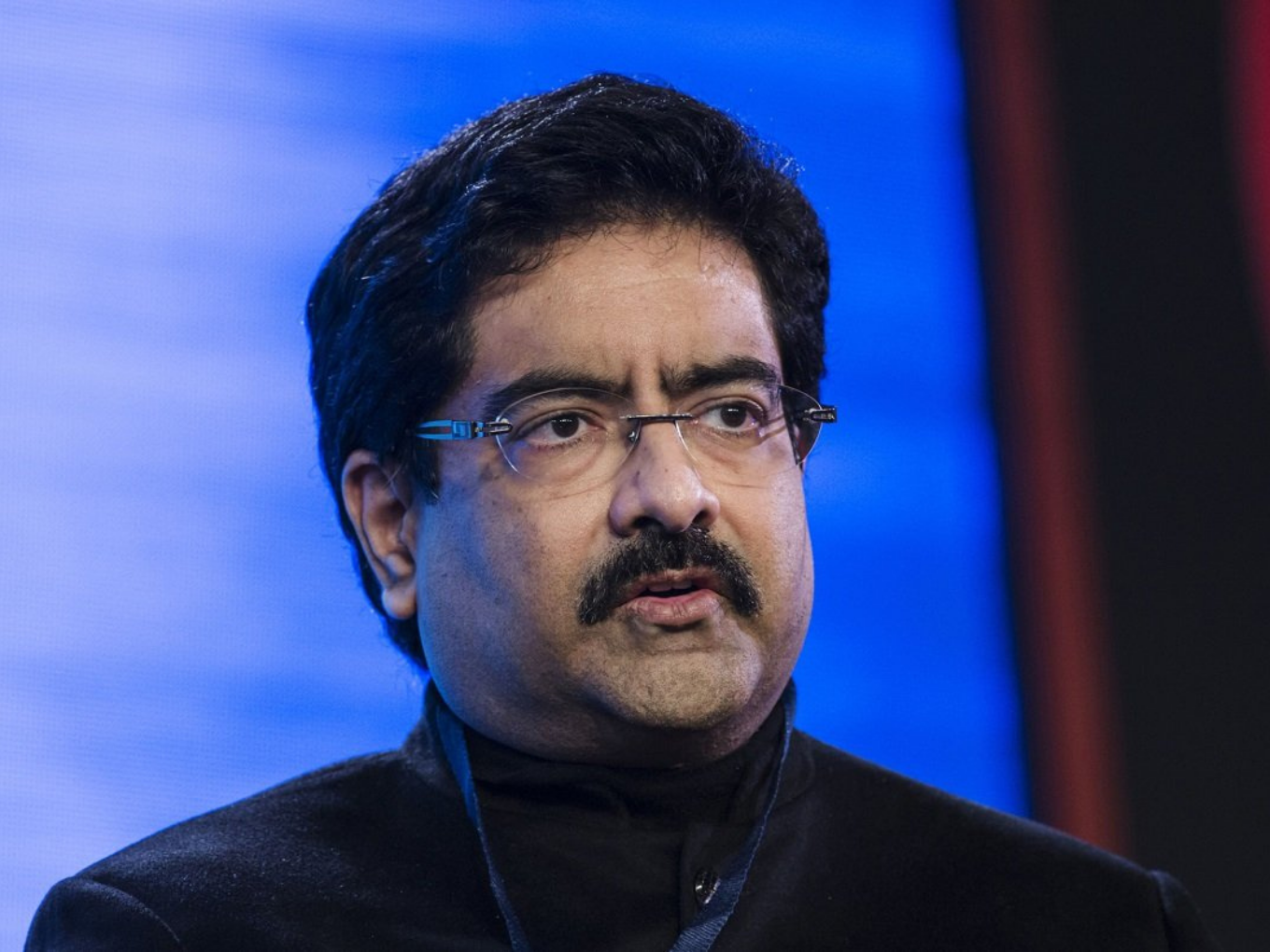

Chairman of the $50 Bn Aditya Birla Group, Kumar Mangalam Birla, on Friday said that the startup world was awash with capital and there was perhaps no better time to be an entrepreneur.

