Ecommerce platform was among the early crop of online businesses, and it has seen it all.

The platform, founded by Kunal Bahl and Rohit Bansal, started as a deals platform in February 2010, before moving to an ecommerce marketplace model.

After riding out multiple pivots from a pure-play marketplace, leveraging payments through , and Snapdeal 2.0 in 2017, the company’s latest focus is creating mass brands in fashion and lifestyle for the value-conscious customer.

The House of Brands strategy adopted by Snapdeal found a mention in its December 2021 Draft Red Herring Prospectus under the head of Power Brands.

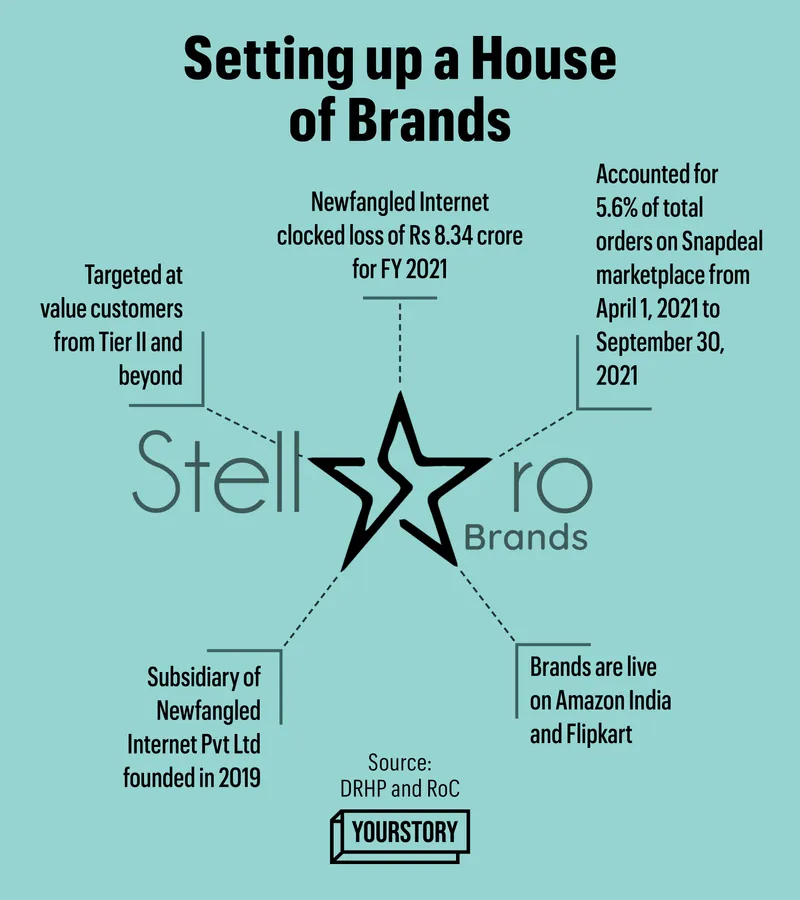

While Snapdeal has shelved its Rs 1,250 crore IPO plans, owing to macroeconomic conditions, it is hoping to grow its portfolio of mass brands under the subsidiary—Stellaro—to touch break even.

At present, Snapdeal Limited’s businesses include the core marketplace business and two subsidiaries—cloud-based ecommerce enabler Unicommerce eSolution and Newfangled Internet that houses Stellaro and its portfolio brands.

