If 2020 and 2021 were the years of the SPAC, 2022 is shaping up to be the year of the reprimand.

Nearly all of the electric vehicle manufacturers that took a shortcut to an IPO by merging with a special purpose acquisition company over the last two years are being investigated by the Securities and Exchange Commission. Most of them attracted scrutiny mere months after debuting on the public market for misleading investors with unrealistic projections.

In fact, these companies have proven so difficult to monitor that the SEC in March proposed new rules to instill oversight.

Here is a guide to all of the investigations on EV-SPAC combinations going on right now. We’ll keep this primer updated as the situations develop.

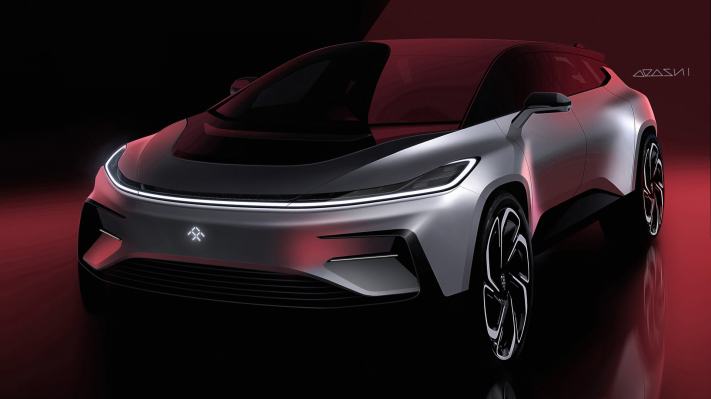

Faraday Future

Faraday Future grabbed everyone’s attention when it revealed its flashy concept at CES 2017, but it has yet to build or deliver a single vehicle five years on. Now, it’s in danger of being delisted from the NASDAQ.

The company went public in July 2021 by merging with SPAC Property Solutions Acquisition in a $3.4 billion deal. Shortly after, a report from investment firm J Capital alleged that Faraday misled investors.

The company concluded an internal investigation on April 12 that culminated in the removal of founder and former CEO Yueting Jia as an executive officer and the dismissal or probation of others. Meanwhile, the SEC has been conducting its own investigation and subpoenaed several executives who may have been involved, forcing Faraday to delay filing the paperwork necessary to comply with NASDAQ guidelines.

The SEC’s investigation is ongoing.

Lordstown Motors

Electric truck company Lordstown Motors, which also has yet to sell a product or earn revenue, is under investigation by both the SEC and the U.S. Department of Justice for allegedly misleading investors with a falsified book of 100,000 pre-orders for its pickup truck.

Lordstown went public in October 2020 through a $1.6 billion SPAC merger with DiamondPeak Holdings. Six months later, Hindenburg Research, a New York-based activist short-seller, published a report warning of bogus pre-orders, such as the $735 million sale of 14,000 trucks to E Squared Energy, a company based out of a small residential apartment in Texas that doesn’t operate a vehicle fleet.

Both investigations remain open.