Scaling your business can involve a number of strategies that can work to your company’s benefit, but one of the most sustainable ways of doing so is through diversification of the services you offer.

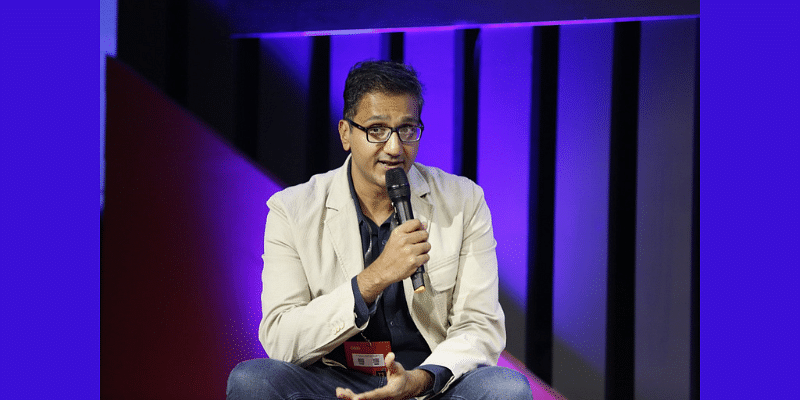

At a fireside chat on ‘Is diversity the name of the game in fintech now?’ at TechSparks 2022, Razorpay CBO Rahul Kothari spoke about the company’s diverse portfolio of services and how it helped the company grow into one of the country’s leading digital payments platforms.

Mapping the explosive growth of Razorpay

Starting as a payments platform eight years ago to help startups and small businesses with online payments, Rahul said that as their merchant partners grew, Razorpay understood their growing financial services needs as well. “We started by providing online payment services for businesses, but [merchants] don’t think of payments in isolation. They also think about managing their money better: they have to invest it, disburse it, pay their vendors, sometimes they have capital requirements, and need to pay their employees. As we saw all these different requirements of businesses, we also grew our entire strategy from being a payments company to being a one stack platform for end-to-end money movement for businesses,” Rahul explained.

The company then expanded into other financial service verticals such as payroll and credit options. Gaining the trust of merchants through their base digital payments platform, Razorpay was able to onboard the same merchants for their other products as well. Rahul said, “Since we had a strong captive base of merchants we could have adjacent products to payments which could add value to their business. That’s how our corporate cards and payroll products evolved, and now we have more than one hero product on our platform.”

Diversification is key

The need to diversify itself was more of a need than a want for Razorpay, especially in a country like India where markets for tech products are not deep. Building up adjacent products was a natural step for scaling Razorpay.

“While individual products can become multi-billion dollar businesses in developed economies, it’s extremely important to build multiple products here in India where markets are not so deep. We have to make them adjacent to each other and sell in the right way to have more value for the customers, to build strong businesses,” Rahul said, adding that Razorpay’s payroll and corporate credit card services were their fastest growing products at the moment.

Expanding to other global markets, Razorpay was able to build a similar product stack for the Southeast Asia region by making sure their product is localised for each geography, Rahul explained.

Rahul also added that diversification and becoming omnichannel was the way forward for digital payments companies. “We’re now reaching a convergence or an inflection point where omnichannel (payments) will become a reality for a few reasons: One, the customer awareness while making a purchasing decision is much higher and their behaviour has changed significantly. For example, you may have rewards or discounts to utilise online, and you’d expect those rewards at offline stores as well. Secondly, UPI has played a big role in having a presence in the online and offline space,” he mentioned.

Social:

1. From a simple digital payments platform to having multiple financial service offerings, Rahul Kothari, CBO, Razorpay said that diversification was key to the company’s success. Read more from his session at #TechSparks2022 here:

2. Diversifying your service offerings is one of the most sustainable ways to scale, Rahul Kothari, CBO, Razorpay said in a fireside chat at #TechSparks2022. Read more from his insightful session here:

Newsletter:

From a simple digital payments platform to having multiple financial service offerings, Rahul Kothari, CBO, Razorpay said that diversification was key to the company’s success. In a fireside chat at TechSparks 2022, Rahul explained how companies– especially those in the fintech space – should diversify their offerings to survive and scale in India.