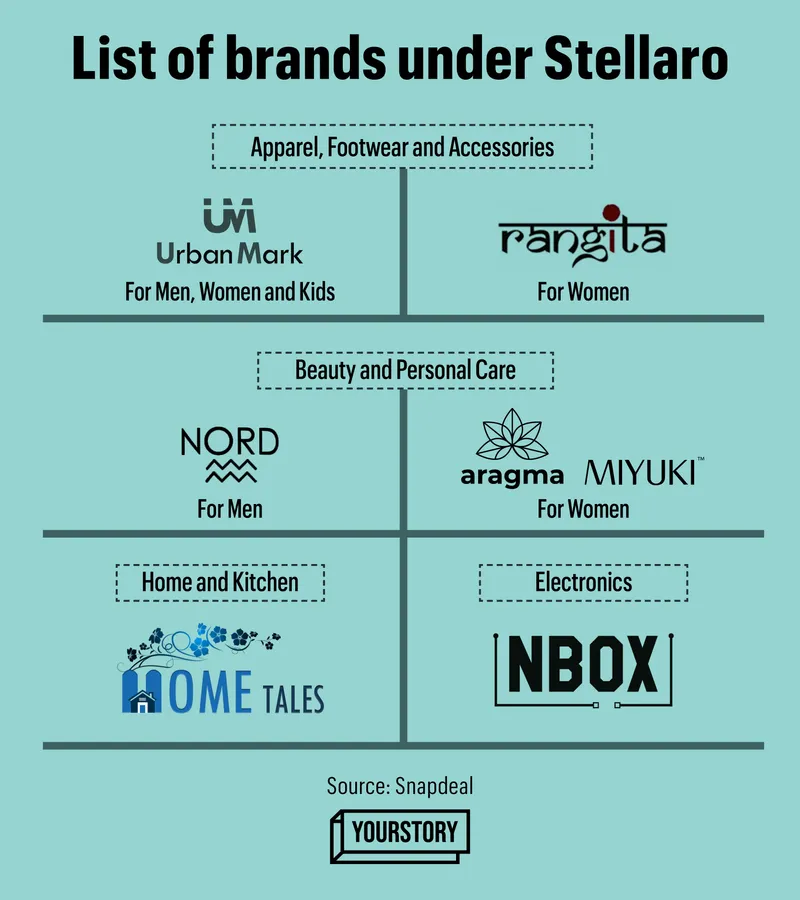

“We decided to focus on three distinct things—first was to operate in the lifestyle segment across fashion, footwear, accessories, beauty and personal care, and home categories,” says Himanshu Chakrawarti, President at Snapdeal.

“The second was to focus on the value segment, and the third was to create a curated marketplace,” Himanshu adds, who joined Snapdeal in November 2021 to make the entity public-market ready.

Since its inception nearly three years ago, Stellaro has stacked up a portfolio of eight brands. The number was 13 when Snapdeal filed its DRHP last year, which made up for nearly 5.6% of its total orders on the platform between April 2021 and September 2021. Over the last year, some of the brands have been consolidated.

Creating differentiation

Snapdeal hopes that besides driving better margins through these brands, it will also help create differentiation in the market for its buyers from Tier II and beyond.

“We had to take a call on what we will do and what we won’t do. It is very tempting for us as we have a history of people looking to purchase everything on the site. We asked ourselves whether we are solving a problem or are we another player in the market,” says Himanshu.

The company had been the number three ecommerce player for some time as it competed with Amazon and Flipkart before the rejig. According to Himanshu, the player with the cheapest offerings or the fastest speed of delivery is likely to do well.

In its current avatar, Snapdeal wants to be a platform for value shoppers, capping its price range between Rs 299 and Rs 999 across specific categories. It has also stayed away from low-margin businesses, including grocery, electronics, and white goods.

“Another lens to look at this is disintermediation,” says Himanshu, adding that the lifestyle and home categories fetch higher margins.

Stellaro has a 14-member team from a retail background with prior experience building mass brands such as Max, Pantaloons, and others.

Before joining Snapdeal, Himanshu served as the CEO of Arvind Fashion’s value retail store chain, UNLIMITED, later sold to V-Mart.

Brands under Stellaro

Not a private label

Snapdeal licenses its brands under Stellaro to select sellers who are required to comply with brand standards, and the company holds the brand rights and IP. Creating these brands is central to ensuring repeat customers for the assured quality and fit.

Himanshu says that the business is different from private labels floated by ecommerce marketplaces to create brands, which give them high margins. “Private labels have failed. If you ask a seller on your platform for a brand name on his products, there is no value-add and nothing changes. That is what a lot of platforms have done.”

He adds that Stellaro’s brands are created to address specific gaps in the market, including the price range, number of lines, supply, design language, and other specifics.

Cleaning the house

The focus on curation and sustained quality has also meant cleaning up its seller base—a consistent pain point for Snapdeal. According to Himanshu, the platform has managed to pare down the number of sellers by nearly 75% over the past three years to remove those who didn’t sell in the current focus categories and others who did not comply with the quality standards.

“Our approval rate for onboarding new sellers is just 1%,” he says, adding that the platform’s quality check team filters sellers based on price range and ratings on other marketplaces and checks some of their premises.

The company, in its DRHP, said that for the six months ending September 30, 2021, 1,000 sellers fulfilled more than 80% of the shipped units.

How the numbers stack up

Though Snapdeal hasn’t filed its annual revenue for FY 2022, the company reported revenue from operations of Rs 471.56 crore for FY 2021 compared to Rs 882.9 crore in FY 2020. It registered restated losses of Rs 129.5 crore for FY 2021 and over Rs 270 crore in FY 2020.

In its DRHP, Snapdeal also said that it delivered 8.59 million units for the quarter of July 2021 to September 2021. The marketplace expense per delivered unit of Rs 105.93 for the six months period ending September 30, 2021.

Stellaro by the numbers

Marketplace expense per order or cost per order is a sum total of all expenses incurred by an ecommerce marketplace to ship orders over a set period of time. The expenses include customer acquisition costs through advertising, fulfilment cost, packaging and shipping costs. The total cost divided by the total number of orders during the time frame determines marketplace expense per order.

Riding on its House of Brands strategy, Himanshu says that Snapdeal is targeting to break even at a company level in two months. “One of our brands went live on Amazon India, and one of them recently debuted on Flipkart,” he adds.

If its recent pivot pays off, it will help Snapdeal to continue in the running of Indian ecommerce players. According to a report by research consulting firm RedSeer, nearly 64% of online sales during the festive season came from Tier II cities and beyond.

However, it will have to contend with well-funded players like Meesho, which is targeting a similar Total Addressable Market.