Hello Reader,

It’s World Emoji Day on Sunday, and Emojipedia has released a draft list and sample images for Emoji 15.0. Contenders for the latest emojis, which will likely be rolled out in September, include a shaking face, a high five, and a pink heart.

The newest entry on the list–a shaking face used to express shock– is probably an apt reaction to the #BoycottNothing and #DearNothing hashtags that began trending on Twitter hours after London-based startup Nothing launched its phone (1).

The reason behind the outrage was apparently a prank video by a YouTube channel, which claimed that the phone maker was ignoring South Indian reviewers.

In other news, Alphabet Inc has said it would slow the pace of hiring for the rest of the year as high inflation and the Russia-Ukraine crisis impact businesses across the globe. Other companies rethinking hiring plans include Uber and Microsoft.

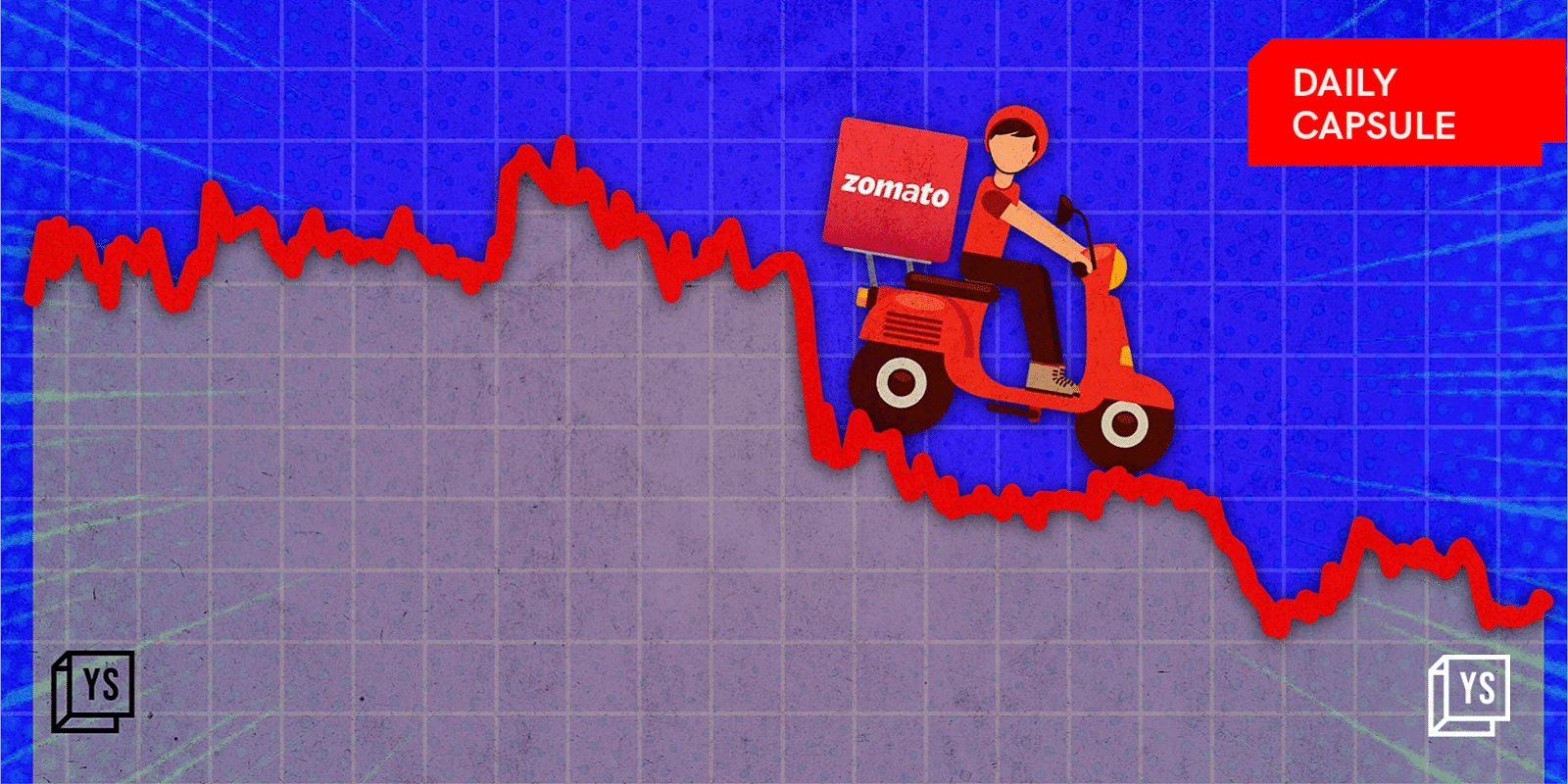

Zomato’s choppy ride

On July 14, 2021, the Rs 9,375-crore initial public offering (IPO) of Zomato—the foodtech unicorn—opened for subscription at a price band of Rs 72-76 a share, against a face value of Rs 1 apiece.

