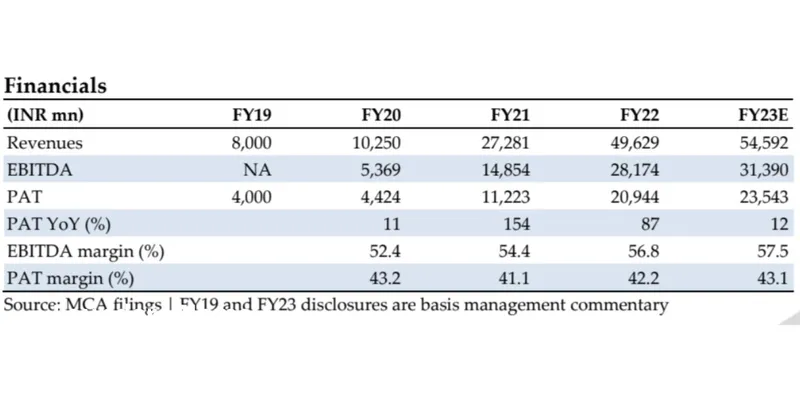

Zerodha is slated to clock a profit-after-tax of Rs 2,354 crore for FY23, a moderate rise of 12% from Rs 2,094 crore earned in the previous fiscal, according to a report by HDFC Securities. However, this jump appears diminished in comparison to the 86% bumper climb in profits in FY22.

Earlier, Co-founder and CEO Nithin Kamath admitted that the company would not be able to match its current revenue and profitability from FY23 onwards for a few years.

Its latest projections are attuned to Zerodha’s business updates in December last year when the management noted that the company had “temporarily hit a plateau in terms of the target market”, besides a decline in new account openings and a slowing bull market momentum.

According to the report, Zerodha estimates its FY23 revenue at Rs 5459.2 crore—up by 10% from Rs 4962.9 crore in FY22. Previously, the company had recorded a jump of 81% from FY21 in the same metric.

“Zerodha is slated to clock revenue/PAT at ~Rs 55 billion/25 billion (+10/12% YoY) in FY23E. Core revenue, at Rs 43 billion (net of pass-through charges), comprises brokerage/float income/other charges at 63/27/10%,” it said.

Source: HDFC Securities

The brokerage firm witnessed a sharp moderation in average monthly demat additions at 1,40,000-1,70,000 (vs 3.2 lakh-3.5 lakh during 2020-2022).

“With a large overlap of customers opening multiple broking accounts in the industry, 65% (higher than pre-pandemic levels) of the additions at Zerodha are new-to-KYC customers indicating first-time investors,” the report said, noting the higher than industry levels.

Further, of the 12 million customer base, 6.5 million are NSE active clients, 2.5 million are overall F&O (Futures and Options) users, and 1.5 million are active F&O traders (at least once a month).

The top 35% of its customers contribute 70% of revenues, it added.

Although the KYC data on new demat additions suggests 65% of customers are coming from beyond the top 15 cities, the IP location of trading devices indicates that 70% of customers reside in Tier I cities.

“This suggests a large client base that has migrated from the smaller towns in search of job opportunities,” the report observed.

Nithin Kamath, Founder and CEO, Zerodha

Open to increasing intraday trading charges

The report further suggests that the stock brokerage is open to considering a Rs 20/order on delivery trades or increasing intraday/F&O trading charges. Currently, only Groww and Upstox are charging such a delivery fee among the top four discount brokers.

“HSIE estimates suggest this can generate additional broking revenues to the tune of Rs 37 billion (68% of FY23TD revenues) at Zerodha,” the report noted.

Talking about the overall industry outlook, experts predict that broking revenues may witness growth moderation or de-growth with a lag if the customer dropoffs are not replaced by demat additions, which itself is witnessing a significant slowdown.

“A flattish or sharp correction could pose a threat to derivatives volumes,” it observed.

![Read more about the article [Funding alert] NBFC firm Kogta Financial raises $111M in Series D round](https://blog.digitalsevaa.com/wp-content/uploads/2022/03/funding-shutter1-1648567691865-300x150.png)