Top Indian cities and startup hubs find themselves facing a lockdown again with a surge in Covid cases across India

While last year, companies, authorities and consumers were equally clueless about operations during curfews, a better outcome is expected in 2021

On-ground movement of deliveries has been impacted in a few cities so far but the healthcare capacity being stretched might have severe impact on operations in the medium term

Two days in a row, India has reported well over 200,000 active cases of Covid-19 even as a few state governments took strong measures to curb infections.

Once again top three Indian startup hubs as well as the cities that host the most Indian online consumers are facing movement restrictions and lockdown-like situations as authorities struggle to control the rate of infections. On Thursday, Delhi NCR imposed a weekend curfew when only essential services will be allowed to operate. Karnataka has also imposed night curfews in several districts including Bengaluru. Earlier in the week, Maharashtra imposed similar curfews that last through the week and are stringent on weekends.

If the cases continue to rise despite these efforts, the government will have no other option but to impose a lockdown just like last year. And onus will come on startups which have already announced measures delivery partner vaccination to curtail customer concerns. But with the on ground rules changing on a daily basis, or remaining vague, startups remain on the guard against regulatory surprises.

As part of the new curbs, no one, except those engaged in essential services or exempted from the curbs will be allowed to move in public places without a valid reason, unless it’s for essential work.

Delhi NCR, Mumbai-Pune belt and Bengaluru are home to a bulk of the online service consumer base of India. According to a report by Gradeview Research, in 2020, South India held the largest share of 34.6% in terms of online grocery revenue. The region is expected to maintain its lead over the forecast period. The regional growth is attributed to the presence of several prominent players, such as Bigbasket, Grofers, Supr Daily and Amazon in the region and the highest number of online consumers located in Bengaluru and Chennai.

Western India is projected to be the second fastest-growing region with a CAGR of 37.3% by 2028, led by cities like Mumbai and Pune which have a large working professional population. So movement restrictions are likely to directly impact companies operating in this space.

While not as chaotic as the rules for the lockdown in 2020, which were sprung on startups overnight, companies will still have to go back to their playbooks from last year, particularly to figure out updates in curfews and curbs on a day-to-day basis. While the curfew restrictions have much more clarity this time around, many decisions have been left to local authorities and municipalities to impose as per their judgement. More importantly, with the definition of “essential services” still being vague, many businesses will be struggling to figure out how they can function while also dealing with a shortage of labour.

Two days into restrictions which are expected to get tighter, how are delivery platforms dealing with the new rules across Delhi NCR and Maharashtra?

As per concerns raised by customers on social media platforms, the apps are facing challenges in mobilising ground-level operations and also facing a deluge of orders reminiscent of the panic buying situation witnessed last year when lockdowns were imposed across the country. Grocery delivery platform Bigbasket has started issuing tokens for delivery slots to manage the surge of online order.

