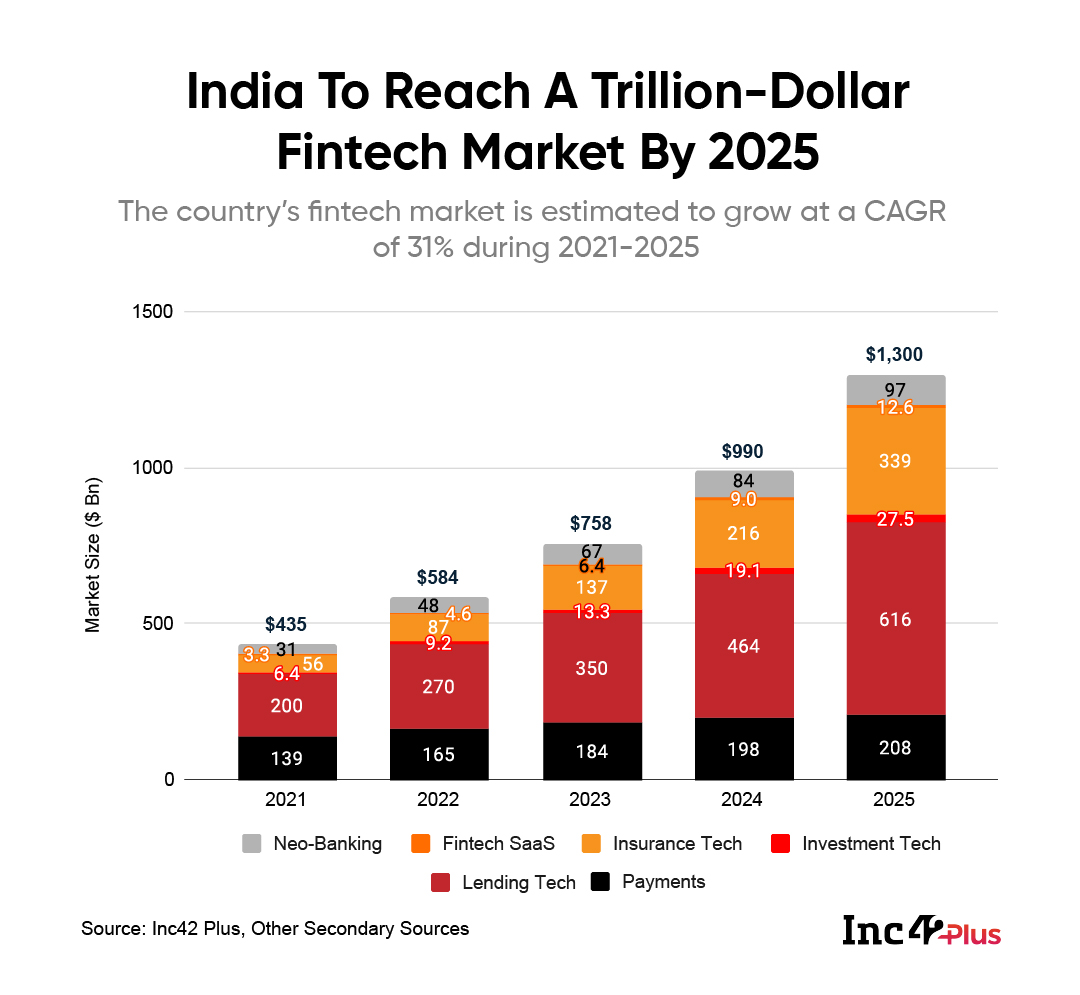

$1.3 Tn fintech market opportunity in India by 2025

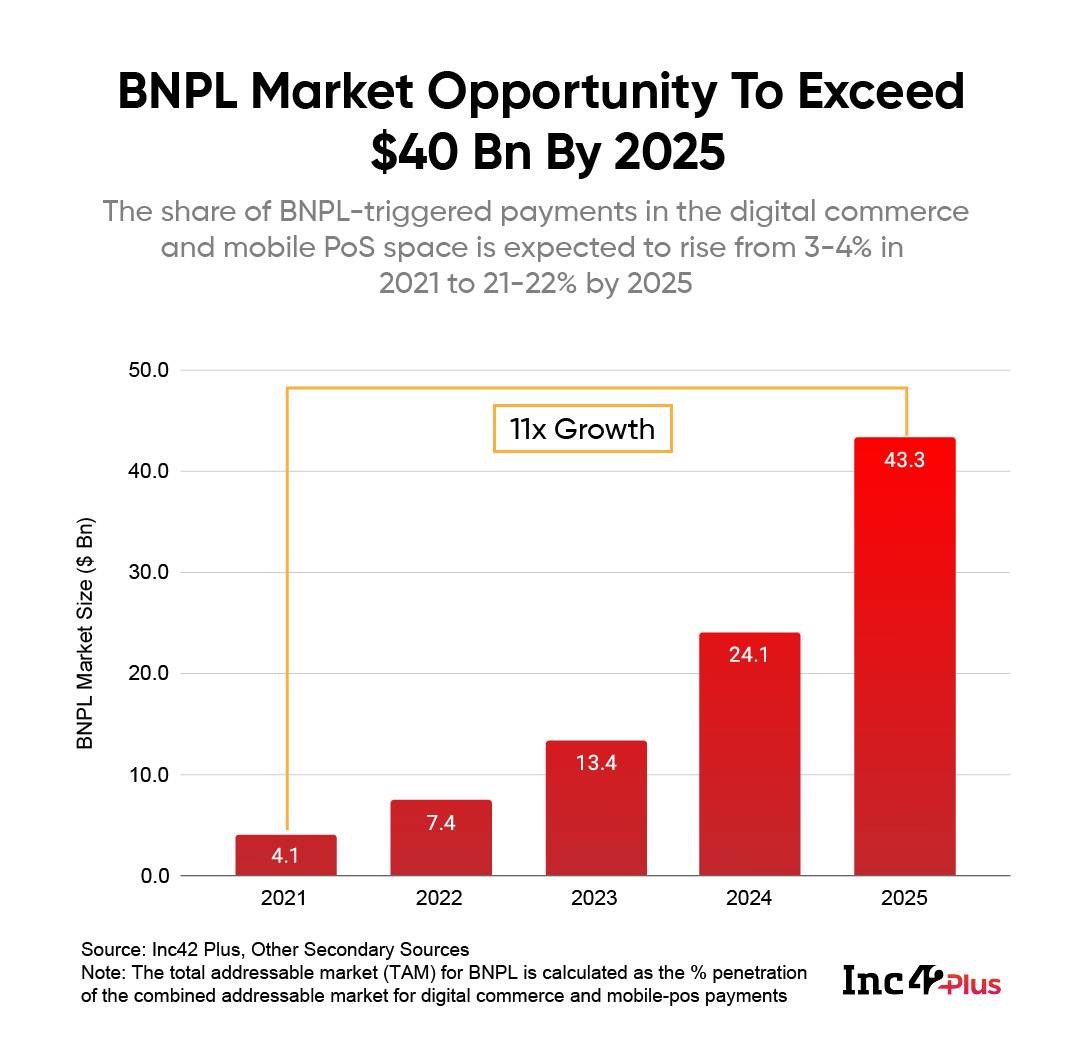

11x growth in BNPL market size from 2021 ($4.1 Bn) to 2025 ($43 Bn)

Growing at an 80% CAGR, BNPL is the hottest fintech sub-segment in India right now

Since 2018, fintech has sparked maximum interest among venture capital investors, keen to put their money in Indian startups. The rising demand for technology-enabled fintech products across a fast-growing addressable market is the primary reason behind sustained investor confidence towards fintech startups during the past four years.

Consider this. In 2021, the country’s fintech startups raised around $8 Bn ($7.97 Bn, to be precise) across 280 funding deals, a record high in both cases, while the average investment ticket size stood at $33 Mn. Among the fintech subsectors, lending tech and digital payment startups bagged the most venture capital inflow in 2021. Together, they accounted for 68% of the total funding amount and 44% of the deal count.

