India has emerged as the third largest startup ecosystem in the world, with many new companies having global ambitions. Mumbai-based venture capital firm Cactus Venture Partners (CVP) aims to partner with startups to guide them on this path.

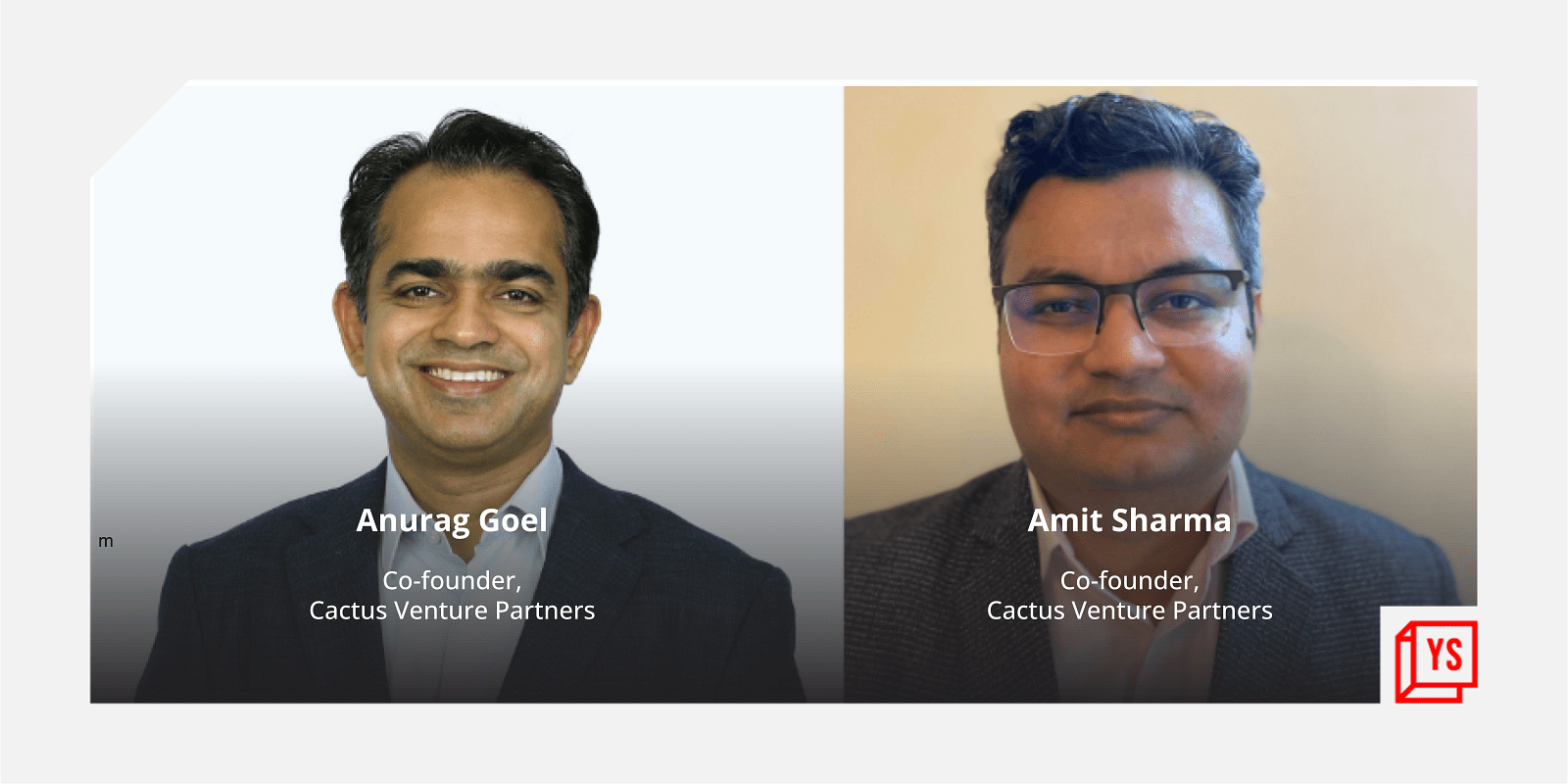

Founded by Anurag Goel and Amit Sharma in late 2020, Cactus Venture Partners believes it has much to offer startups in how they can take their business global with sound business fundamentals.

