After his stint as an investor at Accel Partners, Saransh Garg decided to start Prodigal, a fintech startup. In the process, he realised there was another big gap in the market – health insurance for small companies.

“I found it very difficult to get health insurance for my seven-employee company. There was no one platform where I could search for health plans for companies, get unbiased advice, and get quick answers. Also the topic is quite deep so doing research takes several hours of time,” says Saransh.

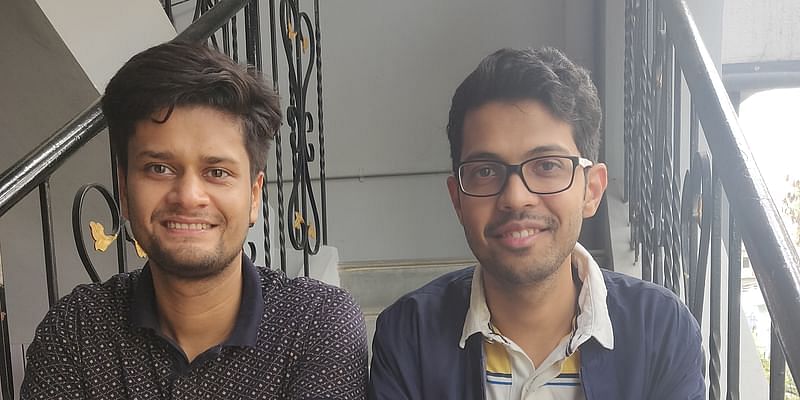

And thus, in October 2020, Saransh and his friend, Yash Gupta, founded Nova Benefits, an employee benefits platform centred around corporate health insurance. The startup recently raised $1 million in funding.

The round was led by Better Capital, Multiply Ventures, and Snapdeal founders Kunal Bahl and Rohit Bansal’s, Titan Capital. The round also saw participation from Sumit Maniyar, CEO of Rupeek, and Ashish Goyal, CEO of EarlySalary.

Nova Benefits core team

Saransh had noticed that his friend Yash, who was earlier working with Samsung in South Korea, had all his health expenses covered without any hassle. He also had access to a POC who was there to help with any sort of appointment or reimbursement, at zero out-of-pocket cost, but with $500 cut from his pay cheque every month.

Digging deeper into this area, the duo found a rabbit hole of insurance problems, and discovered that employees in India often had a cumbersome experience when it comes to health insurance – it covered only hospitalisation, and most people didn’t even know that their company offered one.

With Nova, team-members are provided with a single platform to access their company-provided benefits. Nova consults with companies to decide the best health plans while maximising coverages and minimising cost, and also enables priority claims resolution for its clients for faster claim settlement.

Starting up and funding

This shift was timely for Saransh as the now Y-Combinator backed Prodigal was focussed on the US market, and Saransh had to come back to India for personal reasons. Starting Nova was his next move. “The stagnant pace of innovation from incumbents made it very clear that technology is an edge that we can use to win in this market,” adds Saransh.

“Employee insurance and benefits is a deeply broken experience. We were impressed with Nova’s unique approach and it has been incredible to see them become the fastest growing company in the category in a matter of just seven months”, says Vaibhav Domkundwar of Better Capital, which also is an early investor in fintech and insurtech leaders like Open, Rupeek, Riskcovry, and others.

The team adds that Nova has become the fastest growing insurtech company by onboarding more than 70 clients in seven months with 25,000 members on its platform. Their clients include companies like Snapdeal, Yulu Bikes, Chumbak, Fisdom, Dealshare, ObserveAI and many more.

Nova plans to use the funds to expand its tech and product capabilities. The new category of insurance products work synergistically with a company’s health insurance policy, where the premiums are lower since the corporate health policy acts as the first offering.

Any claims over and above that can be covered by these categories of products. Nova is already working with insurers to bring these to the market.

“India has one of the lowest health insurance penetrations in the world. Making corporate health insurance more accessible, affordable and transparent is a great way to solve the problem. Nova Benefits is on a mission to do that. We are excited to partner with the team at Nova who are reimagining the entire value chain of health and health insurance for a company,” says Bhushan Patil of Multiply Ventures, which also has Raveen Sastry and Sanjay Ramakrishnan as founding partners.

What does the platform do?

Bengaluru-based Nova’s platform is currently free for its clients, and it plans to monetise by up-selling health packages and value-added services in the future. Speaking of the initial days and starting up, Saransh says,

“We initially asked founders of companies to pay us by the hour for our time. Our pitch was that instead of spending 10-20 hours of your precious time finding a health policy, let us do it for you. We would shortlist and select the best health insurance plans for them, letting them focus on their business. When founders started paying us for our time, we knew we were onto something. We also realised that the size of the market is massive – every single company is a potential client! That was the eureka moment for us.”

Companies looking to buy or renew their health insurance can schedule a consultation via Nova’s website. The team then makes a tailored recommendation on the right health plan for the client taking into account their geography, median income, industry and other parameters. The entire insurance policy runs on Nova’s tech-platform.

Employees of the client company will get a web and mobile app where they can see all their benefits, find cashless transactions that hospitals make, and track them. Nova also integrates with leading HRMS systems like DarwinBox, Greytip, Keka and several others, automating the employee addition/deletion process onto an insurance policy thereby saving the HR team’s time and eliminating manual errors.

Challenges

One of the biggest problems the team realised was that insurance companies were still lagging behind when it comes to having an API infrastructure to share insurance related data like e-cards, addition/deletion of employees, claims status and tracking among other things.

“Nova does the heavy-lifting in the backend with insurers to create an intuitive and seamless experience on the front-end for its clients,” says Saransh.

To provide a great claims experience for its clients, Nova overcomes three big challenges that lead to claims rejection:

Hidden policy clauses – There are many hidden clauses like “pre-existing diseases not being covered”, “low room-rent limits”, “disease-wise capping”. Nova does a mine-sweep of all such hidden clauses and gets rid of them at the time of policy purchase

Missing documents when filing a claim from the employee. Nova does a document deficiency check for the employee ensuring all necessary papers are in place when submitting a claim.

Erroneous claim rejection – Sometime insurers unknowingly make a claim rejection because of a difference in interpretation of the documents or a process gap. Nova’s claim team rebuts these erroneous rejections, and brings it to the notice of the insurer, which then gets promptly approved.

Apart from Saranash and Yash, the team also comprises Prashant Rao, who was the CEO of an insurance broking firm. The total team size is now 25.

Startups like Plum Insurance, Acko, and even Practo are some of the other companies addressing insurance segment gaps.