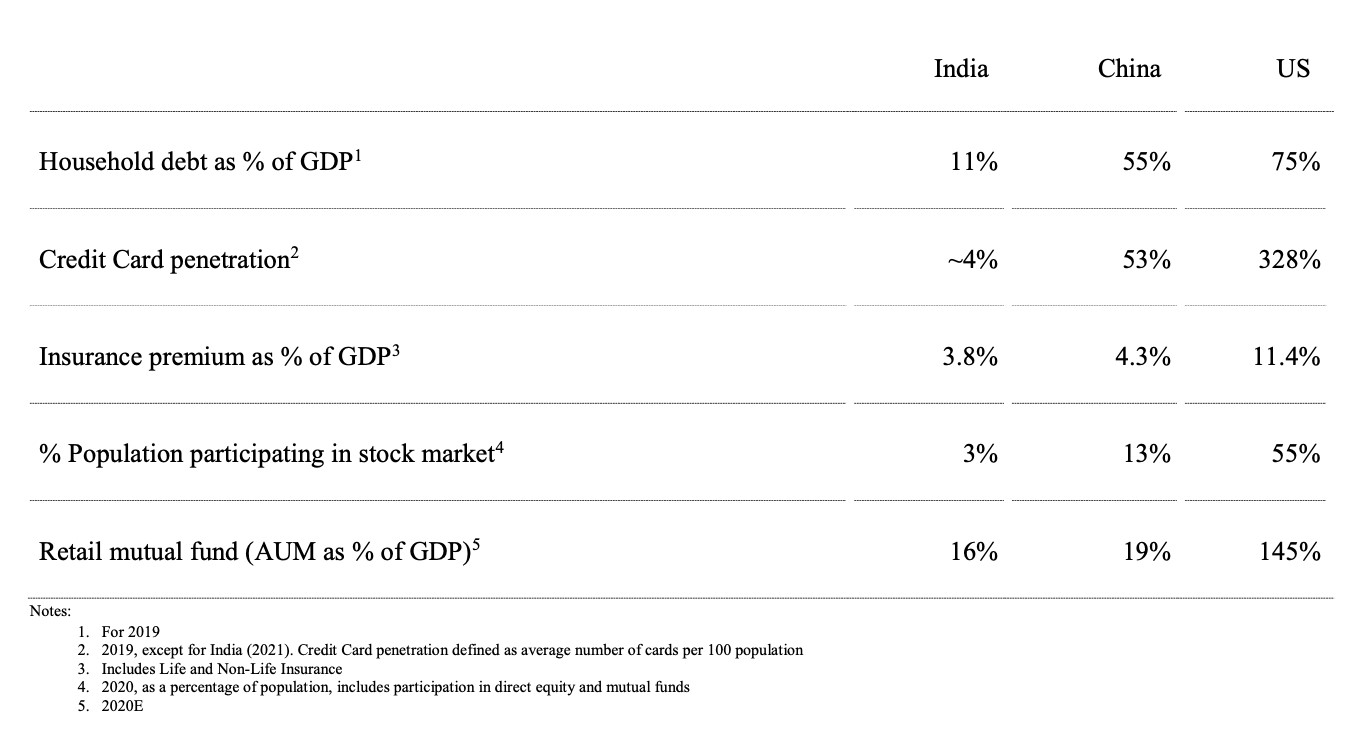

Only A Small Portion Of India Is Bankable, What Niche Will You Go After?

The most important takeaway is that the Indian market is enormous and yet massively underserved despite all the action in fintech and financial inclusion. Most of these are well known but the level of under penetration surprises and motivates me every time I read it!

Why Will Customers Trust You?

Hundreds of millions of underserved consumers and businesses have been looking for solutions that simplify their finances while traditional financial institutions haven’t wanted to or been able to deliver to their needs. For example, UPI and wallets have transformed the payments ecosystem.

One of the superpowers of fintech startups has been their ability to deliver a superior customer experience. While initial adoption was driven by cashbacks and freebies, those have quickly tapered off. Today, rarely do consumers go to their bank apps or websites for payments. Putting the user at the centre has helped fintech startups win and retain the customers’ trust.

