The beauty and personal care product market in India is currently valued at $26.8 Bn and is poised to reach $37.2 Bn by 2025

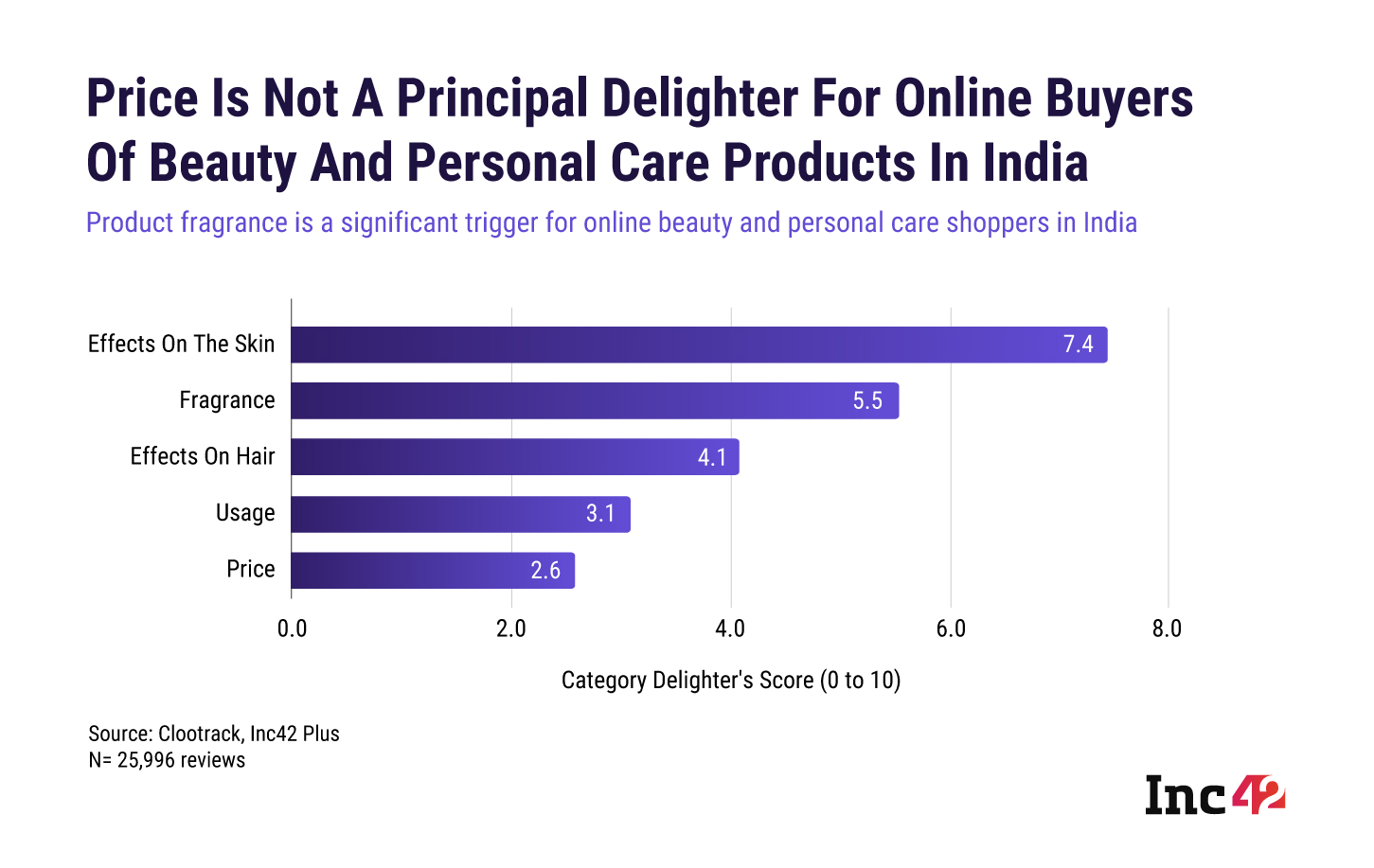

Price is not an essential delighter for online buyers of beauty and personal care brands in India

The number of online beauty shoppers in India is expected to cross 122 Mn by FY25

