Investors will get Instadapp’s soon-to-be-launched INST governance tokens in exchange for the funds

The company has also been backed by Silicon Valley-based entrepreneur investors Naval Ravikant and Balaji Srinivasan

Last week, Delhi NCR-based DeFi startup Unbound Finance raised $5.8 Mn in its first funding round

Fintech startup Instadapp, which works in the burgeoning segment of decentralised finance (DeFi), has raised $10 Mn in its latest funding round from venture capital firm Standard Crypto, Yearn founder Andre Cronje, DeFi Alliance, Longhash Ventures, among others investors.

The company had already been backed by the likes of Pantera Capital and Coinbase as well as Silicon Valley-based entrepreneur investors Naval Ravikant and Balaji Srinivasan, who is also the former CTO of Coinbase.

The latest round, which will see investors get Instadapp’s soon-to-be-launched INST tokens, brings the total fundraising by the startup to $12.4 Mn. The governance token will be launched by June-end, a part of which will go to investors. These tokens allow holders to help shape the future of the Instadapps protocol.

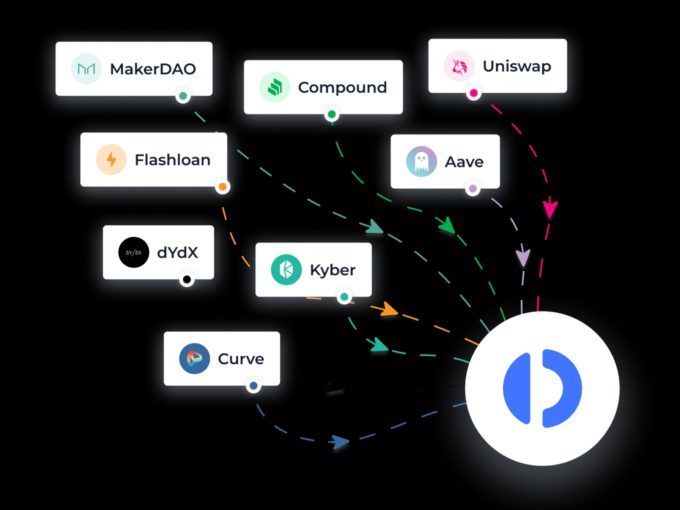

DeFi is essentially a blockchain-based form of finance without the involvement of central financial intermediaries, such as banks, brokerages or exchanges. Instadapp offers a protocol and a smart wallet that simplifies management of funds under various DeFi protocols and makes it easier for users and developers to manage and build their DeFi portfolio.

Founded by Sowmay Jain and Samyak Jain in 2018, it allows users manage multiple DeFi applications to maximise returns without having individual windows open. According to DeFi Pulse, Instadapp is the 7th largest entity in the DeFi space globally with $4.5 Bn worth of assets blocked in smart contracts on blockchain

Cofounder Sowmay Jain told ET the startup will use the funds to hire more employees, fund projects and ramp up product development. “I hope the investor interest in the space will mature over time. And as we see more and more supportive regulations, things will be quite strong,” he was quoted as saying.

The popularity of DeFi has soared over the last couple of years. The increasing total value locked (TVL) in DeFi protocols is a solid proof of the growth the DeFi sector has experienced. The automated market makers (AMMs) such as Uniswap, Balancer, MooniSwap, Curve and Kyber are currently sitting on over $40 Bn worth liquidity pools.

DeFi is rapidly growing in India as companies are exploring newer ways of deploying blockchain. Last week, Delhi NCR-based blockchain startup Unbound Finance raised $5.8 Mn in its first funding round led by global VC firms like Pantera Capital, Arrington XRP Capital, CMS Holdings, LedgerPrime, LD Capital, Future Perfect Ventures, Hashed, TRGC.

The funding round also saw the participation of founders of Angelist, Enjin, Polygon, Kyber, Harmony, Dao Maker, DFYN, Frontier, and Tomochain.