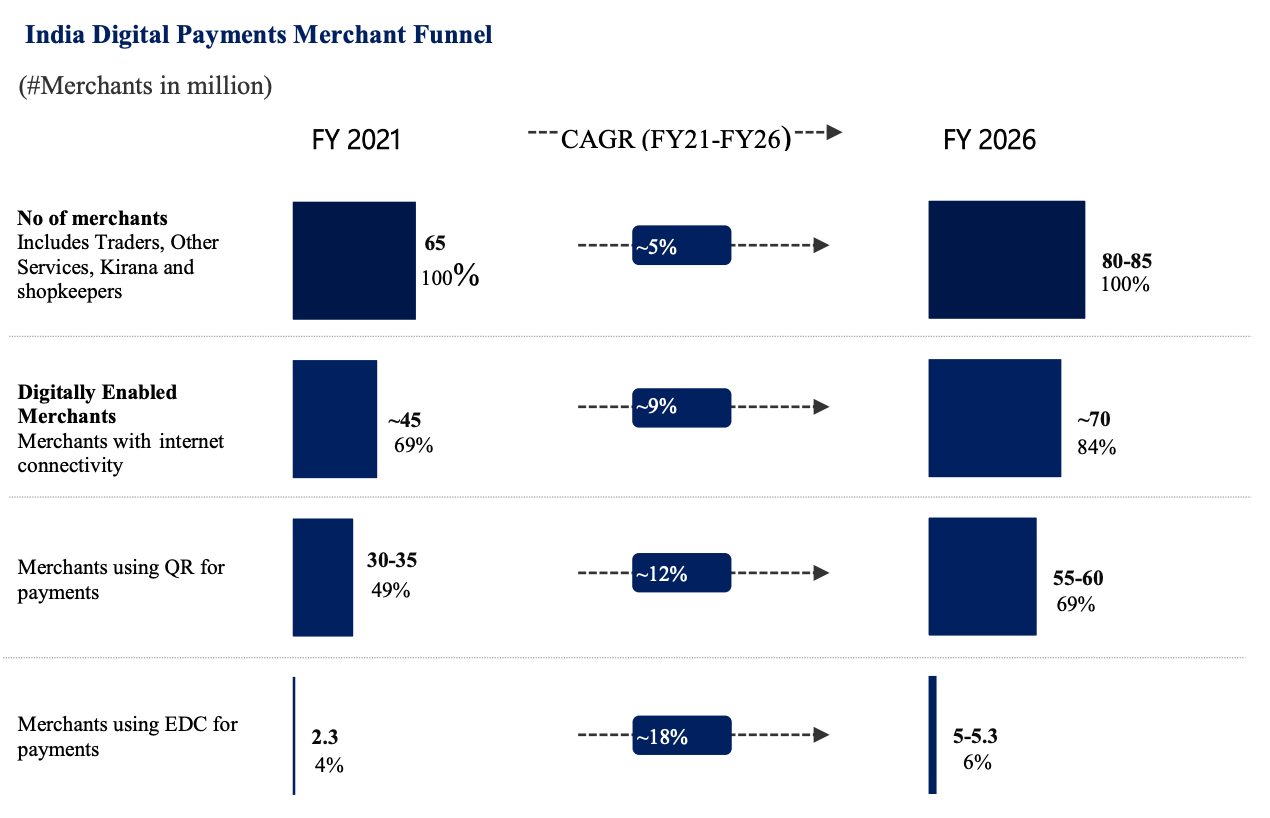

Online Transaction Adoption Will Be Low For These Segments

As seen below nearly 70% of Indian merchants are rapidly adopting digital payment technologies.