Anurag Goel says, “We will look at investing in startups that have passed the test of product-market-fit or unit economics and know where they want to go.”

The experience of the founders, especially Anurag, is expected to play a key role in guiding startups in the growth phase of their business. Anurag co-founded Cactus Communication in 2002 as a science communication company catering largely to research, and has now grown into a global firm with presence in multiple geographies like US, the UK, China, Japan, South Korea, and Singapore to name a few.

Segment focus

As a VC firm, CVP focuses on two segments – direct to consumer (D2C) and technology. It believes in being selective about its investments into startups and go deep along with them.

Cactus made about four investments in 2021 in Auric, AMPM, Vitraya, and Rubix Data Science. Auric is an ayurveda beverage brand and AMPM is into lifestyle clothing. Vitraya and Rubix are hard core tech startups.

Amit says, “What excites us while making the investment decision is the unit economics should look right with a visible path to profitability.”

He says, CVP looks at various parameters before investing in companies in the technology and D2C segments.

In case of technology, the VC firm is looking at opportunities in areas such as fintech, healthtech, and B2B SaaS, while in the D2C space, it is focusing on products which have a global appeal.

“We have the experience of building brands to go global and we can accelerate the growth curve of these startups,” says Amit.

Going global

Today, many tech startups are aspiring to go beyond the Indian markets, and some of the D2C brands have also found wider appeal beyond domestic consumers.

“We come at the intersection of market opportunity and the skills we bring to the table in terms of scaling these businesses,” says Anurag.

Cactus Venture Partners brings in four levers to scale up its business: technology, organisational structure, branding, and digital marketing.

“The startups that we invest in may not need all the four levers, but may need a push in one which provides the transformational difference,” says Anurag.

The idea being to sequence all these levers, where the startup may be good in one or two areas, but not necessarily in the other.

Fund size

In terms of investment, the VC firm wants to operate in a space that falls between Series A and B round of funding, bringing in around $4-8 million into each startup over their lifecycle.

Anurag believes venture asset class has started to attract more number of investors, given the exits the ecosystem provided in 2021 with enough players in the seed or pre-seed stage, but there are not many in the Series A and B stages.

“There are a lot of startups that are graduating into the $5-20 million cheque space and we would like to be there,” he says.

The VC firm has already done its first close with proprietary capital and plans to raise around $100 million fund by end of this year, which will limit partners from both domestic and overseas.

“We are focused on investors who look at high quality and conviction,” says Amit. He adds that they generally pick up decent minority stake in a startup to have a more meaningful say in these organisations.

USP

Given the fund inflow into Indian startups in 2021, there has been a growth of investment firms like VCs, private equity, and angel syndicates, among others. The question arises as to how Cactus stands out in the crowd.

Amit firmly believes that these are still very early days for the Indian startup ecosystem and cites the example of China, where there are over 15,000 funds operating compared to India, where we have just 550 funds.

“There is a lot of opportunity and we expect more fund managers to come in, but we stand apart due to our business building capability,” he says.

Elaborating on this, Anurag says, the two key benchmarks that Cactus Venture Partners would be looking into is the access to best deals and if the entrepreneur will choose them.

“Having been entrepreneurs ourselves, we understand what it takes to deliver that growth and this helps us connect better with the founders,” says Anurag.

In terms of getting access to the best deals, Cactus Venture Partner believes it will be a bit of a challenge in the initial phase, but given the connect it has with other VC firms, angel syndicates, and others, it expects to have stronger traction in the long run.

The founders strongly believe that these are still early days for the Indian startup ecosystem and this year may be different unlike 2021 where there was almost a flood of money.

However, Indian startups are starting to gain scale and look at extending their reach globally and this is where Cactus Venture Partner wants to play a role.

“We would like to be recognised as one of the top 10 venture firms in our category where LPs would want to invest in us and founders would be keen to work with us,” says Anurag.

![Read more about the article [YS Exclusive] Fintech unicorn Slice to raise Rs 200 Cr via NCDs](https://blog.digitalsevaa.com/wp-content/uploads/2022/06/Image36rr-1615958751816-300x150.jpg)

![Read more about the article [Funding alert] Online beauty training platform Vah Vah! raises seed round led by Sequoia Surge](https://blog.digitalsevaa.com/wp-content/uploads/2021/07/photo-1594941250082-85e4c770d293-1626167494579-300x150.jpg)