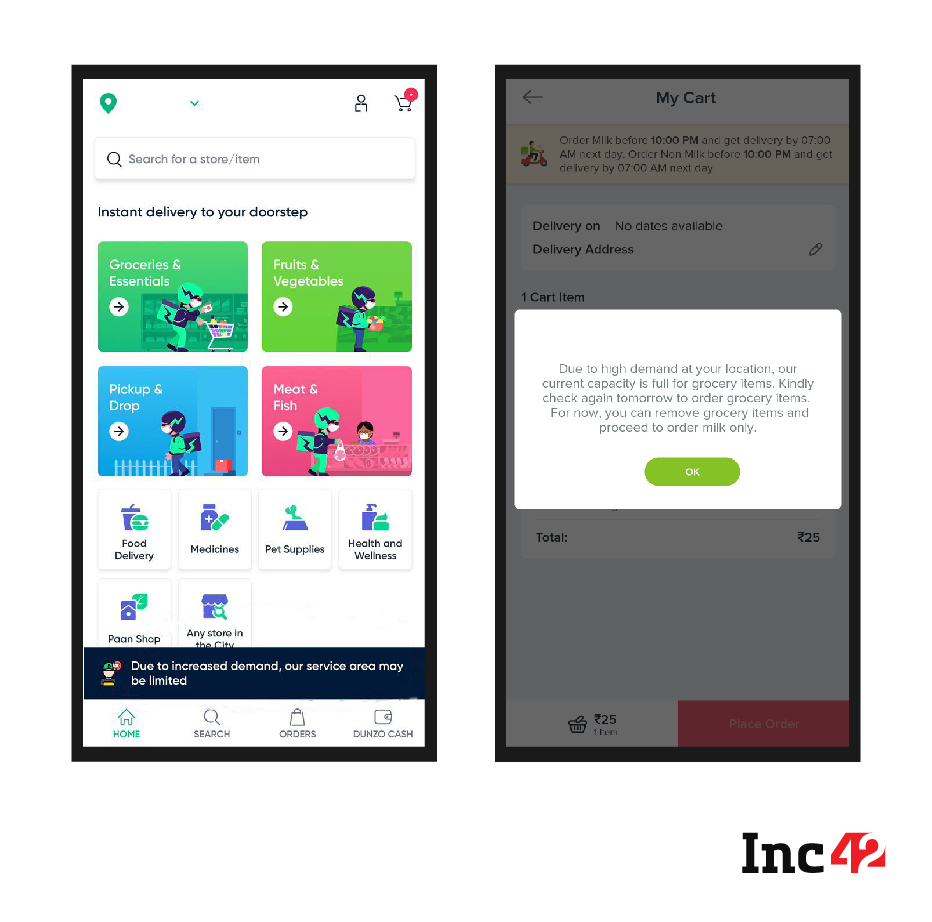

According to complaints on social media platforms, users of hyperlocal and grocery delivery apps across Delhi, Mumbai and Pune regions, are already facing limitations in placing orders. The responses of the related companies suggests that the companies are overloaded with orders.

“We see an increase in order sizes as well as number of orders in all states with Maharashtra being highest. Order volume had increased by 25%. Our delivery teams are well prepared to handle this demand,” Seshu Kumar, national head of buying and merchandising, BigBasket, told Inc42

A Grofers spokesperson reported a similar observation in terms of order value surge with the surge starting a few weeks ago in Mumbai, Pune and Ahmedabad and then extending to other markets.

“We have observed an increase in basket size in Mumbai (19%), Pune (16%), and Ahmedabad (12%) as compared to last month. Overall, customers seem more confident in the supply chain this time around,” the company said.

For now Grofers is experiencing an 80% surge in orders in Mumbai, and a 40% surge in Pune. They are also seeing similar trends in other cities where (partial) lockdowns were announced recently.

Kumar added that BigBasket is making deliveries within expected times in all states except for a few delays in Mumbai and Pune due to movement restrictions. The platform is prioritising delivery of essentials across its delivery locations to cope with the surge in demand. Grofers also stated it has built deeper collaborations with manufacturing, merchant and brand partners, and is confident about having stock for food staples, snacks and beverages, sanitation and personal hygiene products.

However, customers are facing delays in placing orders across different platforms in major cities and complaining that orders are being rescheduled by upto 10 days across various cities in the country, including Delhi and Mumbai. In most cases, the companies have responded to user queries citing renewed on-ground restrictions and capacity constraints.

Even as companies and authorities try to iron out creases in the delivery ecosystem, one can only hope that panicked consumers do not give into hoarding products again choking the system, like last year. So far, no specific product shortage has been reported although deliveries are getting delayed.

Most state authorities have called for delivery persons to be treated at par with frontline health workers and requested companies to vaccinate their workforce. However, with testing and vaccine infrastructure constrained, this might not be possible for everyone. Some like Grofers are covering the cost of vaccination for front-line team members of 45 years and above, and will also cover the cost for the remaining, as soon as the government opens up the vaccination for all age groups. At the same time, one cannot overlook the concern that with an increasing number of cases, and rising uncertainty about the regulations, even the delivery staff may get hesitant about their jobs.

The past year has witnessed massive funding and strategic wins for the online grocery ecosystem from JioMart, Dunzo, Bigbasket’s impending stake sale to Tata Group and Grofers’ IPO plans. As the country stares at an impending lockdown to control the pandemic these heavily funded Indian companies across the hyperlocal delivery ecosystem have a chance to demonstrate their growth and learnings over the past year. We hope for the best.