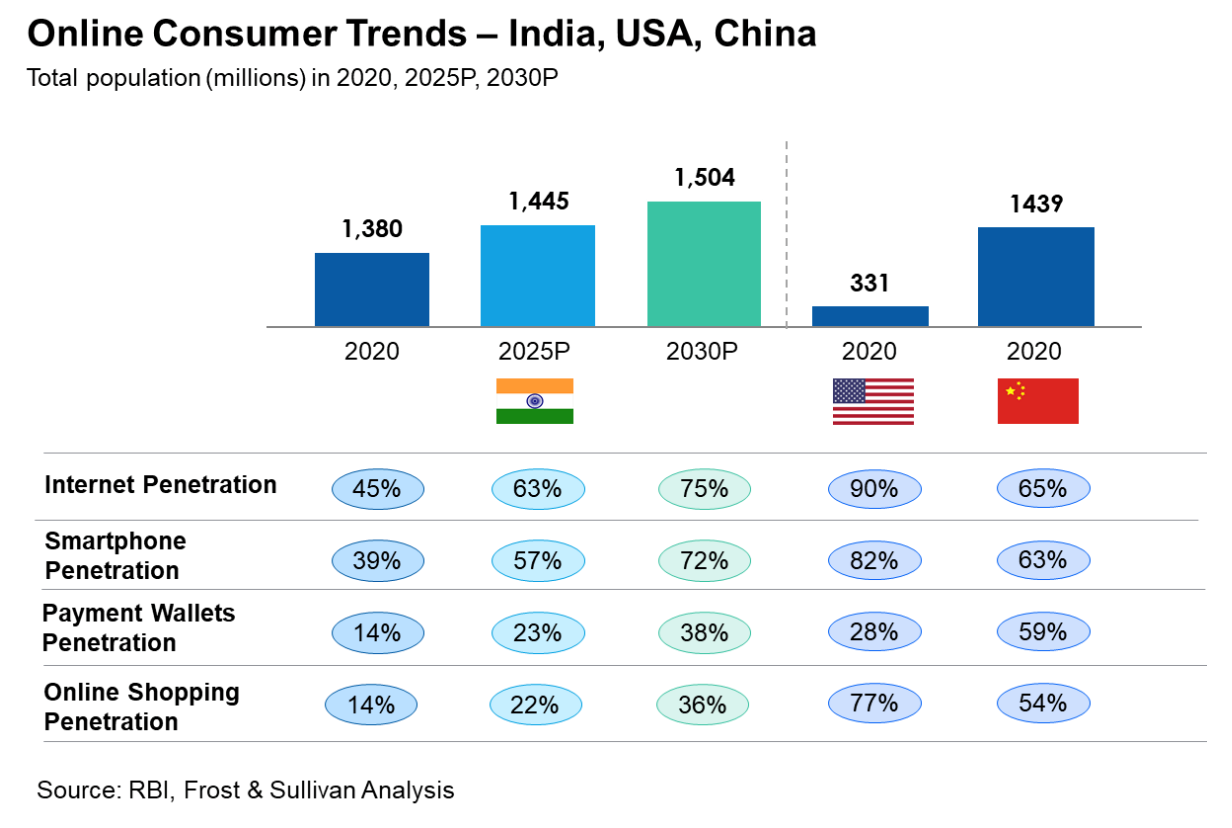

Consumer adoption of online transactions is also expected to gather pace due to the covid-19 pandemic.

Loss-Making Companies Won’t Survive, How Will You Monetise?