The much-hyped IPO from the Indian startup ecosystem closed on July 16 with an oversubscription of 35 times.

Zomato got listed on July 23, at a valuation of over $13.3 billion, with an issue price of Rs 76 apiece.

While Zomato’s share price touched an all-time high of Rs 169.10 apiece on the Bombay Stock Exchange in November last year, its stock price has seen a gradual decline, closing at Rs 137.45 a share at the end of 2021. It touched its all-time low of Rs 50.35 on May 11 this year.

In comparison to the S&P BSE Sensex, S&P BSE 500, and the S&P BSE IPO index, Zomato’s share price performance has been a dampener.

YourStory charts the foodtech giant’s struggles post its blockbuster IPO.

Key takeaways:

- At the close of the day’s trade on July 13, the foodtech unicorn’s market value of $5.8 billion has reduced by $7.5 billion, or by 56.5 percent, compared with its closing value on listing day.

- Mutual funds’ ownership in Zomato has seen a decline in the quarter ended (QE) March 2022 at 2.82 percent, compared to 3.01 percent in July last year and 4.4 percent and 3.88 percent in QE September 2021 and December 2021, respectively.

- During FY 2022, Zomato made minority investments in over half a dozen startups, including $60 million in social rewards startup Magicpin, $75 million in logistics startup Shiprocket, and $50 million in healthcare startup Curefit.

Tapping into digital karma

Securing a loan from a bank requires endless paperwork and is dependent on the borrower meeting fixed parameters. A fintech startup is now looking at this process from a different perspective.

KarmaLife says its model is predicated on dynamicity. It follows its users’ journeys, their payment behaviours, and several other behavioural parameters, and based on those readings, extends financial services.

The fintech platform caters to financially underserved populations such as gig workers, contractors, self-employed individuals, entrepreneurs, and others.

Keeping the score:

- KarmaLife says it borrows from the Indian cultural philosophy of Karma, which is the law by which good or bad actions determine an individual’s future.

- The startup extends its services to users via partnerships with employers and aggregators of gig workers. The plug-and-play platform integrates with most HR management systems and does not require too much set-up time.

- Users are started on very small-ticket, short-duration credits, which, over time, increase based on their ability to repay.

(Design credit: Aditya Ranade, Team YourStory Design)

Bridging the tech talent gap

Serial entrepreneur Amit Verma, who worked in crowdsourcing and technology space earlier, started witnessing a change in the attitude of young job seekers after the pandemic. People looking for jobs wanted something more than a paycheck, he says.

“Today, the young generation is increasingly looking at the learning opportunities that their job roles provide them and give more meaning to their life and careers. But many companies and job roles fail to deliver this expectation,” says Amit.

To strike a balance between the expectations of job seekers and the growing demand for talent in tech businesses, Amit launched Codvo in 2020. The Hyderabad and Texas-based startup helps enterprises crowdsource software engineers to develop digital products.

Key takeaways:

- Codvo.ai curates a talent pool of the best software engineers that helps client companies with different projects related to artificial intelligence (AI), machine learning (ML), cloud computing, ecommerce, UI/UX development, and more.

- With a talent pool of around 150 experts, the team has delivered over 40 projects to companies in different sectors such as fintech, gaming, tech startups, ecommerce, and healthcare.

- As per the filings with the Registrar of Companies, Codvo.ai made a revenue of about Rs 87 lakh in FY22.

Now get the Daily Capsule in your inbox. Subscribe to our newsletter today!

![Read more about the article [Turning Point] Thinking ahead of time, how Amagi Media Labs became India’s first media SaaS unicorn](https://blog.digitalsevaa.com/wp-content/uploads/2022/03/ImageTaggingNewBrandingEditorialTeamMaster7-1648224980585-300x150.png)

![Read more about the article [Startup Bharat] This Rajasthan-based NBFC is redefining rural lending, one small-ticket loan and town at a time](https://blog.digitalsevaa.com/wp-content/uploads/2022/05/MalvikaCopyofImageTagging77-1652175319090-300x150.png)