Food robotics startup Mukunda Foods has pulled the curtains on its high-profile kitchen-as-a-service business after failing to turn it profitable despite signing up marquee brands, according to two people familiar with the developments.

On Monday, the Zomato-backed startup informed clients of Nucleus Kitchens, including ITC, Auntie Fung’s and Biggies Burger, to vacate the premises and close their accounts by the end of this week.

“Unfortunately, we are discontinuing the operation of our all kitchens post 28th February 2023. Please ensure to close your accounts before picking up materials by 25th of this month,” the company informed Nucleus’s partner brands in a letter, which YourStory has seen.

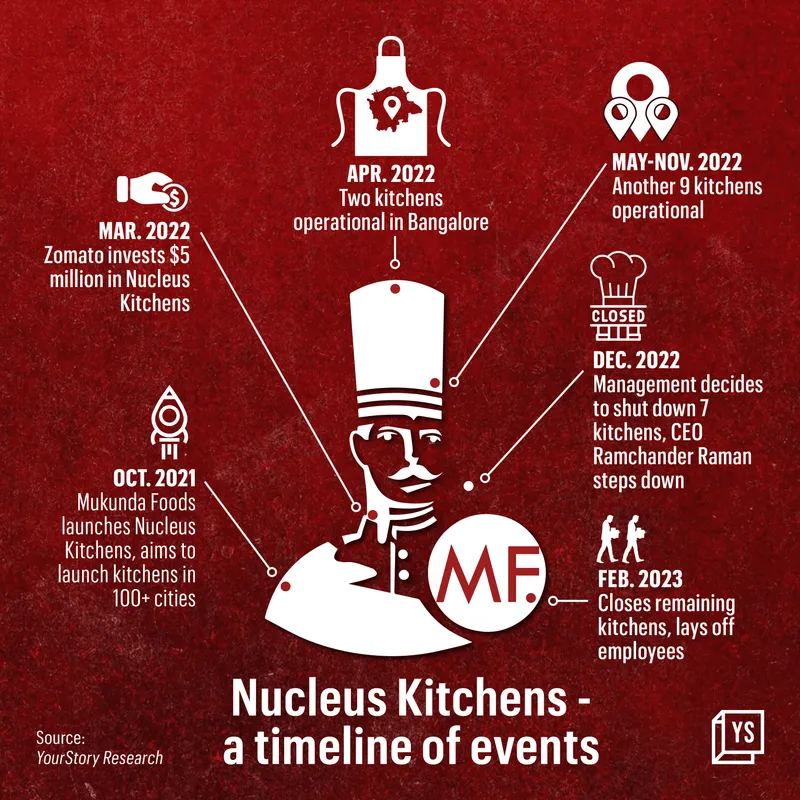

Nucleus’s final three kitchens still operational—all in Bengaluru—will be shut by February 28, while its staff of about 25 employees are being laid off, according to the people mentioned above.

“The management informed employees last Friday that all the kitchens will be closed this week,” one of them said.

Mukunda had been building up Nucleus to be a crucial component of its overall business, with plans to open 100 kitchens in the metros and other large cities across the country.

Since the business was unveiled in October 2021, Nucleus had been able to open only about a dozen kitchens, shutting some within a month or two, said the person quoted above.

Nucleus was key to Zomato investing $5 million in Mukunda Foods in March last year.

Through the investment, the food-delivery unicorn had aimed to strengthen its presence in the kitchen infrastructure space and the quick-commerce segment, with Nucleus’s kitchens catering to its 10-minute delivery service Zomato Instant. Zomato recently shut the service.

Eshwar Vikas, Founder and CEO of Mukunda Foods, told YourStory that the company had announced plans to scale down Nucleus three months ago, and had continued running just three kitchens since.

“Some team members decided to exit with their benefits taken care of. Some team members secured other jobs in the last few months. Majority of the kitchen staff will be absorbed by some of our clients,” Vikas said.

A sectoral problem

Cloud kitchens, or ghost kitchens, were considered not too long ago to be the next growth wave for the foodtech sector. These kitchen spaces allow multiple restaurant brands to use plug-and-cook facilities similar to a shared office space, enabling them to expand quickly and at minimum capital expenditure.

But the concept is facing an identity crisis of sorts.

Mukunda’s decision to close Nucleus Kitchens is emblematic of the wider struggles of the domestic cloud-kitchen industry, a sector in which investors including Sequoia Capital, Lightbox and Anicut Capital have pumped in more than $500 million over the past decade.

In December, Uber Co-founder Travis Kalanick’s CloudKitchens exited India after failing to build a lucrative premium business in the country. Swiggy is divesting its cloud-kitchen business, and Zomato has scaled down its kitchen infrastructure.

“Nucleus Kitchen was a concept of kitchens-as-a-service that aimed to help cloud kitchen brands expand faster by taking care of capex, opex, and manpower, while the brand only needed to generate and fulfil demand,” said Vikas in response to queries from YourStory.

“However, we gradually realised that the market was not yet ready for such a mature plan. Except for a few brands, most did not give enough attention to demand generation compared to their traditional outlet, possibly because their investments weren’t high here.”

The profitability question

Founded in 2012 by Vikas and Sudeep Sabat, Mukunda Foods is a kitchen automation company that provides modern equipment to commercial kitchens. It has raised $8.11 million to date from investors including Indian Angel Network, Anicut Capital and Zomato.

Mukunda Foods launched Nucleus as an asset-light kitchens-as-a-service operation. Nucleus would provide kitchens to brands along with equipment and staff in exchange for a share of the revenue. Partner brands would provide raw materials and food preparation know-how.

But this came accompanied by problems of unsustainable revenue generation and inconsistency in quality.

“Expecting quick profitability in this model is impossible,” said an industry executive, asking not to be identified. Although the model is low on capital expenditure, it adds significant costs to brands as they have to share a cut of the revenue with the kitchen provider.

For the infrastructure provider, the model is hardly capex-light since they are responsible for maintaining real estate, kitchen equipment and staff expenses, this person added.

“Moreover, consistency was a problem as Nucleus’s staff had to familiarise (themselves) with the preparation methods of several brands,” the industry executive said, adding that orders would often get mixed up.

Given these inherent constraints, Mukunda may have been a tad too ambitious with its expectations of Nucleus, giving its kitchens little time to establish their hold in a location, ultimately leading to the business’s collapse.

“Mukunda’s senior team expected every Nucleus Kitchens to be profitable within a month of opening,” said one of the persons mentioned earlier. “If the kitchen showed no sign of sustainability, the Nucleus team was instructed to shut the operations and move to another location.”

(Feature image and infographics by Chetan Singh)