A business idea started forming in Kolkata-based Anisha Agarwal’s head when she scoured supermarket shelves and was unable to find a pre-swim skin cream.

The avid swimmer began thinking. “This was not a personal problem. I would hear from others as well on their inability to source products to protect them from the post-swim tan. The only option was to apply oil and no one really likes that,” says Anisha, Co-founder of Dot & Key, a direct-to-consumer skincare brand, run by Dot & Key Wellness Pvt. Ltd.

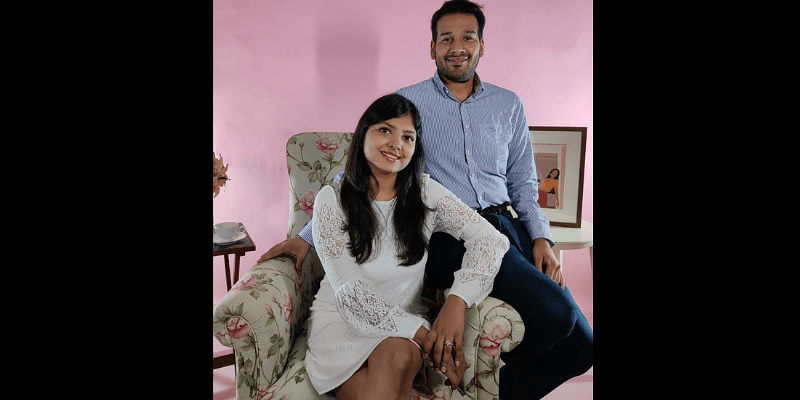

Hailing from a business family, she put her thinking cap on and researched the idea for a year before deciding to do something about it. She and her husband, Suyash Saraf, then started working on various products, distributed surveys and sample products among friends and family, and launched the brand after eight months.

The couple, who looked after their family’s real estate business, bootstrapped the beauty brand with an investment of approximately Rs 3 crore.

The website went live in 2018, with a pre-swim cream among 16 other products. Since then, the D2C brand has ventured into other SKUS, including clay masks, face serums, underarm colour correction cream, and sleep masks.

Currently, products across six categories are listed on the website.

“We don’t classify our products into categories because we create them depending on people’s needs, which are usually quite niche. Mass consumers might not demand a pre-swim product, but a few others would,” Anisha says.

One of Dot & Key’s night cream variants

In the beginning

Kolkata-based Dot & Key began by collaborating with third-party manufacturers to produce close to 2,500 units. Currently, they sell 80,000-1 lakh units every month on their website, and other online marketplaces such as Nykaa and Amazon. Dot & Key claims to have at least five lakh customers at present, having grown from 15,000-20,000 customers during the first year of business.

The firm currently has a team of more than 45 employees.

During the pandemic, many D2C brands saw a major spike in their orders and revenues as people stuck at home had no option but to order online. Sector leaders saw improved bottom lines, including cosmetic brand Sugar, which saw its highest sales in November 2020, and D2C baby and mother care brand MamaEarth, which reached a valuation of $300 million after reaching a revenue run rate of Rs 700 crore.

But Dot & Key, being a small business, did not see such tremendous growth. However, units sold grew more than 30X in three years. The brand also launched 12 new products in March 2020 and is working on introducing at least 50 new SKUs in the next six to eight months, according to the founders. These products will be launched in mass categories, including hair care, body care, skincare, and nutraceutical supplements.

Dot & Key’s vitamin C range

An eye on the future

According to Research and Markets’ Skin Care Market in India 2020 report, the skincare products market was valued at Rs 129.76 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of ~8.22 percent during the 2021-2025 period, to reach a value of Rs 191.09 billion by 2025.

But despite the growth, more than 90 percent of products are still sold through general and modern retail stores. Online shopping for skincare is still a nascent market in India and any brand will need to expand its retail presence to grow beyond a point.

Dot & Key is also looking to do the same.

Its products, which retail between Rs 395 and Rs 1,500, are considered “slightly premium for those [Tier II and III] markets”. However, the company plans to reduce the price points by launching smaller variants of existing SKUs.

“One of the biggest challenges for us is that any player, with some scale in the market, can replicate our popular products,” Suyash says.

The brand, which competes with other D2C skincare brands, including Sequoia India-backed Mamaearth, Kerala-based Juicy Chemistry, and Chrys Capital-backed Wow Skin Sciences, will have to find a way to keep launching unique products, lower customer acquisition costs, and grow its customer base.

The skincare brand, which has mainly serviced consumers in metro cities till now, is looking to attract buyers from Tier II and III cities by entering 600 stores across 14 cities. These would be majorly through partnerships with modern trade retail stores and a few organised pharmacy chains.

“Selling online is good and we are seeing good volumes. But if we really have to scale our brand then we need to go into retail stores, where people can explore, touch, and feel our product,” Anisha says.

![Read more about the article [Weekly funding roundup March 14-18] Steep decline in venture capital inflow into Indian startups](https://blog.digitalsevaa.com/wp-content/uploads/2022/03/funding-roundup-1-1639749230575-300x150.png)