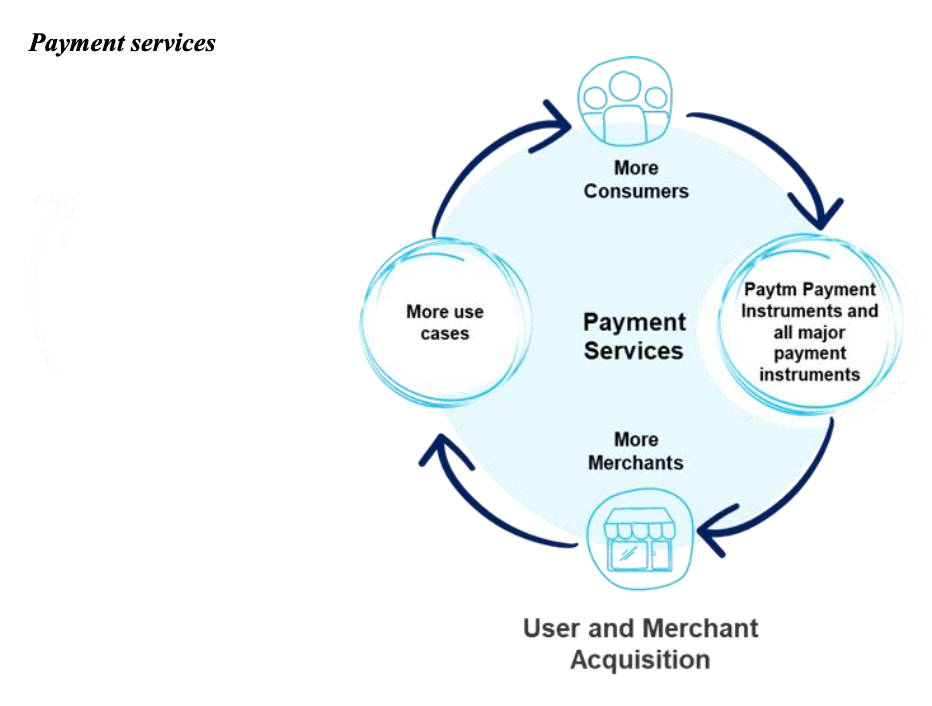

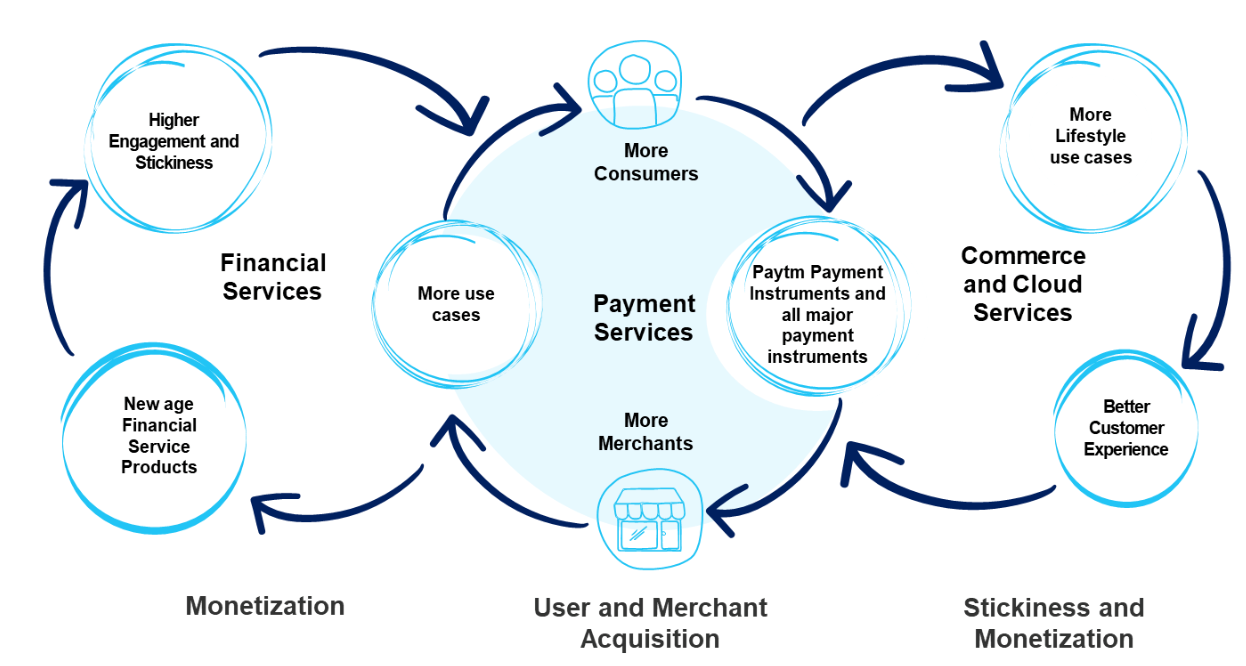

The IPO bound fintech companies have shown that monetisation and profitability will come once competitive advantages are built around distribution. For example, Paytm started off as a payments provider and built a flywheel around the merchants and customers as seen below:

But as they have scaled, they have been able to build multiple businesses and found new ways to monetise, similar to Amazon.

Building A Brand Is Very Difficult!

It takes years of blood, sweat and tears to build a brand but entrepreneurs have proven that it can be done! This excerpt from Policybazaar’s DRHP says it all:

“The strength of our brands is also reflected in the fact that in Fiscal 2021, 83.0% of the policies sold on Policybazaar and 66.0% of loans originated on Paisabazaar were to Consumers who came to our platform directly or through direct online brand searches.”

Moreover, anecdotal evidence indicates that traditional financial institutions and their branches are intimidating for customers from lower-income segments. Hence upcoming fintech startups have an opportunity to build brands that are approachable for underserved segments.

Will Multiple Startups Survive?

Similar to the microfinance industry where thousands of lenders have thrived despite shocks like the Andhra Pradesh crisis and demonetisation, I believe that many fintech startups will co-exist. Case in point are the upcoming IPOs of Mobikwik and Paytm, both competing head-on within the payments space.

Newer startups have seen the opportunity set grow as large banks and incumbents are recognising that they would be better off collaborating with nimble start-ups to reach new segments.

Fintech startups just need to focus on delivering the best customer experience and target the millions of Indians and tune out the noise about the competition.

Regulators Will Favour The Large Incumbents

The RBI is closely monitoring the quality of technology and data security at banks as demonstrated by the bans on HDFC Bank and American Express. In my view, these are clear signs that the changing regulatory environment will favour companies based on their technological prowess. Shortlisting Flipkart Co-Founder, Sachin Bansal’s venture as a candidate for a Universal Bank license is another sign that the RBI might favour fintech startups.

The upcoming fintech IPOs have allayed the concerns of naysayers and validated that swathe of underserved Indians are waiting for better financial solutions. Technology-driven fintech startups are best positioned to capture these opportunities due to their focus on customer experience and the emergence of an ecosystem where large incumbents are looking to partner with fintech companies while the regulators are keen to encourage more competition.

The best is yet to come for fintech startups and I am glad to be a part of it!