India’s overall fintech market opportunity is estimated to be $1.3 Tn by 2025, growing at a CAGR of 31% during 2021-2025. Of this, lending tech is likely to account for 47% ($616 Bn), followed by insurtech at 26% ($339 Bn) and digital payments at 16% ($208 Bn). Among these three, insurance tech is the fastest-growing fintech sub-segment in terms of market opportunity, growing at a CAGR of 57%, followed by investment tech (44%) and fintech SaaS (40%).

BNPL Models Gain The Spotlight

The lending tech industry, which has found credit gaps in the traditional BFSI segment, has come up with numerous such products in the last two to three years to cater to the decline in the spending capacity, rise in the millennial population who demand credit access. From fintech startups, ecommerce giants, NBFCs to banks — everyone has jumped on to the BNPL bandwagon.

As Indian retail slowly recovered from the onslaught of the Covid-19 pandemic in 2021, the buy-now-pay-later (BNPL) model under lending tech saw a quantum leap, thanks to digital-savvy consumers ratcheting up their spending with these instant, small-ticket loans. The BNPL space is estimated to offer a $43 Bn market opportunity by 2025, growing at an 80% CAGR due to the early nature of the market.

The current market has standalone startups which offer BNPL services such as ePayLater, Simpl, ZestMoney, as well as ecommerce companies and fintech players that have introduced products. Paytm Postpaid, PayU’s LazyPay, Amazon Pay, Flipkart Pay Later among others

The market also include BNPL startups like Slice, Uni Cards and others that are facilitating digital payments and physical cards. With several players and models in place for this booming market, the merchant network in this space will grow beyond the realm of digital commerce and reach the traditional retail point of sale.

