No clarity yet on the banks that the crypto exchange has partnered with to launch the service in India.

Coinbase had acknowledged the announcement briefly on its website, but later, deleted the webpage.

India has 15-20 Mn crypto investors, with total crypto holdings of around $5.37 Bn: Report

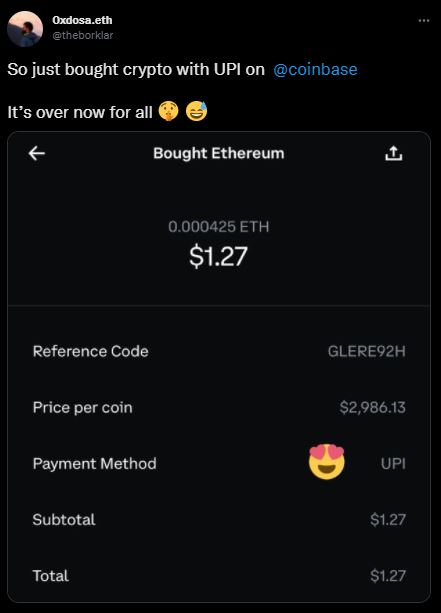

Global crypto exchange, Coinbase, has begun rolling out UPI and IMPS support for its users in India.

This came to light after Indian users noticed the addition of the two payment systems on Coinbase’s app.

Even as it became evident that the company had, indeed, begun adding the payments option on its apps, Coinbase is yet to issue any regarding the same. As a result, the scale of the roll out still remains unclear.

There is also no clarity yet on the banks that the crypto exchange has partnered with to launch the service in India. The firm has for long offered its decentralized app, Coinbase Wallet across the globe. It is operational in as many as 100 markets across the world, including India.

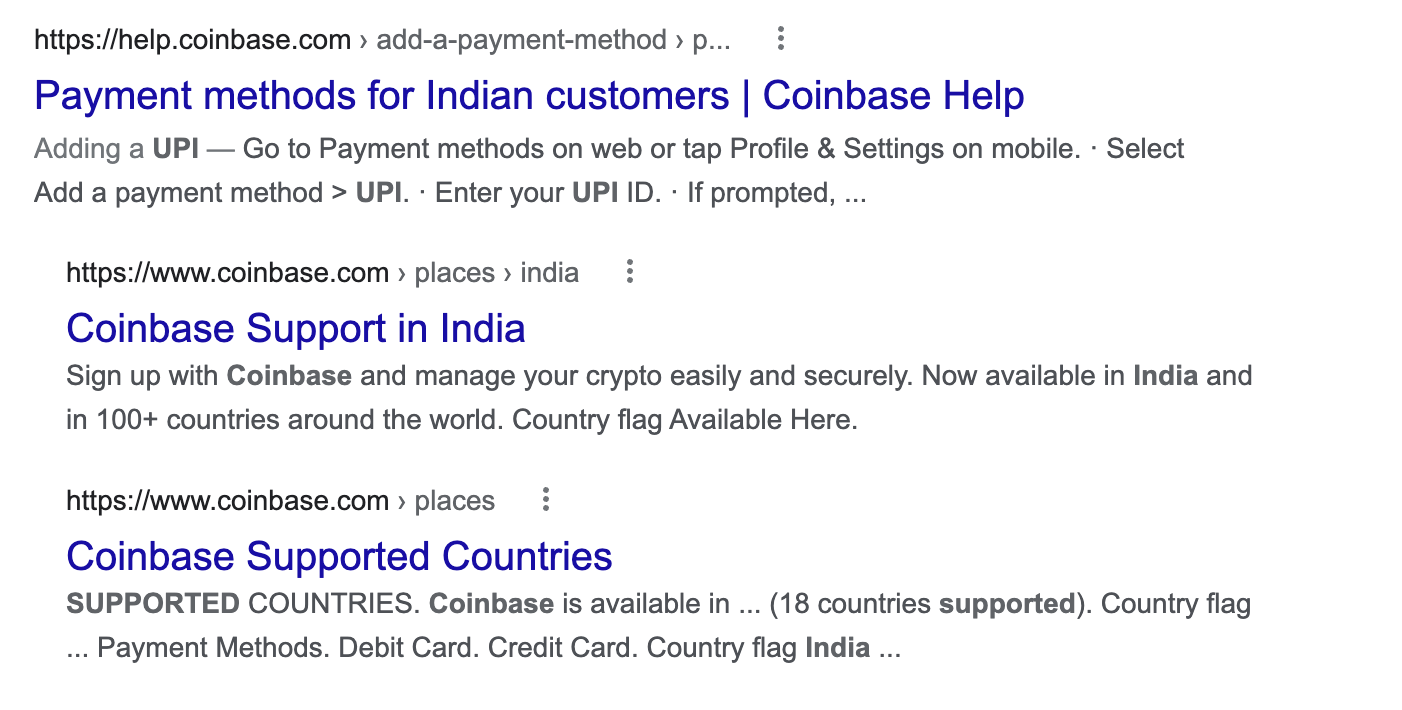

A report by TC claimed that Coinbase had acknowledged the announcement briefly in a now-deleted webpage. Inc42 also tried to verify the blog and was able to find snippets of the page on Google search.

Founded in 2012 by Brian Armstrong and Fred Ehrsam, Coinbase is one of the major cryptocurrency exchanges in the world, operating in varying capacities in more than 100 countries. The company claims to have nearly 89 Mn verified users on its platform and partners with more than 11,000 institutions across the globe..

Debut Amid Regulatory Crackdown

India is a huge market for crypto exchanges. According to several reports and Industry estimates, there are 15-20 Mn crypto investors in the country, with total crypto holdings of around $5.37 Bn.

As such, India is a huge market for the company and could play a pivotal role in Coinbase’s growth story. But, this announcement comes at a time when the Union Government along with RBI has gone overboard with steps to discourage crypto investing in the country.

Earlier on March 25, Indian Parliament approved amendments that ban offsetting crypto losses in one crypto against another.

Apart from that, the government has made provisions to impose 1% TDS on crypto payments over INR 10,000 in a year. In addition, it has also announced a 30% tax on the transfer of digital assets.

But, the biggest headache for the crypto startups in the country appears to be the opaqueness in the policies of the government. Amidst all this, Centre has reportedly been working on a draft law to regulate cryptocurrencies, but no draft has been made public so far.

This has made financial institutions wary of tying up with crypto exchanges and so far they have stayed away from the entire landscape altogether. On the other hand, state backed UPI and BHIM continue to offer their services as payment processors for Coinbase.

Coinbase’s Legacy Issues

Notably, Coinbase Wallet has been a present figure in India’s cryptocurrency exchange market for years now. But, the platform has suffered badly owing to lack of any payment options popular with Indian users. As such, despite having the first mover advantage, the lack of payment support has curtailed user growth for the firm.

In comparison, India’s home-grown startups have grown by leaps and bounds in a short period of time, rivaling big global competitors. Failing to capture the Indian market probably led to a reversal in the company’s India strategy. As a result, Coinbase later ramped up its investments in the country.

The company has investments in two major Indian crypto exchanges – CoinSwitch Kuber and CoinDCX. In addition, last year, the company also hired ex-Google Pay executive, Pankaj Gupta, in April last year to streamline its operations in the country.

Continuing the expansion, Coinbase is also slated to hold an India-focused event on April 7, where top brass of the company, including CEO Brian Armstrong are expected to speak.

Investments worth over $247 Mn flowed into the crypto startups in the country last year. An Inc42 report also notes that more than 350 blockchain startups were operational in the country in 2021 with the cryptocurrency segment receiving the highest funding last year.