Birla made the comments in a heartfelt letter reflecting on the year gone by. He also said that “everyone from angel investors to public markets were lining up to back ideas.”

The statement comes on the back of a strong performance by Indian startups last year. With 1,583 deals and over $42 Bn, 2021 exceeded all expectations. Add to that, 42 unicorns were minted in 2021. And the year 2022 has already recorded 4 unicorns, with over $4 Bn being invested in the ecosystem within the first month.

He, however, cautioned that, “The competition for investment opportunities and the fear of missing out (FOMO) have driven up valuations of had echoed many fledgling companies to stratospheric levels.”

Birla also stressed that the startups need to focus on both high valuation and key financial metrics that generate tangible profits. He also added that parameters like healthy cash flows and gross margins would guide future behaviour and trends.

Earlier this month, Kotak Mahindra Bank Executive Vice-Chairman and Managing Director, Uday Kotak too had warned the startups about rising rates, saying “Cindrella times won’t last forever.” He had specifically pointed out that rising interest rates could play a spoilsport once the risk pricing factor is accounted for in the valuations of startups.

PrimeInvestor’s founding partner, Srikanth Meenakshi, had echoed the same sentiment to Inc42 earlier, he said, “IPO’s primary point is to get capital from the market at the time of listing. And in that sense most of these tech companies successfully bagged the money from the IPO that they wanted to. But subsequently, they have little to no control over the share price in the market, particularly since they also lack profitability.”

The statement comes as a slew of big-ticket startups, despite raising copious amounts of funds from the primary market, haven’t charted out a clear path towards profitability. This includes travel tech startup RateGain which recorded a weak debut on the National Stock Exchange (NSE) in December last year as it got listed with a discount of 15.29%.

Auto classifieds platform, CarTrade, too had made its debut on the stock market in August last year and was subscribed barely 41% on Day 1.Since listing, the stock has fallen over 50%, dashing long term hopes of the startup. Another case in point was the Fino Payments Bank’s IPO in November last year which also received lackluster response from bidders. The offer was barely subscribed 75%, with institutional investors shying away from the debut.

Penning thoughts in his Annual Reflections for 2021-22, Birla said that the coming decade would be one of “Capex Mahotsav.”

In his reflections, he also envisioned the private sector achieving a “double-engine growth” led by the conventional sectors and the new digital economy.

Elaborating further, Birla said that, “Investors are excited about growth prospects in core sectors as well as sunrise sectors. In my view though, the word sunrise sector applies to the entire landscape in India, which includes both conventional sectors like cement, steel, power and auto and emerging areas like digital and renewables. Both hold the promise of high and sustained growth.”

In his letter, Birla also conveyed that, “the hallmark of a new business today is that it seeks to use the brute force of capital, combined with smart technology and operations, to create new customer needs that they did not even know existed.” He drove the point home by giving the example of hyperlocal delivery, that has recently taken off in India.

The 54-year old business tycoon also thanked “healthcare professionals who spent the better part of two years in PPE suits, for the municipal staff who kept civic administrations running, towards the farm and factory workers who kept Kumar Mangalam Birla the economy chugging, towards delivery partners who toiled days on bikes to keep us supplied – and many more”.

Birla ended the letter with a popular phrase from the crypto community – WAGMI!, which is an acronym for We are all going to make it!

The post KM Birla Warns – FOMO Among VCs Has Driven Up Startup Valuations appeared first on Inc42 Media.

![Read more about the article [Funding alert] Impact Analytics raises $11M in growth financing round led by Argentum Capital Partners](https://blog.digitalsevaa.com/wp-content/uploads/2021/02/funding1-1613127711501-300x150.png)