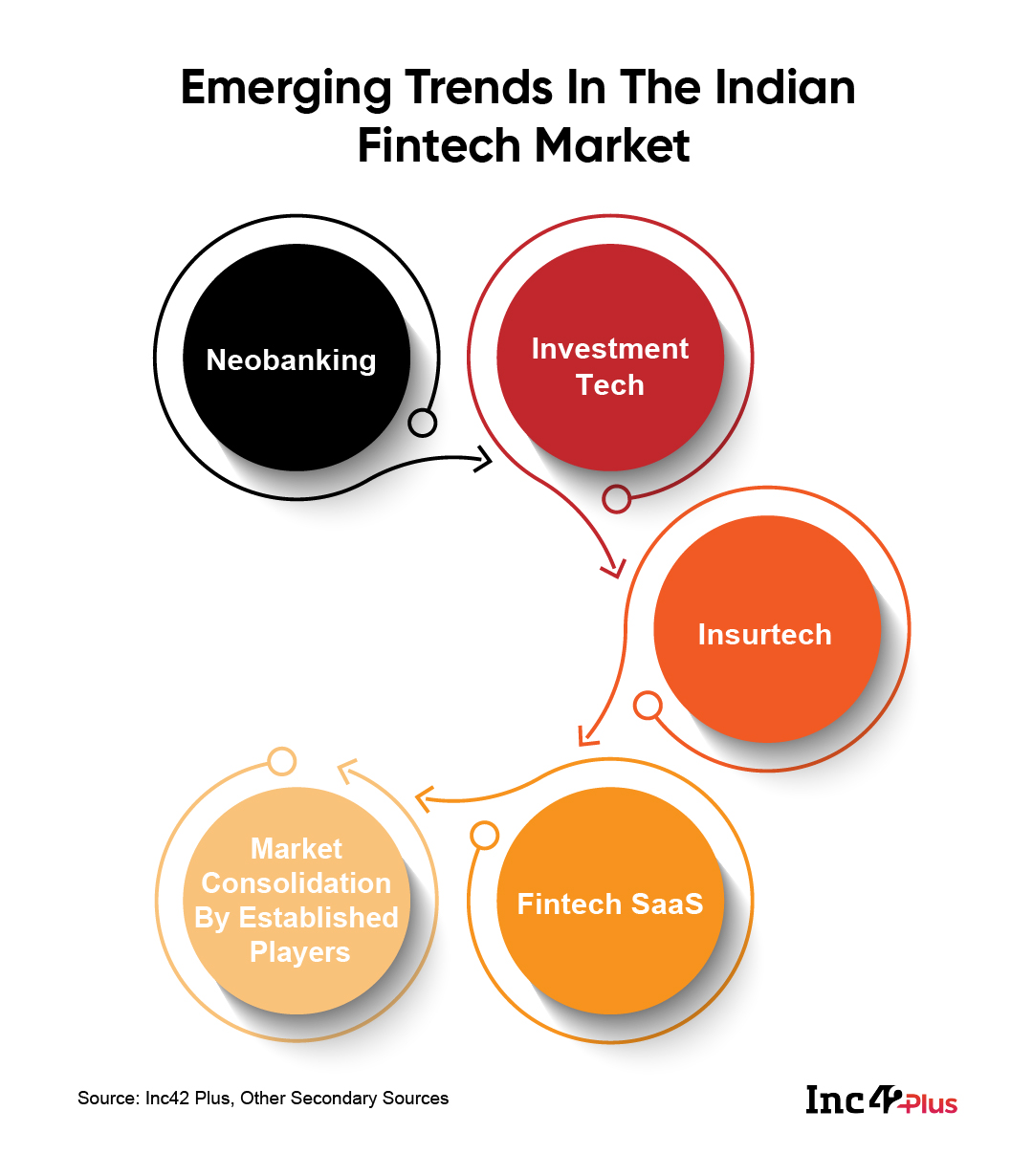

The Fintech Market In India: Emerging Trends

The growing adoption of financial technology products and services in India has given rise to the following trends.

Neobanking

Neobanks in India currently work as a layer2 fintech solution sitting on top of existing legacy banks. But with fintech firm BharatPe acquiring the PMC Bank and the UK-based fintech company Revolut entering India, a full-fledged digital bank may emerge soon.

Investment Tech

As of 2019, only 3% of the Indian population participated in the national stock market compared to 55% in the US. In FY21, the estimated value of total equity in the Indian stock market was $990 Bn, and the same is expected to increase 2.3x to $2.2 Tn in FY26. A combination of growing demand and awareness among the people towards financial securities and a huge addressable market portray investment tech as a lucrative business opportunity in India.

Insurtech

Among other fintech subsectors, insurtech is the fastest-growing in terms of market size. From $87 Bn (2022) to $339 Bn (2025), the addressable market is estimated to surge 4x. The rapid adoption of non-life insurance covering health, education, vehicle and other areas will spearhead the growth of insurtech for the next three years.

Fintech SaaS

The Covid-19 pandemic has accelerated the adoption of digital financial products and services among India’s SMBs, driving the demand for fintech SaaS solutions such as app-based accounting & bookkeeping, no-code payment aggregation and equity cap table management. The market size for fintech SaaS in India is expected to see a 2.7x surge in the next three years, from $4.6 Bn in 2022 to $12.6 Bn in 2025.

Market Consolidation

Many established fintech startups in India are eyeing IPOs this year, including MobiKwik, Navi Technologies and Pine Labs. Understandably, the greater a company’s market share, the better the chance of a successful IPO, which helps raise investor confidence. In fact, a substantial market share is one of the critical indicators that analysts use to determine a company’s competitive position. Hence, a rush of M&A deals is on the cards. Moreover, the requirement of full-stack solutions to capture potential customers and new markets at the earliest will also send these top players on a shopping spree.

Unravel more trends from the Indian fintech market along with the growth drivers and challenges in the burgeoning Buy Now Pay Later (BNPL) market in India. In our latest release— State Of Indian Fintech, InFocus: BNPL, Q1 2022 Report.

![Read more about the article [Funding alert] Edtech startup LearnVern raises $1M from undisclosed investors](https://blog.digitalsevaa.com/wp-content/uploads/2021/04/Imagefoim-1618208288875-300x150.jpg)