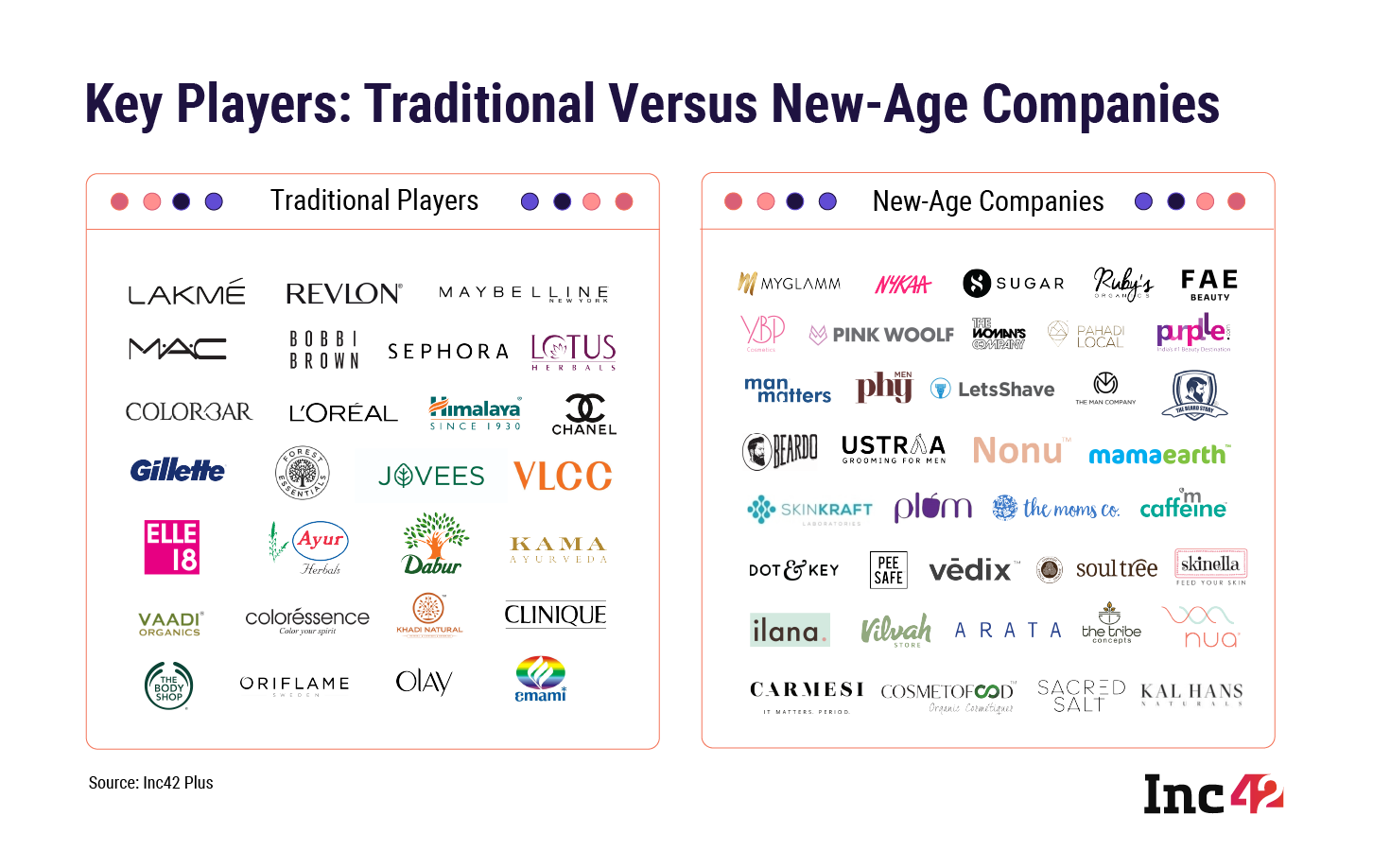

The beauty and personal care market is one of India’s fastest-growing segments, driven by many market triggers and lifestyle changes. Traditionally controlled by legacy brands, the industry is now witnessing a boom due to changing perceptions, growing awareness about natural ingredients/chemical-free products, and most importantly, the rise of direct-to-consumer (D2C) companies making waves in the online retail space.

The outbreak of the Covid-19 pandemic drove online discovery and sales of this new crop of beauty brands after the brick-and-mortar boundaries of retail were demolished by frequent shutdowns of supermarkets, hypermarkets, department stores, salons and the like. For the first time, ecommerce shot to the top of the glitzy beauty business pyramid and saw the highest growth in product distribution share as customers valued the convenience and safety of online shopping and home delivery.

The online beauty and personal care market is estimated to reach $5.6 Bn by 2025, according to a recent study by Inc42 Plus, titled D2C Beauty & Personal Care In India: Customer Perception Report, 2021.

What Is Driving The Purchase Decision Of Online Beauty And Personal Care Shoppers In India?

Multiple factors are at play when a consumer decides to buy a product online. So, it is essential to map customer perceptions to understand the most crucial reasons behind the purchase.

Inc42, in collaboration with Clootrack, has analysed 25,996 online product reviews posted by the buyers of beauty and personal care products in India to identify the critical delight drivers, or the stimuli, that trigger an online purchase.

Among the key delighters that drive the online purchase of a beauty and personal care brand, effects on the skin and product fragrance matter most to online shoppers. As new-age customers are more knowledgeable, a product’s effects on the skin (the top delighter) is a major concern for people looking to buy beauty and personal care items. That is why many D2C brands in the beauty and personal care space focus on providing a wide range of products with natural ingredients and ensure that these are certified organic products, toxin-free and chemical-free. Although most companies are price-conscious, it is not a priority among online shoppers who buy beauty and personal care products.

Which D2C Beauty And Personal Care Brands Are India’s Favorites?

India is home to many D2C beauty brands, and quite a few of them, including mCaffeine, Khadi Essentials, Arata, SUGAR, WOW Skin Science, Plum Goodness, Nua, My Carmesi, Pee Safe, PeeBuddy, The Man Company, Beardo and The Moms Co., have emerged as major players in the online beauty and personal care space. Although traditional players still dominate the overall market, new-age D2C companies are giving them a run for their money.

For instance, popular beauty brands such as Revlon and Lotus took around 20 years to reach the INR 100 Cr revenue mark, but new-age brands Mamaearth and SUGAR took four and eight years, respectively, to reach that milestone. Realising the potential of the D2C model, legacy firms Emami and Marico have already invested in new-age players The Man Company and Beardo, respectively.

To know which Indian beauty and personal care startups are winning the perception war and access critical insights into the Indian market, including market size, the competitive scenario and key factors driving purchasing decisions online, download the full report here